Commercial Lending Certification

Loans are the most significant risk in most bank portfolios.

Commercial lending certification. Omega performances commercial lending curriculum which includes both credit and credit conversation courses comprises a state of the art training suite used by thousands of financial institutions worldwide. This program addresses the consumer lending decision and making sense of each step by covering the application process financial statement analysis credit analysis loan structure compliance documentation procedures and closing. The commercial lending training course builds on existing skills and knowledge to provide an overview of all aspects associated with the assessment type and structure of the loan as well as building relationships with new and existing clients. Start your commercial lending classes immediately with our self paced on demand recorded webinars.

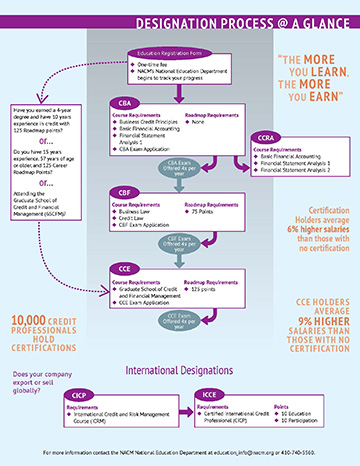

Our comprehensive commercial loan broker training program. 30 continuing professional education credits required every two years. Commercial banking online training. When you attend youll.

Consumer lending presents a unique set of challenges by combining credit risk process with regulatory process. The commercial lending training course is a course that is organised by the five phases of the. Cuna business lending certification school equips you with in depth knowledge and the chance to develop your skills as a sure footed guide for your credit unions business lending. Commercial capital training group provides a loan broker training program founded on the desire to empower individuals to help businesses and real estate investors solve their capital challenges and in turn improve lives and revitalize communities.

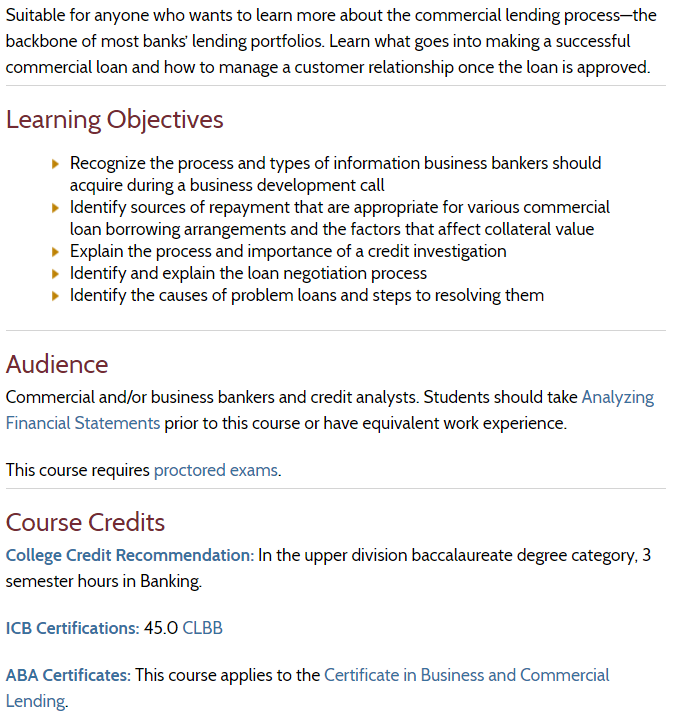

Build an analysis driven risk focused team. Our customized online training platform allows you to take our mortgage underwriting training classes at your own pace. Take 15 minutes at a time or 6 hours the choice is yours. The aba certificate in business and commercial lending focuses on financial statement analysis and commercial lending will familiarize lenders with both audited and unaudited statements and fill any gaps in your understanding of credit analysis and underwriting.

Learn business and commercial lending essentials and best practices. How is the cicc tailored to my learning needs. Certified commercial loan officer cclo. This program assists in developing the necessary credit skills to maintain and manage a commercial credit portfolio as well as the analytical processes needed to.

Pre and post tests allow seasoned lenders to test out and more importantly let the industry know you are credit trained and. Commercial lending problem loans and profitability credit risk followed by an in person exam. Find training on agricultural lending small business and commercial lending loan structure and more. The cicc requires the completion of three elearning courses.