1040ez Form 2018 Printable

Estimated tax for individuals.

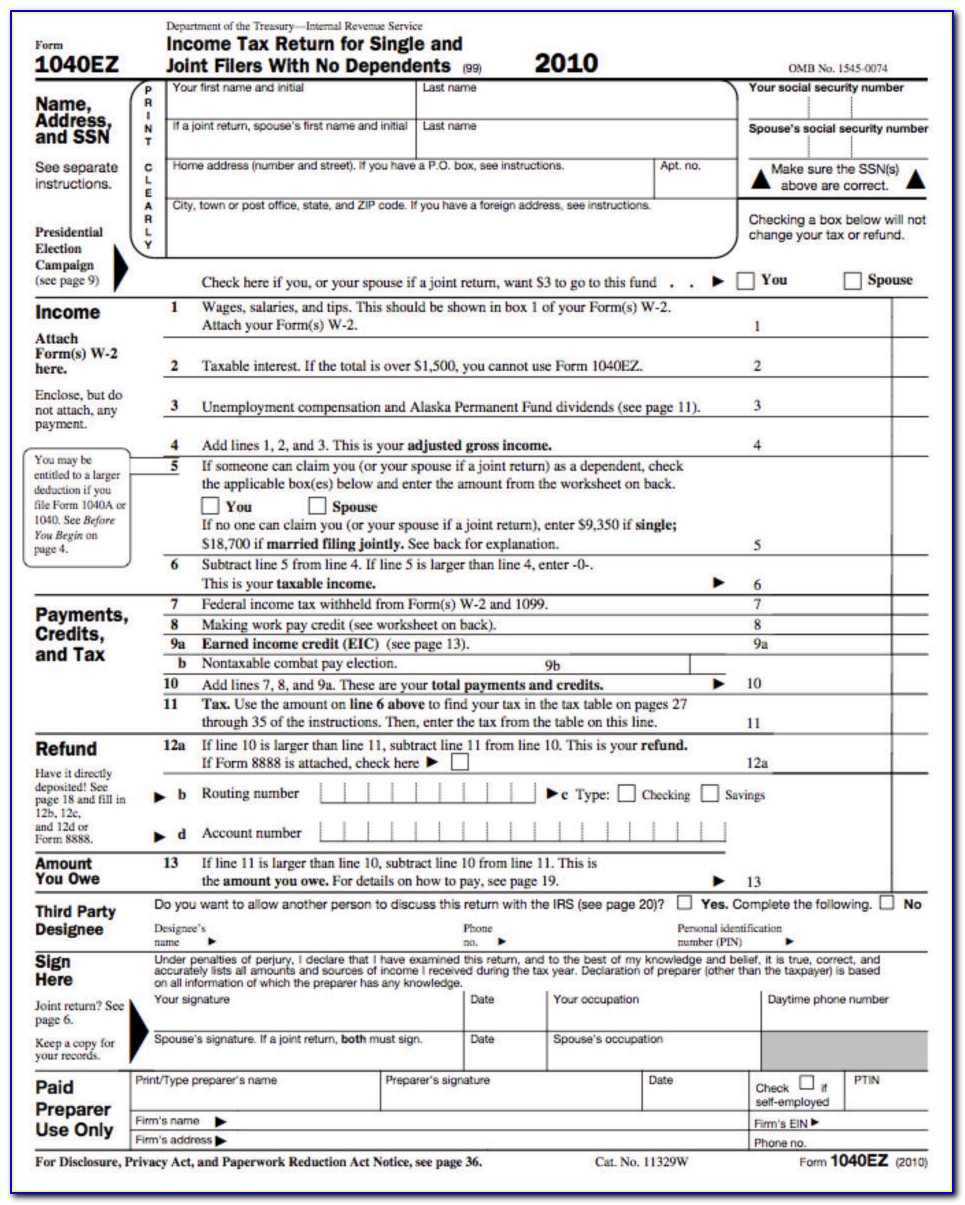

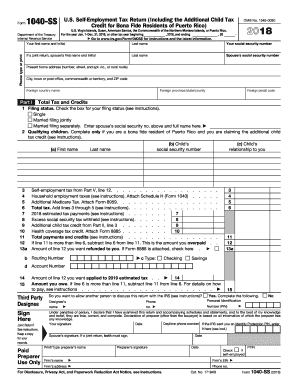

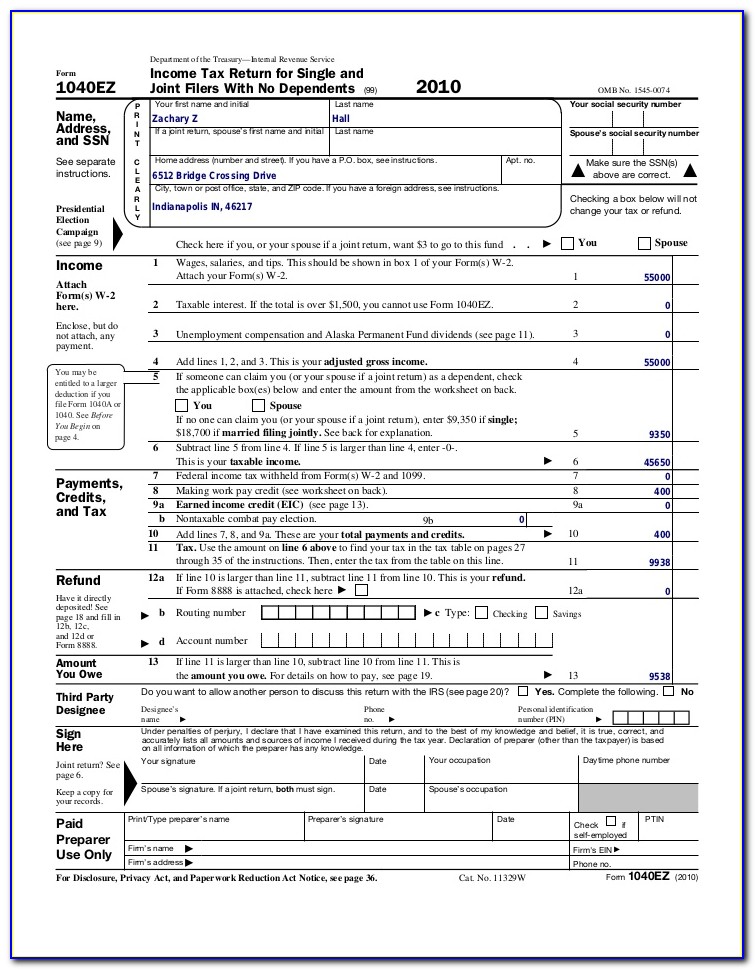

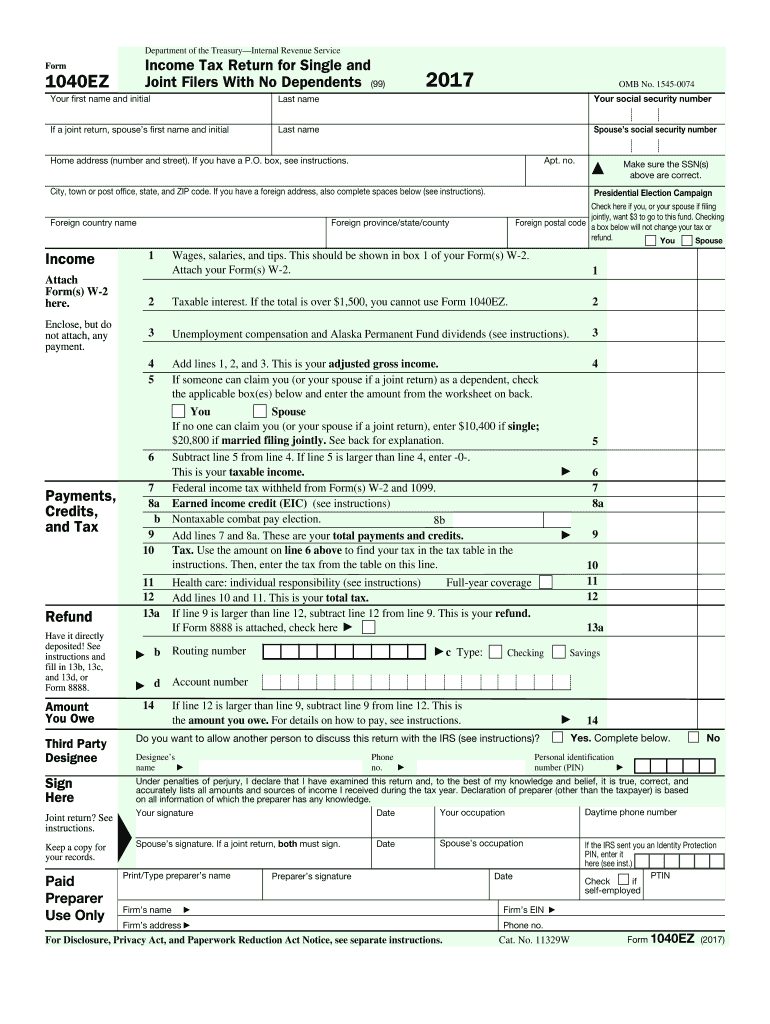

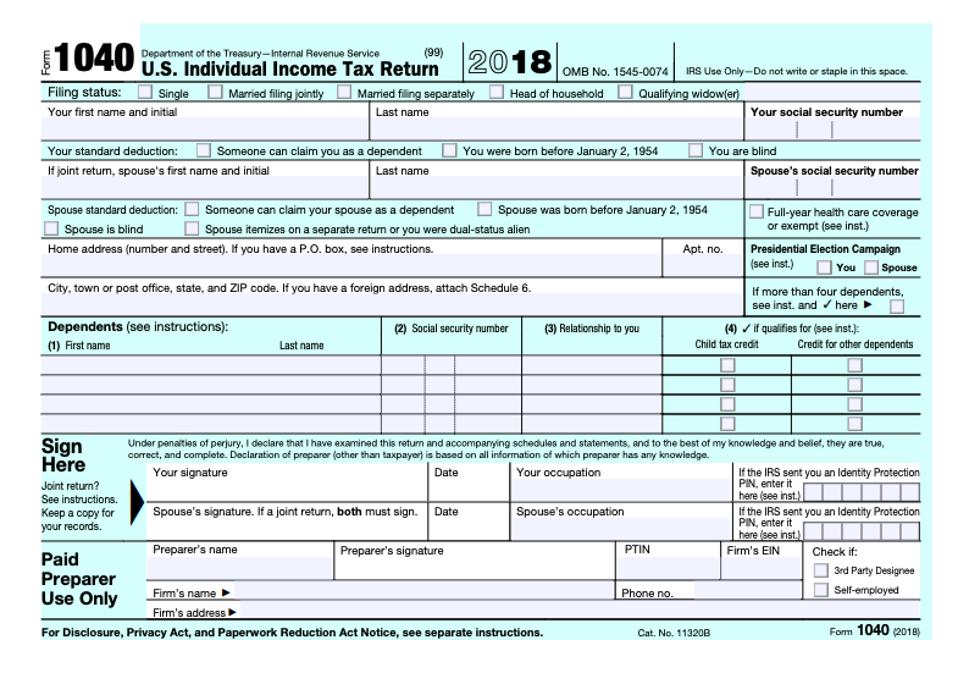

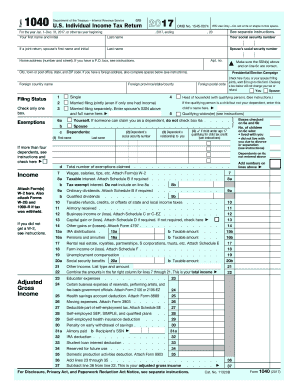

1040ez form 2018 printable. Form 1040 department of the treasuryinternal revenue service 99 us. Printable federal tax forms can be found throughout this section of our website along with instructions supporting schedules and federal tax tablesfor most taxpayers your 2019 federal tax forms must be postmarked by april 15 2020. Click any of the irs 1040ez form links below to download save view and print the file for the corresponding year. Individual income tax return including recent updates related forms and instructions on how to file.

Income tax return filed by certain citizens or residents of the united states. Irs use onlydo not write or staple in this space. These free pdf files are unaltered and are sourced directly from the publisher. Form 1040 is used by citizens or residents of the united states to file an annual income tax return.

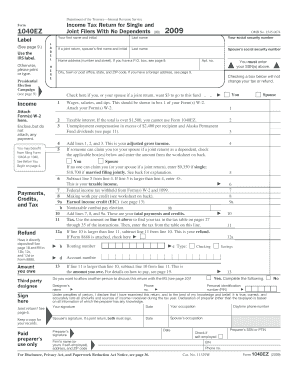

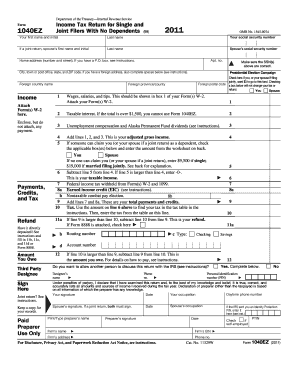

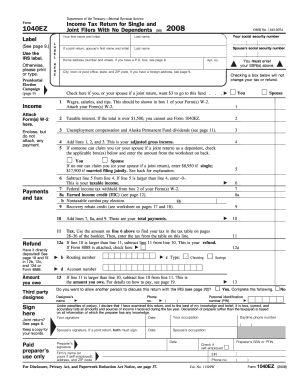

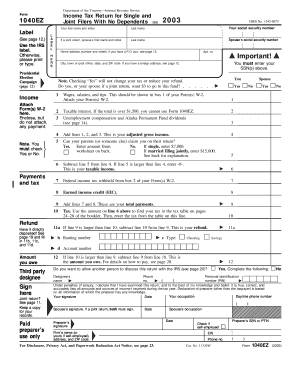

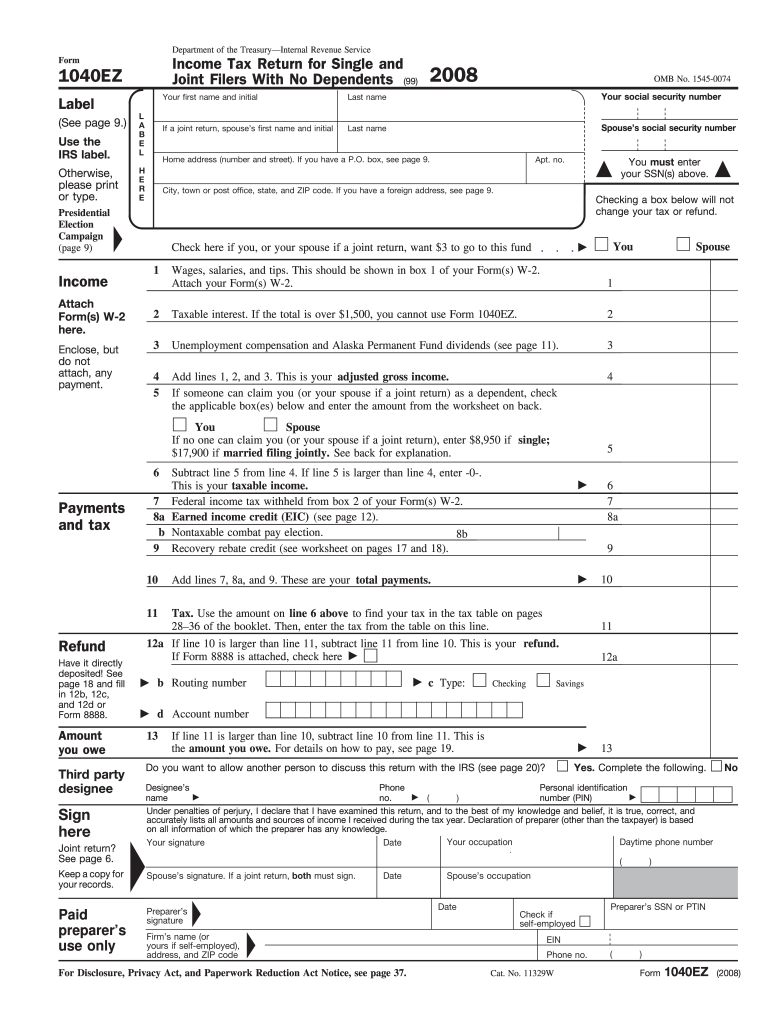

Federal tax forms printable 2019 federal tax forms to prepare form 1040 1040 sr 1040 ss 1040 pr 1040 nr and 1040x income tax returns. 2019 1040ez form obsolete 2019 1040ez instructions obsolete 2018 1040ez form obsolete 2018 1040ez instructions obsolete. We last updated federal form 1040 in december 2018 from the federal internal revenue service. Form 1040 department of the treasuryinternal revenue service.

Irs use onlydo not write or staple in this space. Information about form 1040 us. Individual income tax return. Click any of the irs 1040 form links below to download save view and print the file for the corresponding year.

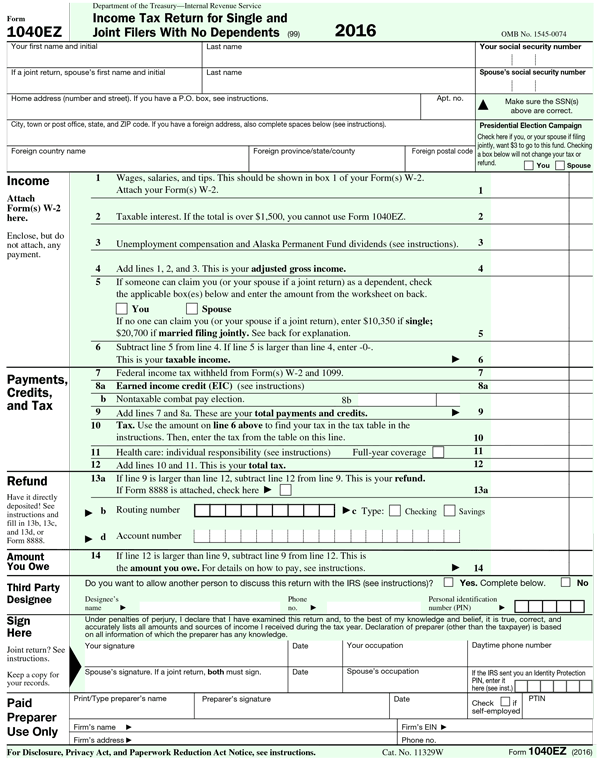

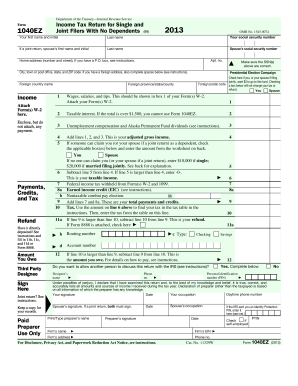

Form 1040 ez is a short version tax form for annual income tax returns filed by single filers with no dependents. These free pdf files are unaltered and are sourced directly from the publisher. The form 1040 tax table can be found inside the instructions booklet. Inst 1040 schedule c instructions for schedule c form 1040 profit or loss from business sole proprietorship 2018 11302018 form 1040 schedule d capital gains and losses 2019 11132019 inst 1040 schedule d instructions for schedule d form 1040 capital gains and losses 2019.

:max_bytes(150000):strip_icc()/Screenshot2018-12-0623.28.52-5c09f72d46e0fb000195b16b.png)

/Screenshot2018-12-0623.28.52-5c09f72d46e0fb000195b16b.png)