Dcu Certificate Rates

A 250 minimum balance is required to open a certificate of deposit.

Dcu certificate rates. Rates are variable and are subject to change weekly. Rates are effective currentdate. Rates effective as of december 2 2019. A penalty may be imposed for early withdrawal.

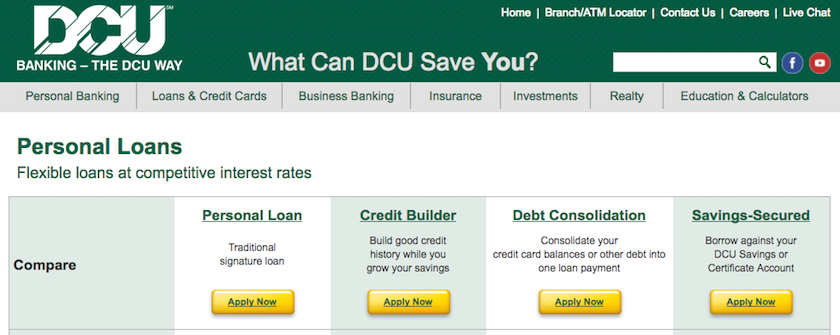

Checking accounts come with a visa debit card atm access non dcu atm reimbursement free checks and direct deposit. Rates are variable and are subject to change weekly. On its personal banking side digital credit union provides savings accounts checking accounts money market accounts and certificate accounts. Please refer to dcus account agreement for consumers and schedule of fees and service charges for important information and disclosures.

Members under age 23 can get high certificate rates with as little as 100 with a dcu quickstart certificate. A penalty may be imposed for early withdrawal. The rate will remain in effect for the term of the certificate once issued. A penalty may be imposed for early withdrawal.

Other conditions may apply. Many credit union members find that communication federal credit union share certificates are an easy safe way to earn higher dividend rates. If you are familiar with bank cds then just think of share certificates as the credit union equivalent. The rates dcu publishes on its website are for customers with a relationship checking.

The rate will remain in effect for the term of the certificate once issued unless you decide to jump up the rate once during the term of the certificate. Add on feature you can make unlimited add ons to your certificate principal on all regular certificates with terms of 12 months or less anytime throughout the term. Rates listed are for this product only and are subject to change at any time. Rates are effective currentdate.

1apr annual percentage rate. This is only available if you have a loan or credit card activate e statements and set up a direct deposit of net pay only. Its regular certificate rates are still competitive but they are no longer rate leaders even with the extra 025 that comes from a checking relationship. Last year dcu was offering very competitive rates on its regular certificates.

I first mentioned dcu in 2005 when it was offering a 5 16 month cd the good old days.