501c3 Donation Receipt

Date of the contribution.

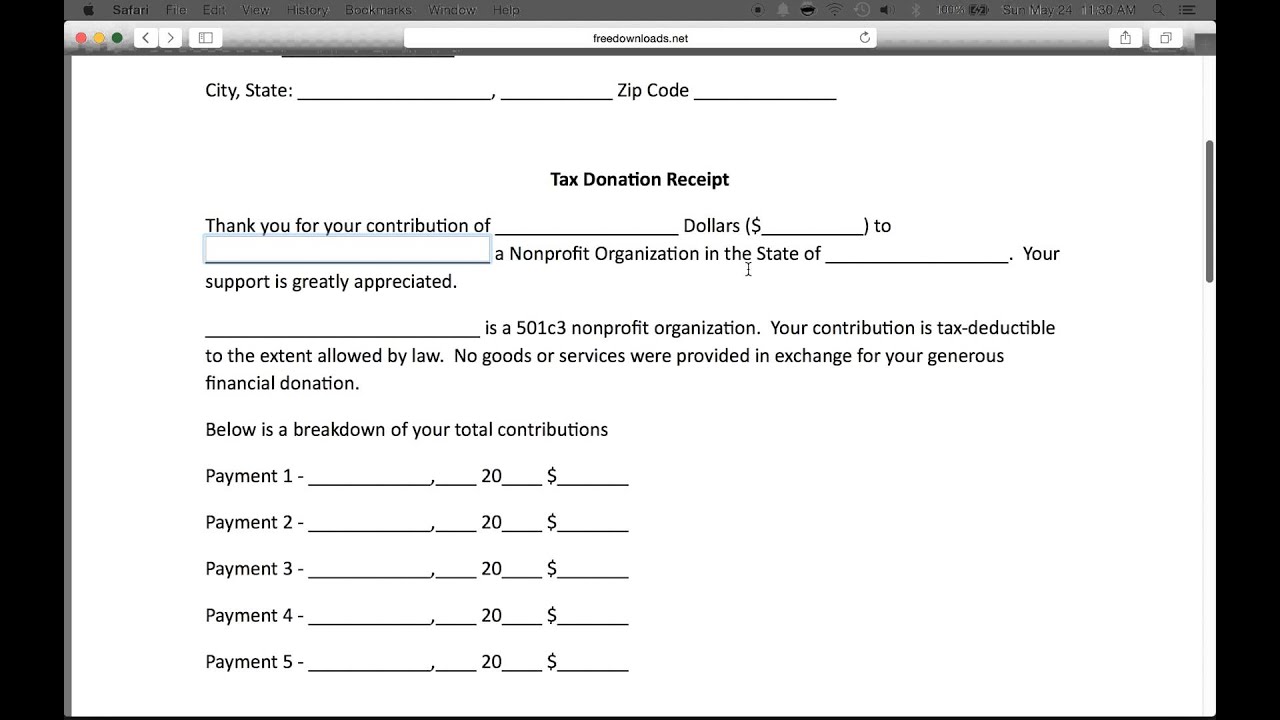

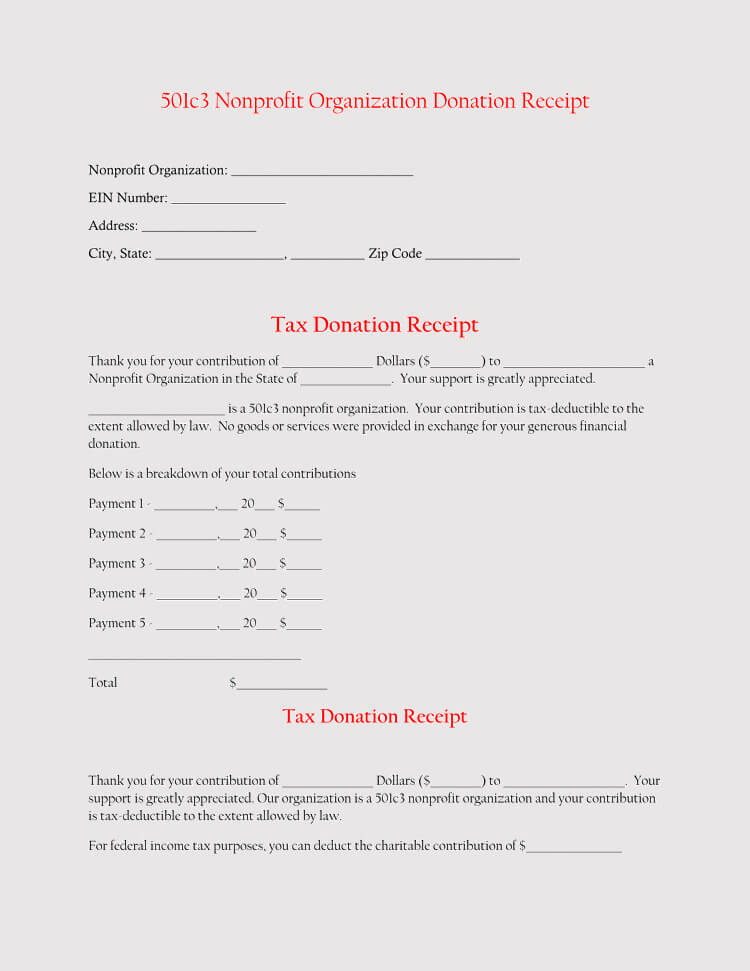

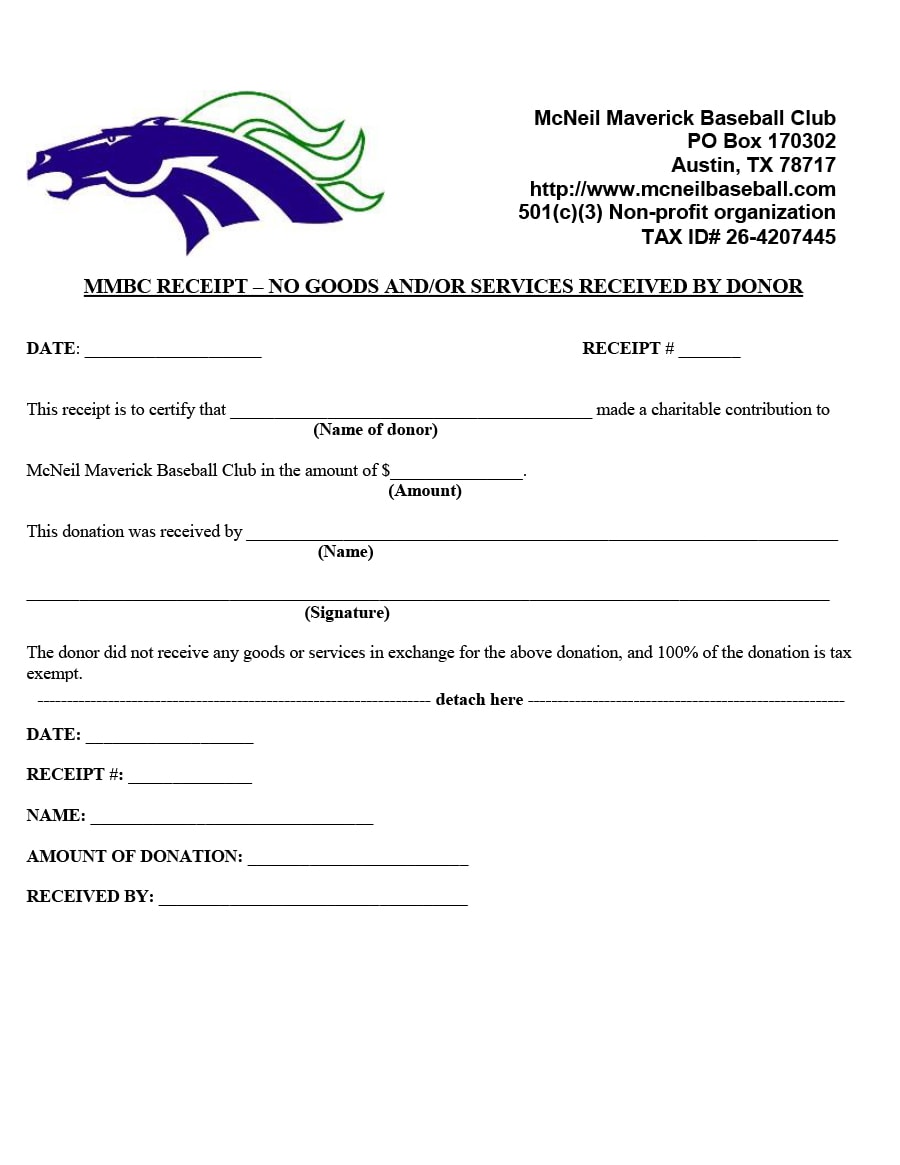

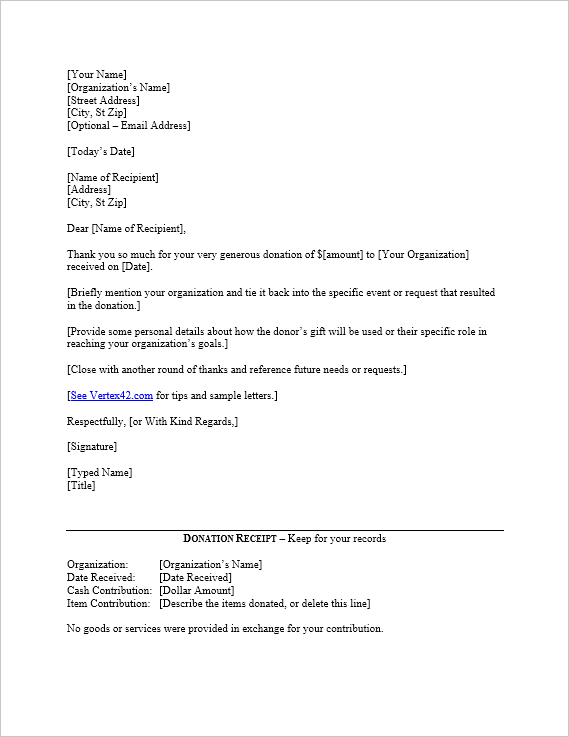

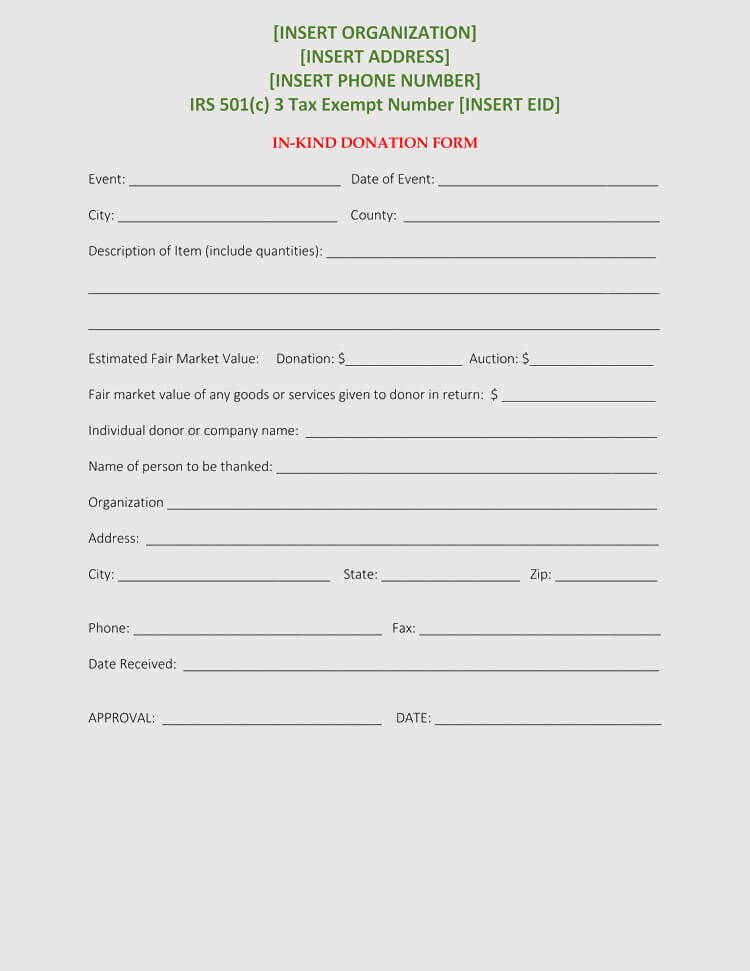

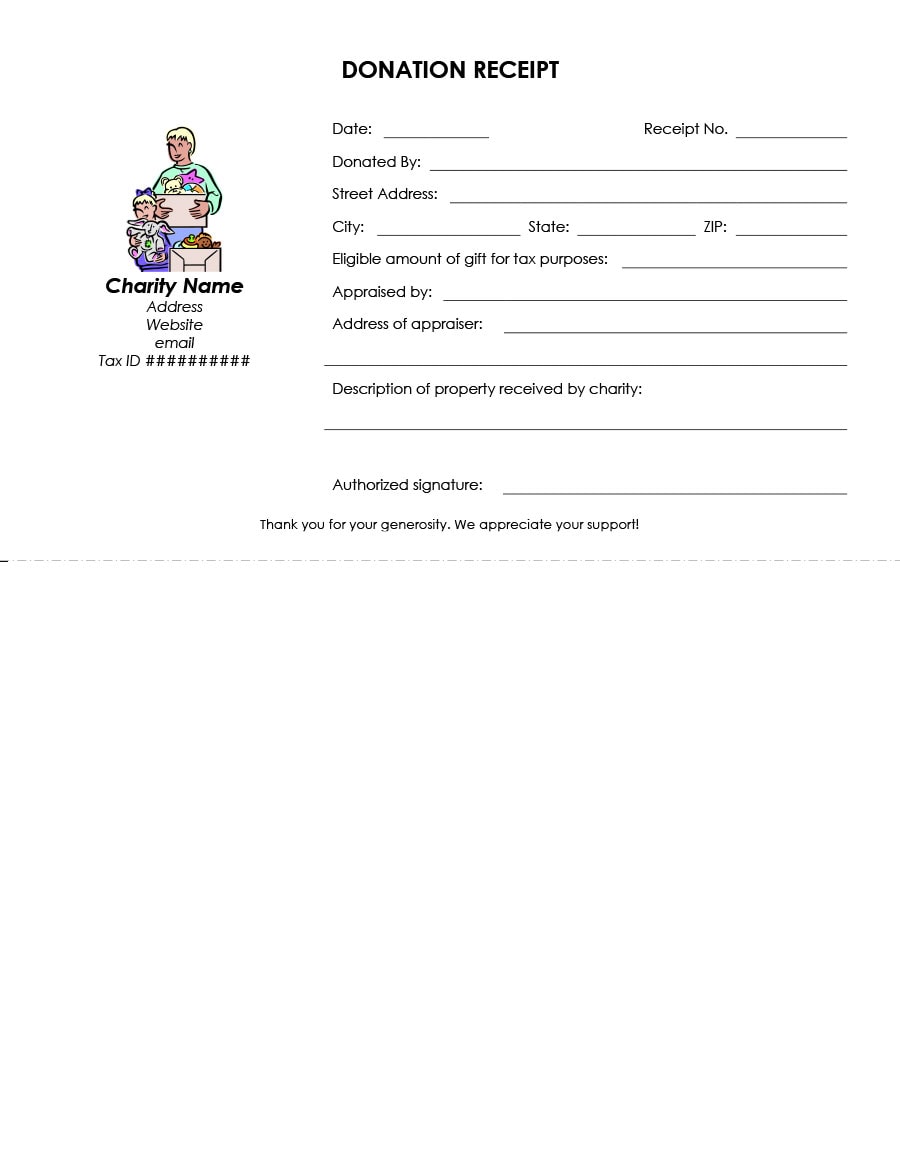

501c3 donation receipt. Include the nonprofits ein in case the donor wants to check the charitys tax exempt status. In order for a donor to take advantage of this benefit however your organization must provide a 501c3 treasury regulation compliant receipt you could theoretically provide a receipt for each. When the irs asks for these documents and the organization is unable to present them they can be charged with a penalty depending on the cause of the donation. This is not an official form to file with your annual taxes but may be needed in the event of a tax audit.

Its important to remember that without a written acknowledgment the donor cannot claim the tax deduction. Donation receipts serve as legal documents or legal requirements for non profit organizations. Some of the allure of donating to a 501c3 non profit organization is that a donor may be able to deduct the value of their donation from their taxes. The date the donation was received.

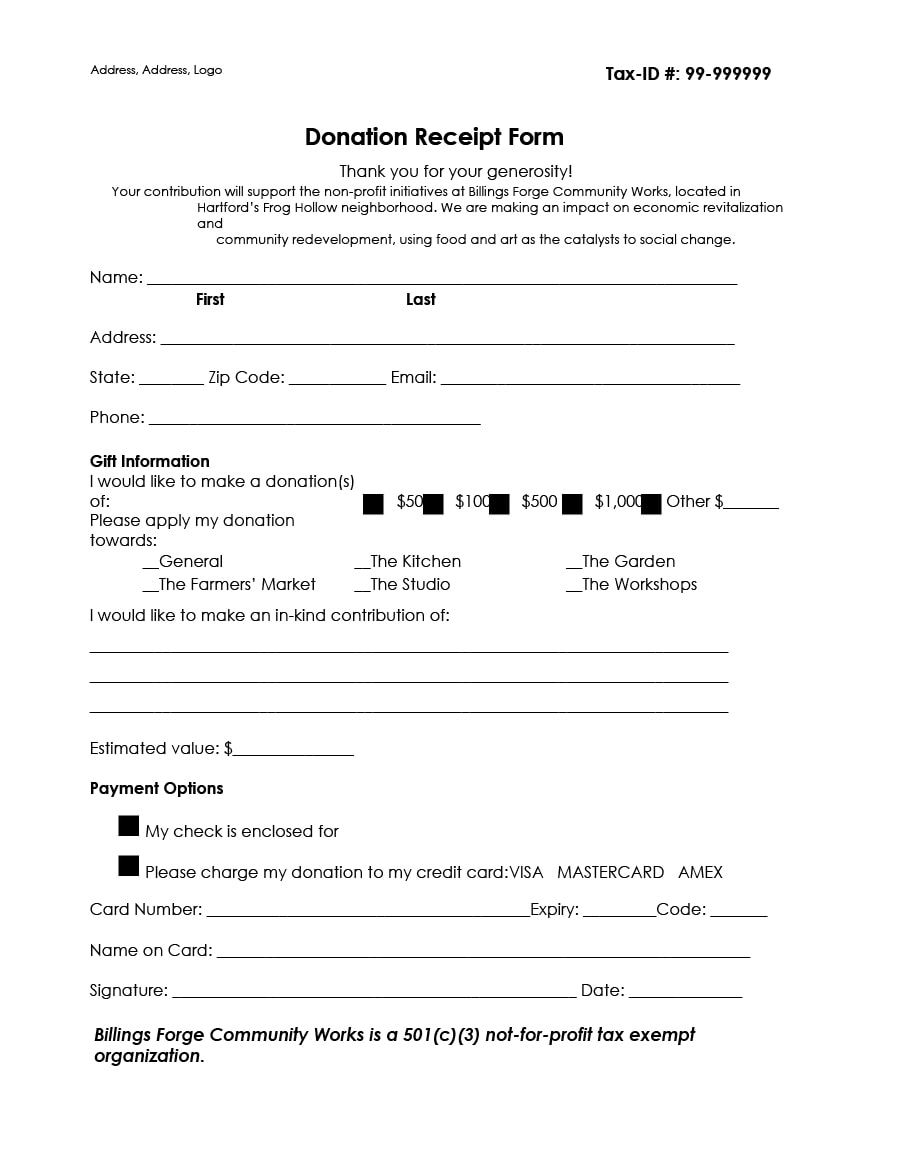

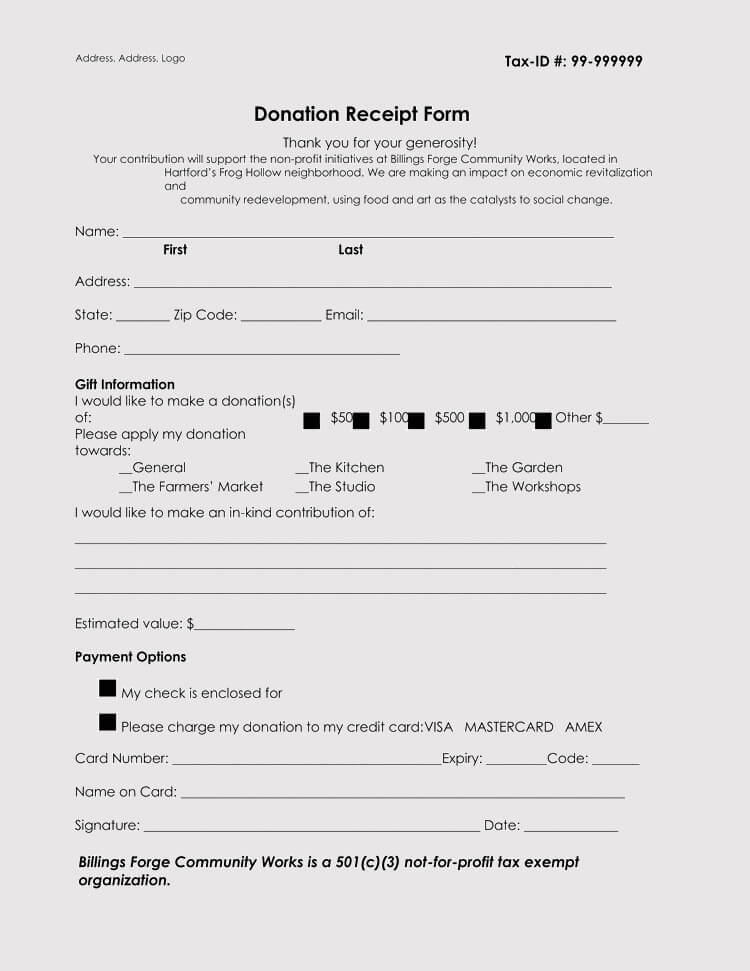

If you provide a good or service in return for a donation of 75 or more you are required to provide a receipt to the donor. That means that if the donor pays 75 and receives a calender or a dinner for example you must provide a receipt under law. Best practices for creating a 501c3 tax compliant donation receipt. Tax deductible donation receipts we have prepared examples of tax donation receipts that a 501c3 organization should provide to its donors.

Statement that the organization is a 501c3 tax exempt organization. The 501c3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or more. The receipt shows that a charitable contribution was made to your organization by the individual or business. Name of the organization the charity and name of the donor.

The receipt can take a variety of written forms letters formal receipts postcard computer generated forms etc. The donation receipt letter for tax purposes also known as form 501c3 is a document to be given to a contributor of a non profit charity that is recognized by the internal revenue service. Give a receipt for a donation of 75 that buys goods or services.