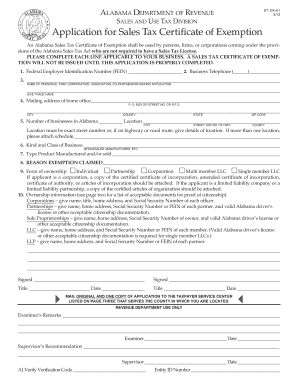

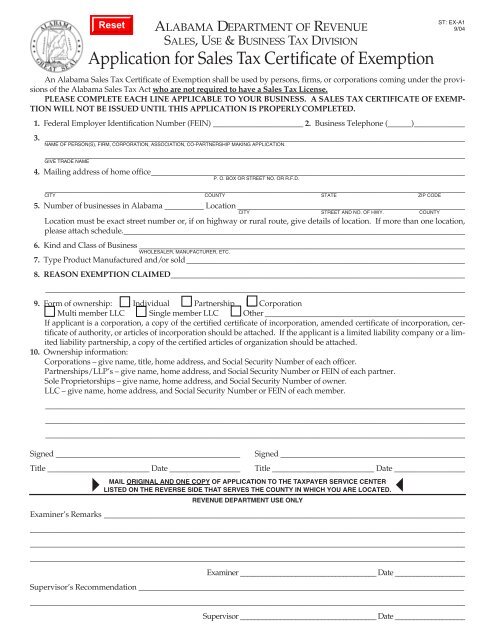

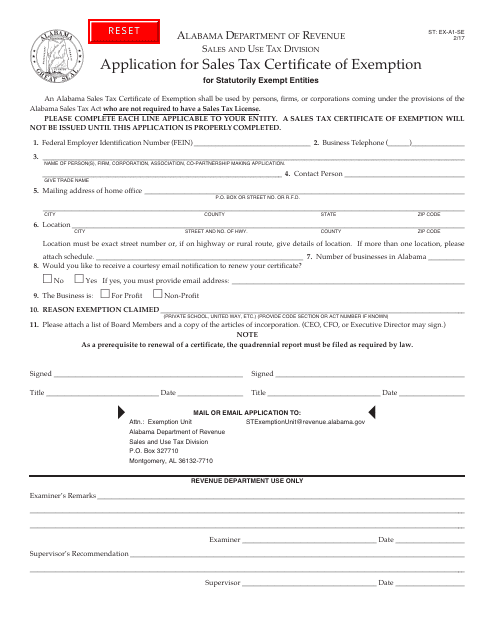

Alabama Resellers Certificate

Similar names for a sales tax license include.

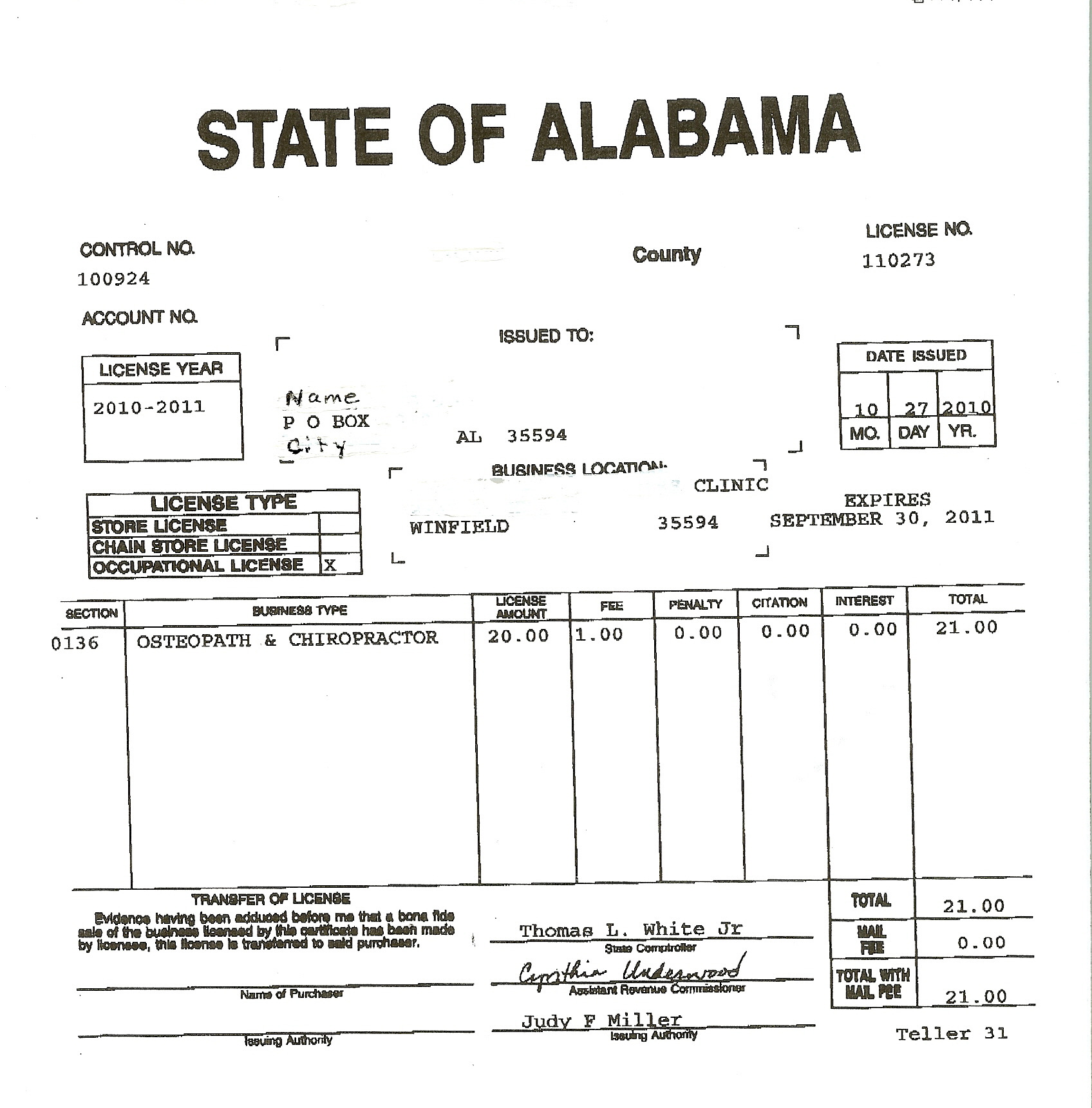

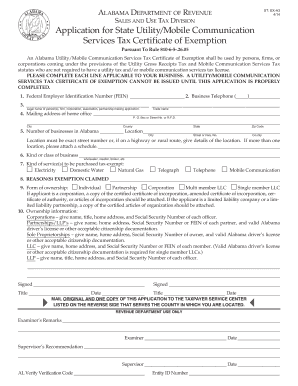

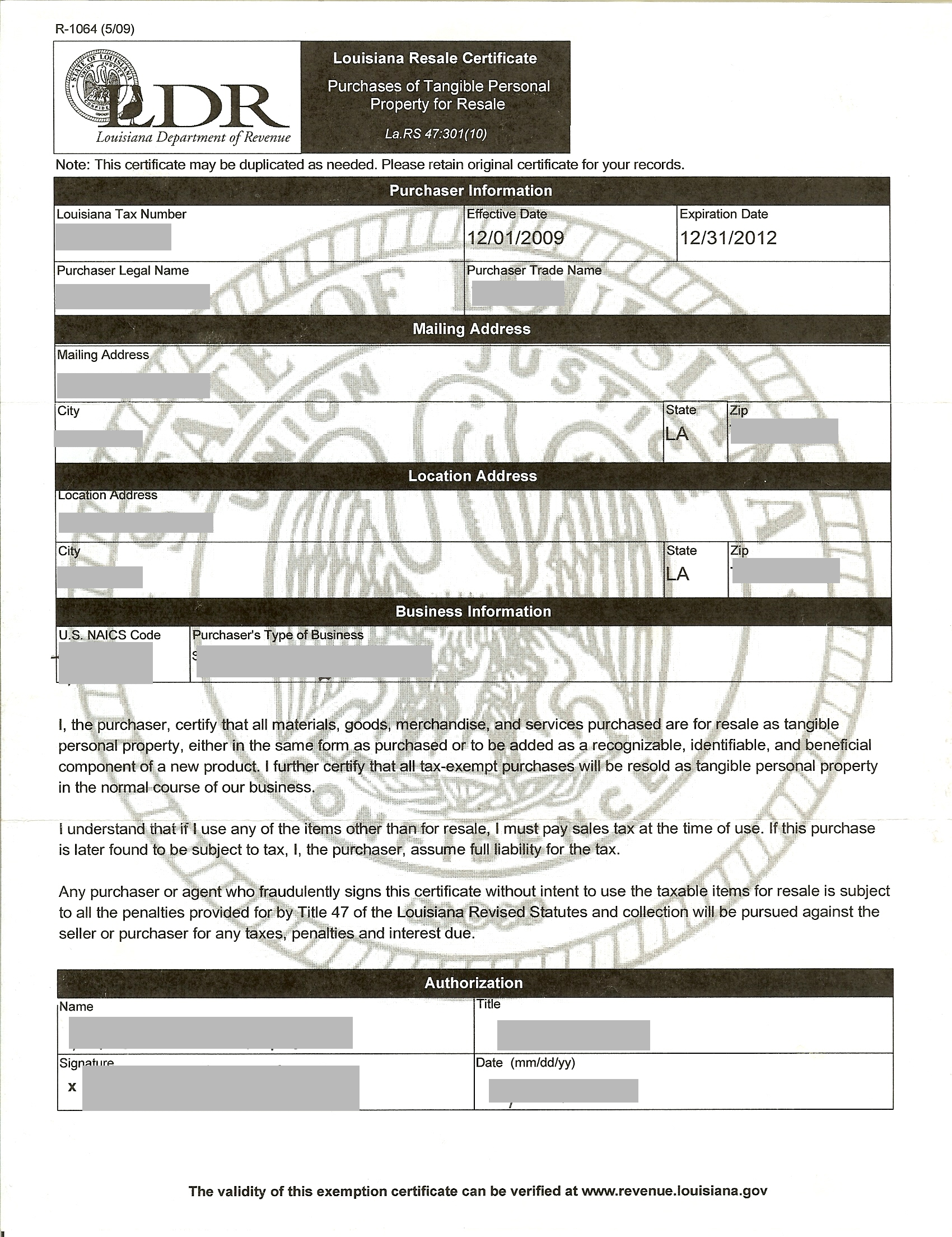

Alabama resellers certificate. Resale certificate reseller number sellers permit exemption certificate or resellers license. Alabama tax exemption alabama resale certificate alabama sale and use tax alabama wholesale certificate etc. Most businesses operating in or selling in the state of alabama are required to purchase a resale certificate annually. The tax is collected by the seller from their customer and remitted directly to the state.

In alabama anybody who is registered for an alabama sales tax permit can buy items they intend to resell but giving a copy of your alabama sales tax license to your vendor. Sales tax is a privilege tax imposed on the retail sale of tangible personal property sold in alabama by businesses located in alabama. Alabama is one of the few states that dont have a resale. Unlike many other states you are not required to fill out a resale certificate.

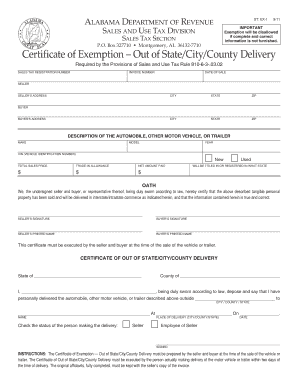

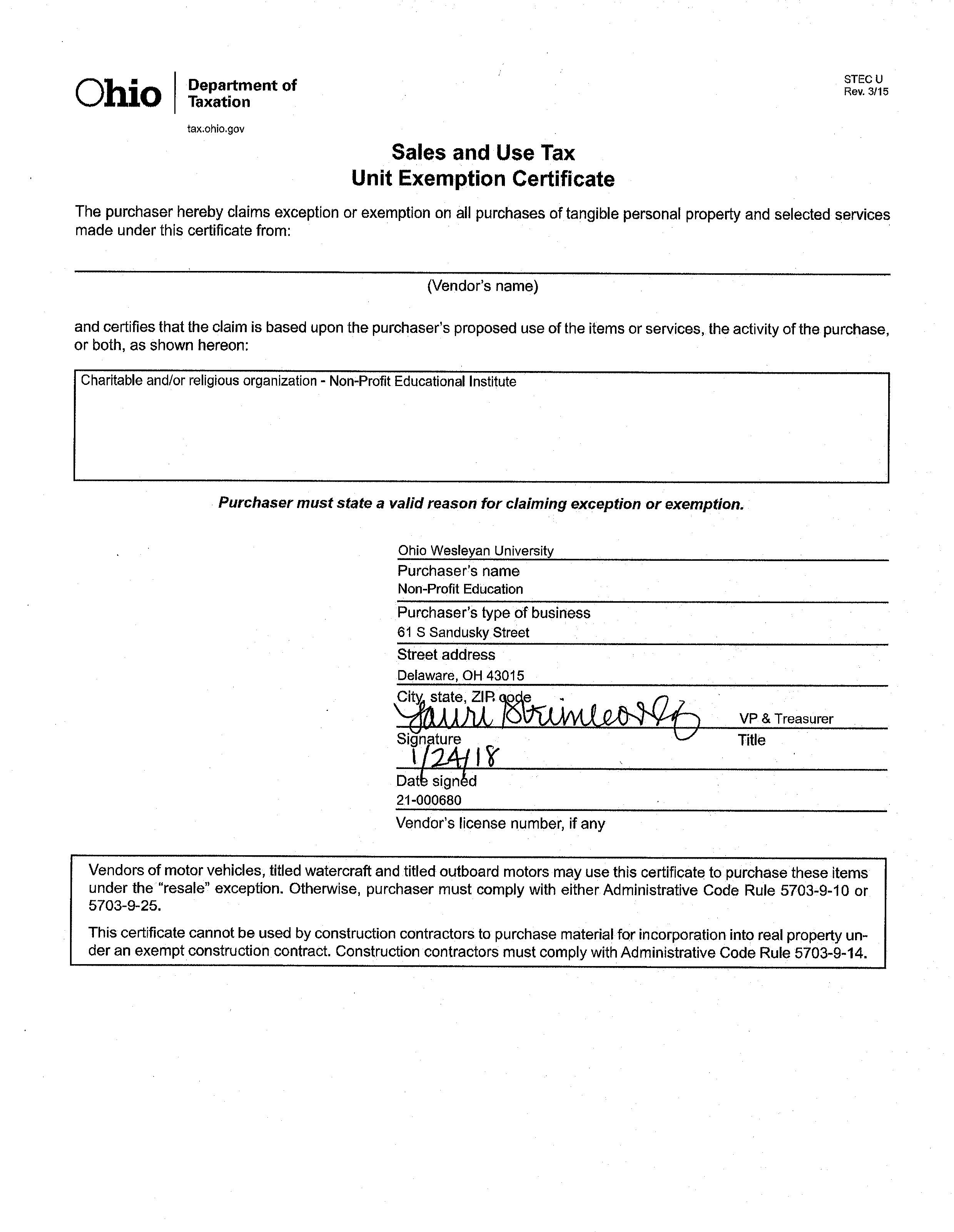

This ia a resale certificate which is a special type of sales tax exemption certificate intended for use by businesses or individuals who are purchasing goods which will be resoldsince sales taxes are meant to be paid by the end consumer of the goods resellers and dealers are allowed to purchase their inventory of goods for resale tax free. This page explains how to make tax free purchases in alabama and lists seven alabama sales tax exemption forms available for download. Even online based businesses shipping products to alabama residents must collect sales tax. In order to prove a buyer intends to resell the product they must provide a valid resale certificate to the seller of the goods.

If you wish to buy items for resale in alabama. Also known as.