1099 Employee Contract Template

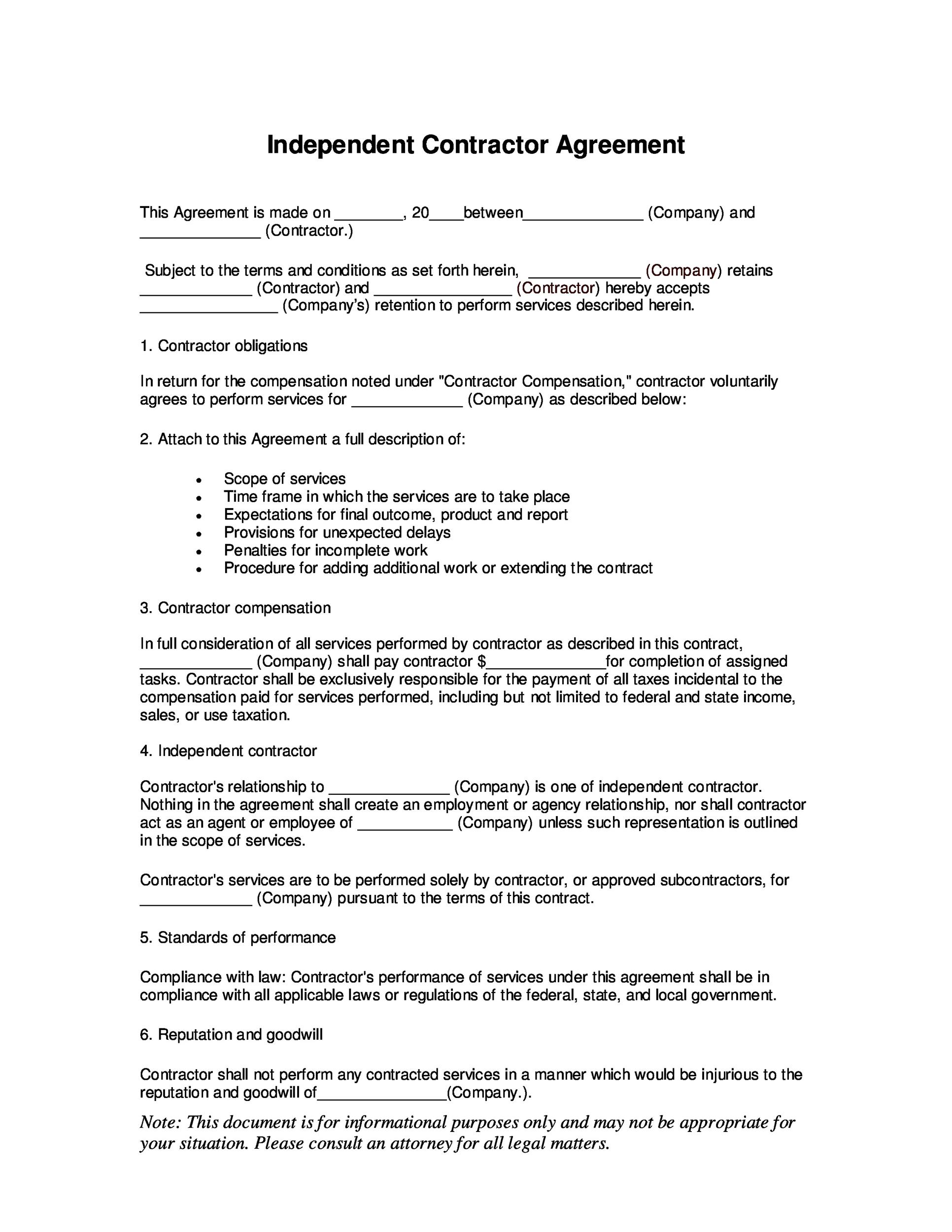

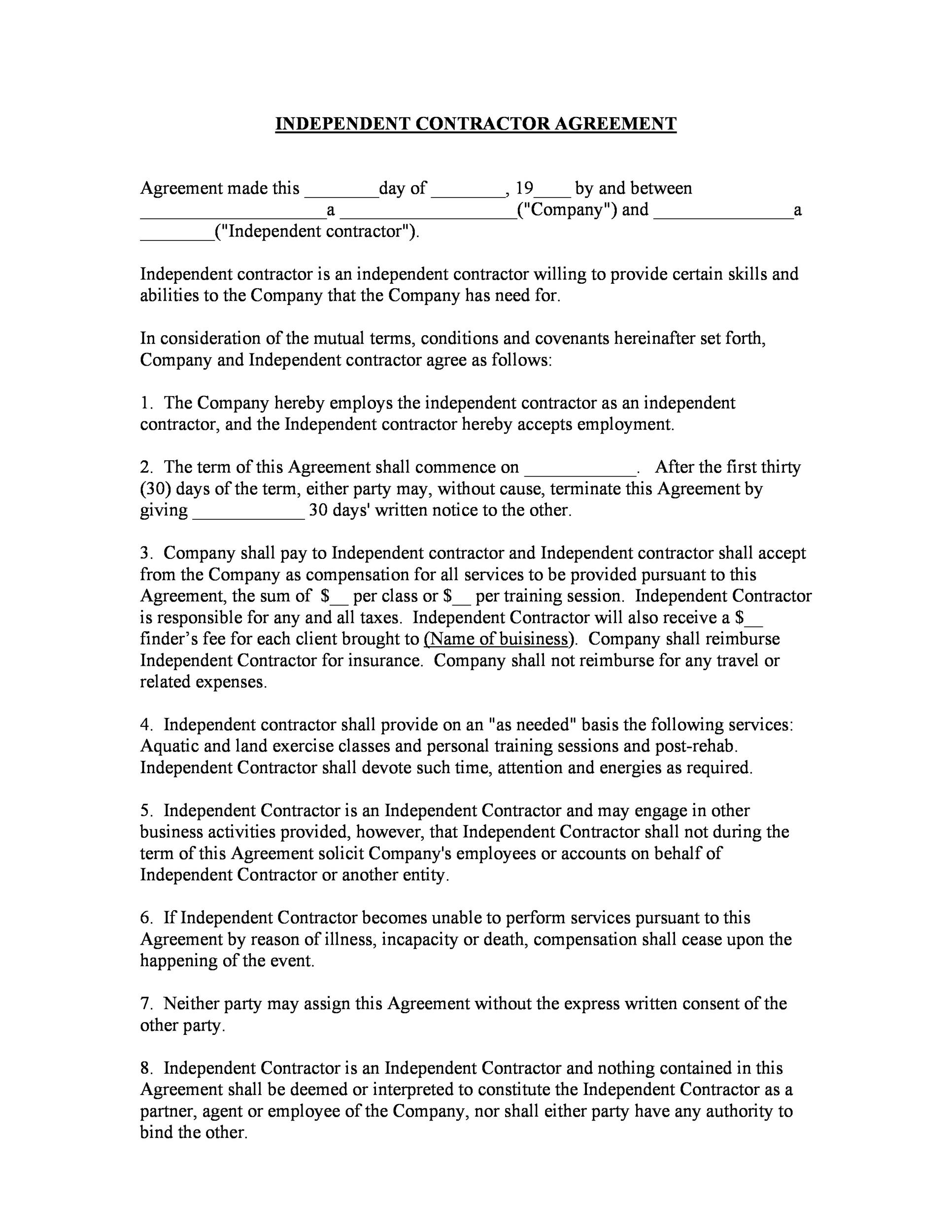

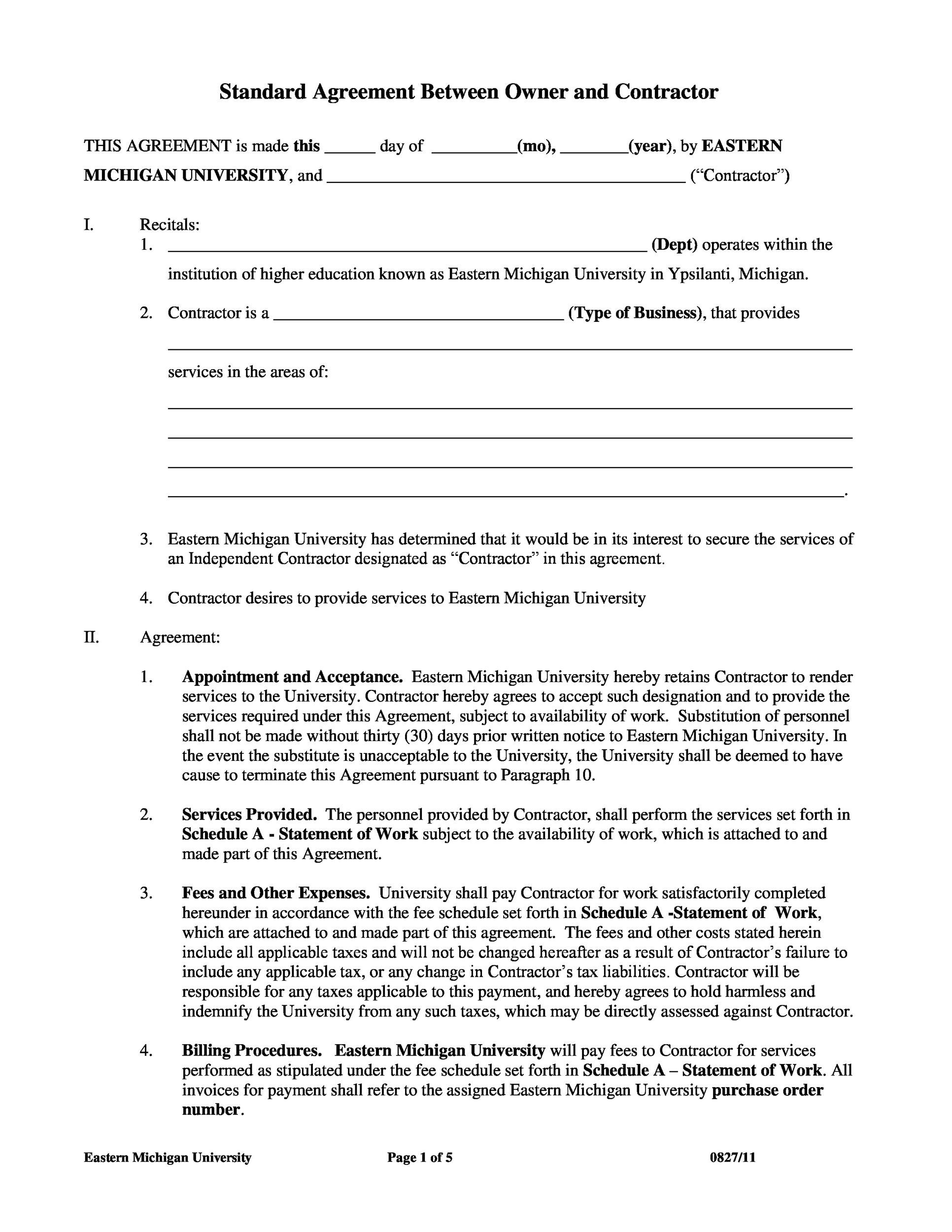

Contractor may perform the services required by this agreement at any place or location and at such times as contractor shall determine.

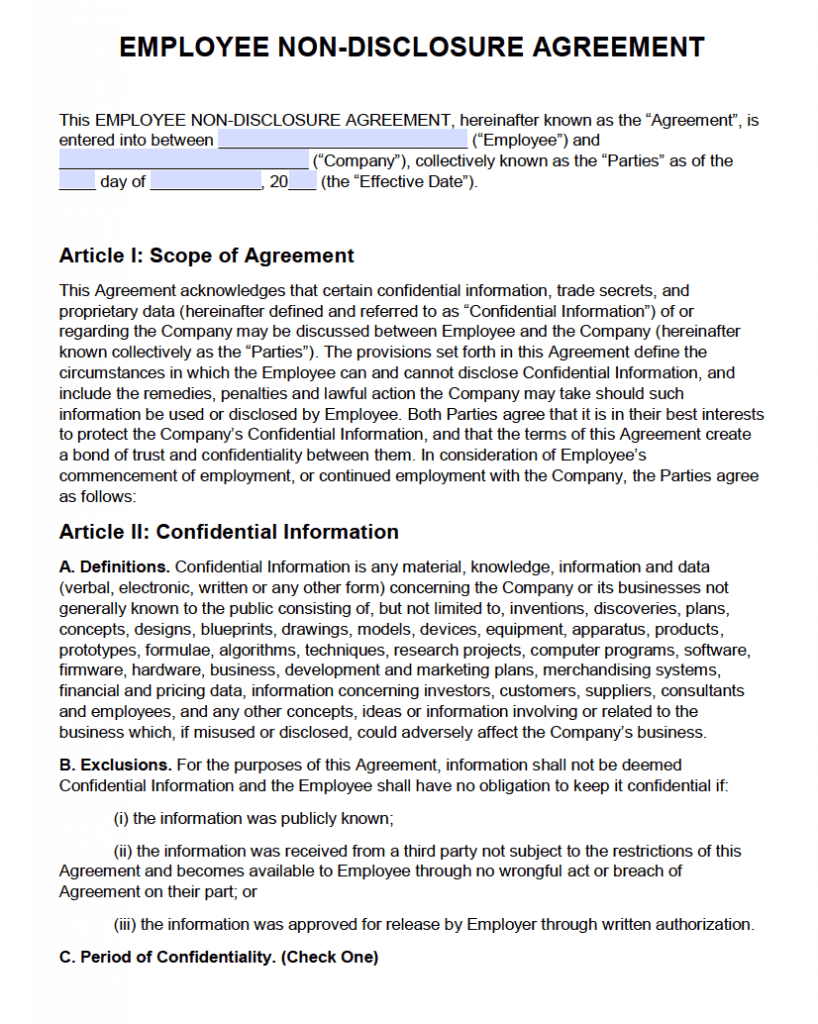

1099 employee contract template. Previous post next post. During the term of this agreement and for a period of one year thereafter neither party will hire or attempt to hire any person who is or was an employee of the other party during the term hereof. If this were an employment contract for a w 2 or 1099 employee you would want the at will clause to apply stating that either party is free to exit the relationship for no cause. This agreement in conjuction with the attached non disclosure agreement exhibit a and commission schedule exhibit b constitutes the entire understanding of the parties and revokes and supersedes all prior agreements between the parties and is intended as a final expression of their agreement.

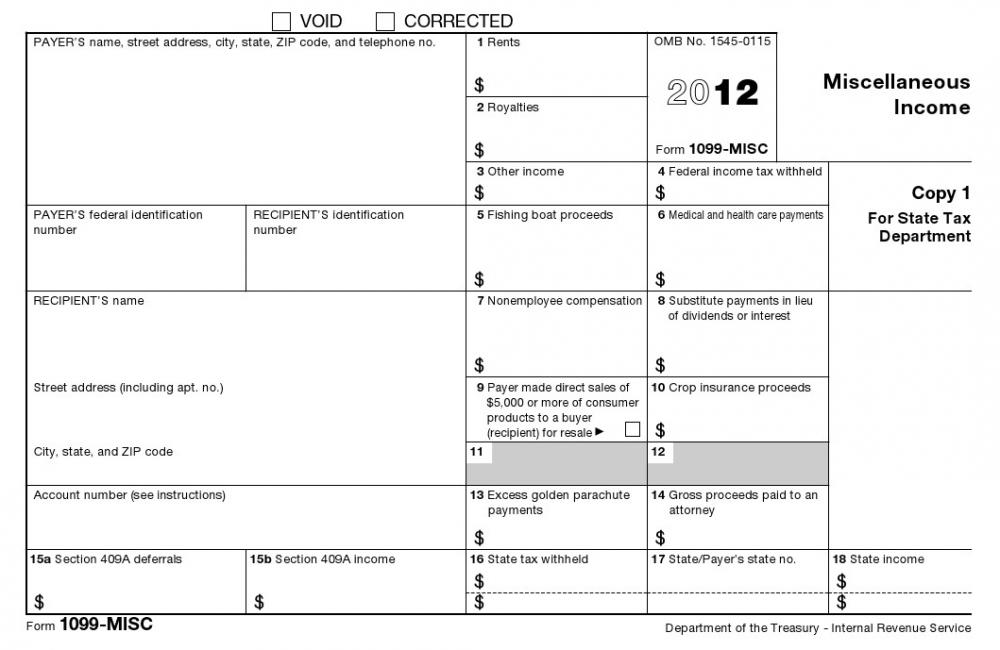

December 15 2017 by dora. Employee contract sample uae. Client will regularly report amounts paid to contractor by filing a form 1099 misc with the internal revenue service as required by law. If youre an independent contractor.

This is especially important if the company hiring the independent contractor is large as independent contractors wont have much power once work has begun. The contractor may not act as agent for or on behalf of the company or to represent the company or bind the company in any manner. Employee contract agreement doc. The information in this document is designed to provide an outline that you can follow when formulating business or personal plans.

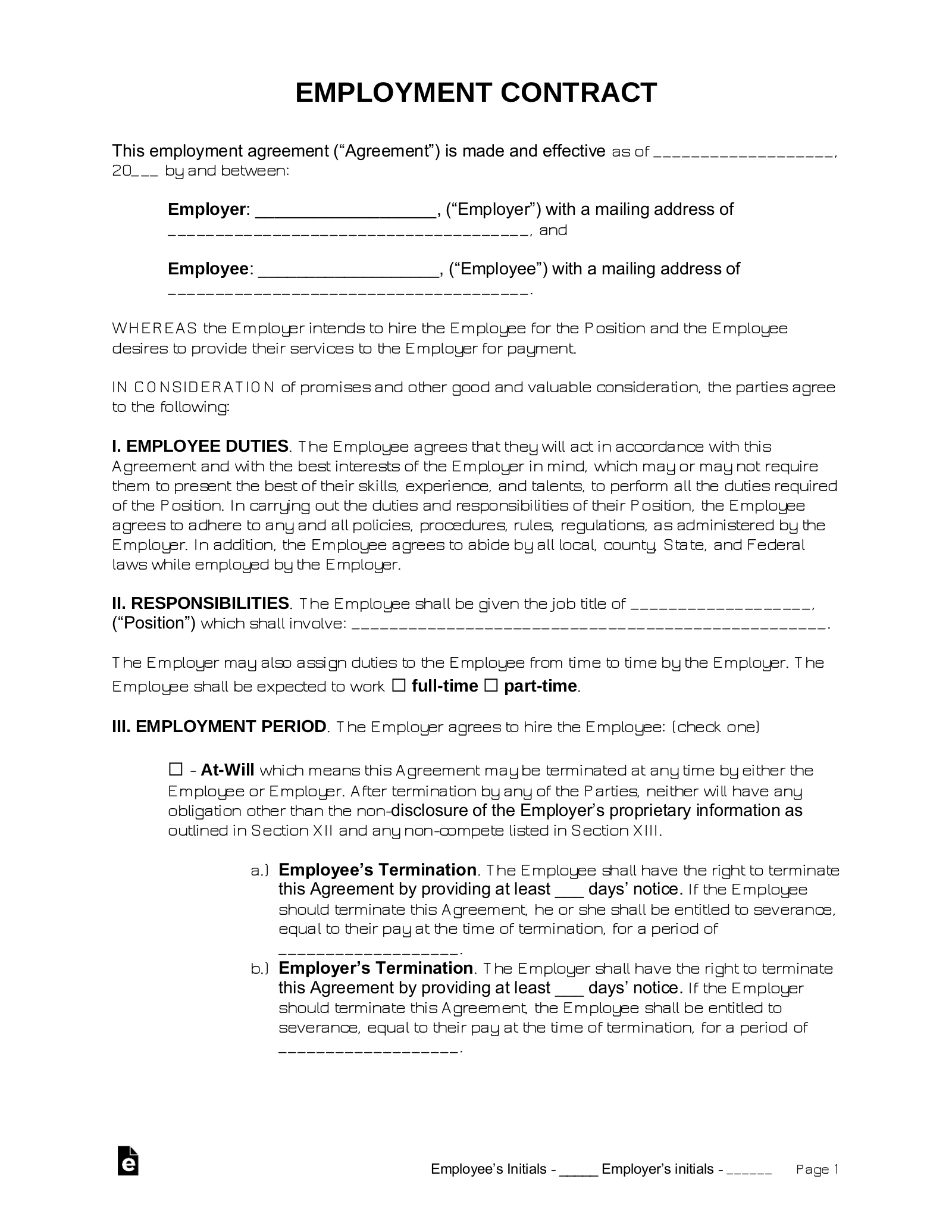

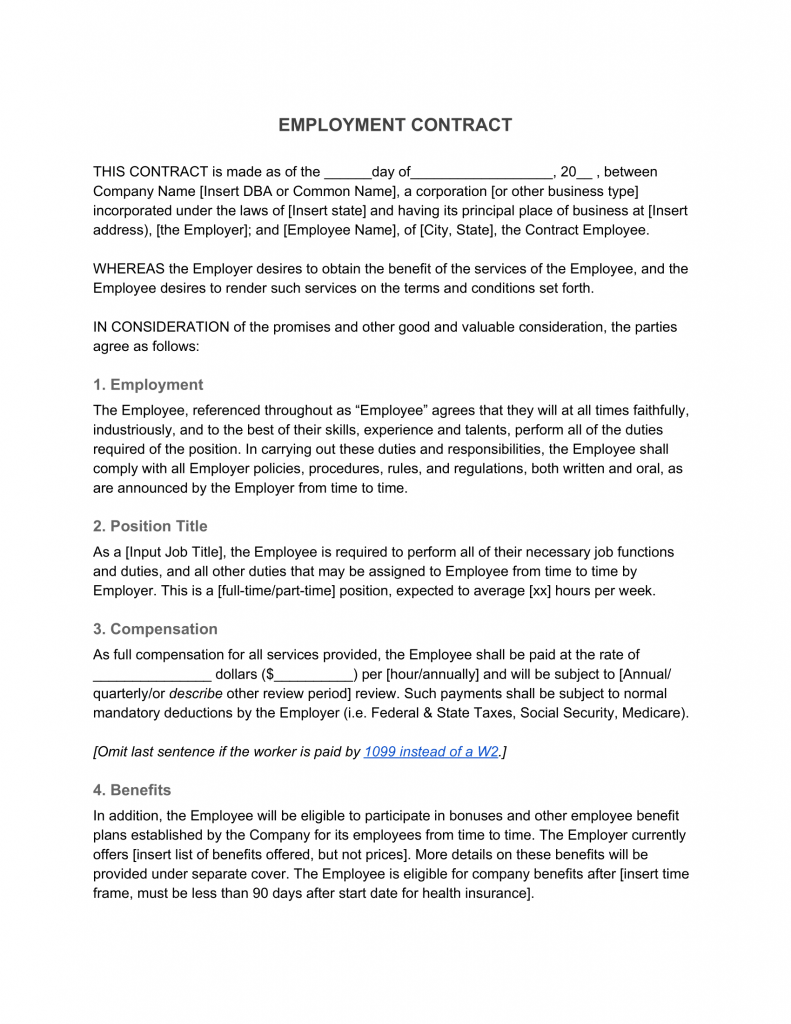

An independent contractor agreement also known as a 1099 agreement is a contract between a client willing to pay for the performance of services by a contractor. The contractor will not be entitled to workers compensation retirement insurance or other benefits afforded to employees of the company. An independent 1099 contractor may want additional clauses added to a contract to ensure he or she is treated fairly. An employment contract is a written employment agreement documenting the shared rights and responsibilities between your company and a w 2 or 1099 contract worker.

There may be an income tax withholding form required by your state. In accordance with the internal revenue service irs an independent contractor is not an employee and therefore. Home templates 1099 employee contract form. Gallery of 1099 employee contract form.

Its typically used when bringing in higher level management employees short term contract employees or freelancers. 1099 employee contract form. Agreement for independent contracting services irs form 1099.