Best Receipt Tracker For Small Business

/Expensify-5b27c8ad8e1b6e00366825ac.jpg)

The app does require you to also use waves free accounting software which provides additional functionality for expense tracking and report creation.

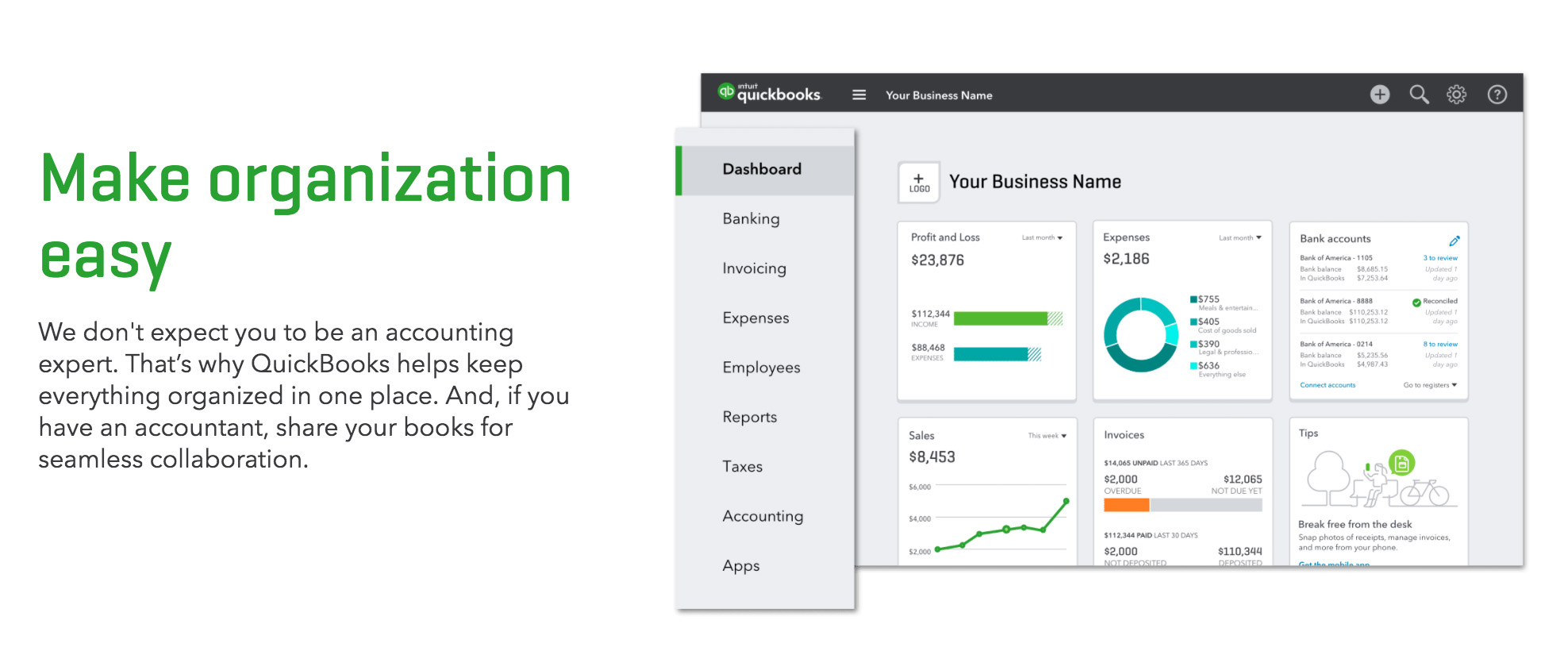

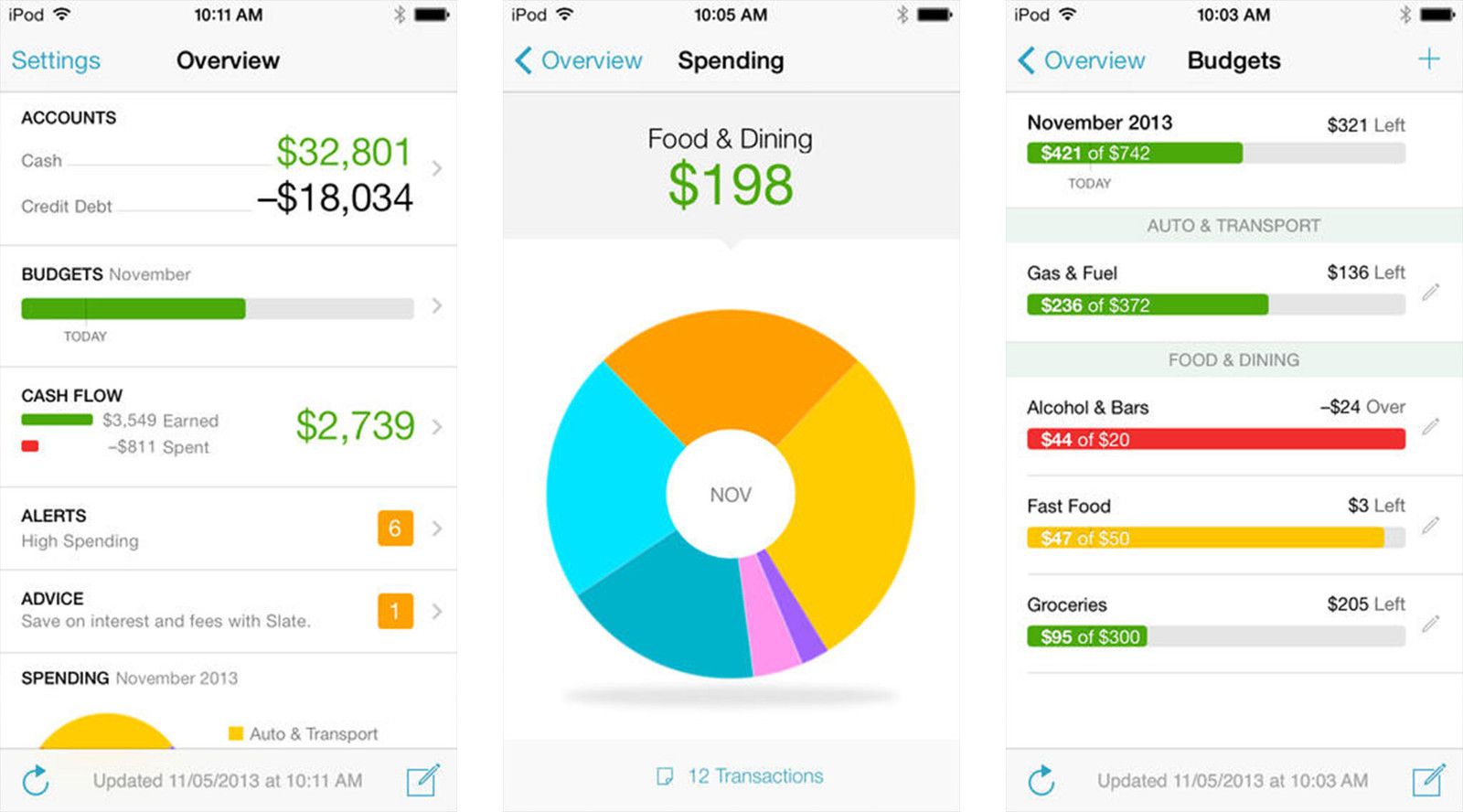

Best receipt tracker for small business. If you decide to use abukai as your expense reporting app an individual plan will run you 120 per year with business solutions plans ranging in cost from 200 per year and up. Wave is an accounting software platform designed for small businesses independent contractors and sole proprietors with nine or fewer employees. The irs is not a big fan of estimating your expenses. Wave lets you track sales and expenses manage invoices and customer payments pay employees scan receipts and generate accounting reports.

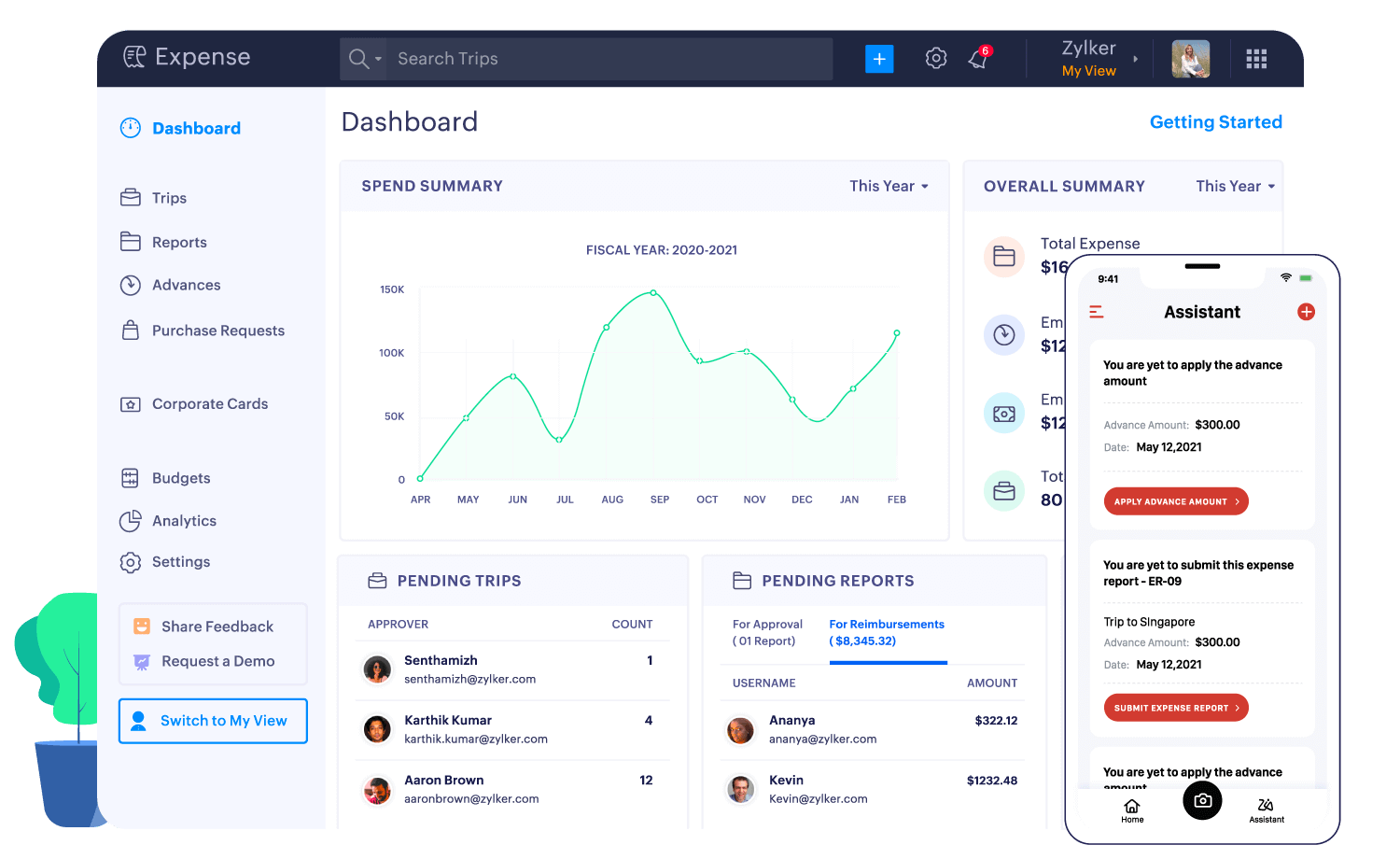

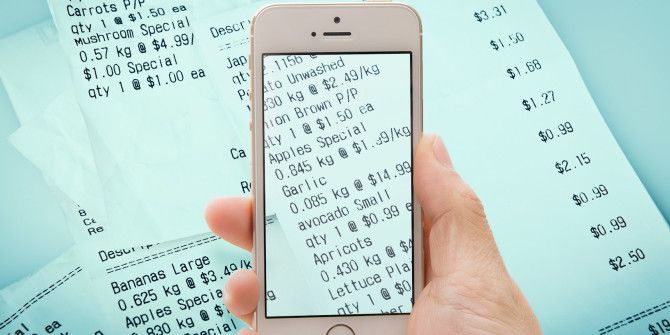

6 best business expense and mileage tracker apps that can track expenses and receipts with your smartphone and get timely expense reports from your employees. Expensify ios and android expensify a great app that you might remember from our best expense. Keeping track of receipts for your small business is very important. Certify is another great choice for small businesses to capture and track expenses more effectively.

Lets look at. The best receipt tracking apps 1. The best news for businesses is that cloud based expense tracking software generally costs less while offering more innovation than on site legacy hardwaresoftware based solutions. The abukai expenses app is a free download which includes three free expense report submissions with up to 10 receipts per report.

This is another cloud based platform that helps employees rapidly capture and send expenses incurred on business travel. Receipts by wave is a great receipt tracking app for small business owners and freelancers who need to keep up with receipts invoices and bills. Receiptmate ios receiptmate brings receipt scanning to a whole new level. Receipts by wave android receipts by wave is a receipt management tool.

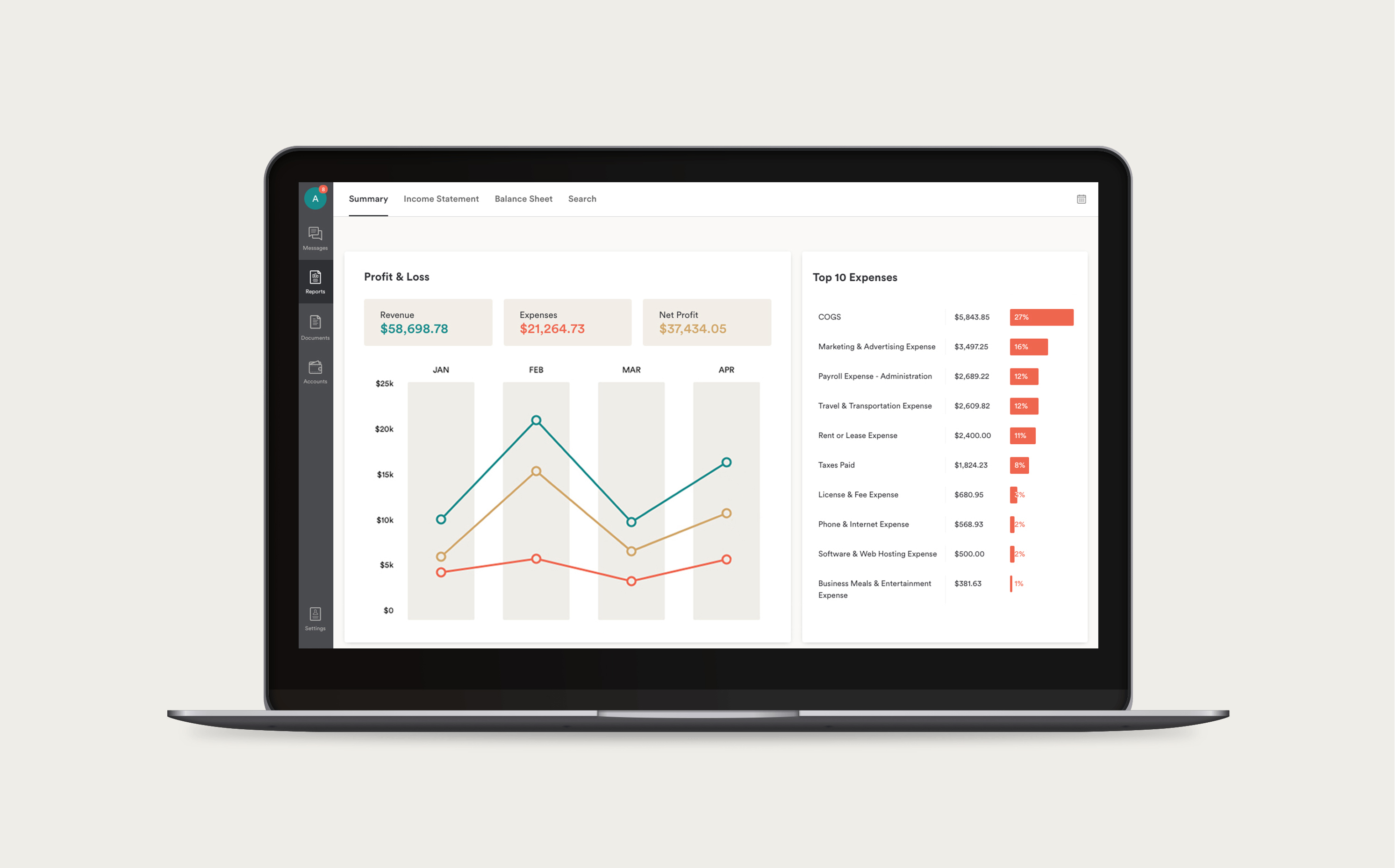

First you need to know how your business is doing and tracking revenues expenses profitability. Certifys platform is especially good at enabling businesses to review employees business receipts. If you are going to claim a deduction youre going to need.

/GettyImages-973212846-5b27e2d43418c60037c1dba0.jpg)