Aml Risk Assessment Template

It also outlines your day to day responsibilities under the money laundering.

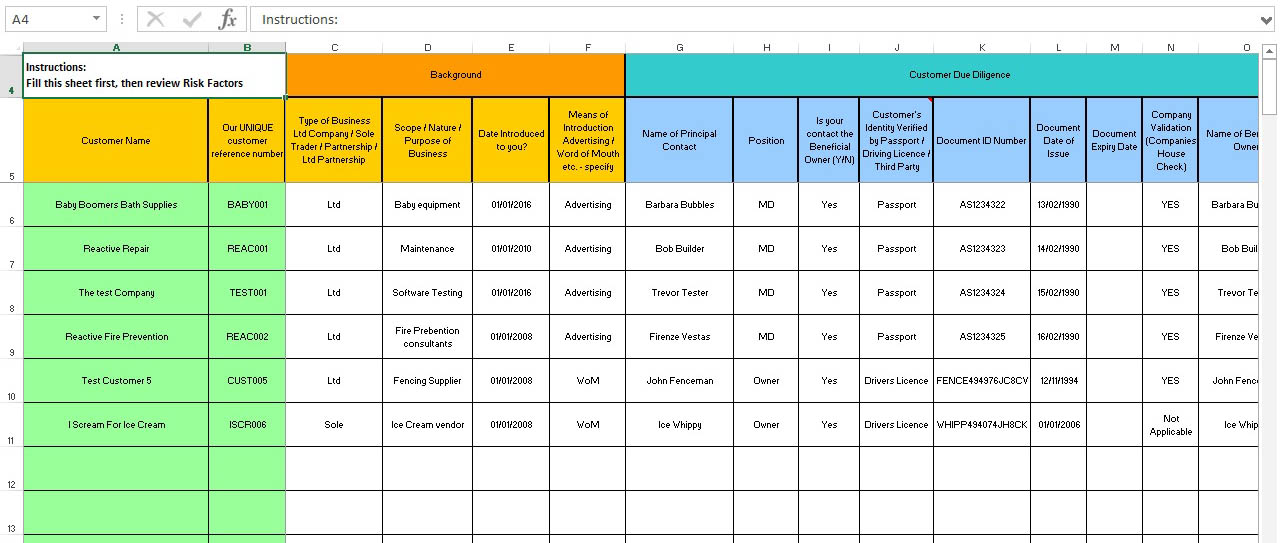

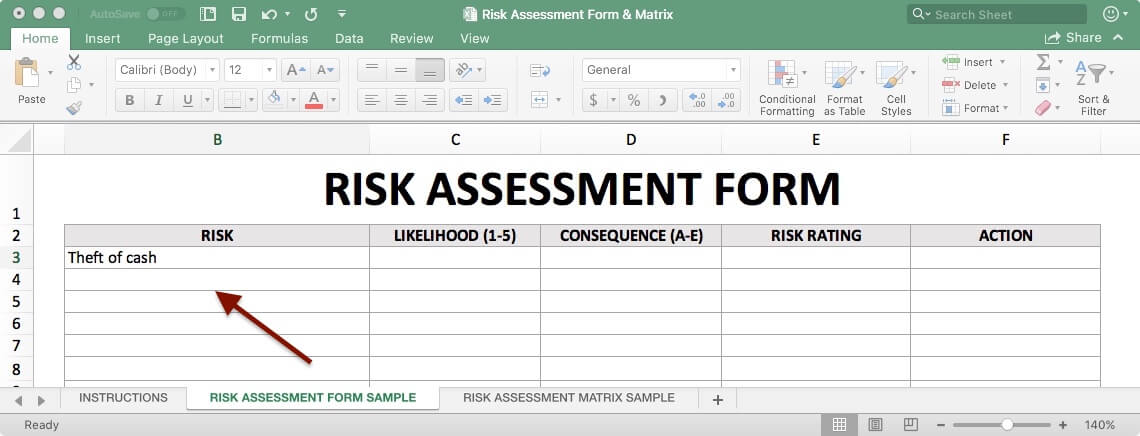

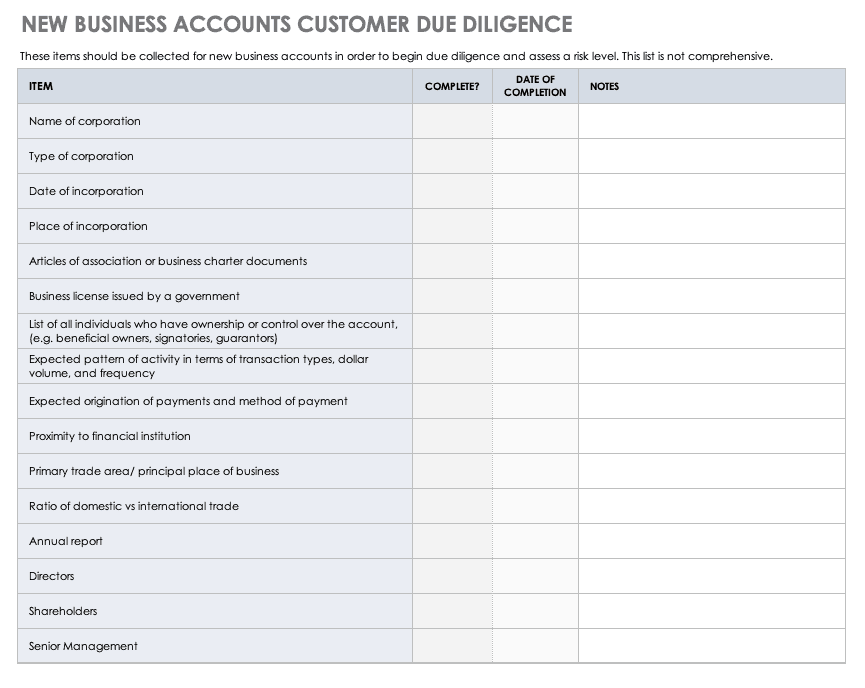

Aml risk assessment template. This guide gives an overview of the risk based approach and helps you to carry out a risk assessment of your business. Take up to 3 months to complete the process. You should also keep note of when you carry out these reviews. The form is designed to help firms in assessing aml risks posed at both client and transactional level.

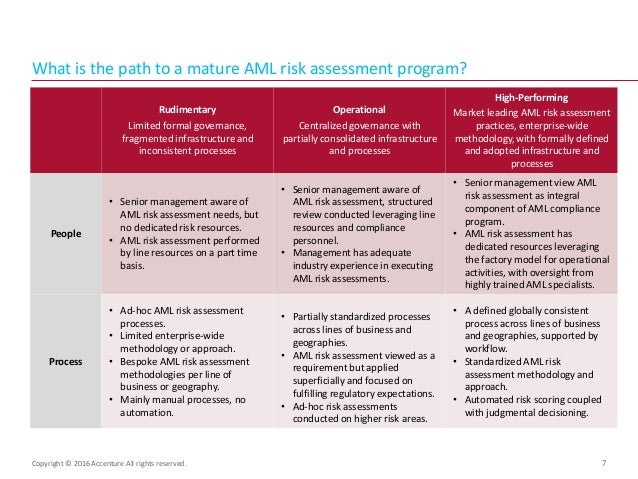

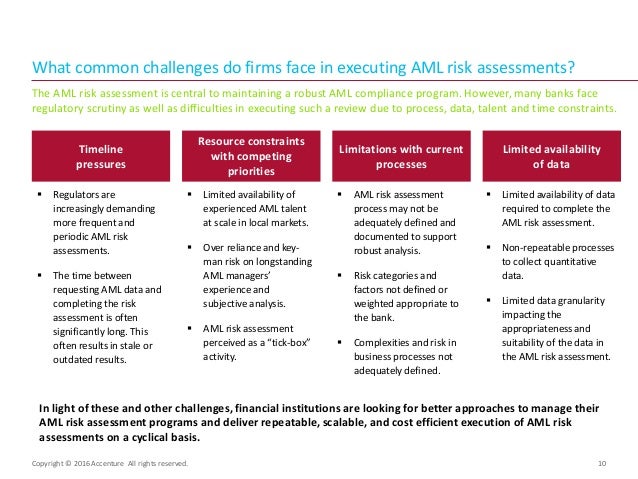

Nearly half of institutions spend a quarter of their year to complete the aml risk assessment process. The theory supporting risk assessment tools and templates is based on the concept that a clients risk aml profile can be measured by applying data driven and risk based calculations on risk categories identified by financial experts and the regulatory community. Of institutions update their aml risk assessment annually. Most institutions are updating their aml risk assessments on an annual basis.

As part of our ongoing work to refresh the anti money laundering aml resources we make available to the profession we have recently added an example aml risk assessment form which can be downloaded and used by member firms. However that should k ome after the risk assessmentc. The conclusion should include a short narrative in support of the conclusion. Egulator on demand a copy of your risk assessment and all steps taken to carry it out regulation 186r 2eep your records of such meetings or consultations.

The template provides text examples instructions relevant rules and websites and other resources that are useful for developing an aml plan for a small firm. Review your risk assessment regularly to reflect changes in your circumstances or the sector wide risk assessments. Firms should also note that they may access all of the guidance finra has provided regarding finra rule 3310 at the anti money laundering main page. Sample bank bsaaml bank risk assessment april 2013 high risk scored as 3 moderate risk scored as 2 low risk scored as 1 rating score comments 1 large and growing customer base in broad and diverse market area andor customer base increased more than 30 over prior year customer base increased more than 15 but no more than 30.

In addition to the practice wide risk assessment you need to undertake an aml risk. Aml risk assessment reviews. Note that you must also have your firms aml policy approved by senior management regulation 19. The key is to understand the banks risk exposure and develop the necessary policies procedures systems and controls to mitigate the risk.