Cap Rate Excel Template

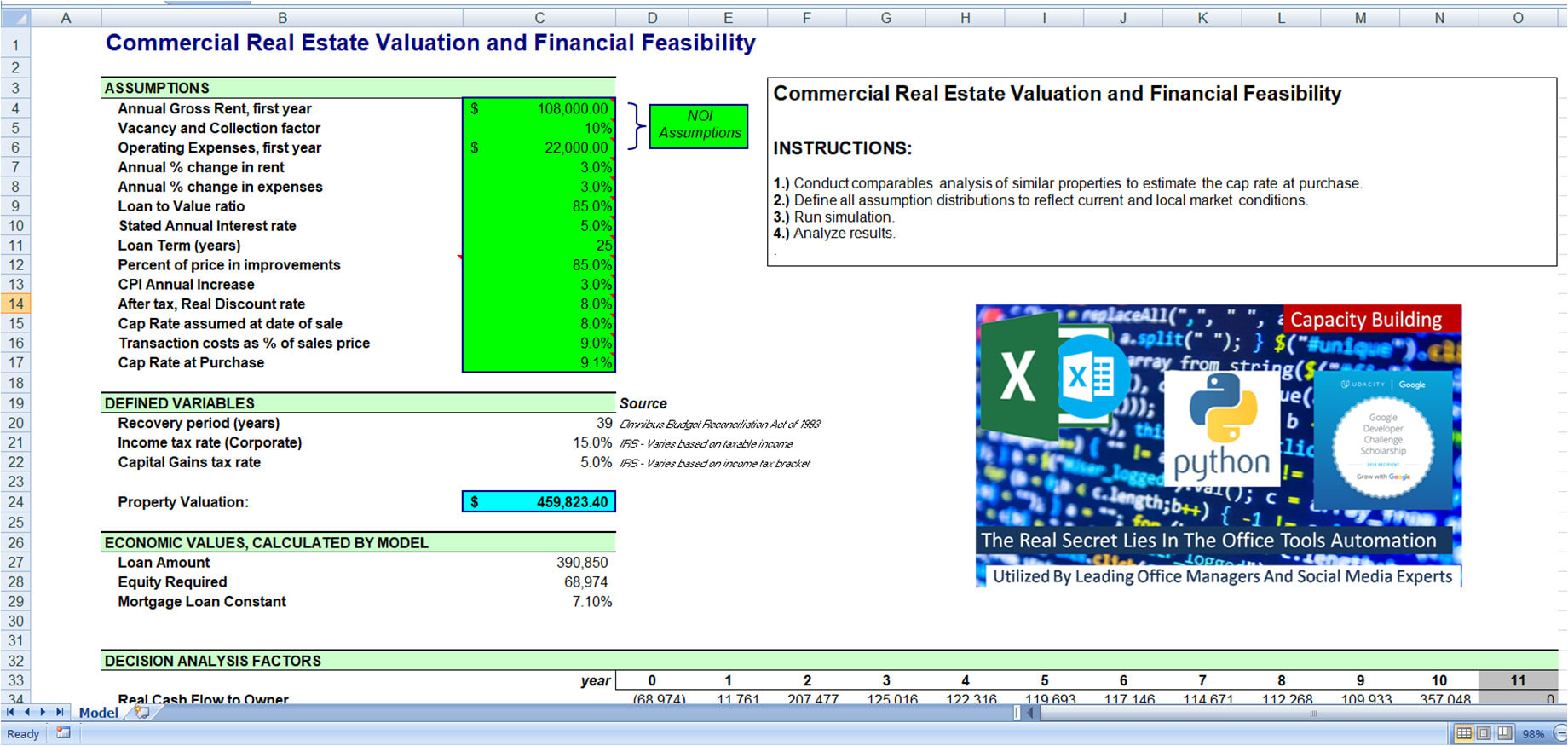

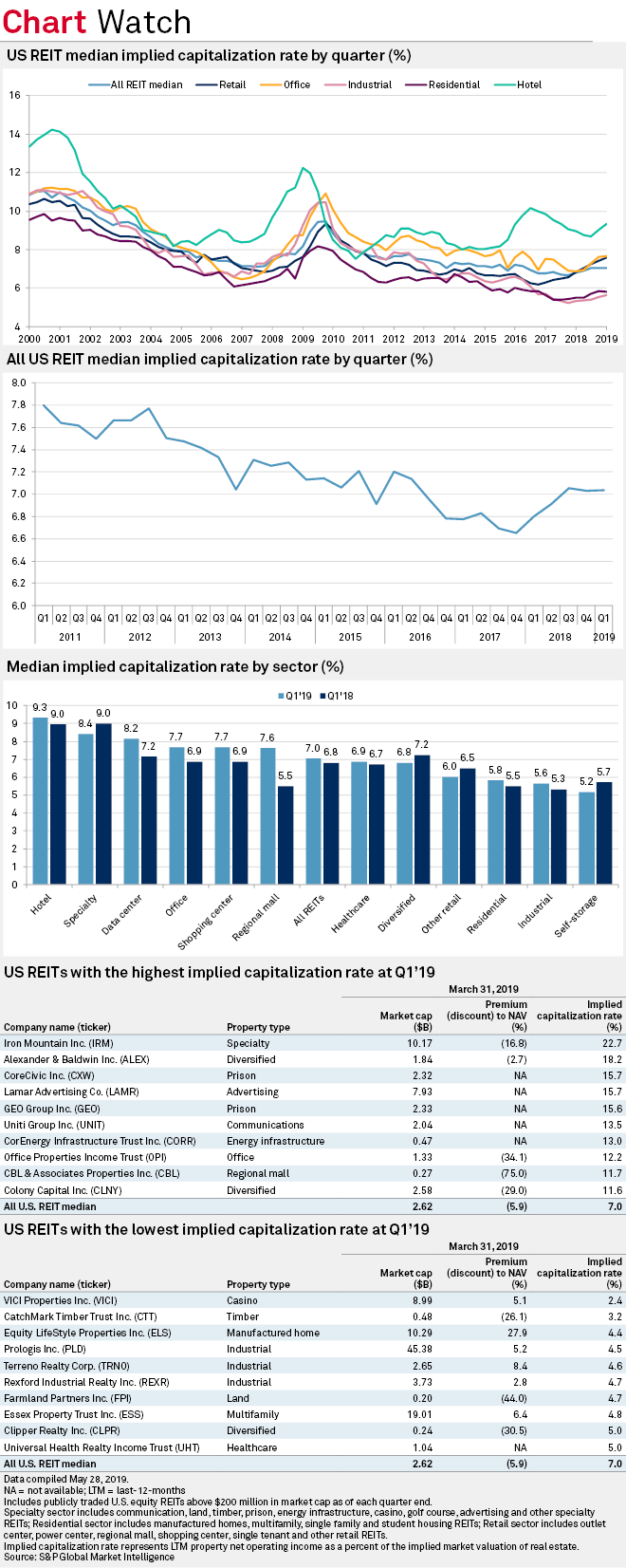

Investors can then decide whether the property is a good value.

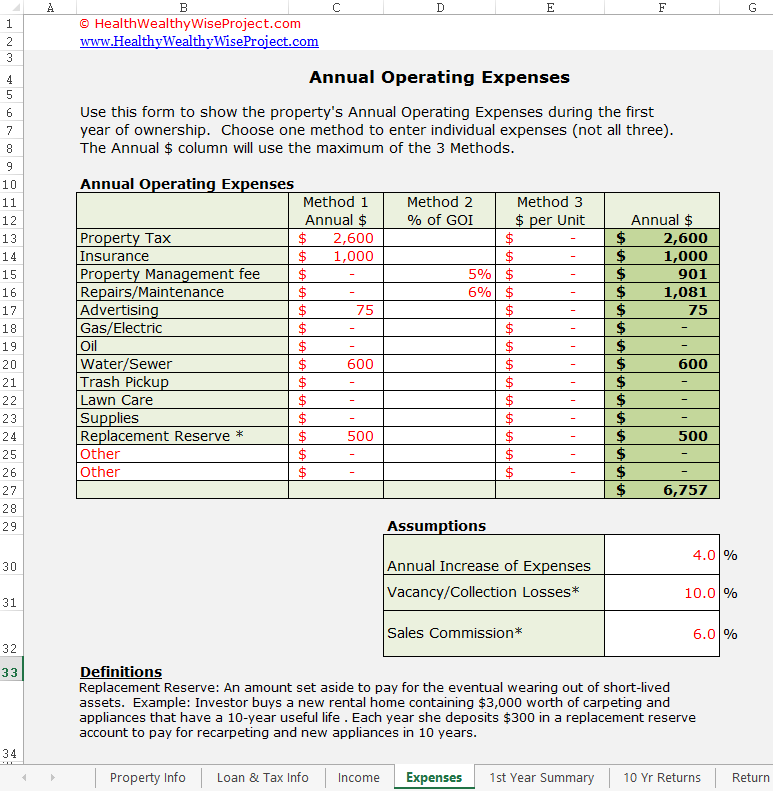

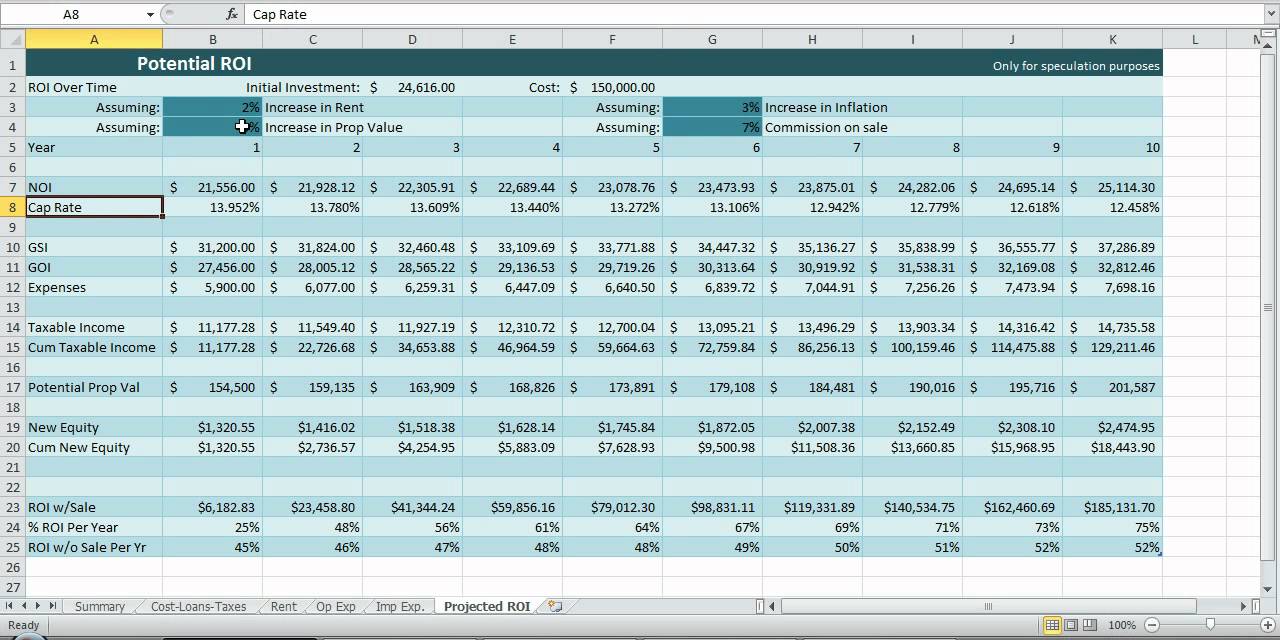

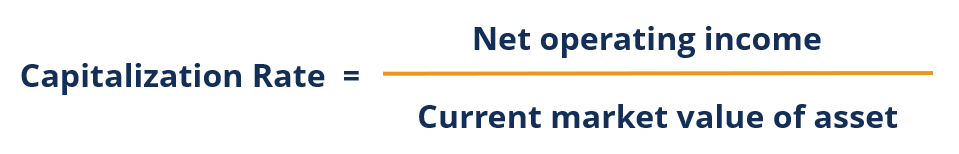

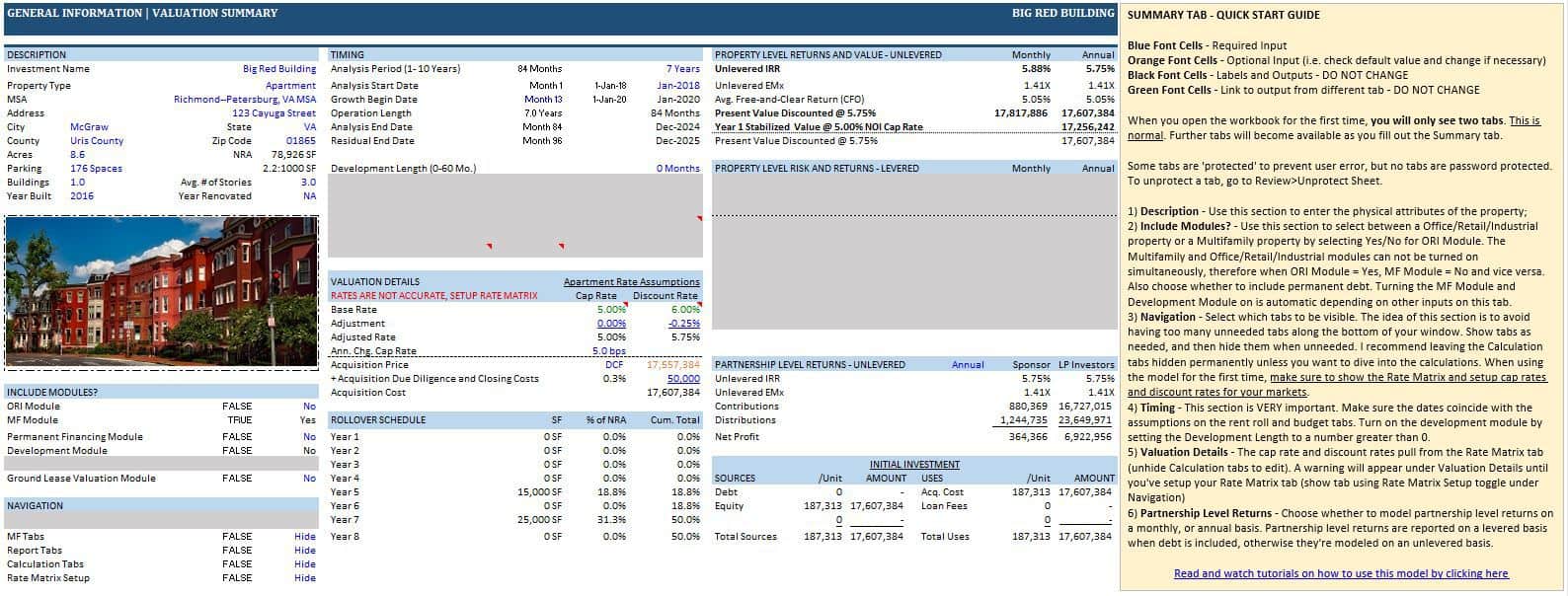

Cap rate excel template. Great for basic pricing with a net operating income. Of share ownership and equity ownership calculation. The spreadsheet assumes the loan is a fixed rate loan. Cap rate or capitalization rate is the rate at which you discount future income to determine its present value.

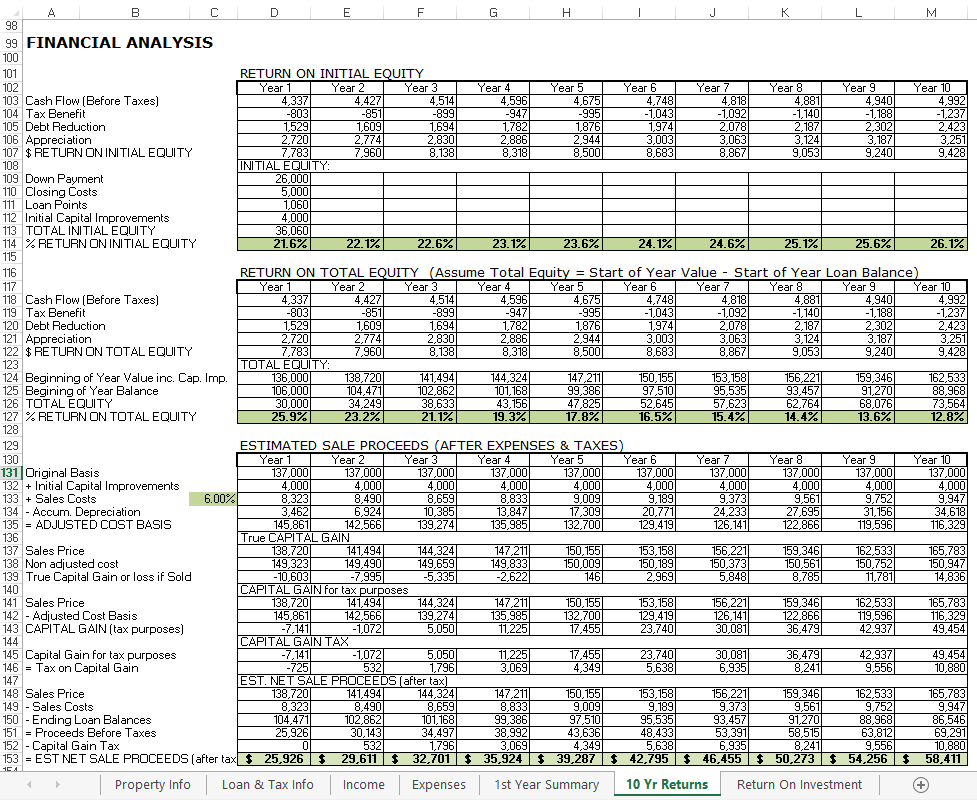

The cash on cash return is where you see the effect of leveraging the banks money. Sellers and buyers alike need to compute these benchmarks accurately in order to make sure they are getting the best deal possible. Capital raising rounds from seed to series a c until exit. The cap table example financial model template includes the following elements.

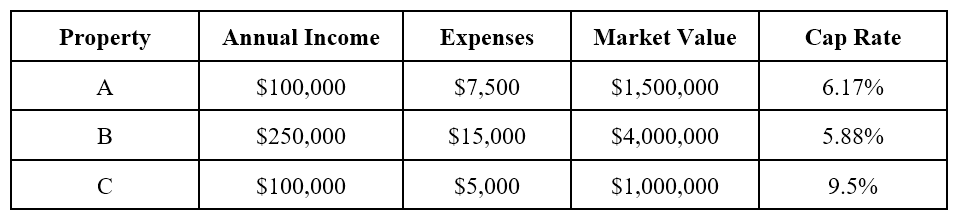

A cap rate is a rate that helps real estate investors evaluate an investment property. Now divide that net operating income by the sales price to arrive at the cap rate. Our free cap rate calculator generates a propertys net operating income and cap rate based on inputs including property value gross income and operating expenses. Enter your down payment fees and interest rate to calculate the initial investment and total debt service.

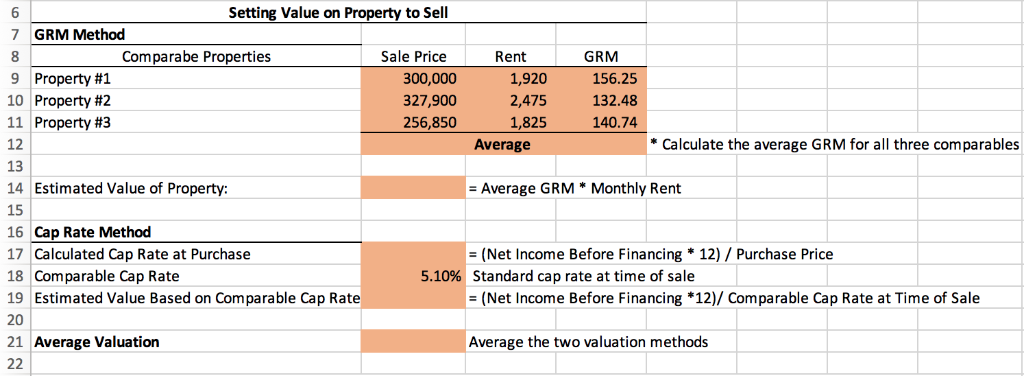

In practice you will typically use cap rate to express the relationship between a propertys value and its net operating income noi for the current or coming year. Grm calculator matrix a basic grm calculator including a sensitivity matrix. Capitalization rate can be defined as the rate of return for an investor investing money in real estate properties based on the net operating income that the property generates. List of financial model templates.

The cap rate percentage is the same regardless of whether you have a loan or own the property outright. You are about to take a listing on an apartment complex for 1300000 with a gross rental income of 200600 3 vacancy rate and operating expenses of 42. You want to see whether the cap rate is in line with prevailing cap rates in your market area. Calculation of exit market value.

Explore and download the free excel templates below to perform different kinds of financial calculations build financial models and documents and create professional charts and graphs. Total of shares and financing. Great for basic pricing with a net operating income. Cap rate calculator matrix a basic cap rate calculator including a sensitivity matrix.

24000 in expenses divided by the 300000 sales price gives you a capitalization rate of 08 or 8 percent.