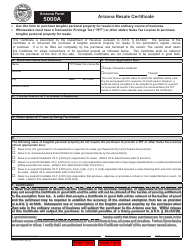

Arizona Resale Certificate

Arizona residents who purchase goods using a resale certificate and the goods are used stored or consumed in arizona contrary to the purpose stated on the certificate.

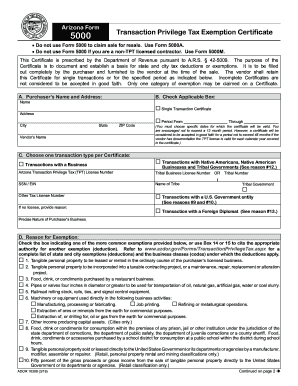

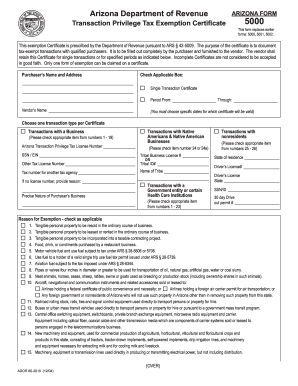

Arizona resale certificate. Arizona tax exemption arizona resale certificate arizona sale and use tax arizona wholesale certificate etc. The vendor shall retain this certificate for single transactions or for specified. Arizona transaction privilege tax tpt is a tax on the vendor for the privilege of doing business in the state. Most businesses operating in or selling in the state of arizona are required to purchase a resale certificate annually.

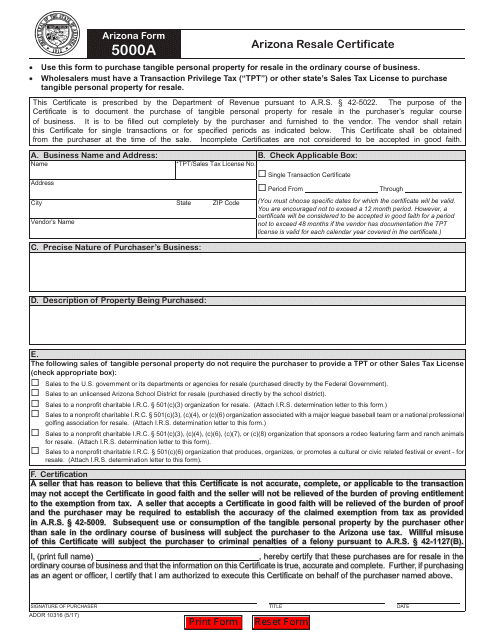

Arizona form 5000a arizona resale certificate this certificate is prescribed by the department of revenue pursuant to ars. The purpose of the certificate is to document the purchase of tangible personal property for resale in the purchasers regular course of business. We strongly encourage taxpayers to file online via the aztaxesgov website for faster processing and fewer errors. The purpose of this certificate is to provide an online lodging marketplace olm registered with the department pursuant to ars.

60 2018indd arizona resale certicate arizona form 5000a this certicate is to be completed by the purchaser and furnished to the vendor who shall retain it. The purpose of the certificate is to document the purchase of tangible personal property for resale in the purchasers regular course of business. Because arizona has a transaction privilege tax tpt rather than a sales tax it can be a bit more confusing to use a resale certificate in arizona than it is in other states. Resale exemption certificate document title.

A new certificate does not need to be made for each transaction. Arizona form 5000a arizona resale certificate this certificate is prescribed by the department of revenue pursuant to ars. It is to be filled out completely by the purchaser and furnished to the vendor. Arizona resale certificate.

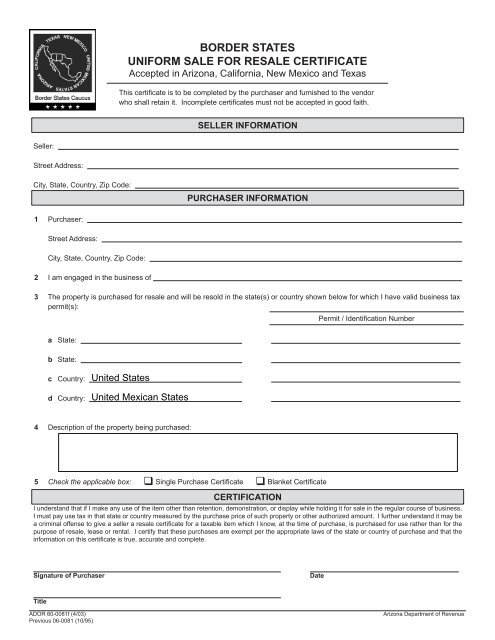

When you buy products for resale in the state of arizona you can avoid paying sales tax on some items by presenting an arizona resale certificate. Arizona does permit the use of a blanket resale certificate which means a single certificate on file with the vendor can be re used for all exempt purchases made from that vendor. The purpose of the certificate is to document the purchase of tangible personal property for resale in the purchasers regular course of business. Even online based businesses shipping products to arizona residents must collect sales tax.

Incomplete certicates must not be accepted in good faith. 42 5005 with exemption documentation from an owner of property in this state that is listed with the olm where such property is located on a native american reservation and is owned by a member of the tribe for which the reservation was established.