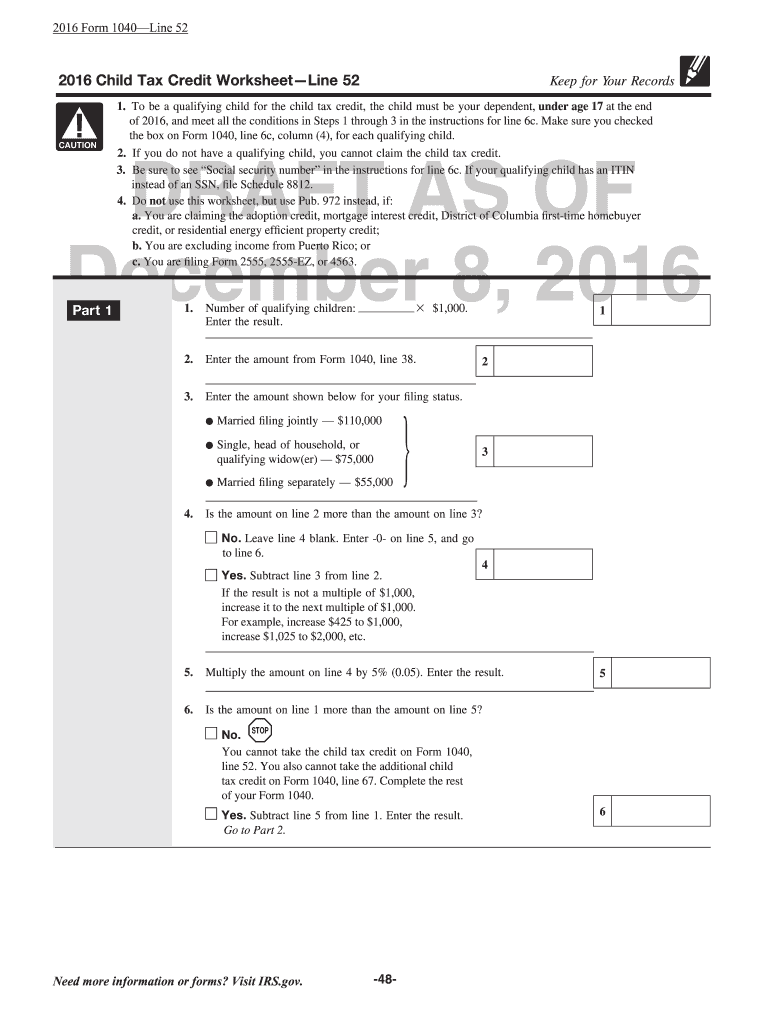

2016 Child Tax Credit Worksheet

Make sure you figured the amount if any of your child tax credit.

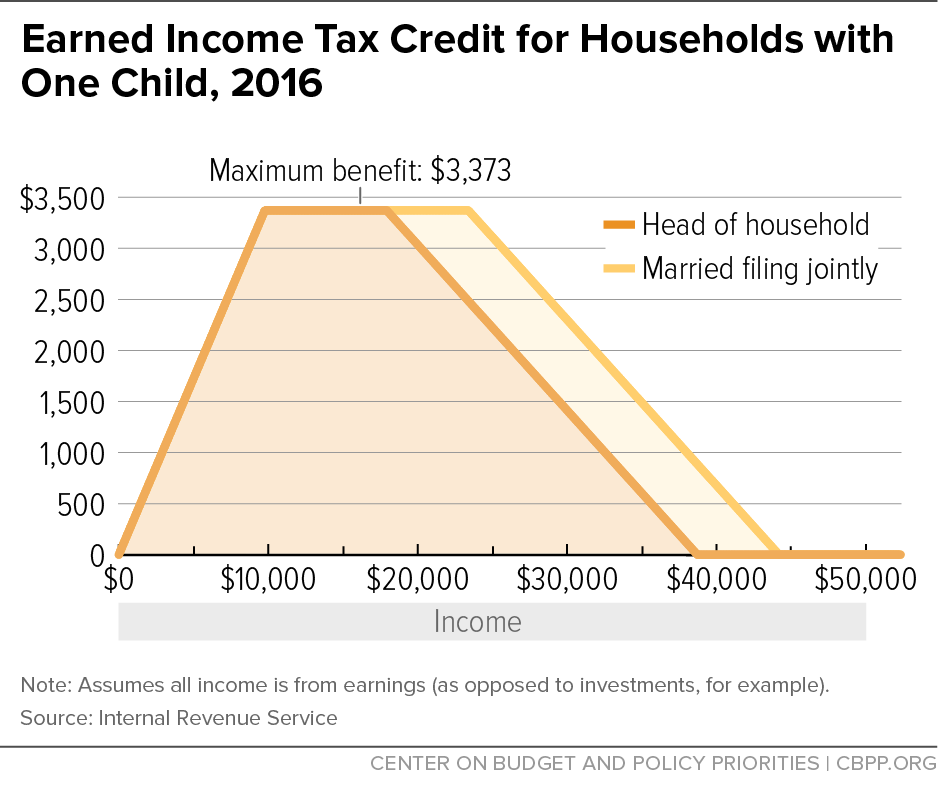

2016 child tax credit worksheet. How to fill out a w4 with wikihow from child tax credit worksheet 2016 source. To be a qualifying child for the child tax credit the child must be your dependent under age 17 at the end of 2018 and meet all the conditions in steps 1 through 3 under who quali es as your dependent. The purpose of the worksheet is to help you calculate how much child tax credit you can claim this coming tax year. The additional child tax credit follow the steps below.

Worksheets are forms 1040 1040a child tax credit work 1040nr 2016 credit 1 of 14 1453 2016 child tax credit work line 35 work line 12a keep for your records draft as of credit 1 of 13 1039 2018 schedule 1299 i income tax credits information and 2016 publication 972 child tax credit work line 51 keep for your records. To be a qualifying child for the child tax credit the child must be under age 17 at the end of 2016 and meet the other requirements listed earlier under qualifying childalso see taxpayer identification number needed by due date of return earlier. Topic page for child tax credit worksheet. 2018 child tax credit and credit for other dependents worksheetline 12a keep for your records 1.

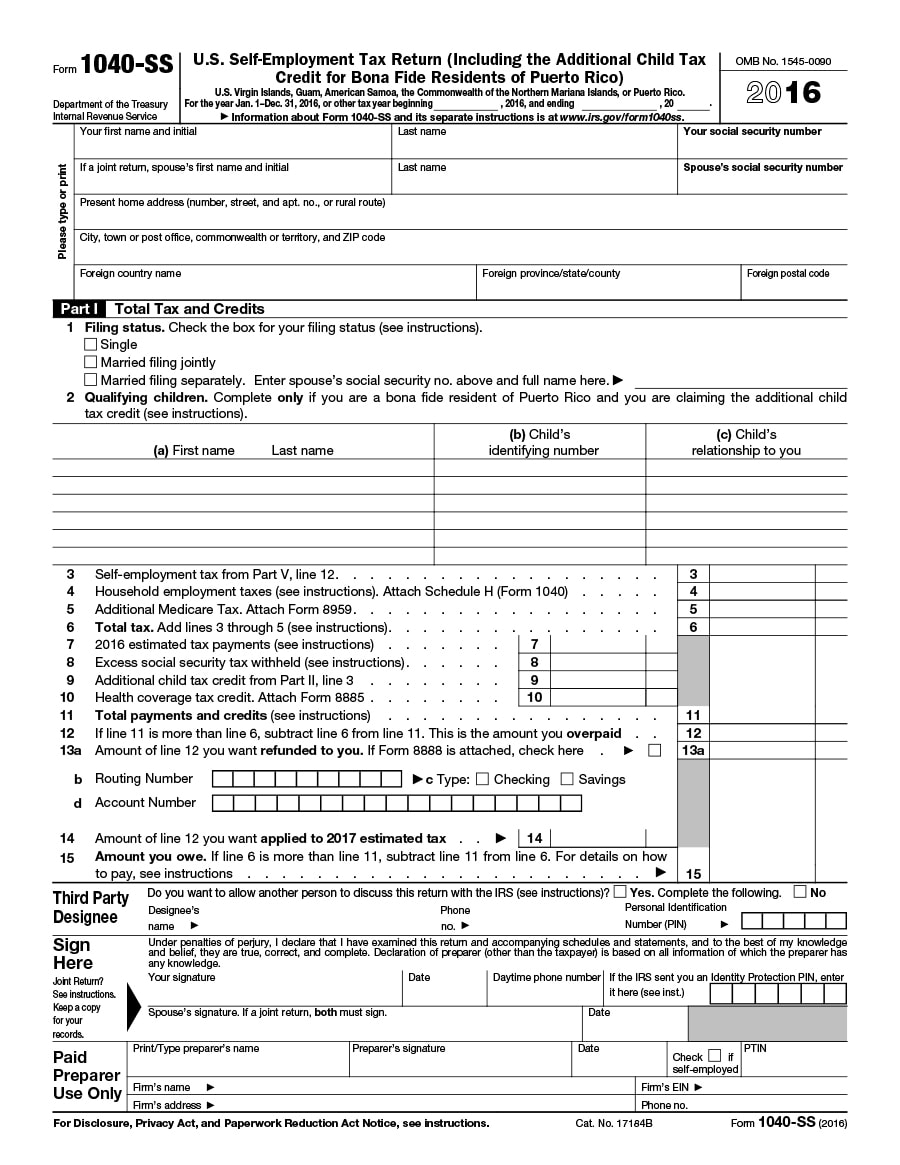

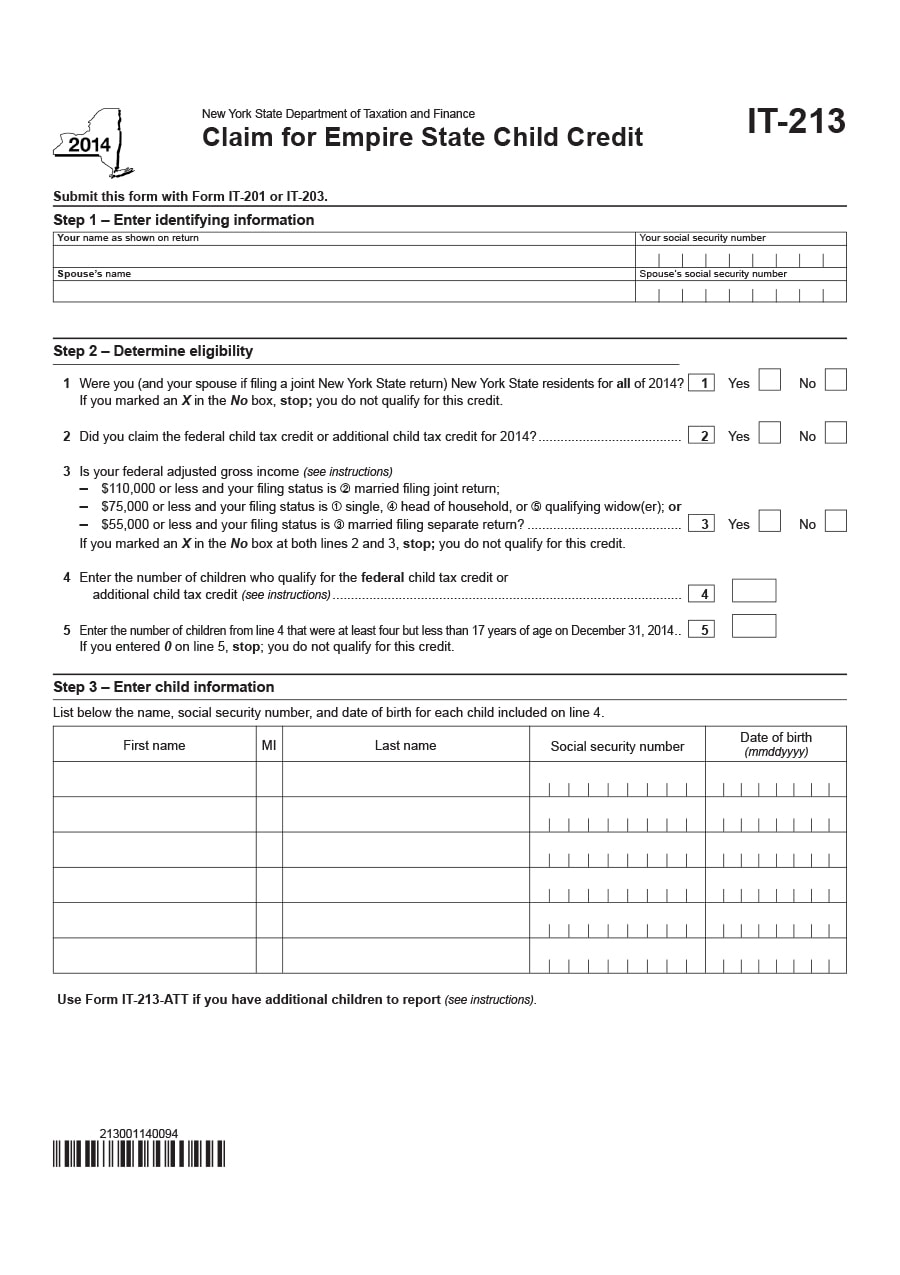

Self employment tax return including the additional child tax credit for bona fide residents of puerto rico. Instructions for form 1040 ss us. To be a qualifying child for the child tax credit the child must be under age 17 at the end of 2015 and meet all the conditions in steps 1 through 3 listed in the instructions for line 6c. The child tax credit worksheet is a helpful resource provided by the irs.

Yes no b for the second dependent identified with an itin and listed from child tax credit worksheet 2016 source. Child tax credit and credit for other dependents worksheetcontinued. Self employment tax return including the additional child tax credit for bona fide residents of puerto rico. If you do not have a qualifying child you cannot claim the child tax credit.

If you answered yes on line 9 or line 10 of the child tax credit worksheet in the form 1040 form 1040a or form 1040nr instructions or on line 13 of the child tax credit worksheet in this publication use. Irs child tax credit worksheet. Make sure you checked the box in. Make sure you check the box on form 1040a line 6c column 4 for each qualifying child.

This is the second page of the child tax credit and credit for other dependents worksheet to determine the amount of child tax credit and credit for other dependents the taxpayer can claim.