Cqf Certification Cost

The certificate in quantitative finance cqf is designed to transform your career by equipping you with the specialist quant skills essential to success.

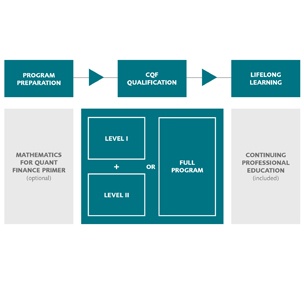

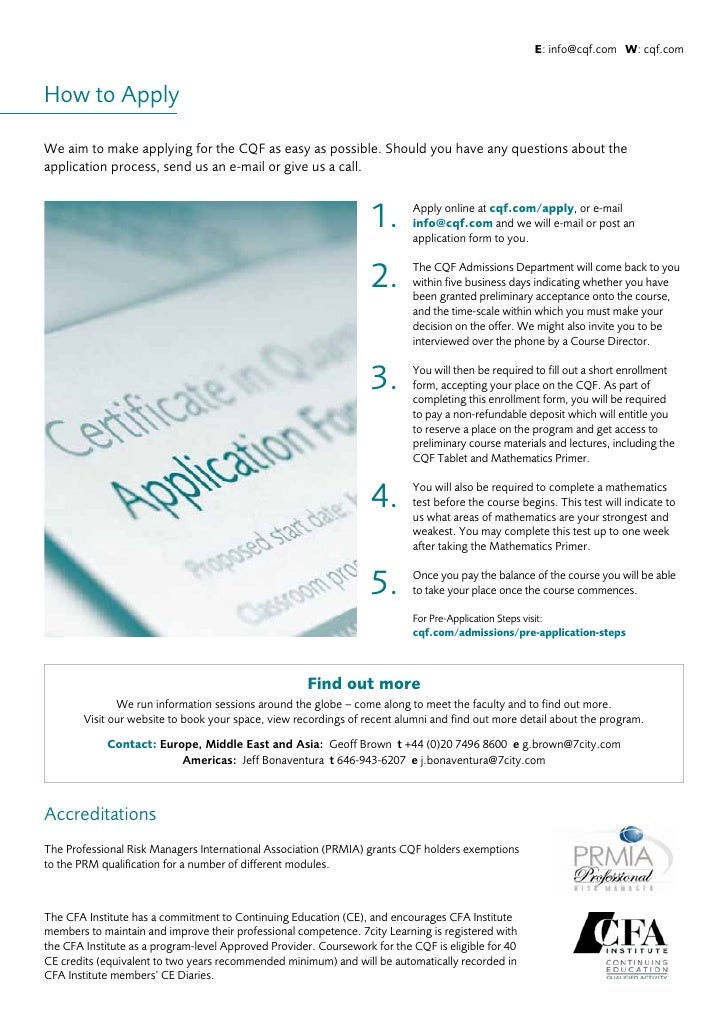

Cqf certification cost. You can start your cqf journey in either january or june with two flexible study options the full program or level i and level ii separately. With our new financing options for self funded residents of the usa or canada that decision is now easier to make as you can choose to either spread the payments over time or pay in full prior to the start of the program. Each exam is a practical assessment of the knowledge and skills youve learned. Preparation optional primers the cqf qualification modules and electives and lifelong learning continuous education.

Even if cqf is severely criticized for its cost it allows you to have access to lifetime programs which will update your knowledge over time and you will remain an industry expert for a long period of time. Making the investment in the cqf is a career changing decision. Again cqf is not for everybody. The cqf is a lower cost course compared to other quant programmes but its not a cheap course coming in at close to 14k for a six months course it is quite steep.

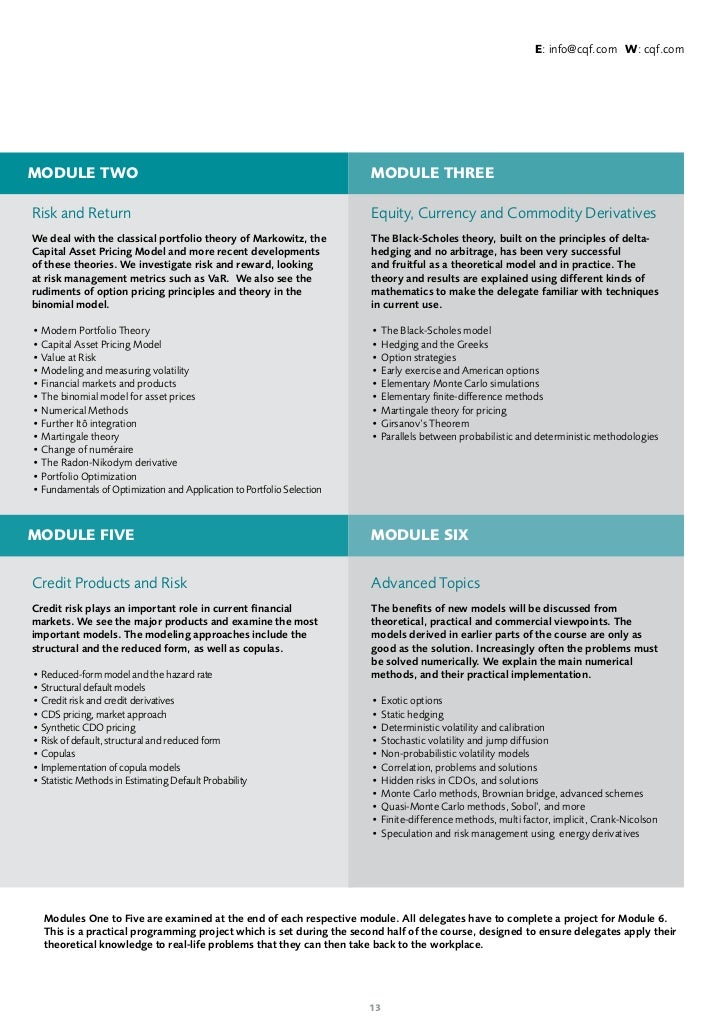

The cqf qualification is made up of six modules two chosen advanced electives three exams and a final project. Difference between frm and cqf. The certificate in quantitative finance cqf is the worlds largest professional qualification in quantitative finance. The globally recognized program is designed to help you develop practical market ready skills you can apply today and in the future.

It is designed for in depth training for professionals and students who want to make their career in derivatives it quantitative trading insurance financial model validation or risk management. Thats why the emphasis is on teaching current real world techniques you can apply with confidence from the moment you learn them. My view is that the program material is very dated. The cqf is split into three essential phases.

What is certificate in quantitative finance cqf. Cqf is a part time financial engineering program that is delivered and taken online.