Affordable Care Act Worksheet

Enroll now for 2020 coverage.

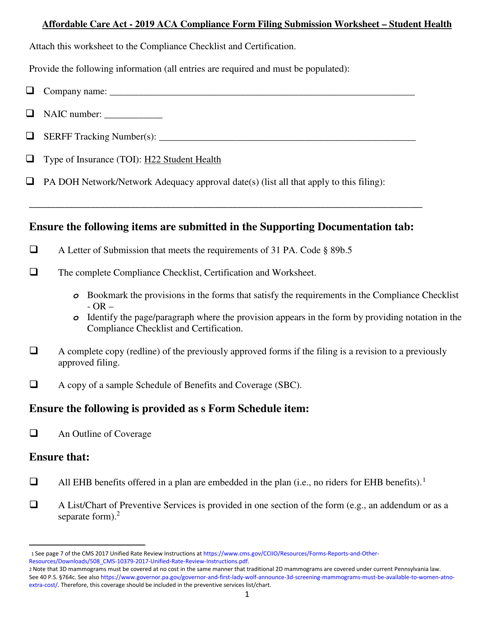

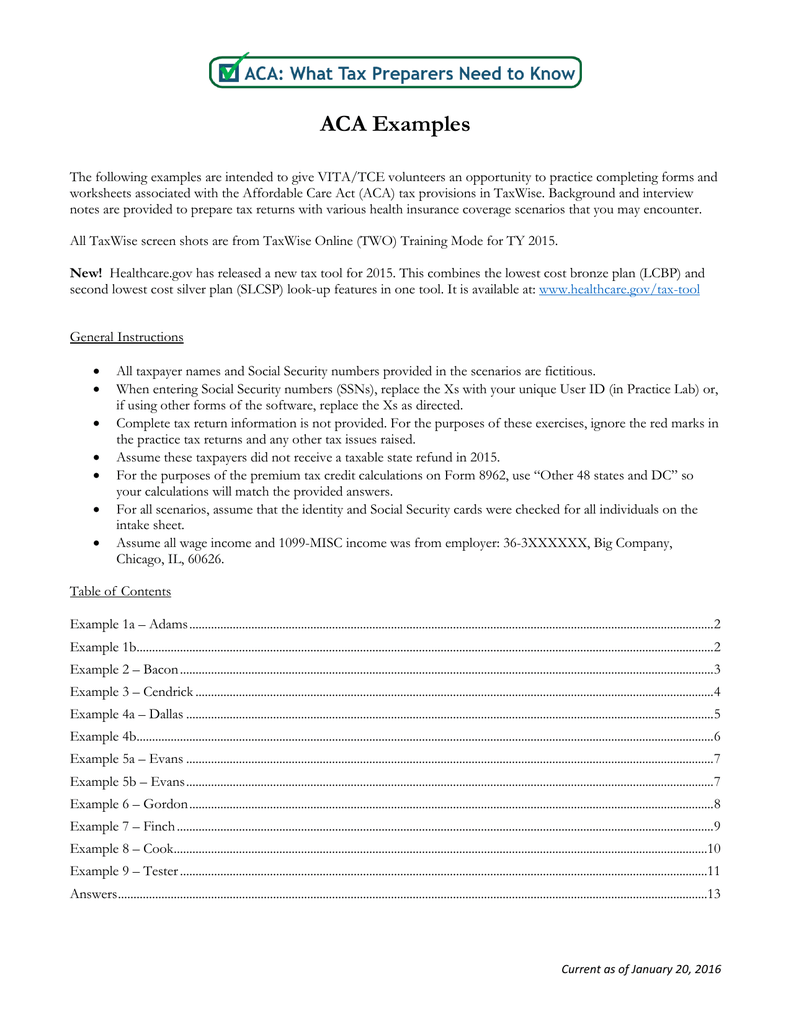

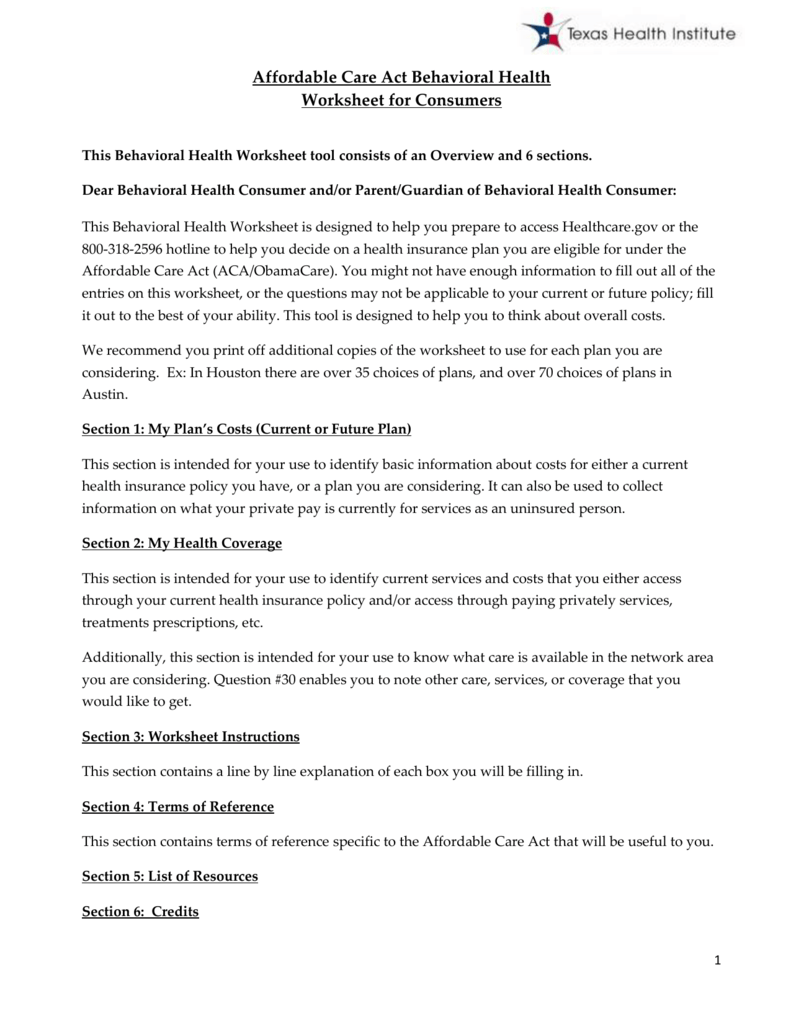

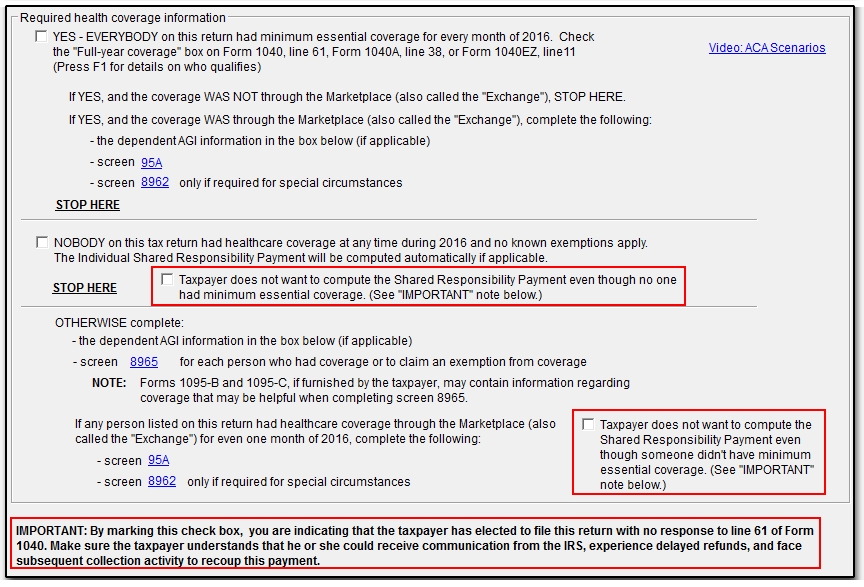

Affordable care act worksheet. Topic page for insolvency worksheet. Section 9010 of the patient protection and affordable care act aca imposes a fee on each covered entity engaged in the business of providing health insurance for united states health risks. This article was originally published on january 23 2018. Official site of affordable care act.

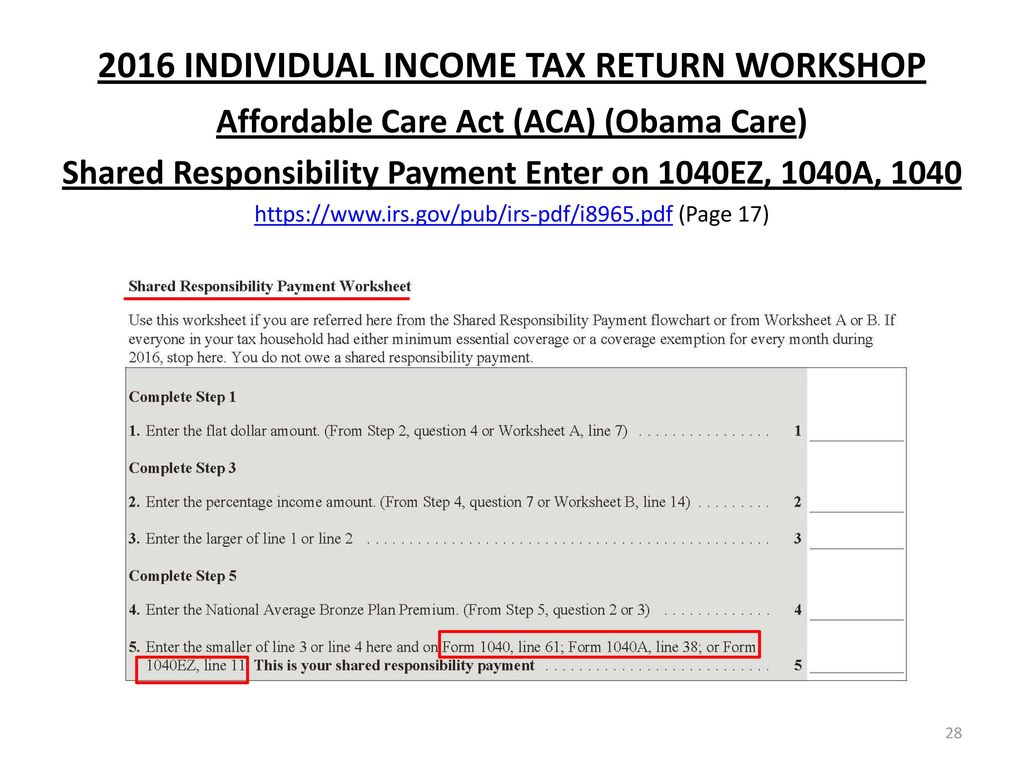

Insolvency worksheet publication 4681 canceled debts foreclosures repossessions and abandonments html. Instructions for form 8615 tax for certain children who have unearned income. See health coverage choices ways to save today how law affects you. Under the affordable care act eligibility for income based medicaid1 and subsidized health insurance through the marketplaces is calculated using a households modified adjusted gross income magi.

Community care is based on specific eligibility requirements availability of va care and the needs and circumstances of individual veterans. Va provides care to veterans through community providers when va cannot provide the care needed. You may have heard that tax reform eliminated the affordable care act aca individual penalty but its important to note that the removal of the so called healthcare tax penalty starts with 2019 tax returns filed in 2020. Under the recently enacted tax cuts and jobs act taxpayers must continue to report coverage.

The public inspection page on federalregistergov offers a preview of documents scheduled to appear in the next days federal register issue. Information page regarding aca section 9010. The affordable care act definition of magi under the internal. Topic page for tax computation worksheet.

High deductible health plans hdhp with a health savings account hsa allow you to set up a savings account in which you can accumulate additional money on a tax deductible basis to pay for current or future medical expenses.