Accountant Certification Requirements

Sep 16 2019 find out what you need to become an accountant.

Accountant certification requirements. Read on to learn about how to become a cpa including the educational requirements. Earn cpa or cma certification. The cpa credential is focused on accounting and auditing professionals. Certified public accountants cpas perform accounting tax and auditing services for public accounting firms businesses or individuals.

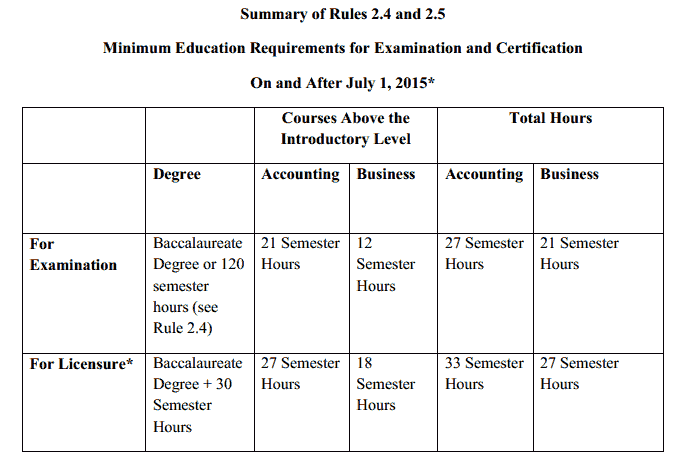

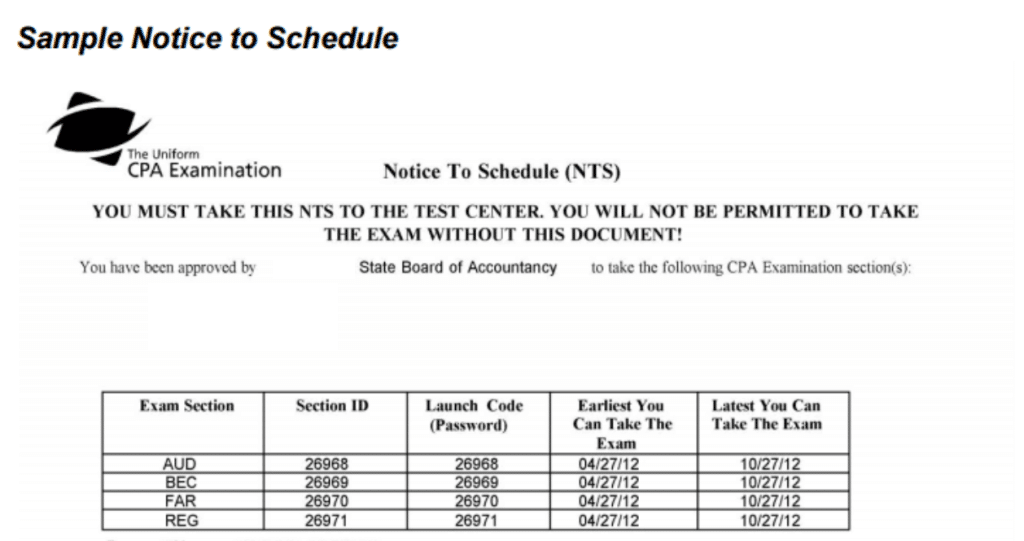

All cpa candidates must pass the uniform cpa examination to qualify for a cpa certificate and license ie permit to practice to practice public accounting. They also help those with prior degrees meet the certified public accountant cpa license requirements or prepare for the certified management accountant cma exam. This is due to the designations unique capabilities. The difference in education requirements between boards has to do with how many credit hours are required in each of the core areas of ethics and law accounting and business.

Research education requirements and learn about the experience you need to. A certified public accountant cpa is a similar designation to the cma. If you are unsure whether you want to become a cma or a cpa check on the course requirements for both credentials. While the exam is the same no matter where its taken every statejurisdiction has its own set of education and experience requirements that individuals must meet.

You can think of the cpa as the gold standard since everyone knows what it is and it earns great respect. Certification usually requires 150 credit hours. Whether you are licensed or soon to be licensed nasba provides information and resources you need to earn and maintain the respected cpa credential. Becoming a cpa a cpa license is the accounting professions highest standard of competence a symbol of achievement and assurance of quality.

An important distinction should be made between requirements to sit for the exam and requirements to become certified. Read on to learn about the education and testing requirements involved in becoming a cpa. How to become an accountant. The certified public accountant credential is the oldest and most well known accounting designation in the profession.

Many states allow candidates with a bachelors degree with specific credits in accounting and business courses to sit for the cpa exam. Although the uniform cpa exam is the same in all states and jurisdictions the eligibility requirements for taking the exam are not. Higher level certificates often lead to career advancement and new employment opportunities. What training is necessary to become a cpa.