Certificate Public Accountant

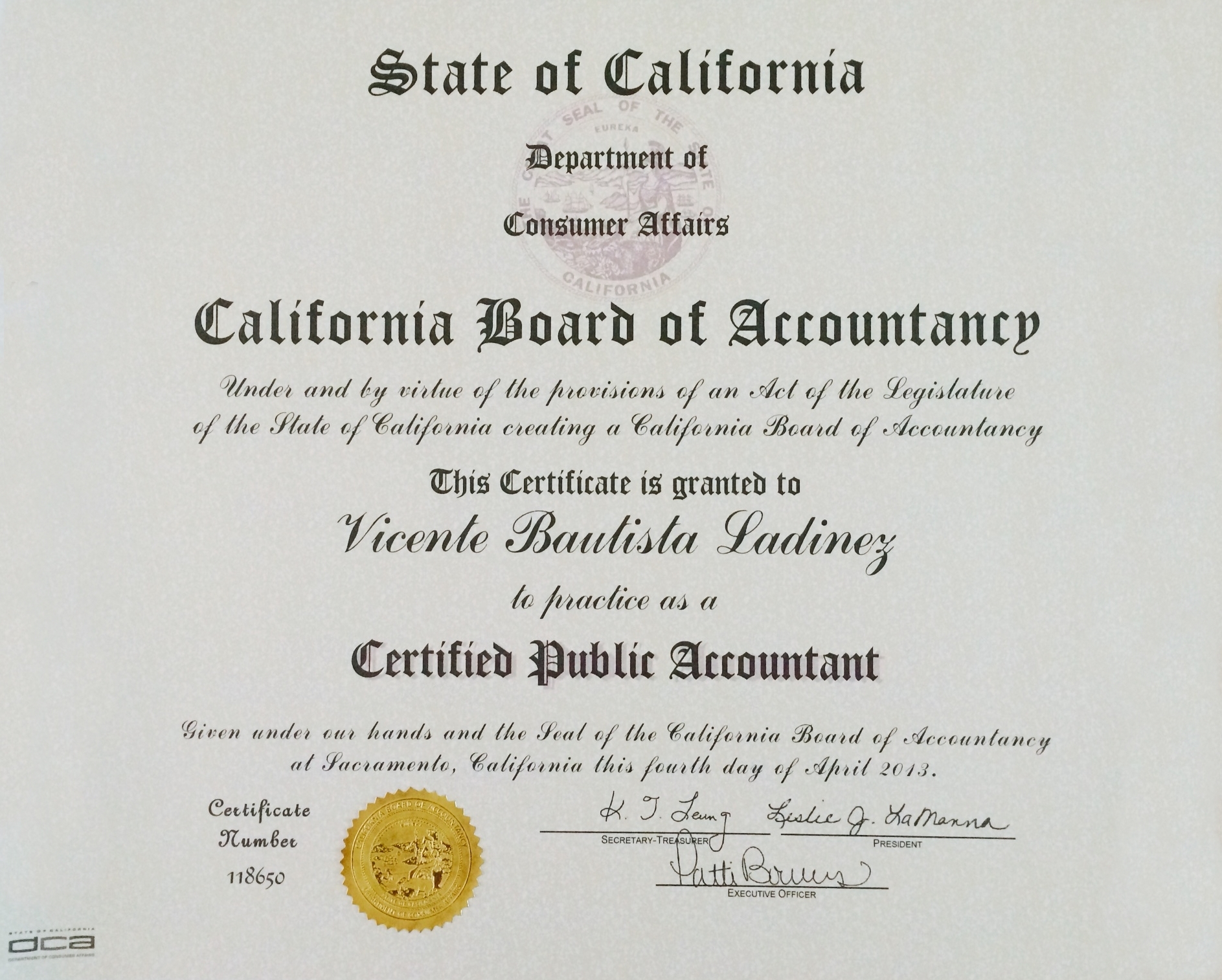

It is required by almost any accounting firm or employer regardless of other certifications held.

Certificate public accountant. A certified public accountant or cpa is a financial advisor who helps their clients file taxes stay compliant with government regulations and manage finances. These professionals offer financial statement audits and other attestation services to help inform investors about the financial health of organizations. Public accounting firm application forms form 6r application for public accountancy firm 16 kb this form is to be completed by any professional corporation pc limited liability company llc limited liability partnership llp partnership or sole proprietorship that needs to register with the education department as a public accounting firm. Heres a list of the best accounting certifications.

The custom plate fee varies if the plate number is assigned by dmv or if you personalize it. Certified public accountant cpa certified financial analyst cfa certified management accountant cma enrolled agent ea certified internal auditor cia certified information systems auditor cisa certified fraud examiner cfe. Types of accounting certifications. A certified public accountant cpa is a designation given by the american institute of certified public accountants aicpa to individuals that pass the uniform cpa examination and meet the education and experience requirements.

Certified public accountant cpa the cpa designation distinguishes licensed accounting professionals committed to protecting the public interest. The cpa certification is the most common certification in the accounting world. You should plan to get your cpa certification regardless of what other certifications you are. The cpa designation helps enforce professional standards in the accounting industry.

It is awarded by each of the 50 states for practice in that state. A copy of your current registration certificate issued by the new york state education department.