Capital Account Excel Template

They are running totals of the members ownership and investment.

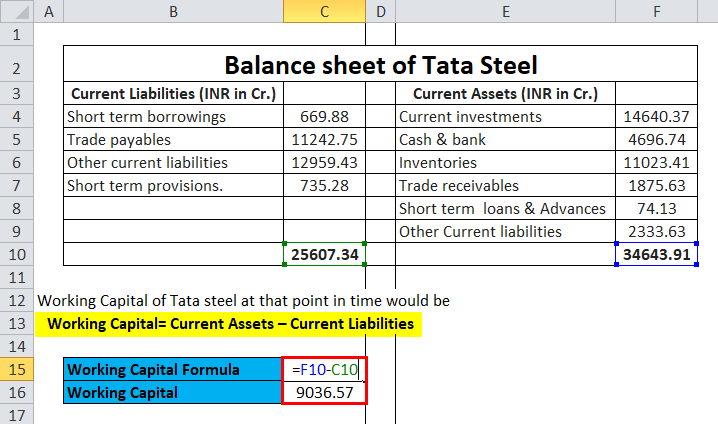

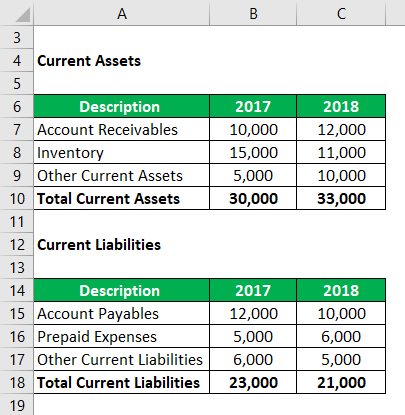

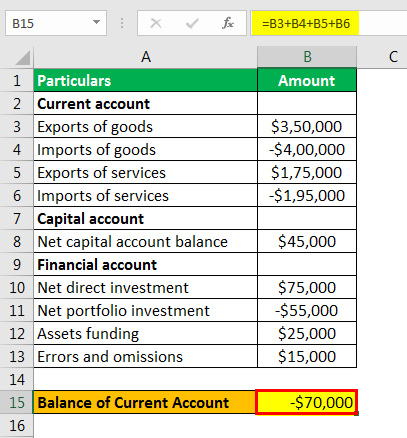

Capital account excel template. Our tutorial on capital lease accounting gives full details about how to account for capital leases. The basic formula for value is beginning balance plus contributed capital plus earnings from the current accounting period less any withdrawals. At the end of year 2 partners a and bs ending capital account balances are 240 and 300 respectively. Capital accounts partners a and b have different ending capital account balances.

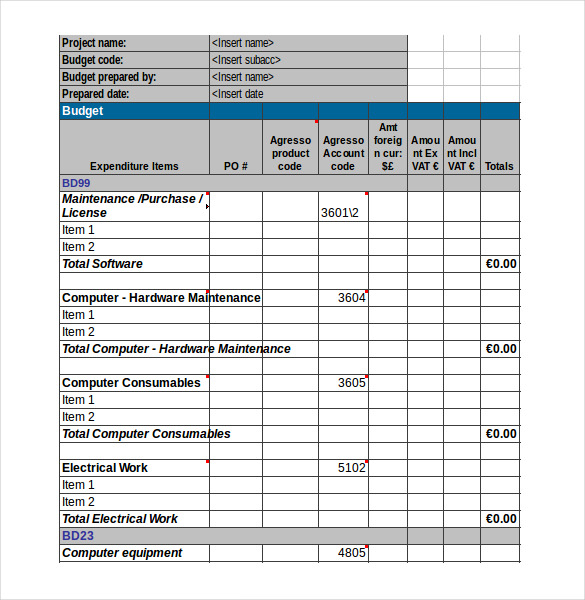

The excel sheet available for download below will help you calculate the principal interest split for a given accounting period and provide the accounting journals needed to post the asset and associated depreciation the lease liability. Negative capital accounts commonly result when your share of llc losses and expenses total more than your capital account balance. Although it depends on the terms of your llc operating agreement members generally have an obligation to bring their capital account balances to at least zero which could require making additional contributions. 5 min read capital accounts llc are individual accounts of each persons investment in an llc.

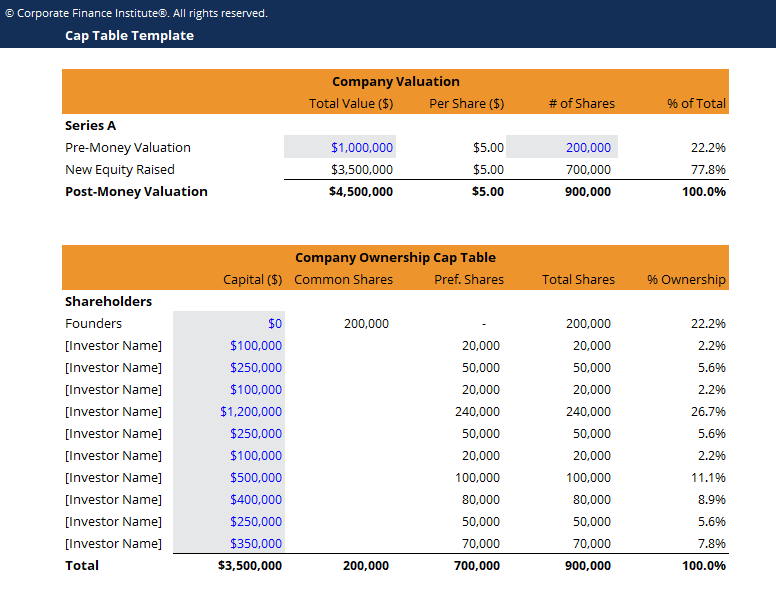

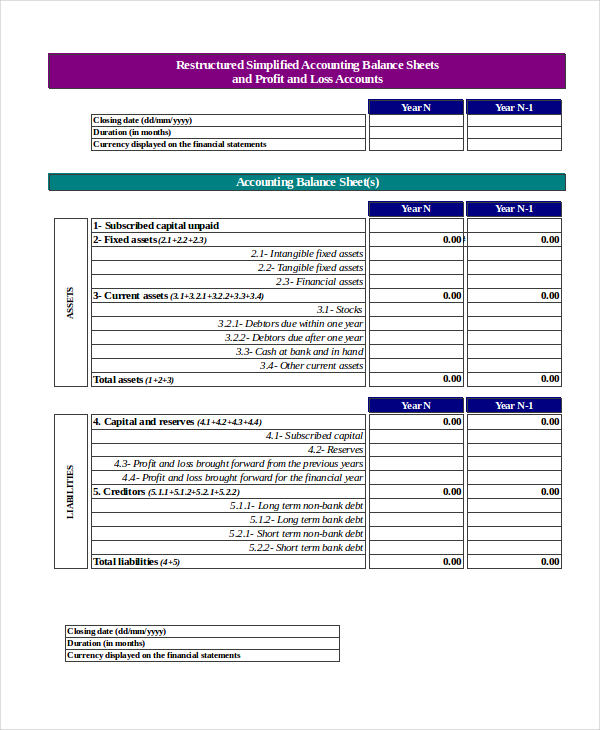

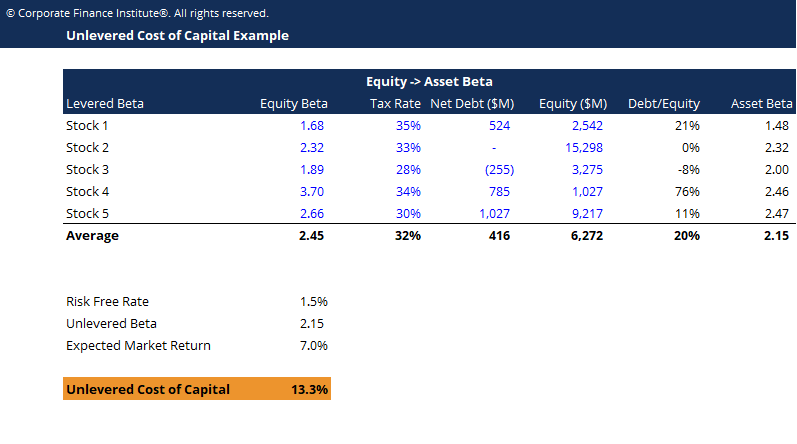

A capital account is a term used in partnership and in limited liability company business formats. Download excel template try smartsheet template weve also included links to similar accounting templates in smartsheet a spreadsheet inspired work management tool that makes accounting processes even easier and more collaborative than excel. It refers to the individual balances in the equity section of the balance sheet. When forming a limited liability company each member contributes a certain amount of cash or real.

Account payable template is a ready to use excel template easily to record your payable invoices all in one sheet. If your needs are more complex please consider the professional template software referenced on this site. Capital accounts llc are individual accounts of each persons investment in an llc. This additional paid in capital template demonstrates the calculation of additional amount of capital paid by investors.

Apic can be created whenever a co. Furthermore it consists of a payment section that lets you know the amount outstanding to pay to that supplier against each invoice. Upon formation each partner owned a 50 interest in the partnership. Partner as ownership percentage in the ab partnership decreased as a.

These accounts track the contributions of the initial members to the llcs capital and adjustments are made for additional contributions. An llcs capital accounts allow the company to maintain an accurate accounting of each members contributed cash or property.