Bank Account Template

Account payable template is a ready to use excel template easily to record your payable invoices all in one sheet.

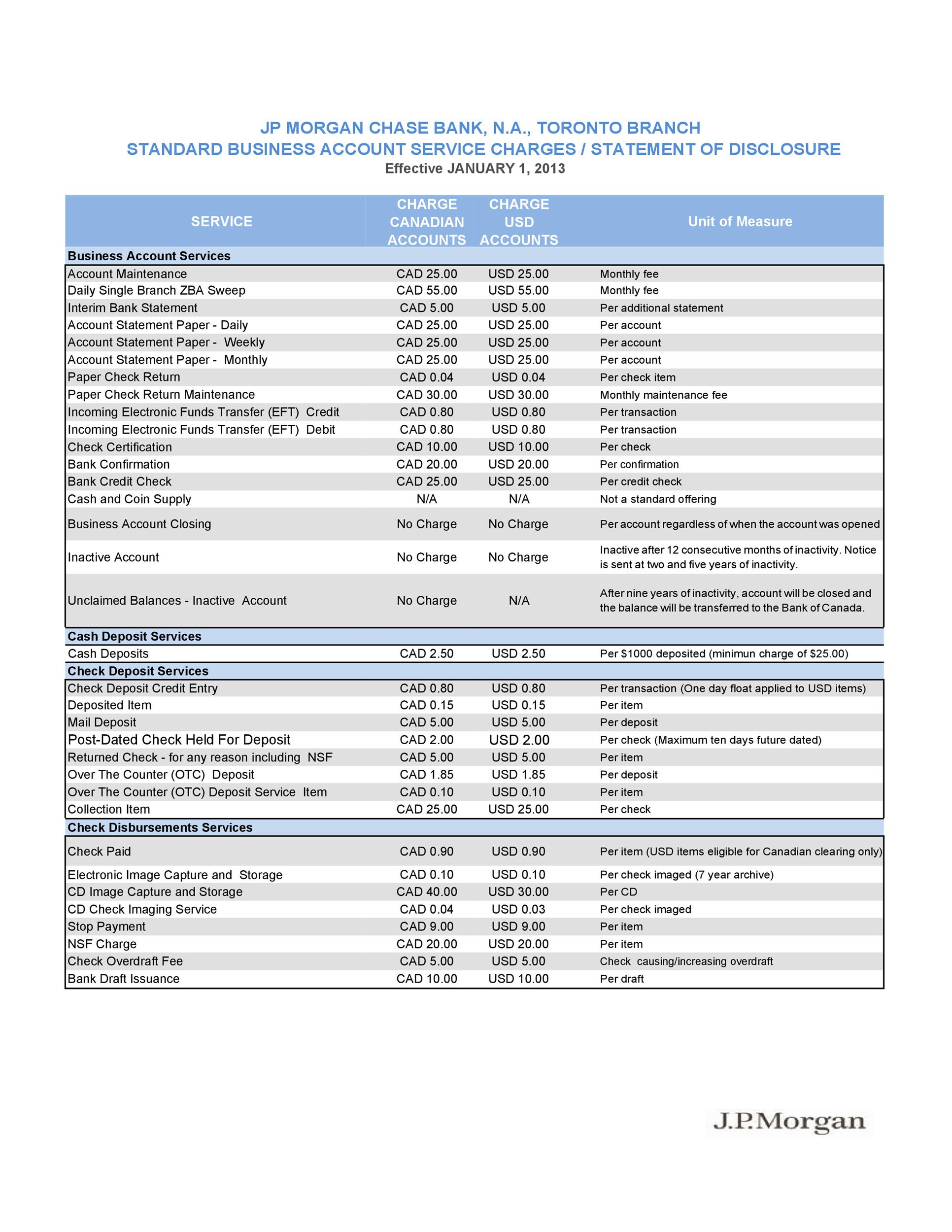

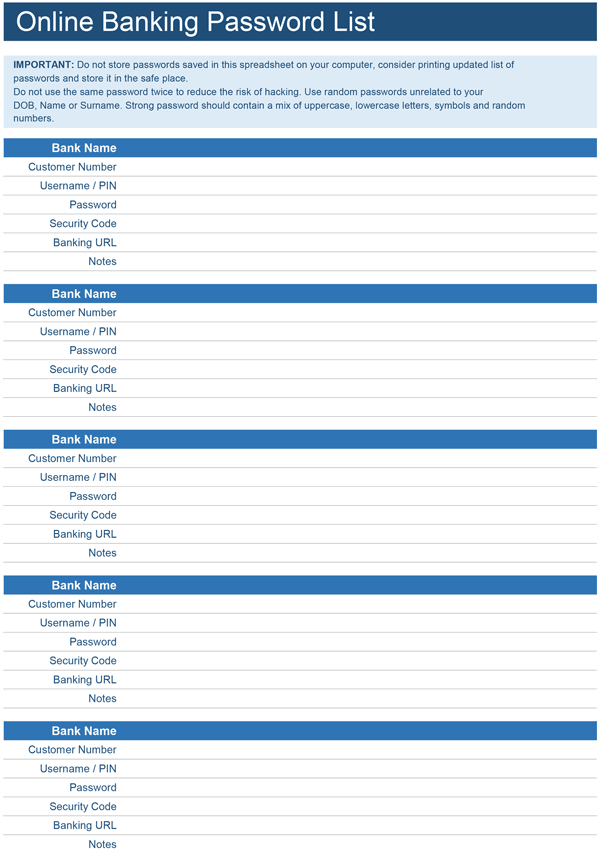

Bank account template. Businesses can also use it for reconciling balance sheet accounts such as accounts payable by editing the template to show the appropriate account information. Keep a buffer of cash in your account so that you can absorb any. Theres no need to wait on hold and explain yourself to customer service you can just send the letter and be done with it. Set up alerts so that your bank automatically notifies you of any large withdrawals or if your balance falls below a certain level.

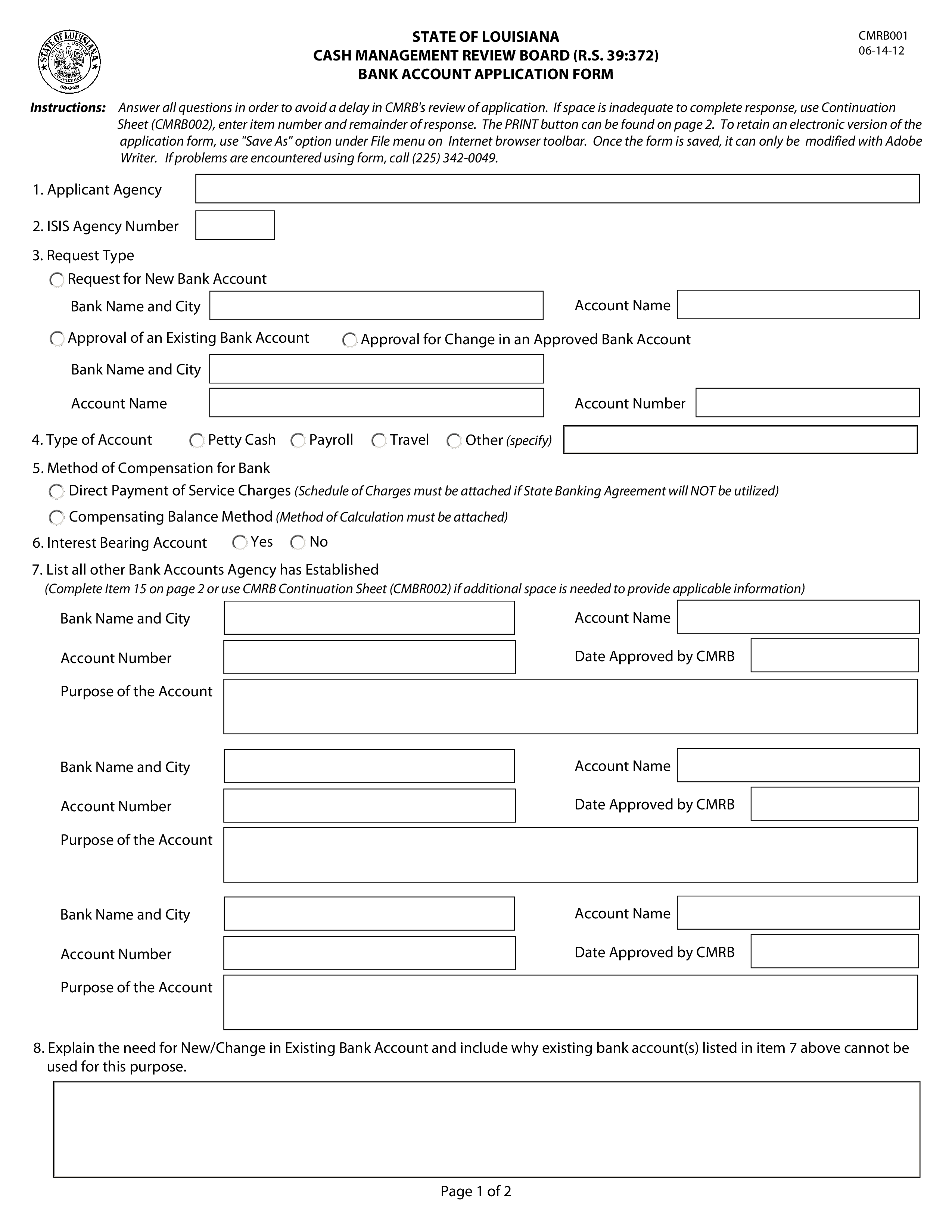

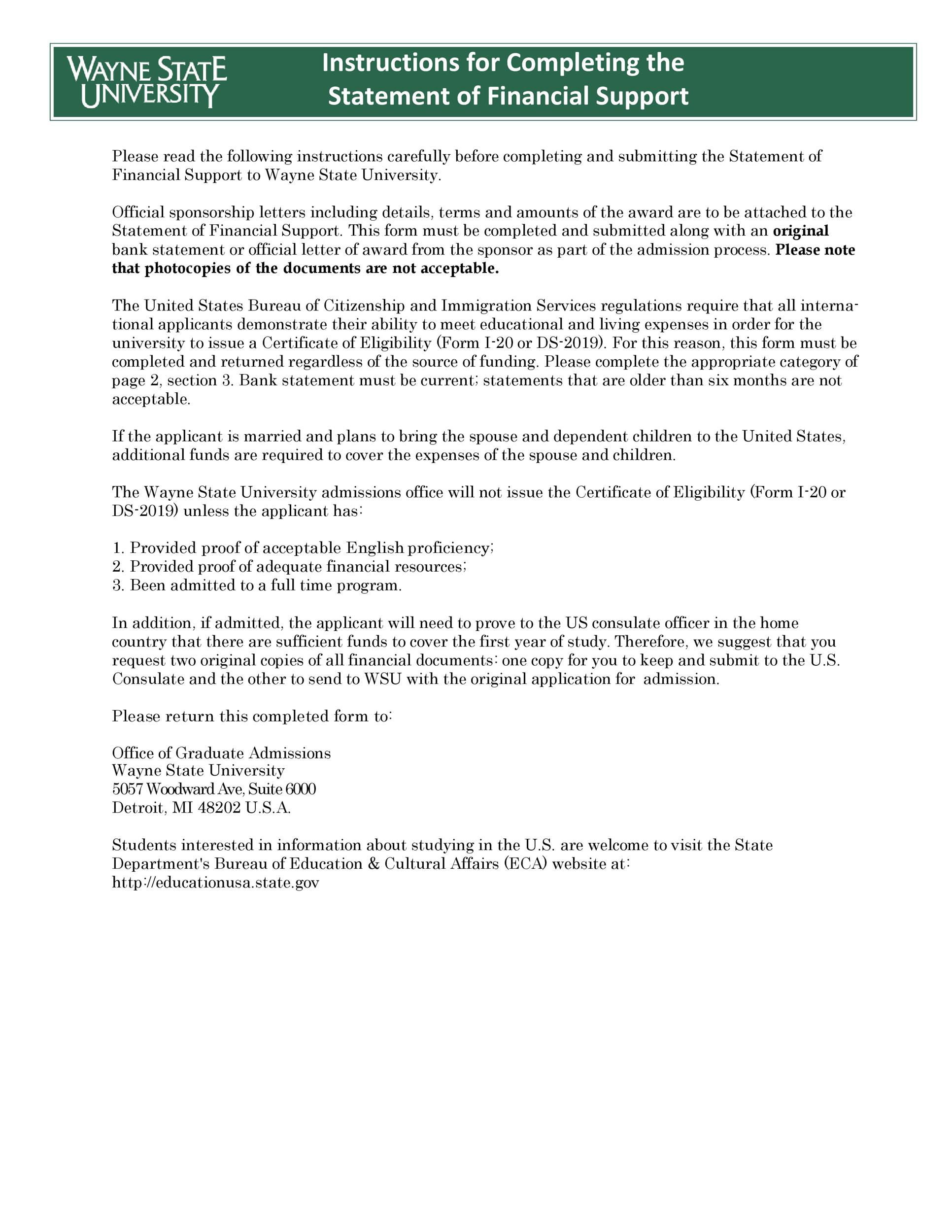

Furthermore it consists of a payment section that lets you know the amount outstanding to pay to that supplier against each invoice. Our most popular excel bookkeeping template. Just download the template and start using it entering by your company details. Therefore it is essential that before the opening of bank account the accountant of bank will ask the client to fill a bank form where the customer will answer the questions asked by the bank.

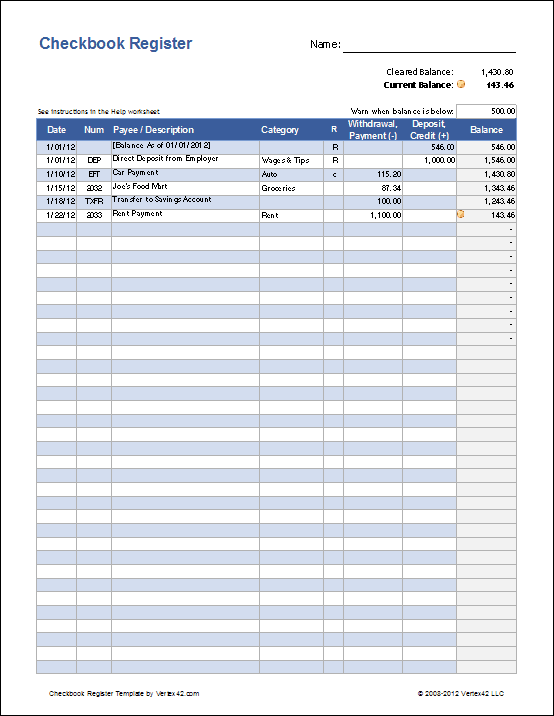

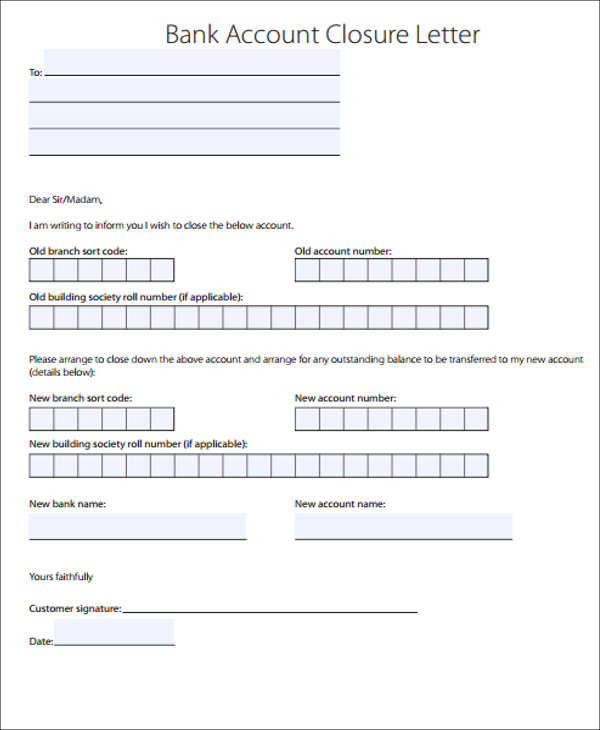

Even if a letter isnt required it might be the easiest option. A bank account form template will be filled up by an individual at the time of account opening. To close a bank account you might even be required to send in a letter. The excel cash book is the simplest and easiest way to start recording and tracking your business income and expenses and bank balance for your day to day bank accounts.

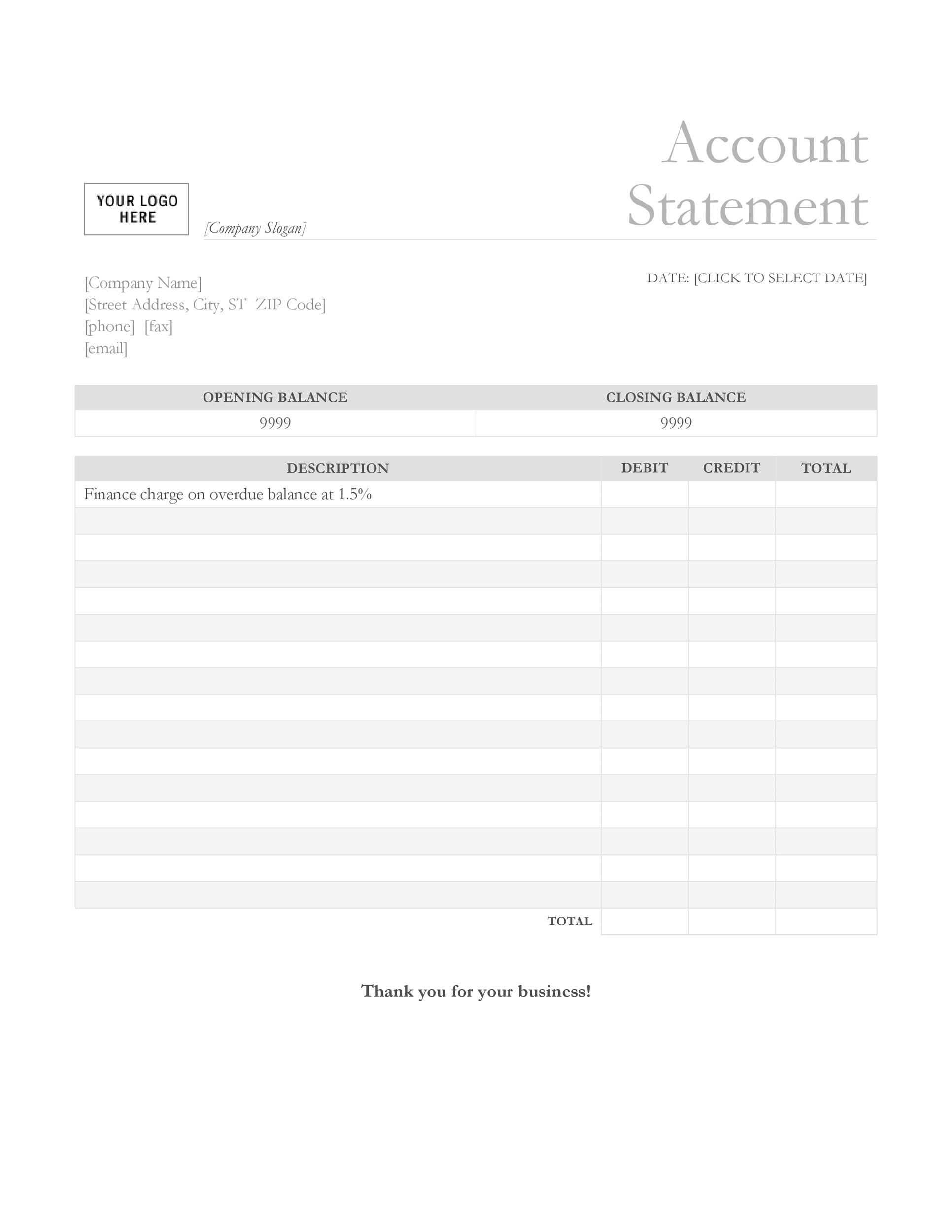

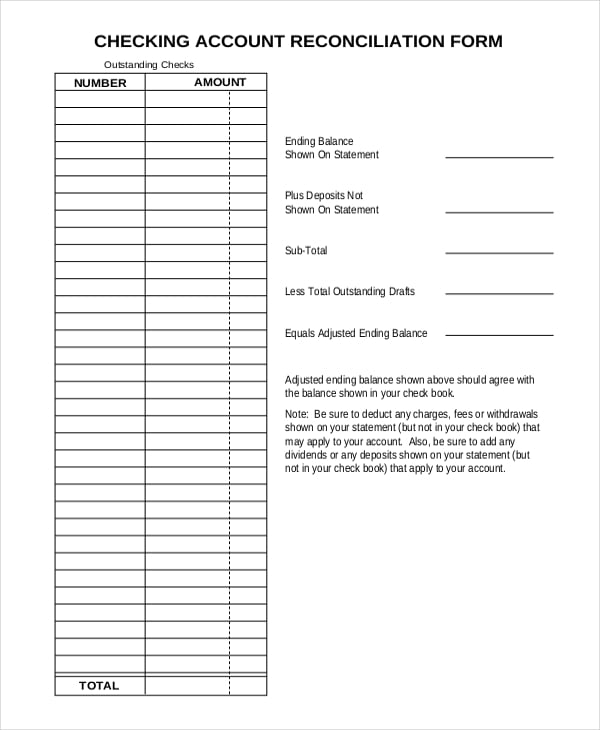

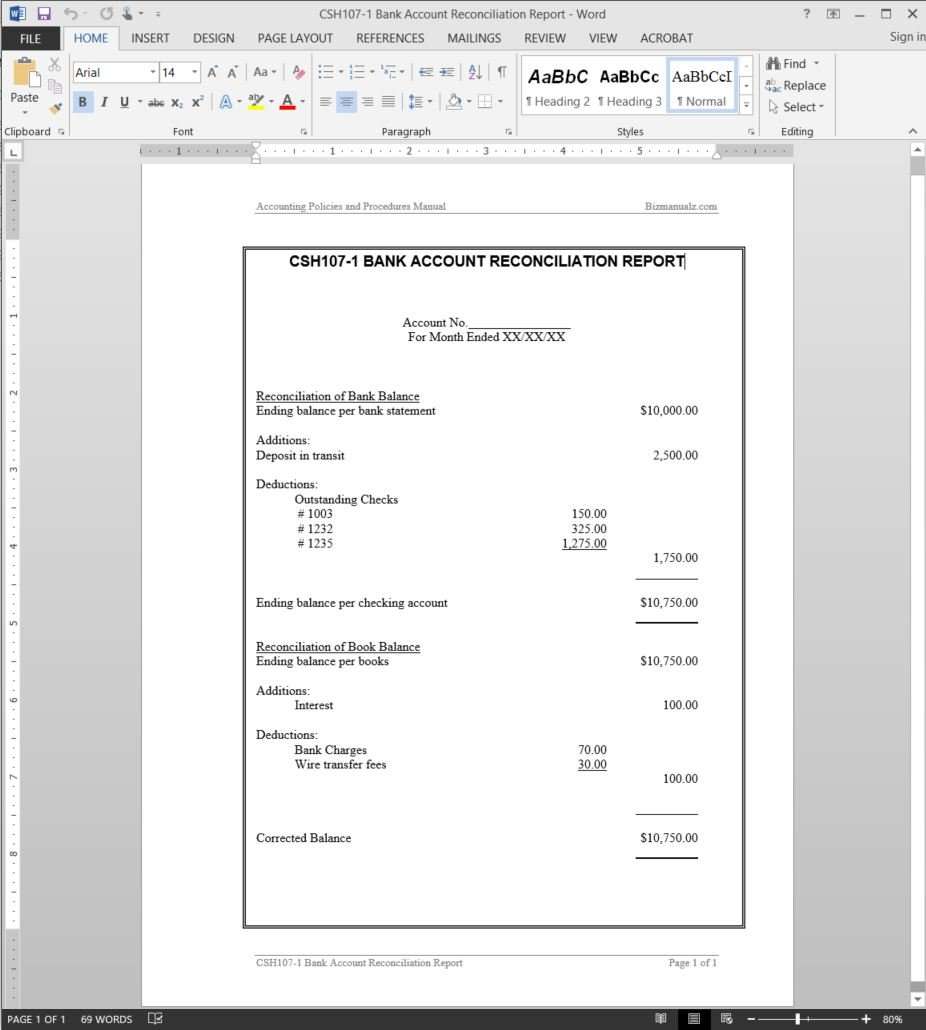

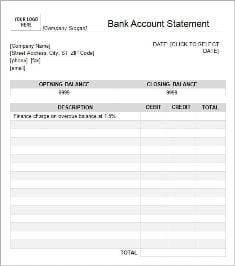

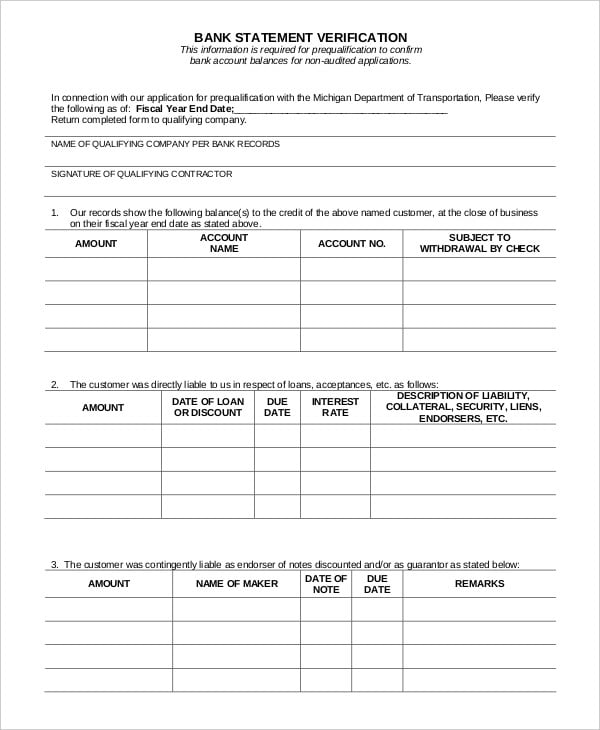

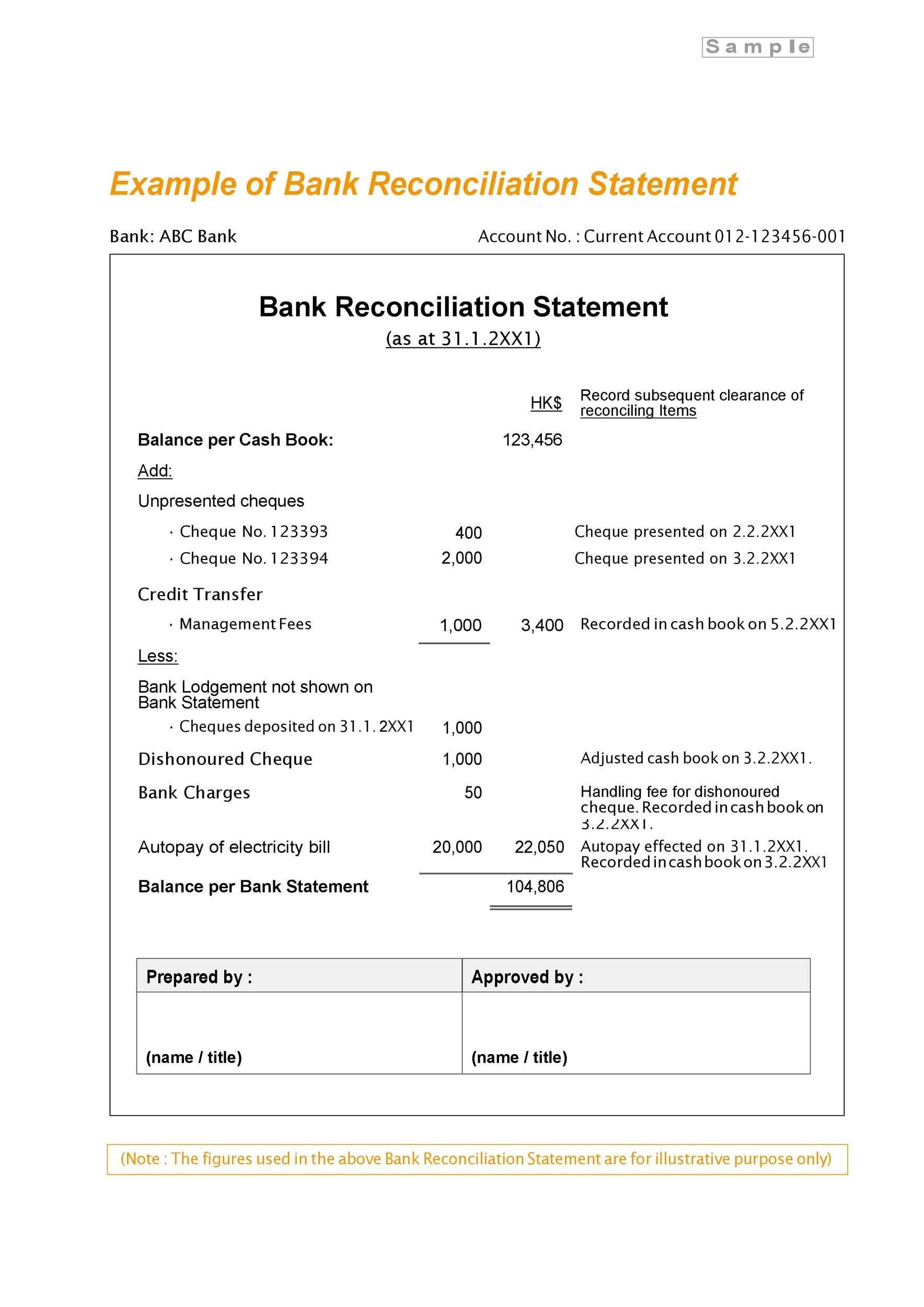

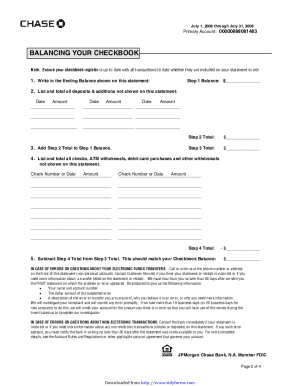

This statement will help you to reconcile the. A bank reconciliation is a check between your records or your companys and the banks records. Download this bank reconciliation template and incorporate it into your month end close process. Bank account reconciliation form template.

This is a template of the bank account reconciliation statement. Going through the bank reconciliation process can identify errors and unrecorded transactions. You can add or delete unwanted columns and delete or insert more rows. Enter the balance from your bank statement or subledger along with the general ledger balance and adjust amounts based on outstanding deposits and checks.

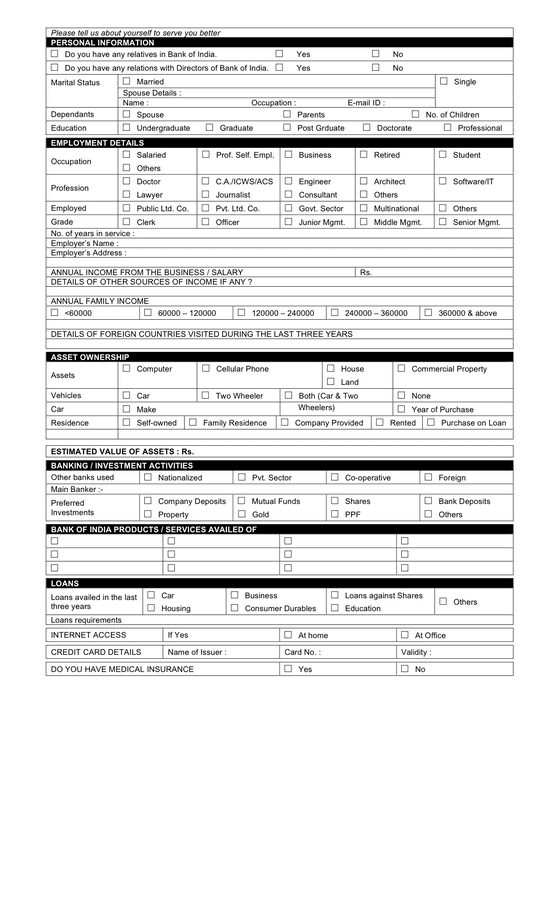

An account closing letter to the bank is a letter written by an account holder in which he addresses the bank manager and requests for account closure. By getting this bank form filled a banker gathers information about new account holder like this form will tell name of the account holder date of account opening his address type of account he has initial amount deposited in the account sources of income etc. Every bank has its own bank account form which is filled and signed at the time when a new customer opens account with the bank. Most banks and credit unions can send text or email alerts based on rules that you specify.