Certificate Of Domicile

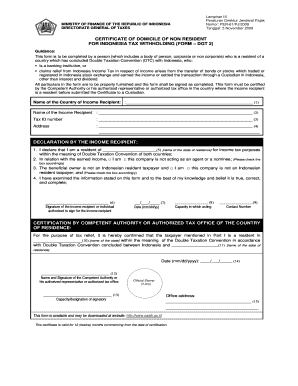

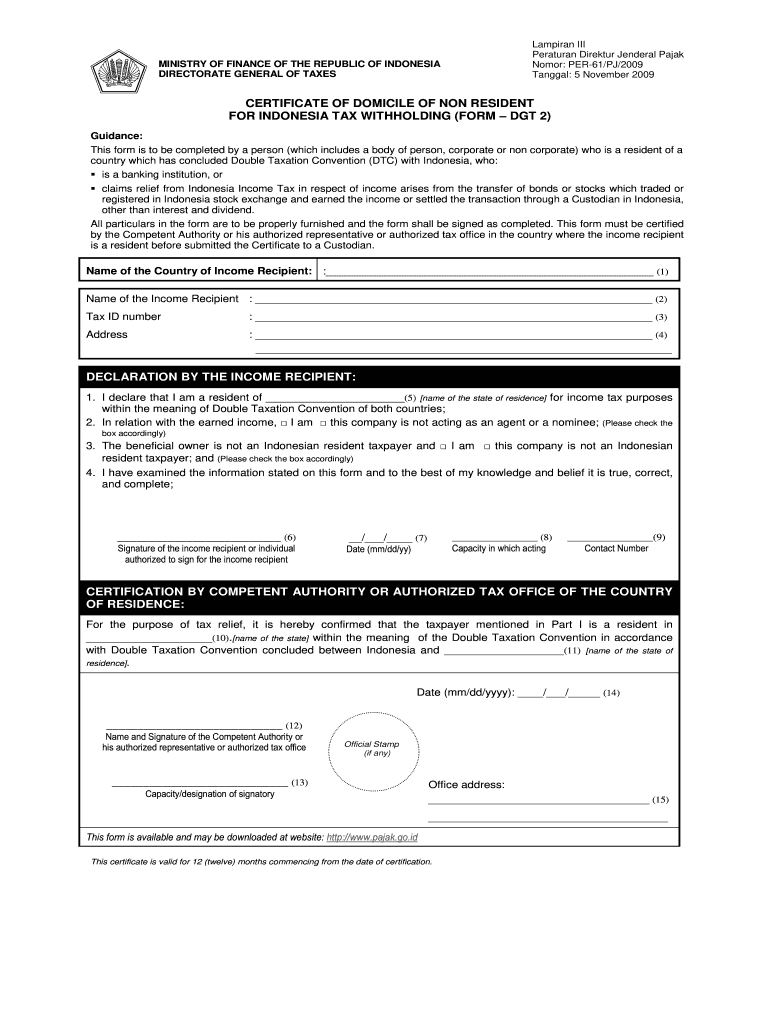

The internal revenue service irs procedure for requesting a certificate of residency form 6166 from the philadelphia accounts management center is the submission of form 8802 application for united states residency certification.

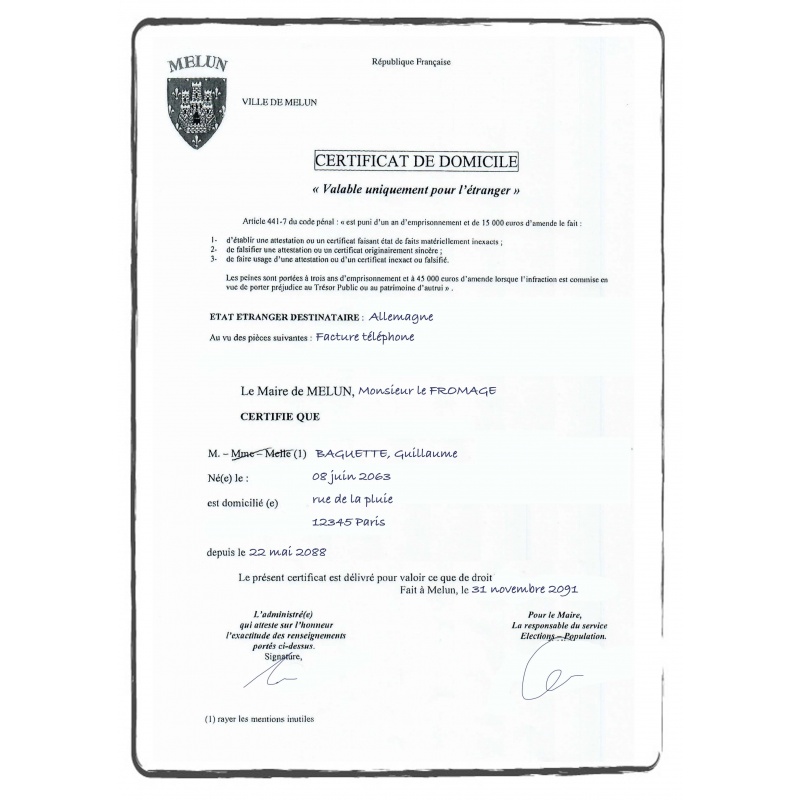

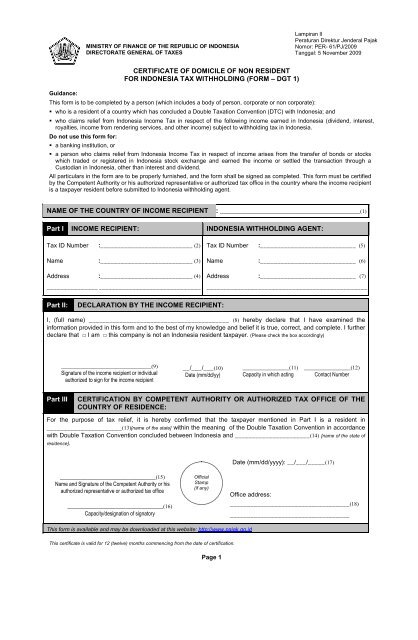

Certificate of domicile. Form 8802 application for united states residency certification is used to request a certificate of residency form 6166 that residents of the united states may need to claim income tax treaty benefits and certain other tax benefits in foreign countries. You must apply for and submit a new certificate to your college every year at the beginning of the semester of which you attend. Cod is used to prove that a particular taxpayer is a residence of a state who signed tax treaty. Certificate of domicile cod is used in relation to the double taxation avoidance agreement tax treaty.

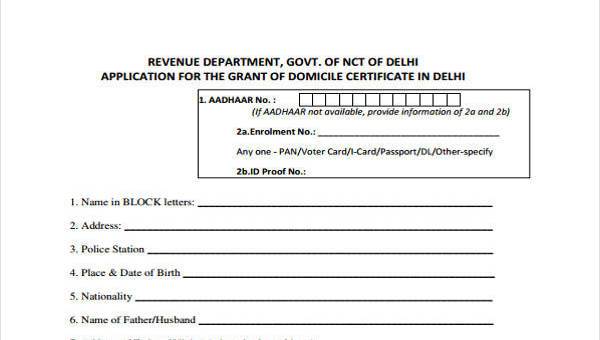

Certificate of domicile is a mandatory requirement of a foreign taxpayer to obtain the rights eg. Both regulations replace previous guidance in these areas. Please print all information see reverse side for directions last name first name social security community college important. Tax rate reduction in accordance with indonesias tax treaty with the countrys foreign taxpayers domicile concerned in which the country which issues the cod is the competent authority of domicile of such foreign taxpayers country of domicile.

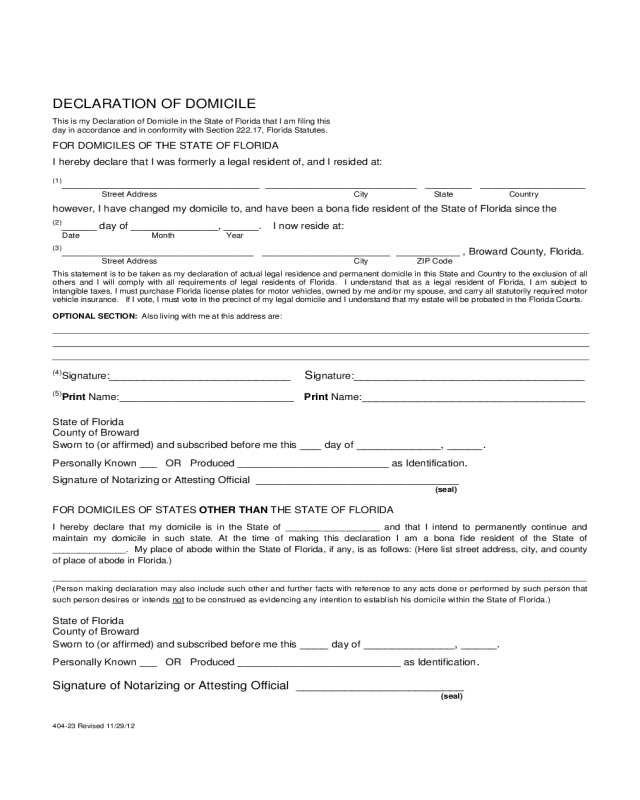

This certificate is required as proof of residence to avail domicileresident quotas in educational institutions and in the government service as also in case of jobs where local residents are preferred. Florida statute 22217 states that a person can show intent to maintain a florida residence as a permanent home by filing a sworn declaration of domicile with the clerk of the circuit court. Per 08 is effective as from the date of issuance and per 10 is effective as from 1 august 2017. The certificate is effective for one year from the date it is issued.

A domicileresidence certificate is generally issued to prove that the person bearing the certificate is a domicileresident of the stateut by which the certificate is being issued. Certificate of residence affidavit or affirmation and application. Certificate of domicile cod to apply for treaty benefits and a regulation per 10 dated 19 june sets out the requirements for a nonresident to obtain benefits under indonesias tax treaties. Thus cod shall be issued by the state in which a person or entity registered as domestic taxpayers residence.

A certificate of residence must be dated two 2 months or less prior to the start of the semester.