1099 Misc Form Template

If this form is incorrect or has been issued in error contact the payer.

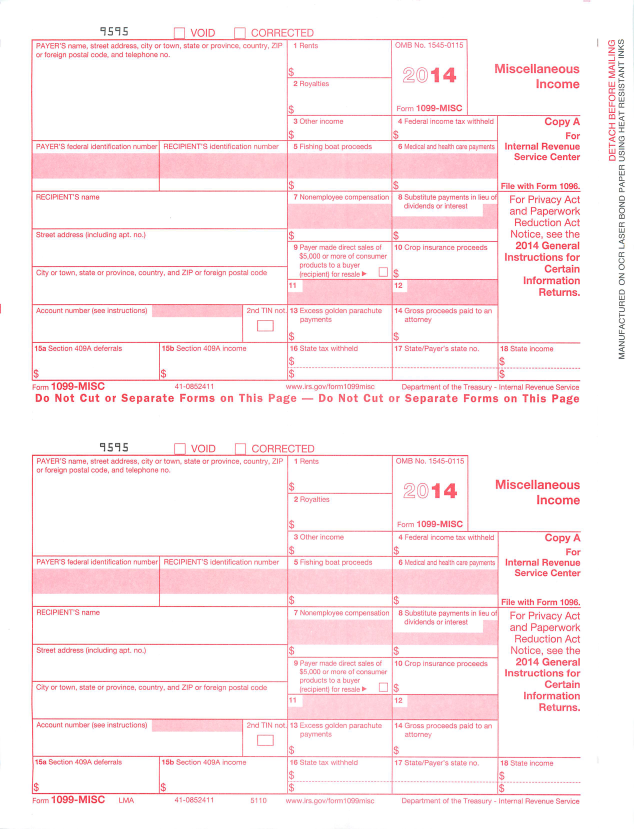

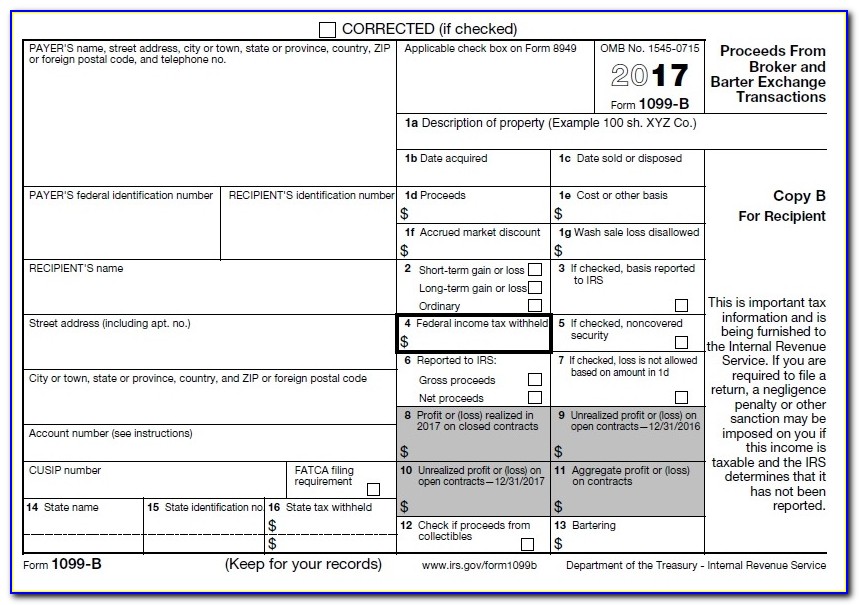

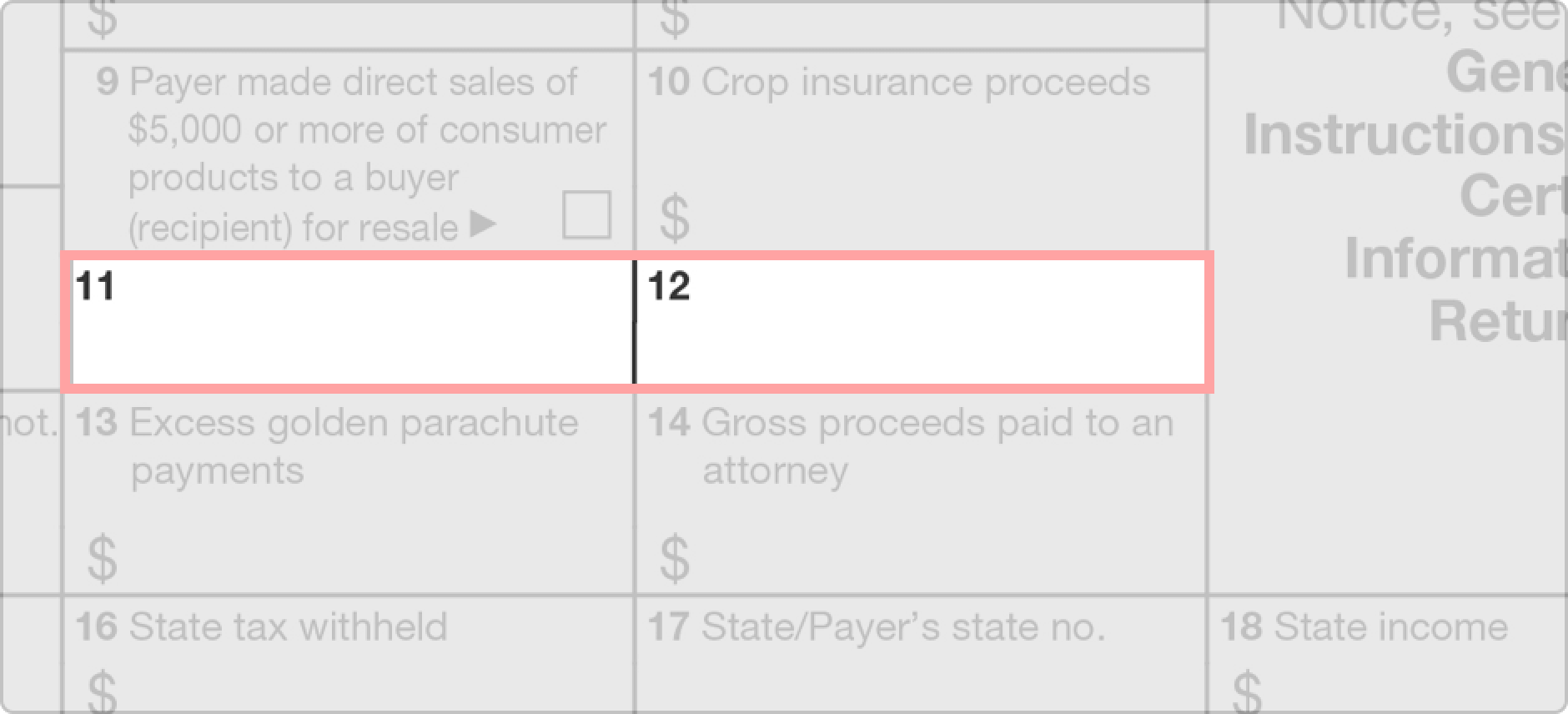

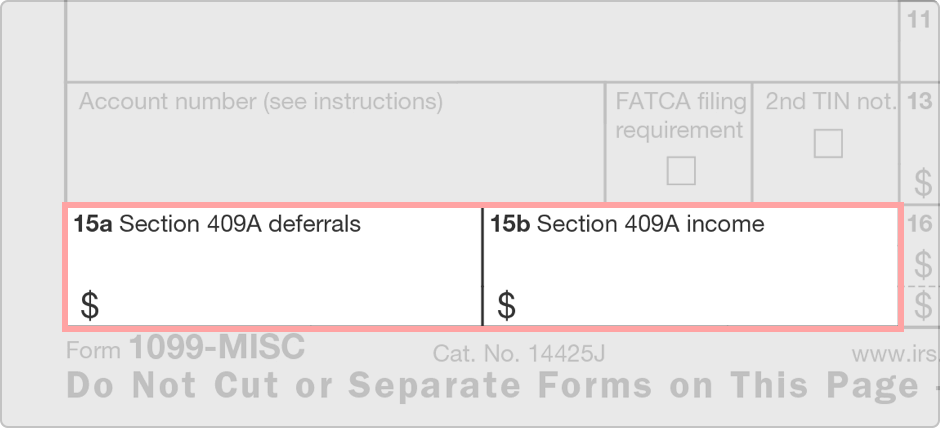

1099 misc form template. Report payments made in the course of a trade or business to a person whos not an employee. Looking for a printable form 1099 misc and independent contractors. The 1099 misc form is a specific version of this that is used for anyone working for you that is not a true employee. Form 1099 misc is used to report rents royalties prizes and awards and other fixed determinable income.

1099 misc template free download irs form 1099 misc 1099 fire easitax for 1099 and w2 forms and many more programs. A 1099 form is a tax form used for independent contractors or freelancers. Report income from self employment earnings in 2019 with a 1099 misc form. Payers use form 1099 misc miscellaneous income to.

If you cannot get this form corrected attach an explanation to your tax return and report your income correctly. The most popular type is a 1099 misc form. Information about form 1099 misc miscellaneous income including recent updates related forms and instructions on how to file. Irs form 1099 misc miscellaneous income is an internal revenue service irs form used to report non employee compensation.

Independent contractors freelance workers sole proprietors and self employed individuals receive one from each business client who paid them 600 or more in a calendar year. In common words a 1099 form reports all income earnings dividends payments and other personal income. The social security administration shares the information with the internal revenue service. On this website users can find.

Employers furnish the form w 2 to the employee and the social security administration. Online service compatible with any pc or mobile os. Create complete and share securely. Printable versions for 1099 form for the 2019 year in pdf doc jpg and other popular file formats.

Instantly send or print your documents. Create your sample print save or send in a few clicks. Report rents from real estate on schedule e form 1040 or 1040 sr.