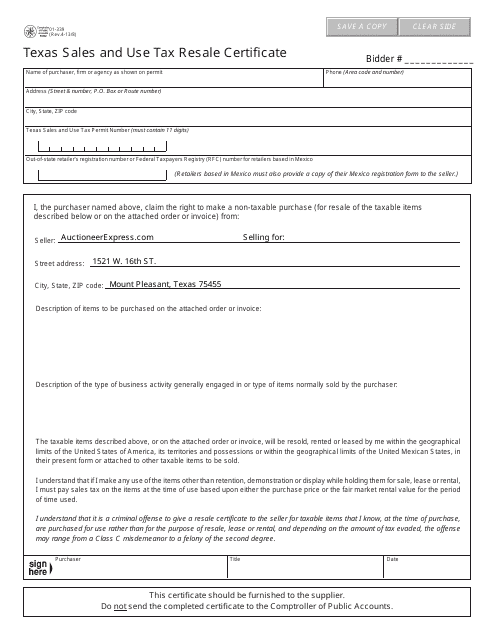

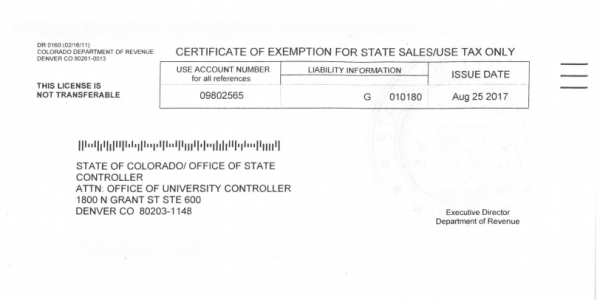

Colorado Resale Certificate

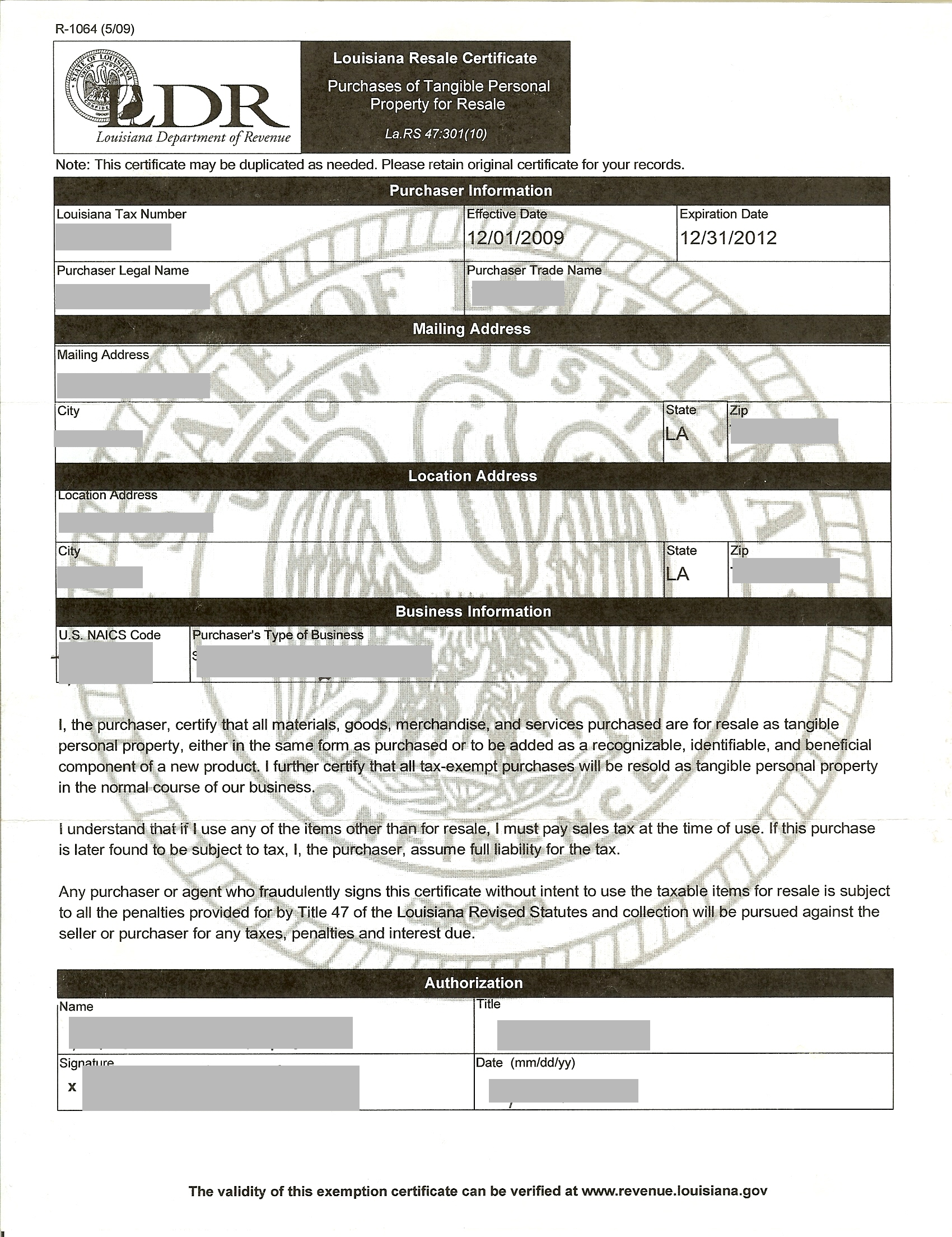

Colorado allows a retailer to accept an exemption certificate issued by another state.

Colorado resale certificate. Even online based businesses shipping products to colorado residents must collect sales tax. You cannot use your resale certificate to buy items youll use in the normal course of business such as office supplies. Simply ask them to give you their multi jurisdiction. Colorado does permit the use of a blanket resale certificate which means a single certificate on file with the vendor can be re used for all exempt purchases made from that vendor.

Acceptance of uniform sales tax certificates in colorado. If a non colorado based retailer buying from a colorado based seller or the consumer has an exemption certificate issued by another state then the seller is not bound to collect the sales tax from him. A new certificate does not need to be made for each transaction. Most businesses operating in or selling in the state of colorado are required to purchase a resale certificate annually.

Colorado sales tax resale certificate number. If you wish to use a colorado resale certificate. In colorado you can only use your resale certificate to either buy items for resale or component parts to make items you will later resale. Colorado tax exemption colorado resale certificate colorado sale and use tax colorado wholesale certificate etc.

The colorado sales tax license in other parts of the country may be called a resellers license a vendors license or a resale certificate is for state sales tax and any state collected county city and special district taxes that the colorado department of revenue collects and distributes back to local governments.