Best Way To Save Receipts For Taxes

As a business owner receipts copies of invoices bills and other paperwork can pile up quickly making our desks cluttered and offices messy.

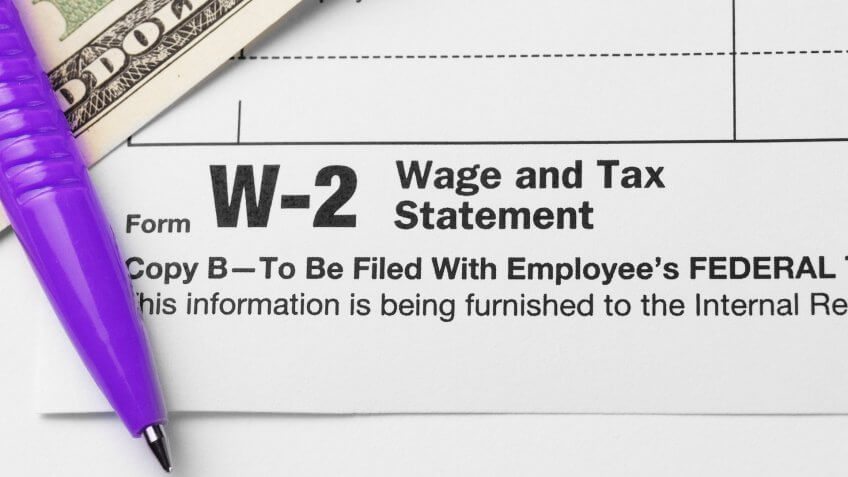

Best way to save receipts for taxes. The irs allows taxpayers to scan receipts and store them electronically. However you can shred them once youve stored them in your computer. After you get in the habit of saving of receipts youll need a good. Yes the irs can come knocking for documentation and audit you up to six years back in some cases.

Scanning your receipts does mean you will have to keep them. When preparing their annual income tax returns filers may take a standard deduction or itemize their expenses. The irs is not a big fan of estimating your expenses. Scan and save them.

However hoping that the ink on your home depot receipt hasnt faded away is a whole other issue. Check if you qualify for the earned income tax credit. Rather than stuffing all of your business receipts into a desk drawer a better system is required for when its time to do bookkeeping. How to organize business receipts and paperwork.

Expenses that are less than 75 or that have to do with transportation lodging or meal expenses might not require a receipt. Scan receipts and keep them at least six years. Keep electronic and paper backups. For the 2019 tax year the standard deduction is 12200 for single taxpayers and 24400 for those who are married and filing jointly.

When first starting a business you might want to keep receipts gathered in order to deduct business expenses on your income tax and more. 4 easy ways to keep track of receipts. It keeps you organized keeps you on budget and can be a big money saver when you file deductions at tax time. If you opt for the standard deduction retention of your receipts is not important for tax purposes.

Tips for organizing receipts and expenses check in monthly. Copies of invoices are not commonly thought of as important tax documents to save but keep in mind that as states search for ways to make more. This will save the receipt as a pdf file. Always keep receipts bank statements invoices payroll records and any other documentary evidence that supports an item of income deduction or credit shown on your tax return.

Back up your information. If youre a bit more on the organized side then maybe save your receipts for the few days and scan them in batches. Document expenses on the go. Click on save to save to google drive.

Keeping track of receipts for your small business is very important.