1095 C Word Template

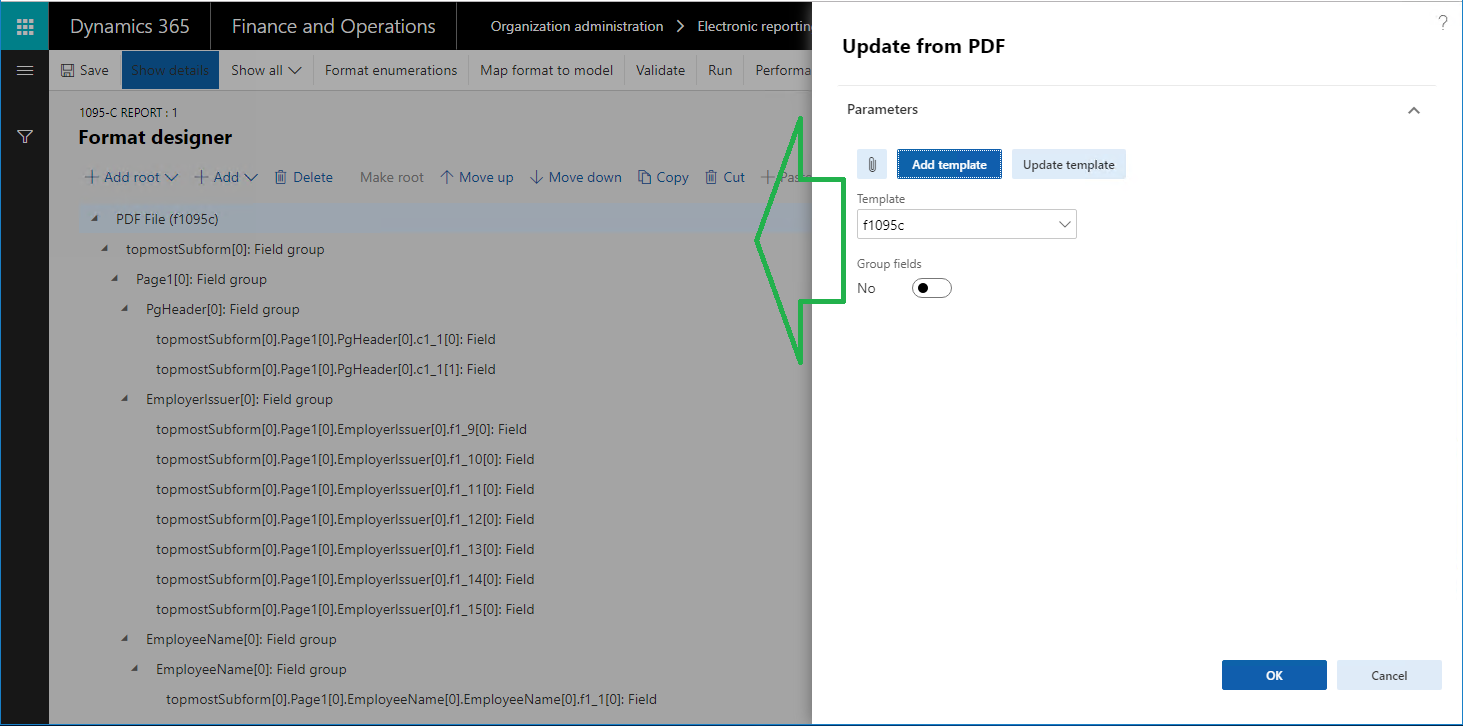

To specify a different location choose setup file locations click the file creation tab and change the location in the 1095 c data field.

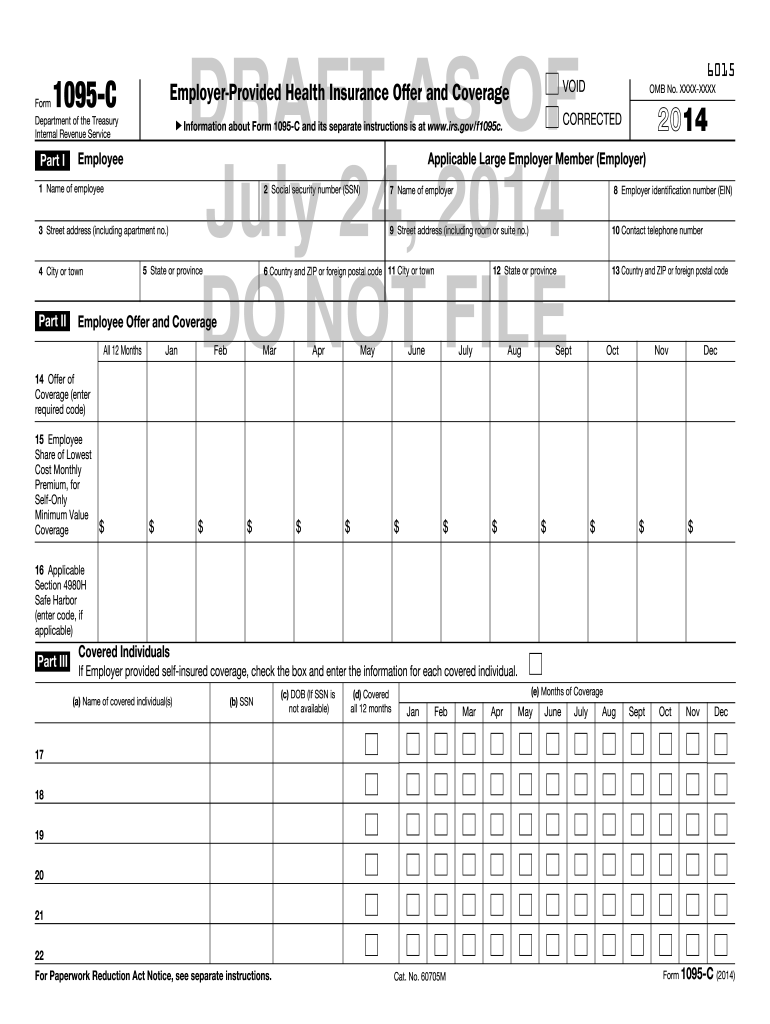

1095 c word template. Form 1095 c is a new irs tax form that you received because your employer is subject to the employer shared responsibility provision in the affordable care act. Column a form type. Go to the internal revenue service website and download a copy of the irs form 1095 c with the filling instructions. Accounting cs saves each template spreadsheet to the location specified in the export to field at the top of the export 1095 c data screen.

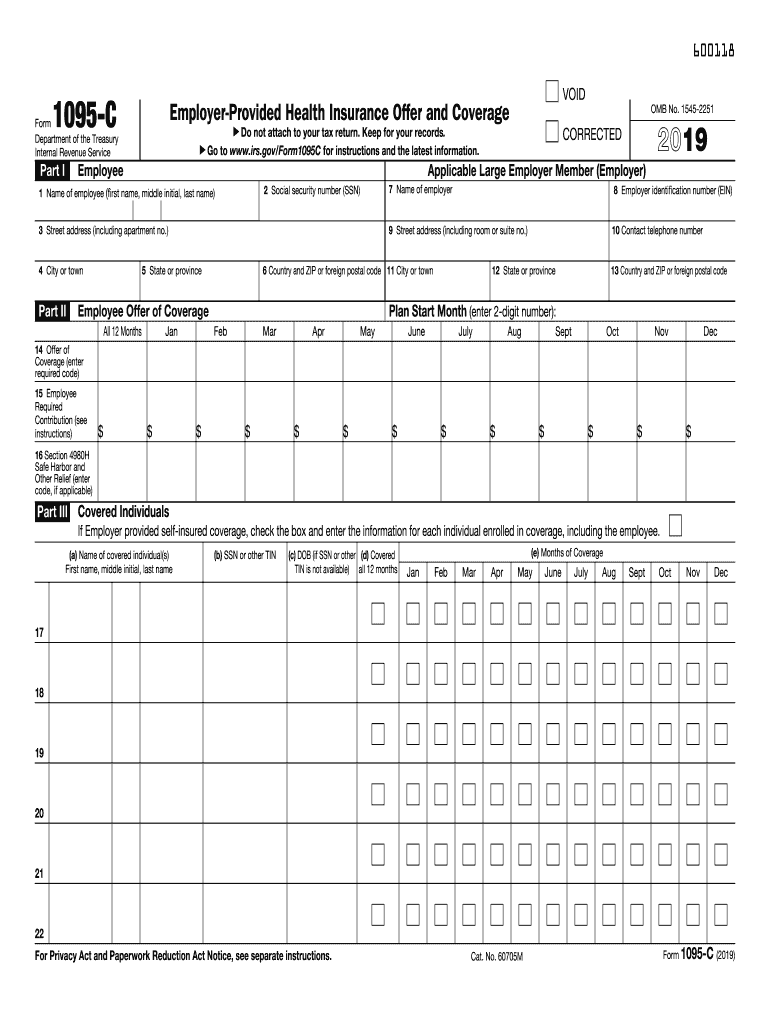

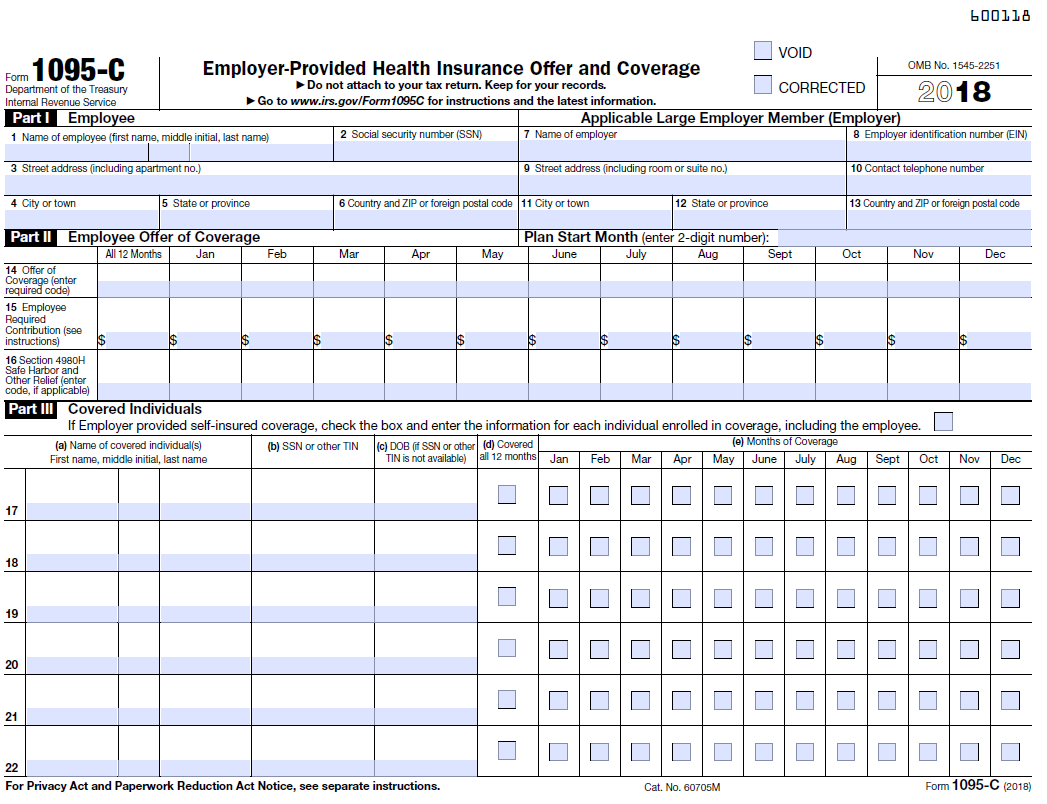

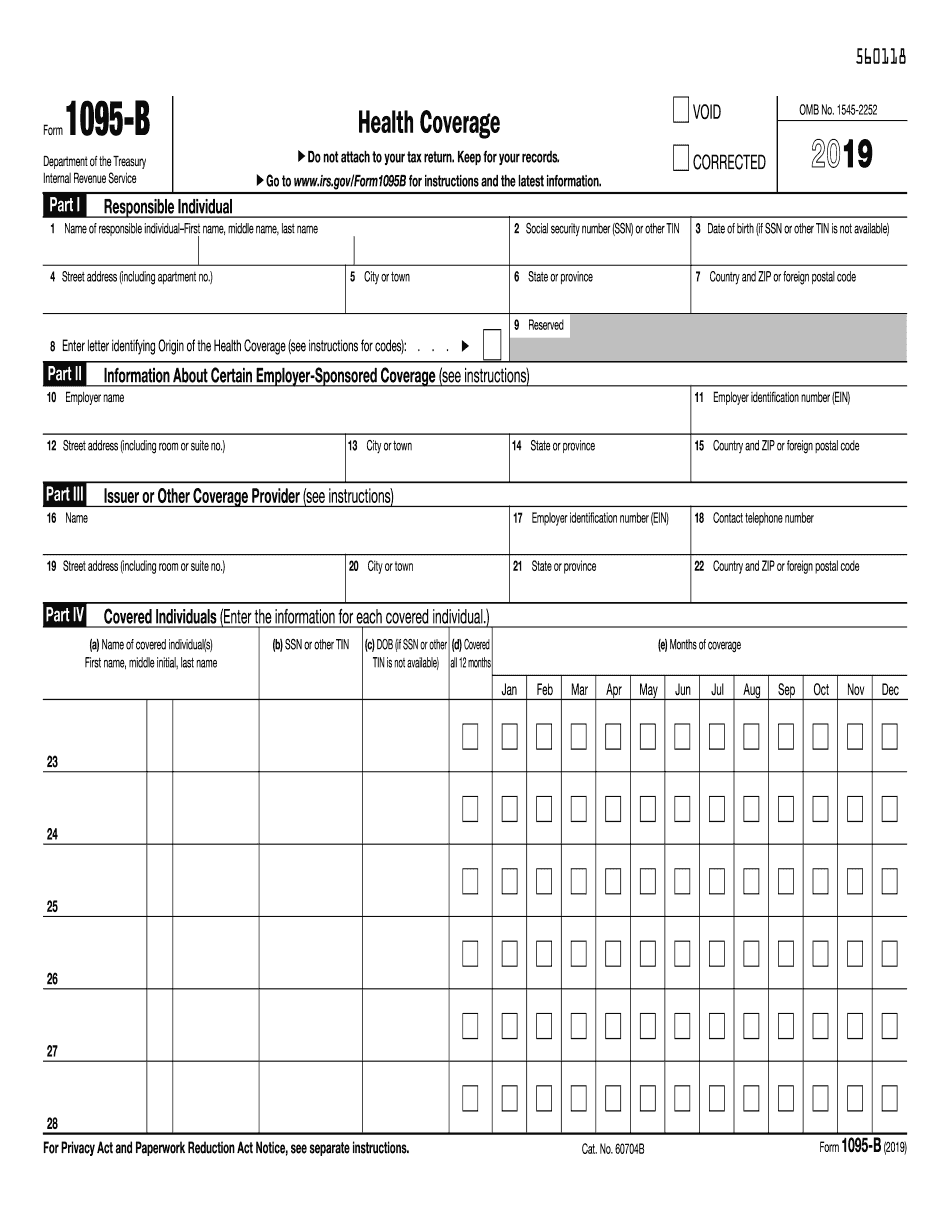

Upload the excel template and preview your data as its processed by the program. Type of plan referred to as a self insured plan form 1095 c part iii provides information about you and your family members who had certain health coverage referred to as minimum essential coverage for some or all months during the year. The 1095 c template spreadsheet exports from accounting cs populated with basic employee information that is formatted to match the sample 1095 c template available in the 1095 c spreadsheet import dialog. A sample form is available on the irs website.

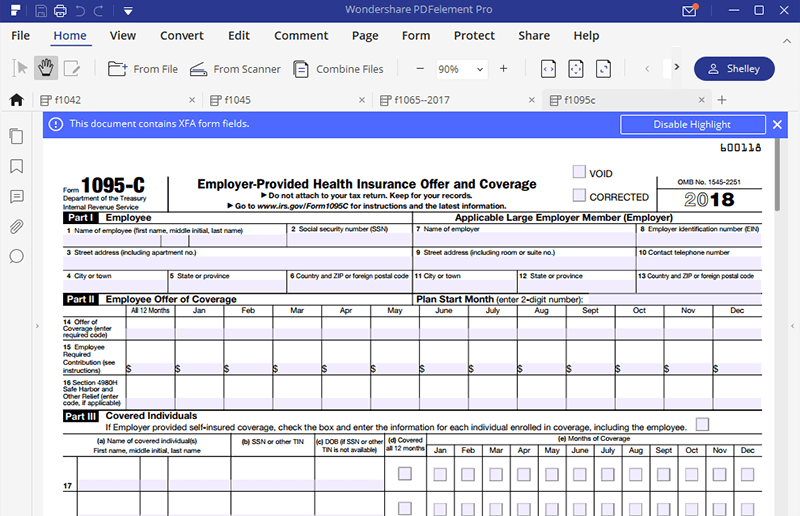

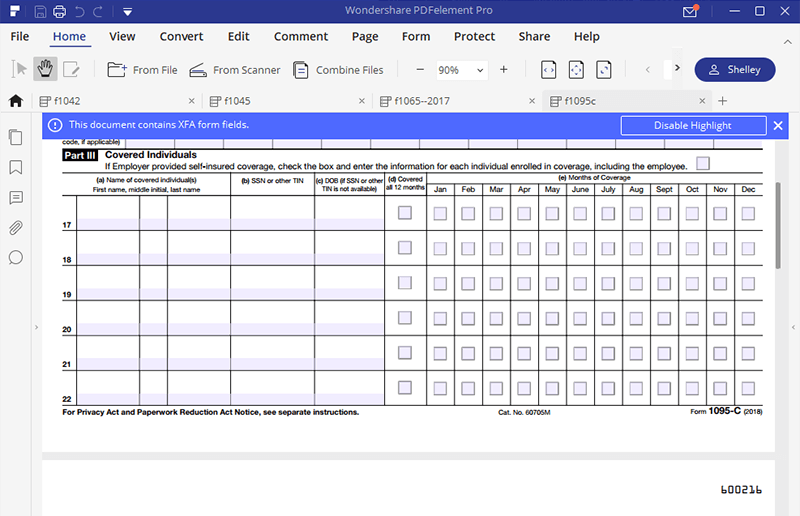

Form 1095 c is a new irs tax form that you received. Fill in the required employee offer coverage and covered individual details. Annual updates based on irs draft forms all template column headings and sample data match the most recent 2017 10941095 forms. The follow guide provides an insight on how you can complete the irs form 1095 c using the pdfelement program.

If you or your family members are eligible for certain. Download our custom excel template for form 1095 c. Mapping the 1095 c excel template to the form for easier data input here is a mapping tool to use when entering data into the 1095 c excel template. If additional changes are released by the irs the most recent version will always be available in yearli performance and yearli desktop.

Open it with pdfelement and start filling it out using the program. 1095 c tax form in addition to the standard w 2 form employees also receive the federal tax form called a 1095 c.