2020 W4 Form 2019 Printable

However once the new version is available employees must complete the new form and submit it to their employers.

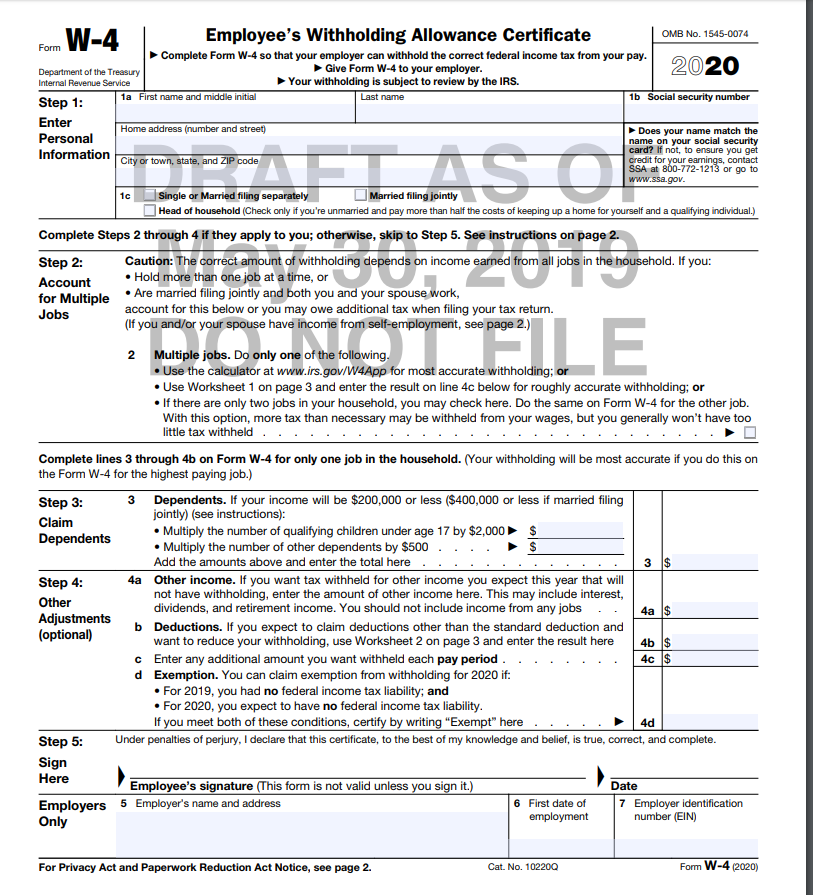

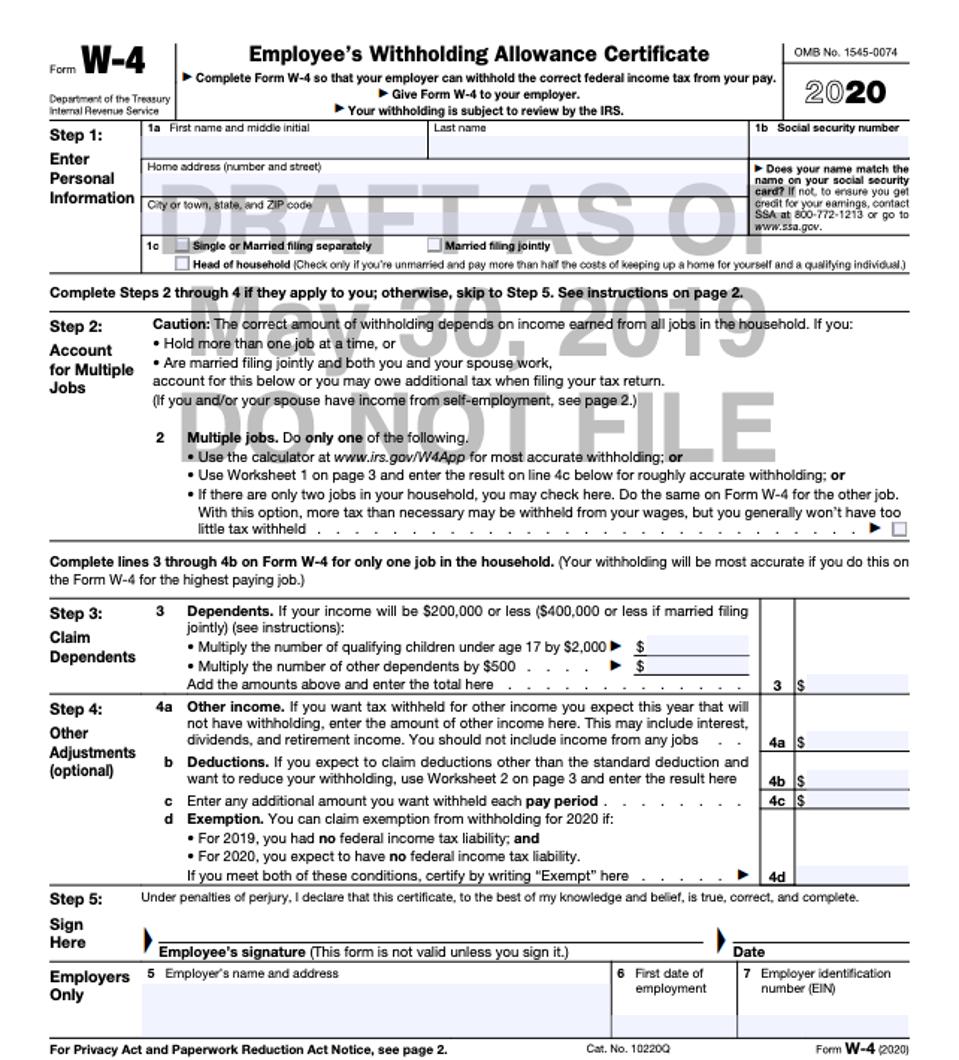

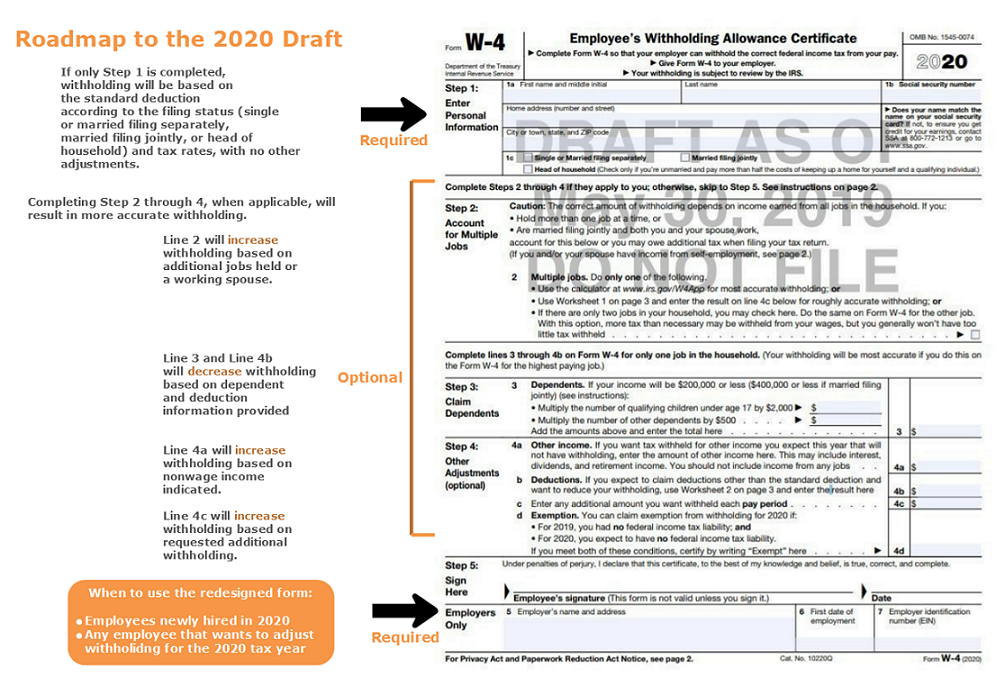

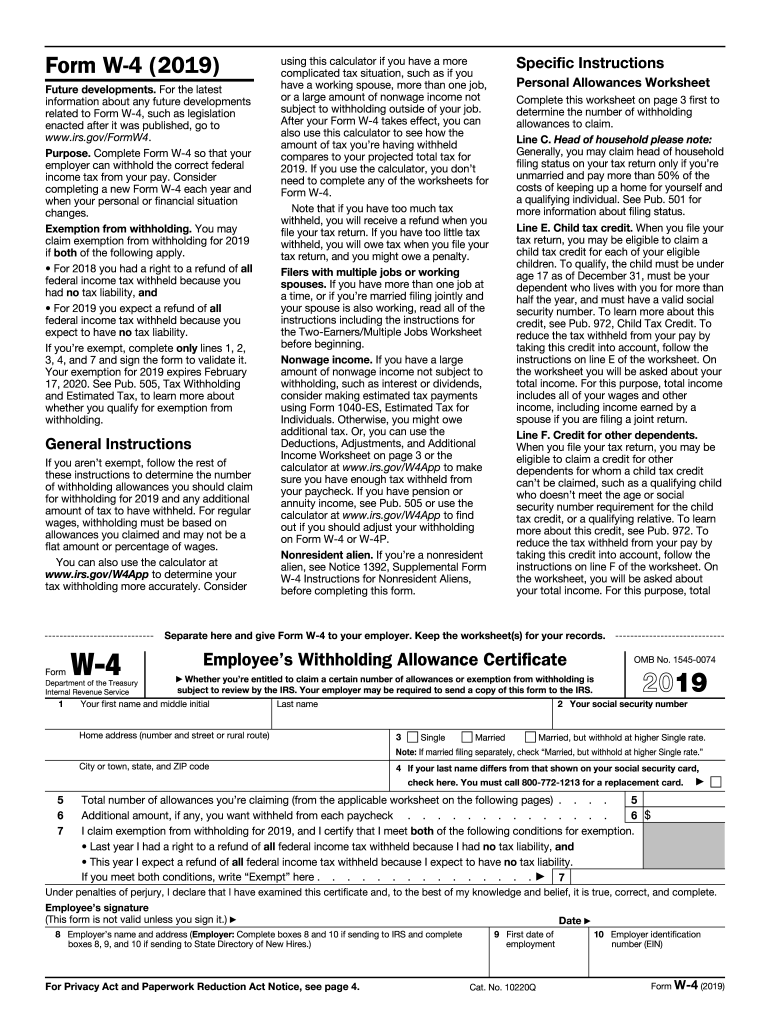

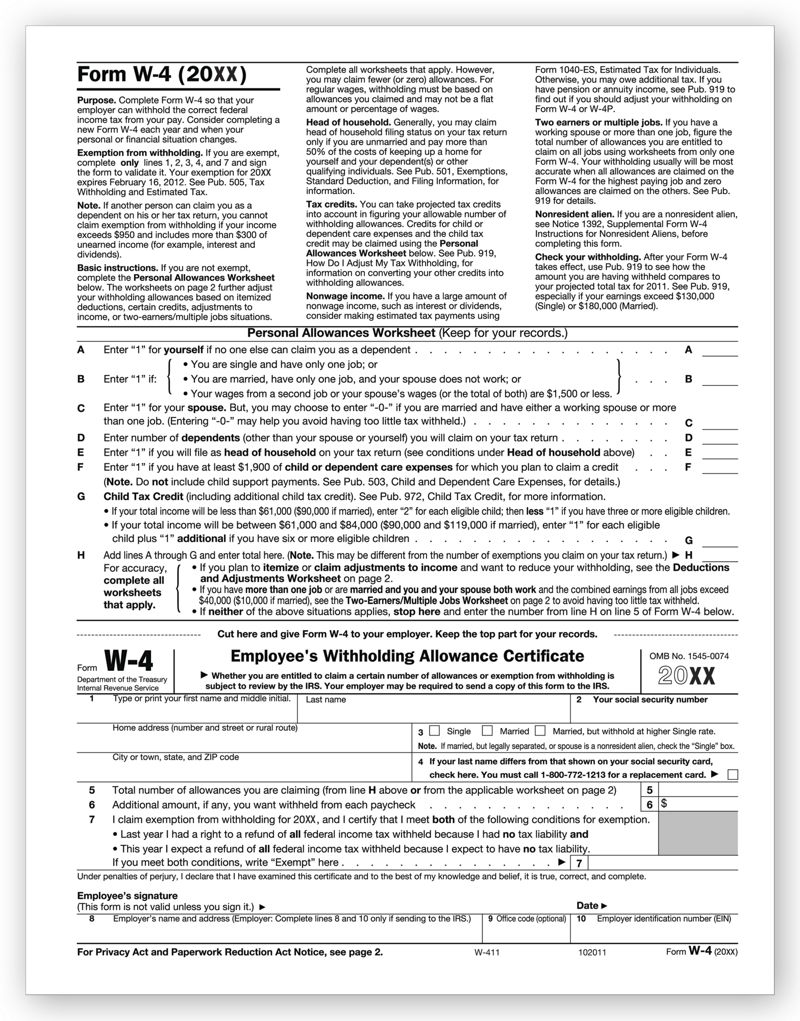

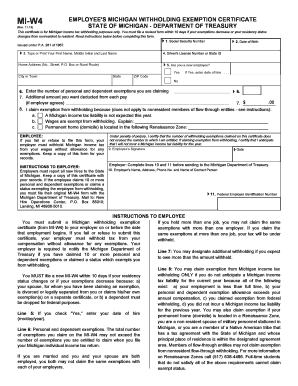

2020 w4 form 2019 printable. The irs works with the treasury department on form w 4 employees withholding allowance certificate whenever it needs an update. 2020 form il w 4 employees and other payees illinois withholding allowance certificate and instructions. Information about form w 4v voluntary withholding request including recent updates related forms and instructions on how to file. Note that to be accurate you should furnish a 2020 form w 4 for all of these jobs.

For the year 2020 a new w 4 form will be released by the treasury department and the irs. 9 comments on 2020 federal w 4 printable form. Follow these instructions to determine the number of withholding allowances you should claim for pension or annuity payment withholding for 2020 and any additional amount of tax to have withheld. Claim exemption from withholding if you are an iowa resident and both of the following situations apply.

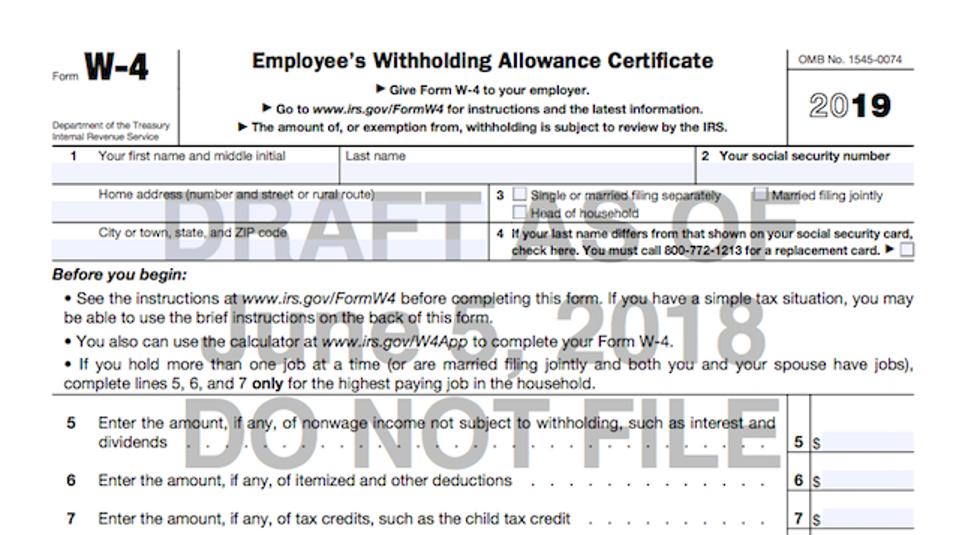

Form w 4 2020 employees withholding certificate. Withholding certificate for pension or annuity payments 2020 01312020 form w 4s. For the current 2019 tax year the irs continues to strongly urge taxpayers to review their tax withholding situation as soon as. Line 16 on your 2019 form 1040 or 1040 sr is zero or less than the sum of lines 18a 18b and 18c or 2 you were not required to file a return because your income was below the filing threshold for your correct filing status.

Use this form to ask payers to withhold federal income tax from certain government payments. Step 2 of the redesigned form w 4 lists three different options you should choose from to make the necessary withholding adjustments. The old form w 4 accounted for multiple jobs using detailed instructions and worksheets that many employees may have overlooked. Form il w 4 for the highest paying job and claim zero on all of your other il w 4 forms.

Exemption from withholding. You may reduce the number of allowances or request that your. The irs is working closely with the payroll and the tax community as it makes additional changes to the form w 4 for use in 2020. 1 for 201 9 you had a right to a refund of all iowa income tax withheld because you had no tax liability and 2 for 2020 you expect.

The current version of w 4 can still be used as of december 2019. Effect if you dont file a form w4p for 2020. 2019 12132019 form w 4 sp employees withholding certificate spanish version 2020 01022020 form w 4p. Ia w 4 instructions employee withholding allowance certificate.

Section references are to the internal revenue code.