Debt Validation Letter Template

A statement that the collector has 30 days to respond to you if you dispute the debt and ask for more information and.

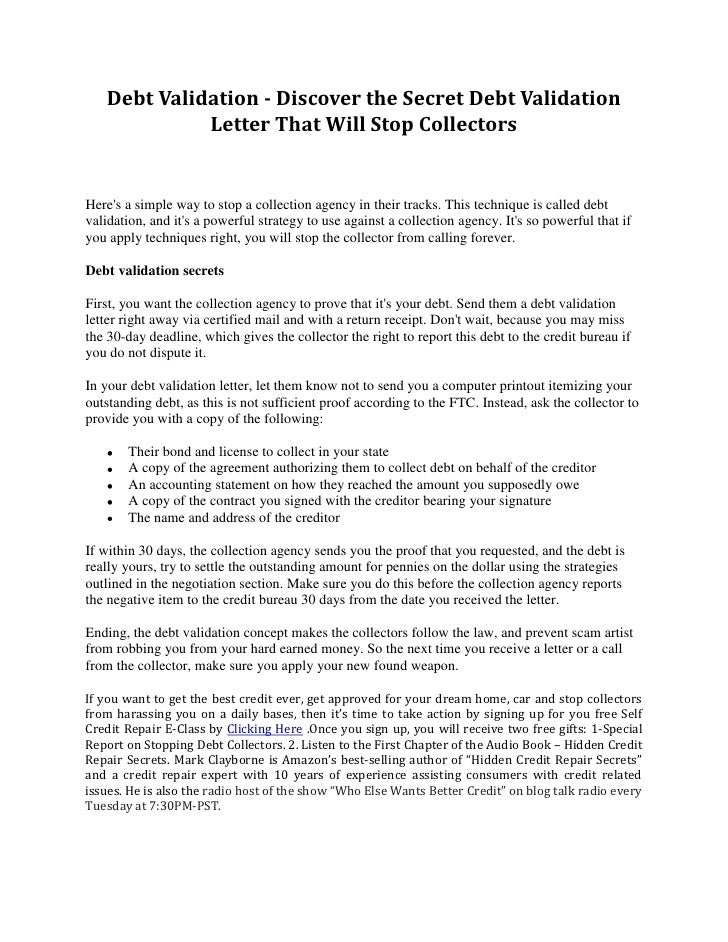

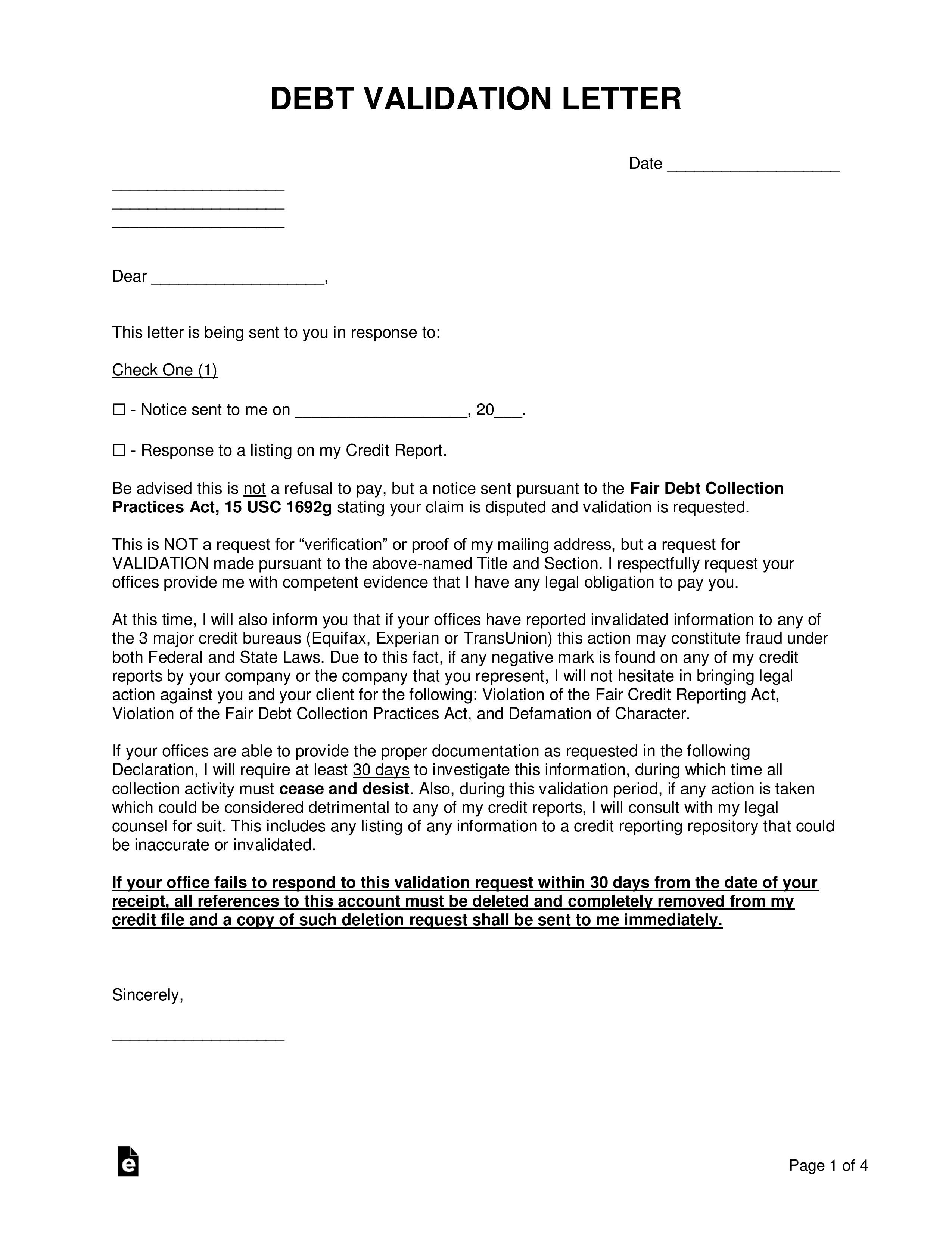

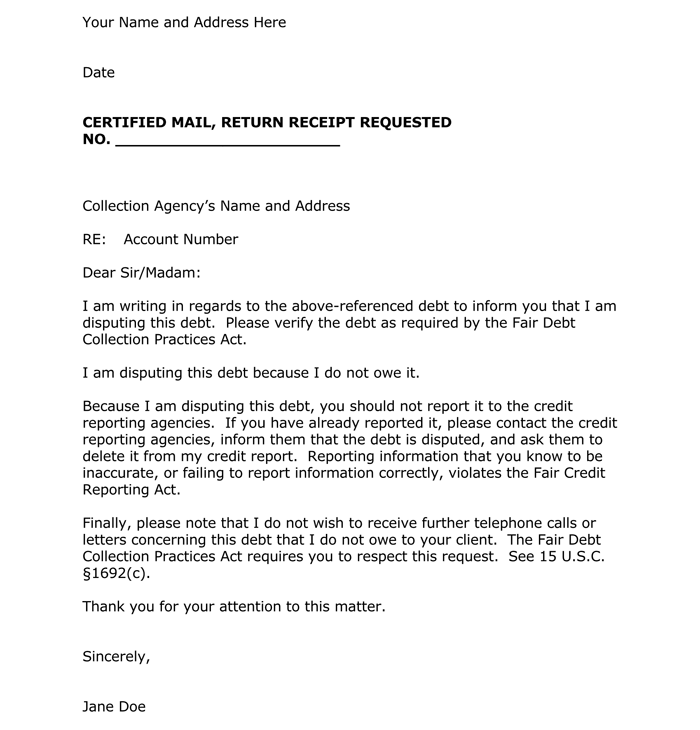

Debt validation letter template. Downloadable debt validation letter templates. Under federal law. Step 4 send and wait 30 days. Do not simply copy and paste the letter.

That they have assumed your debt to be valid unless you dispute in 30 days. You must make your request in writing within 30 days of the debt collectors initial contact with you. Debt validation letter template. Sending a debt validation letter on a valid debt also potentially arms the debt collector with the means to escalate their collection efforts against you.

The validation letter will also have a number of statements of your rights including. Simply disputing a debt after receiving a validation letter wont make the debt disappear. Send debt validation letter to the debt collector if you believe you dont owe the debt and thus the debt collector has to provide the proof. Youre speaking to a human so dont be threatening such as mentioning a lawsuit or filing a complaint with the federal trade commission.

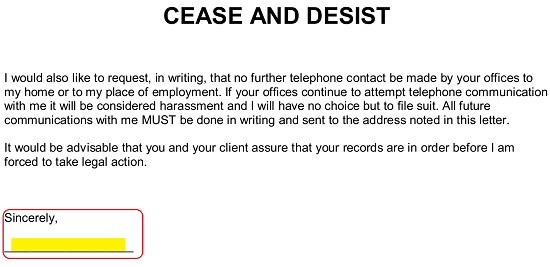

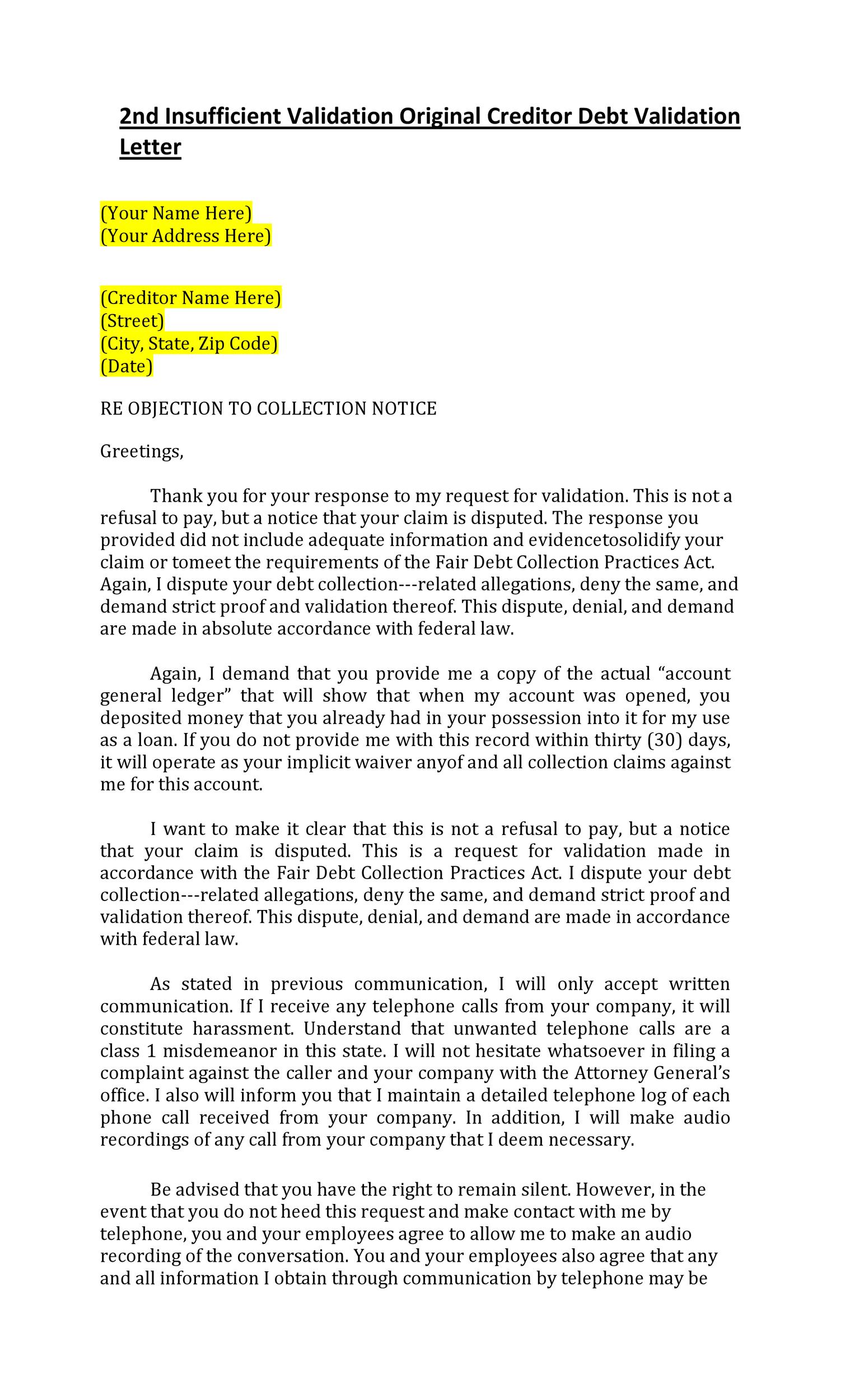

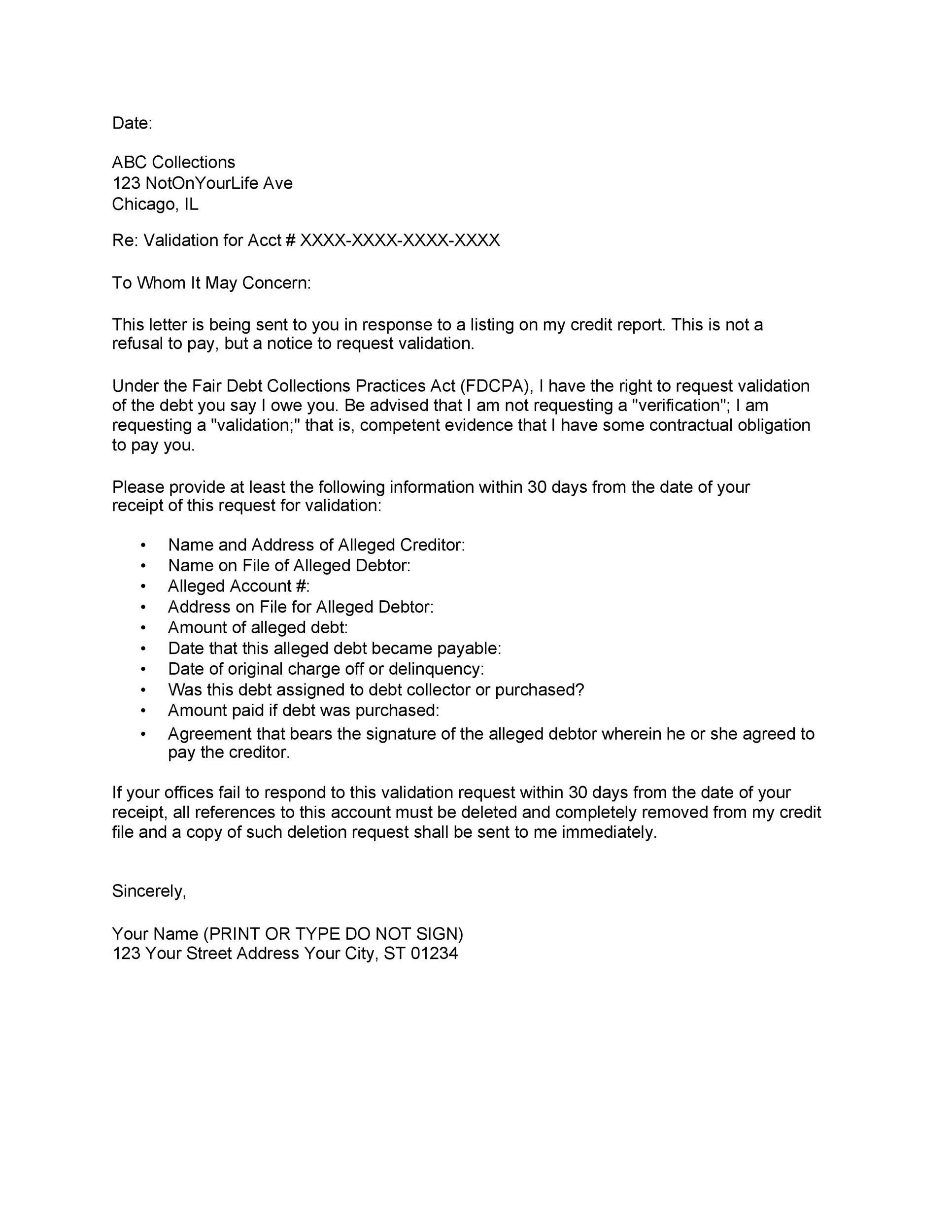

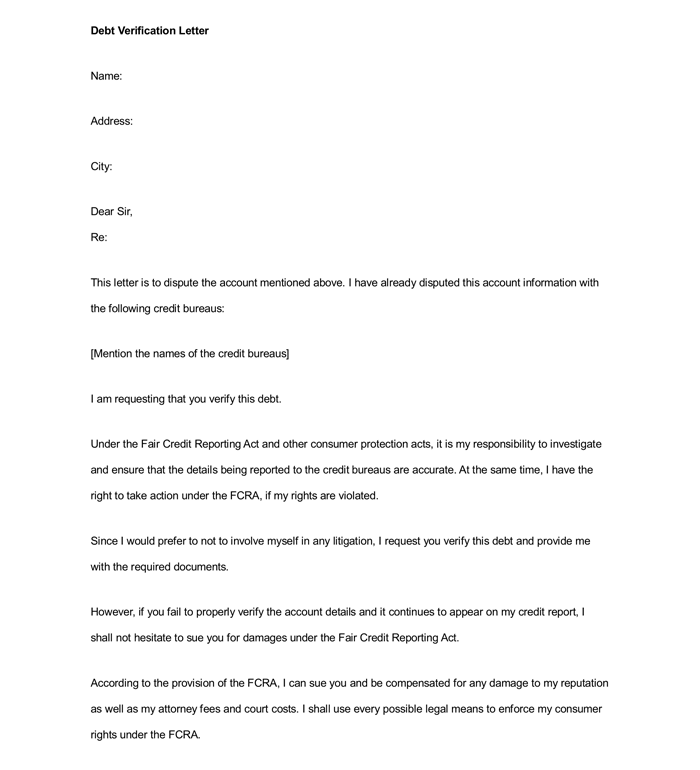

What to include in a debt validation letter. There are no statements. Sample debt validation letter a written request to validate the debt. Step 2 add a cease and desist addendum optional under 805.

As per the fair debt collection practices act you can request for validation of the debt that the collection agency ca claims you owe to them. Unfortunately thats simply not the case. That if you request more information about the initial creditor and debt that they must provide it in 30 days. Be sure to check whether there is an impact on the credit report as there are chances that the debt might affect the credit report.

There is no contract. A common misconception about disputing debt with a collection agency is that the debt will be removed from your credit reports if disputed. If you wait more than 30 days your validation request may not be covered under debt collection law. The fair debt collection practices act fdcpa gives you the right to request validation and provides you many other protections against debt collectors.

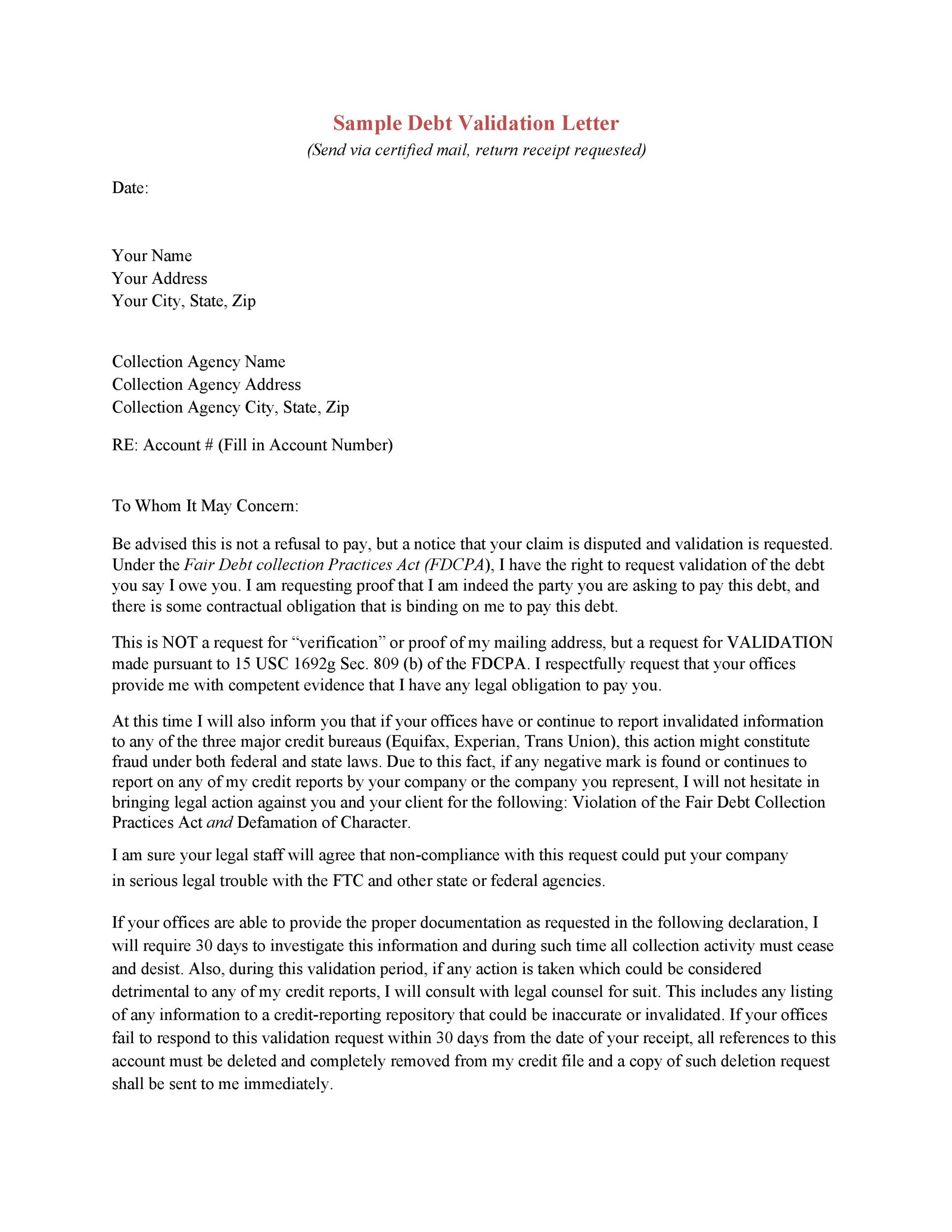

How to send a debt validation letter step 1 write the debt validation letter. Customize it to your situation. You can use and send the following debt validation letter via certified mail to make the ca validate the alleged debt. Sample debt validation letter the letter below is a sample debt validation letter.

The debt validation request is time sensitive. In accordance with the fair debt collection practices act fdcpa you can challenge the validity of a debt. When debt buyers or collection agencies are assigned debt it is generally done by way of an excel spreadsheet.

:max_bytes(150000):strip_icc()/960563v1-5ba433644cedfd0050c28bf1.png)