2020 W 4 Form Printable State

Changes to form wt 4.

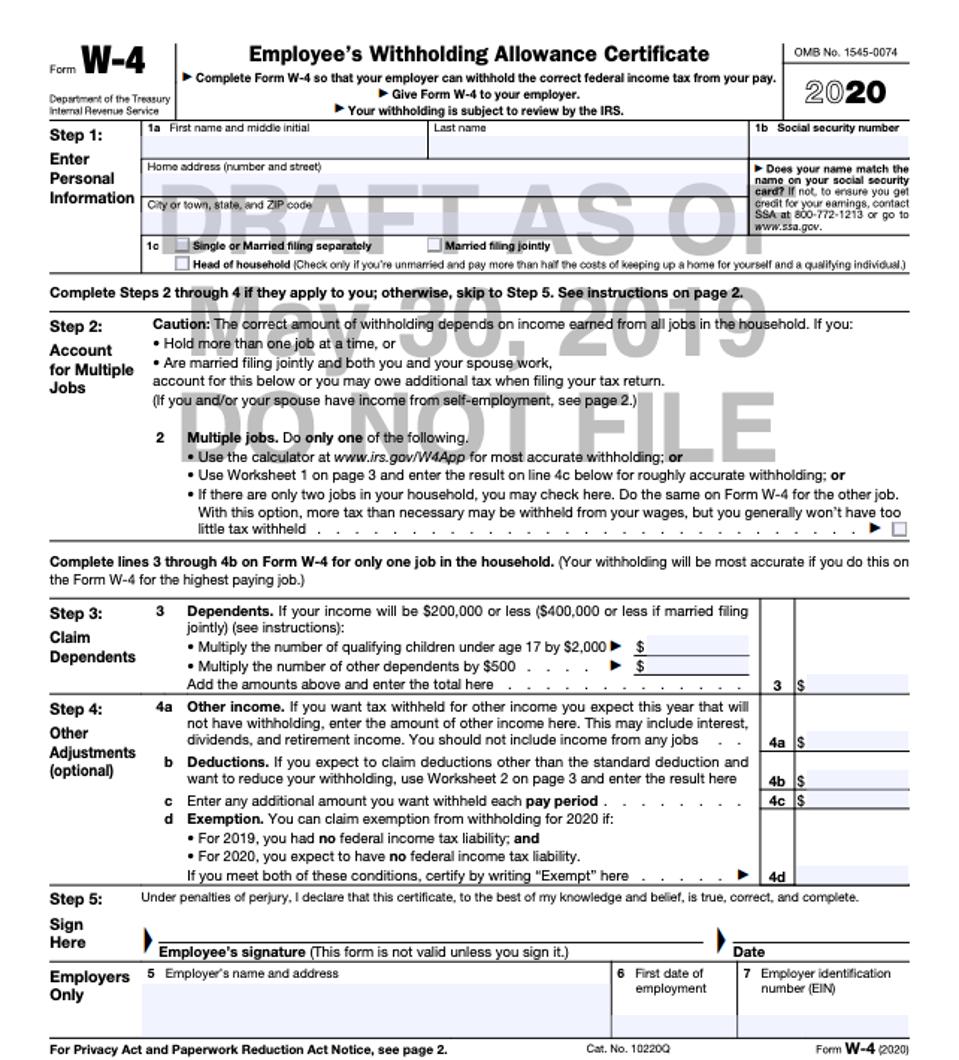

2020 w 4 form printable state. The old form w 4 accounted for multiple jobs using detailed instructions and worksheets that many employees may have overlooked. The treasury department and the irs are working to incorporate changes into the form w 4 employees withholding allowance certificate for 2020. The current 2019 version of the form w 4 is similar to last years 2018 version. The current version of w 4 can still be used as of december 2019.

The irs works with the treasury department on form w 4 employees withholding allowance certificate whenever it needs an update. The irs is working closely with the payroll and the tax community as it makes additional changes to the form w 4. Prior to this change an employee could use form w 4 for wisconsin purposes if the employees federal allowances equaled his or her wisconsin. Explained in the draft posted on the irs website federal allowances have been removed.

2020 form il w 4 employees and other payees illinois withholding allowance certificate and instructions. Form ct w4 employees withholding certificate department of revenue services effective january state of connecticut rev. Since the w 4 form is not related to your state income tax whether you live in connecticut or any other state for that matter the w 4 form will remain the same and you will have to complete it. For the year 2020 a new w 4 form will be released by the treasury department and the irs.

If the employee does not complete a form w 4mn you must withhold tax at the single filing status with zero allowances. The 2020 federal form w 4 will not compute allowances for determining minnesota withholding tax. Every employee that completes a 2020 form w 4 must complete form w 4mn for you to determine their minnesota withholding tax. 1219 1 2020 employee instructions read the instructions on page 2 before completing this form.

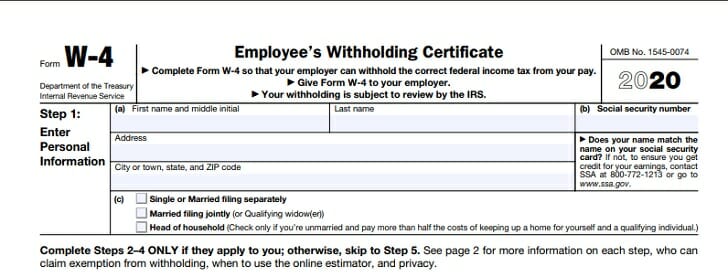

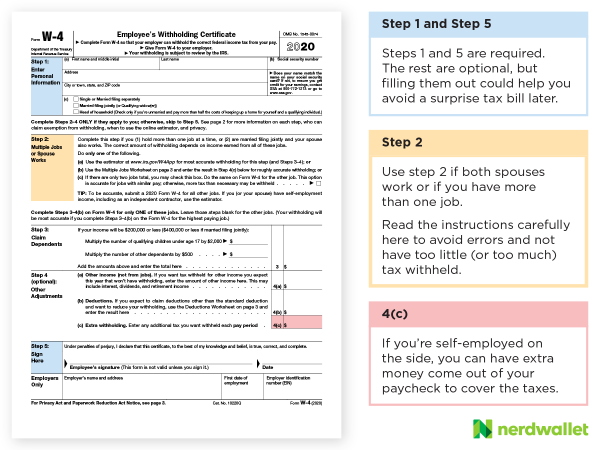

Step 2 of the redesigned form w 4 lists three different options you should choose from to make the necessary withholding adjustments. Form w 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay. You may reduce the number of allowances or request that your. There is likely going to be a new form for 2020 but it appears to be more detailed and complex as it takes more time than expected and it is something unusual for the irs.

Form w 4 2020 employees withholding certificate department of the treasury internal revenue service complete form w 4 so that your employer can withhold the correct federal income tax from your pay. Information about form w 4 employees withholding certificate including recent updates related forms and instructions on how to file. Select the filing status you expect to report on your connecticut income tax return.

/Form-w4-a3514b86fc7147d2abaec5bd575f11b4.jpg)

/how-to-fill-out-form-w-4-0947bf269e304790a4a4e818b097522f.png)