Donation Receipt Format For Ngo

Donation receipts are important but one should not make mistakes while issuing them to the donors.

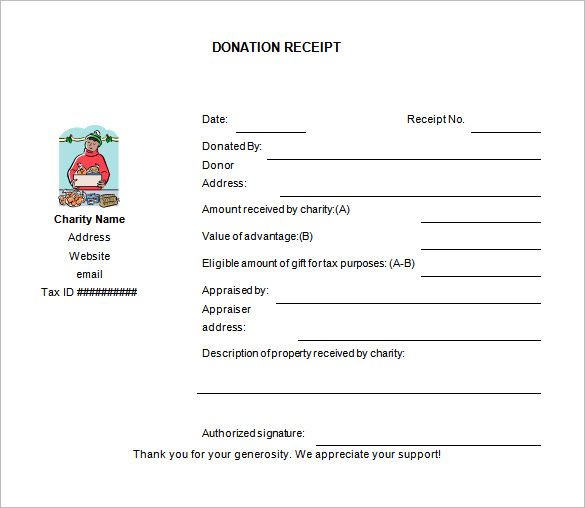

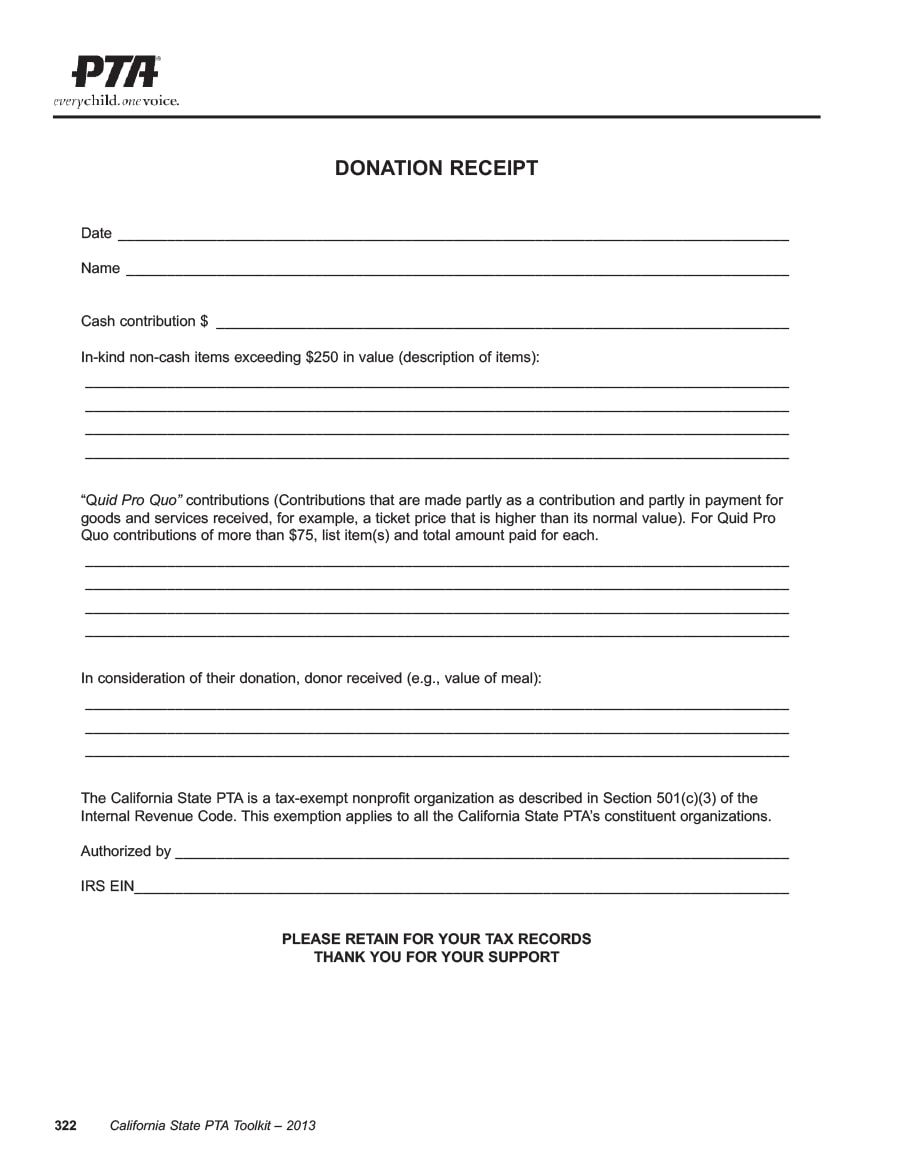

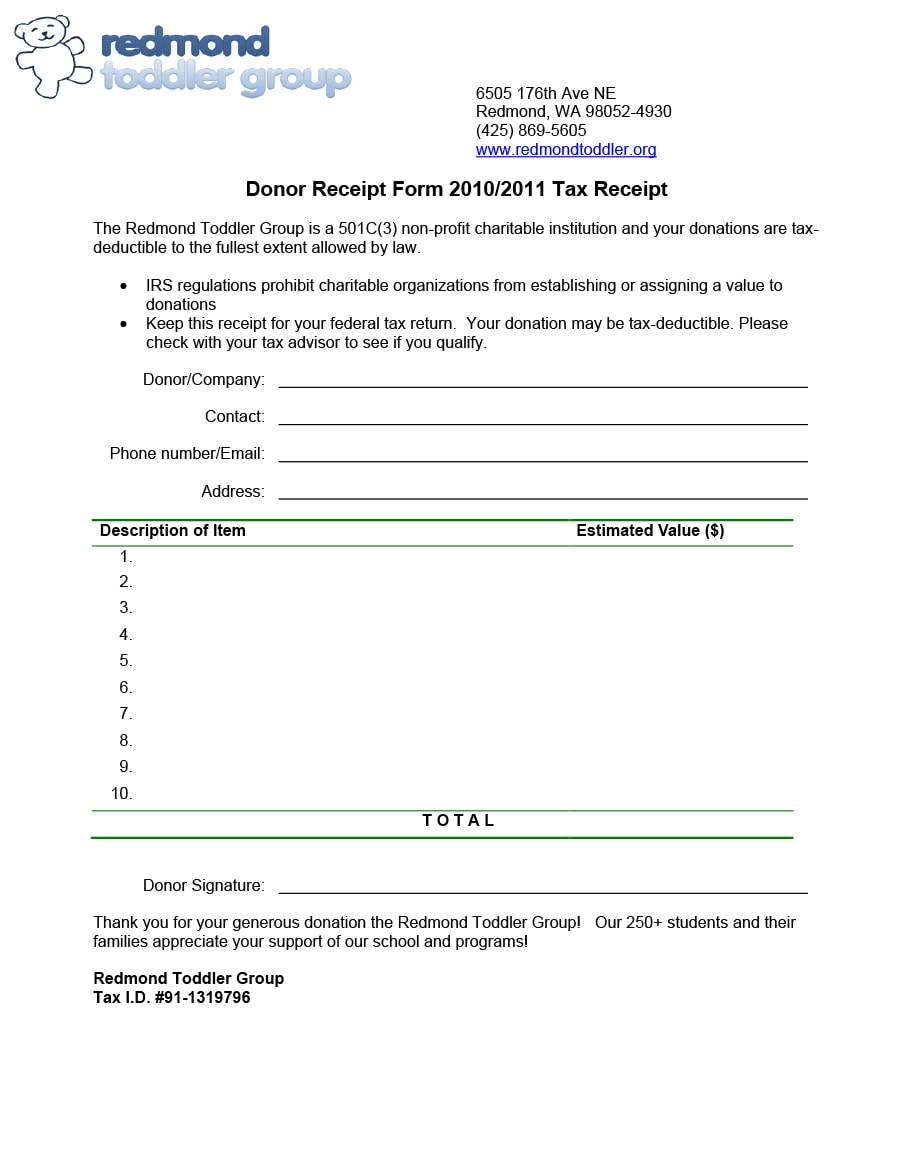

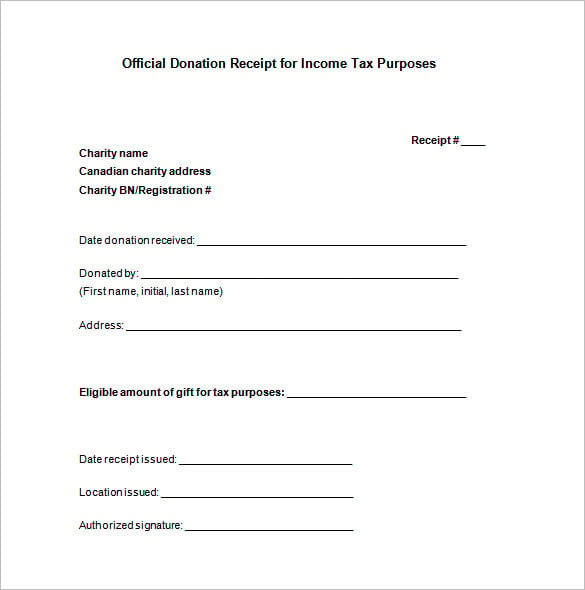

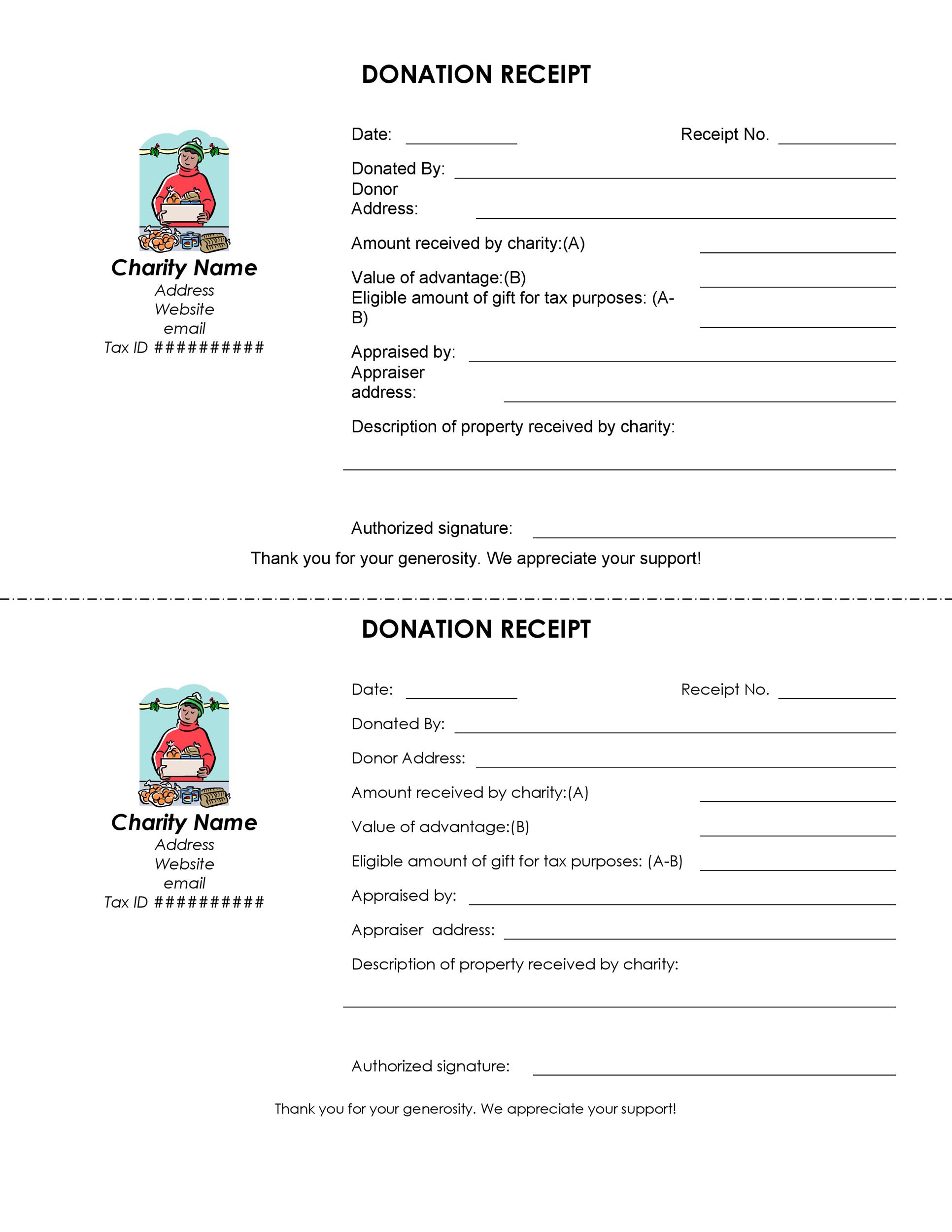

Donation receipt format for ngo. A lot of non profit organizations give out their donation receipts at the end of the year when the donation has been given or in the first month of the. Ngos can give receipt for 100 donation amount to donors following is the feedback we received from an ngo. The charity receiving this donation must automatically provide the donor with a receipt. Free tax deductible donation receipt template doc.

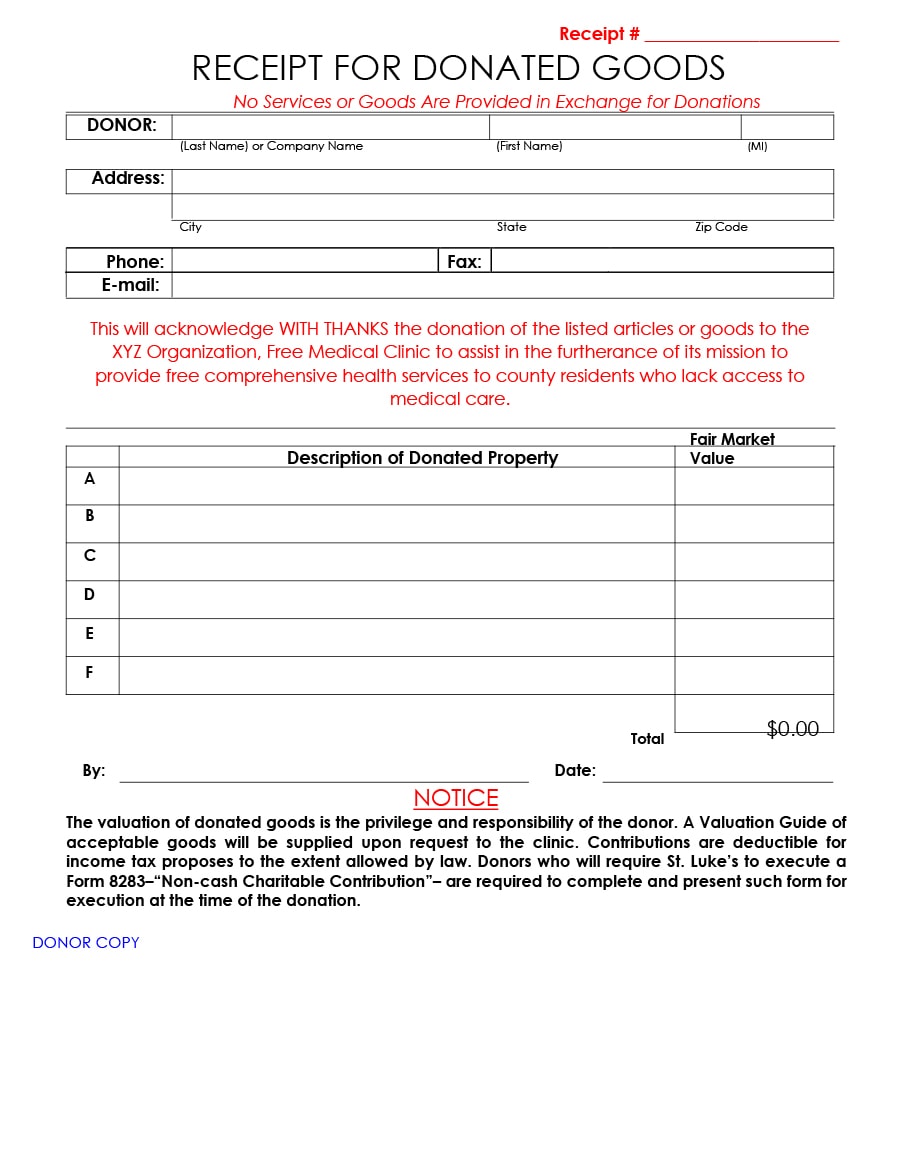

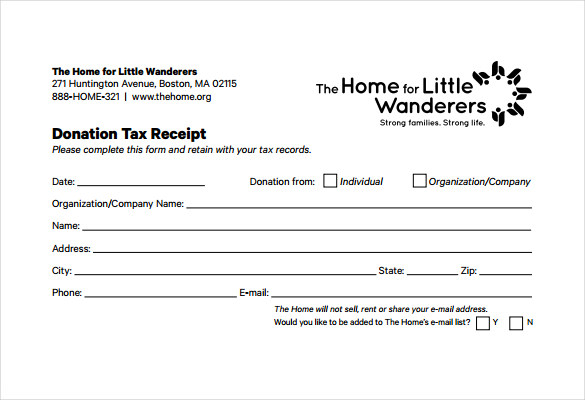

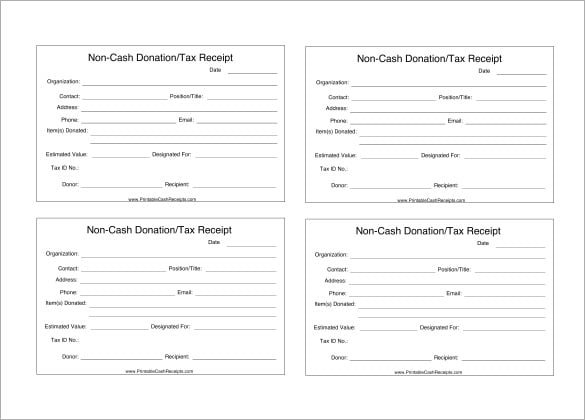

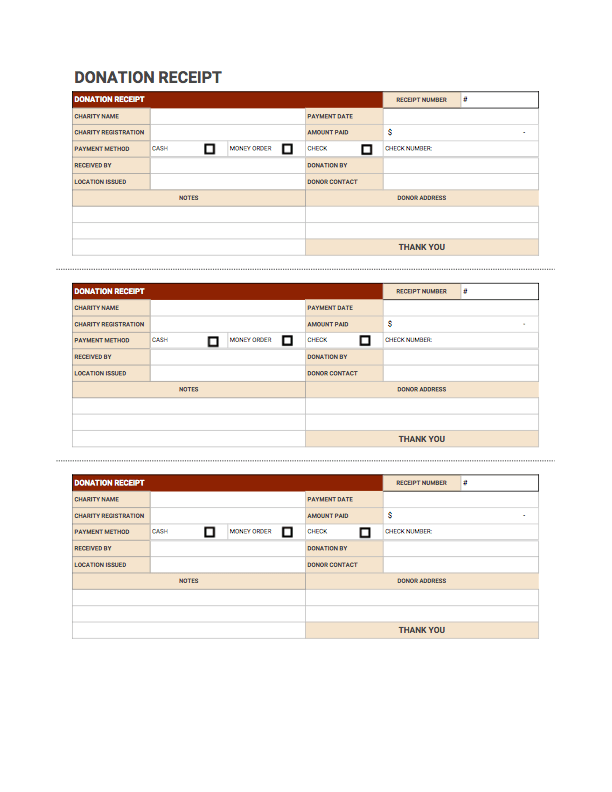

The library donation receipt in pdf is issued to acknowledge donation of old books money to library. Often a goodwill donation receipt is presented as a letter or an email which is given or sent to the benefactor after the donation has been received. For most nonprofits organizations. Non profit donation receipt template for donors.

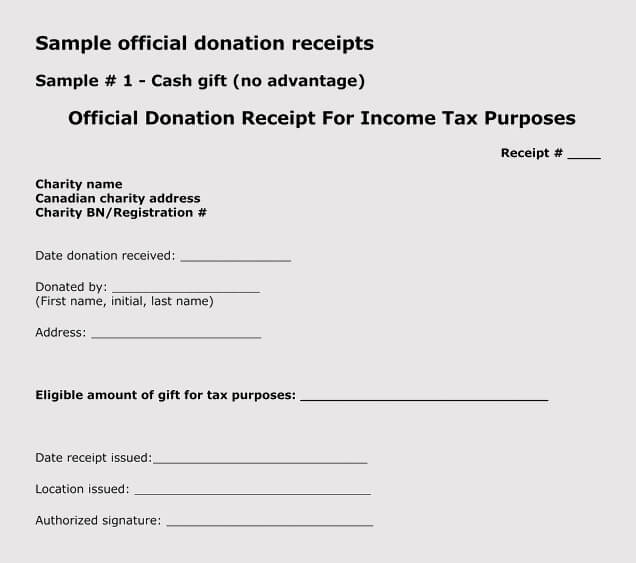

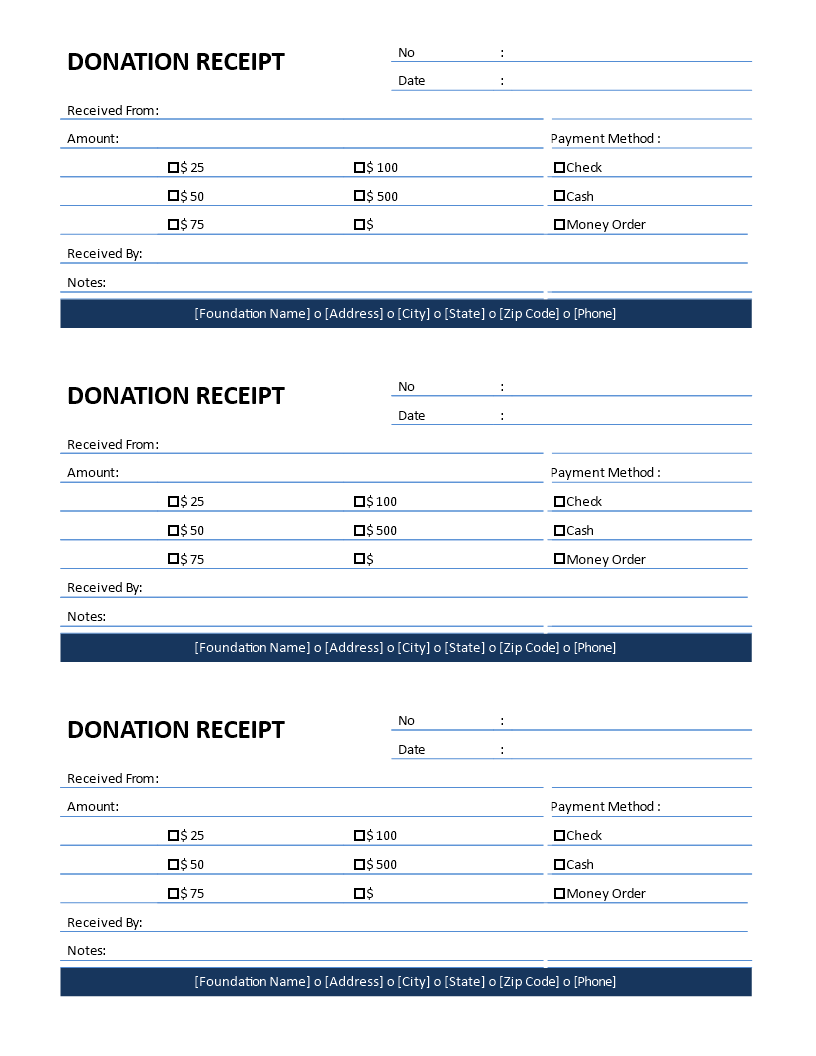

Any donations worth 250 or more must be recognized with a receipt. Often ngosnonprofits send receipts out by the end of the year the gift was given or in january of the following year. Deductions on tax returns. Donation receipt stands for the proof that a contribution either in kind or monetary was given to an organization by a certain donor.

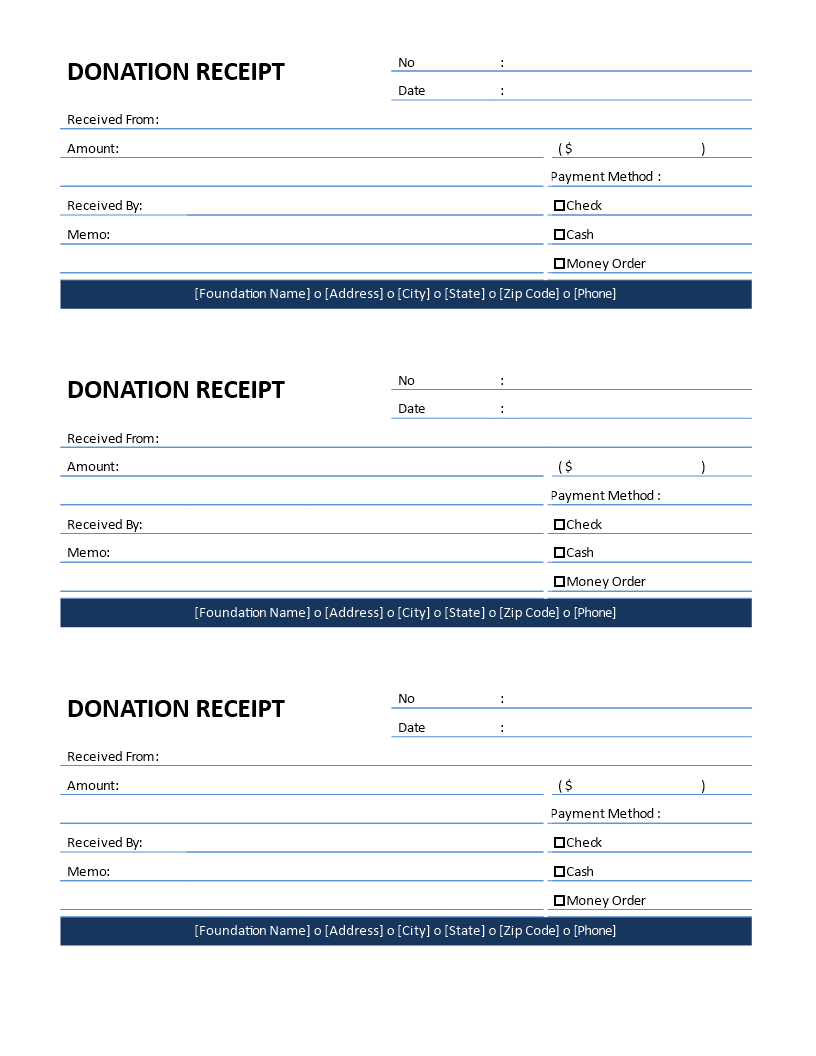

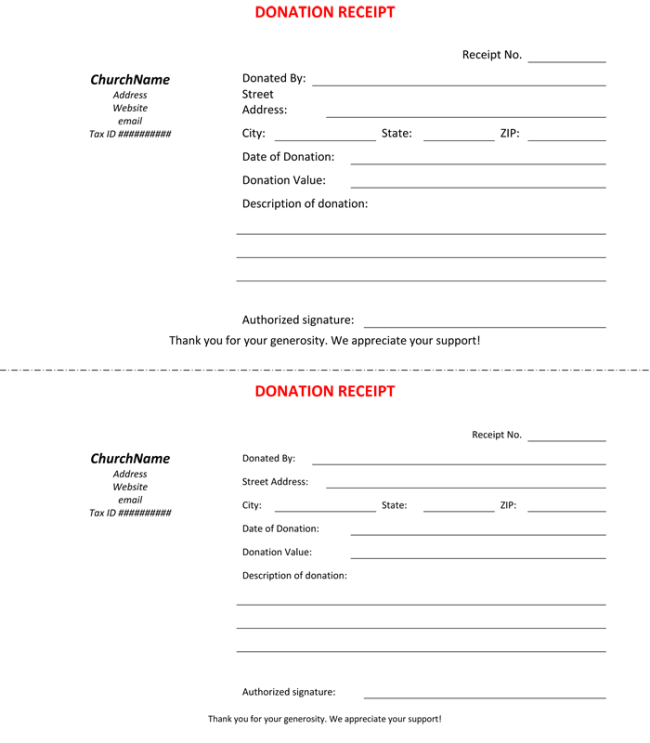

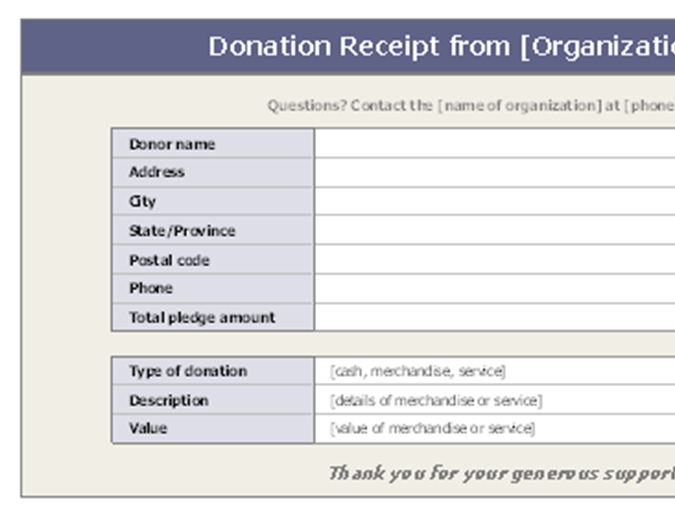

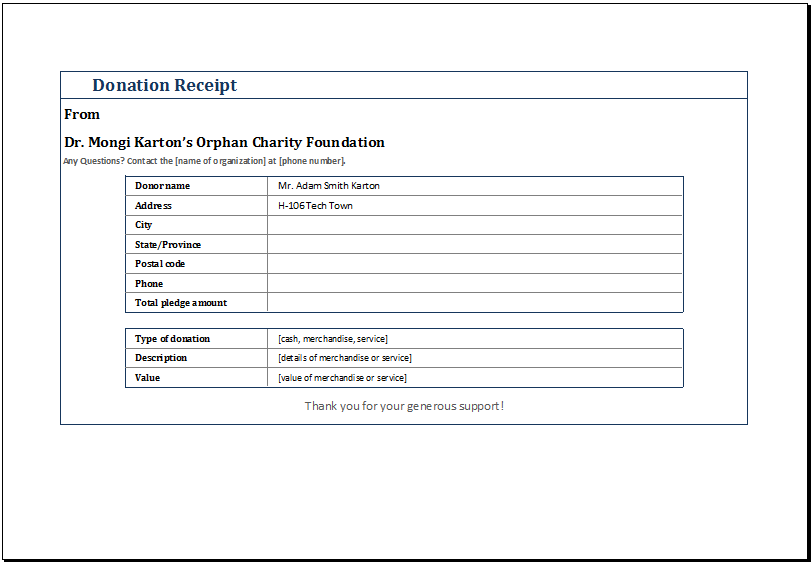

The receipt can be a letter a postcard an e mail message or a form created for the purpose. A sample of a charitable receipt is as follows. You must give this receipt only when the donation is complete that is when you receive the full amount of money or the items donated. The donors details are recorded in the company receipt.

The receipt number and the library name can be seen on the receipt. Most at times these receipts are emails or letters directed to supporters once donations are made. You may also see service receipt template. A donation receipt is an official document issued by an ngo or a charitable trust which can be provided to a particular person or an organization who has made the donation.

Ngo should issue the receipt for full amount and claim for expense of 15 paid to you. Your non profit organization can customize and use this receipt template to acknowledge patrons donations that may be tax deductible. This donation receipt is important in order to receive the tax deductions associated with charity a donor needs such proof of donation. Every organization should make sure that they have a donation receipt to give to those that make donations for their records and the recipients records.