Ea Certification Tax

Department of the treasury to represent taxpayers before the irs for audits collections and appeals according to the national association of enrolled agents naea.

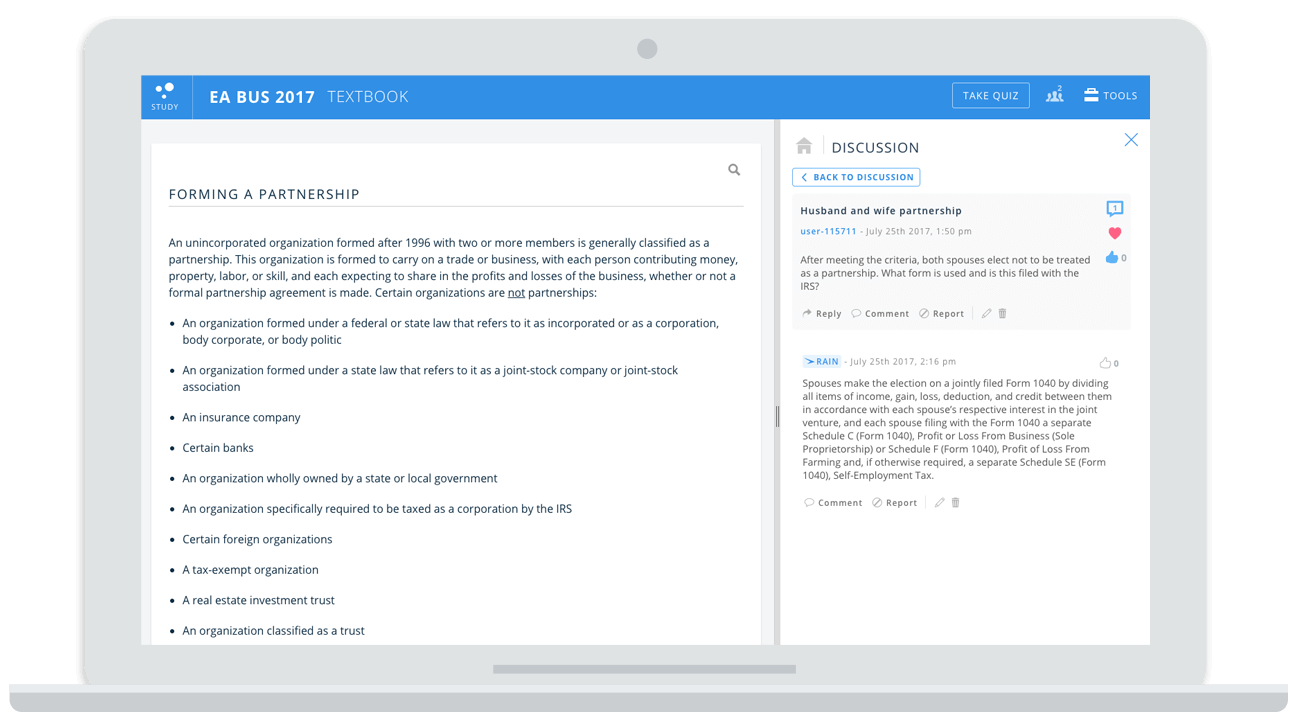

Ea certification tax. Achieve passing scores on all three parts of the see within two years. The irs will notify you when your renewal cycle is approaching. If you are an enrolled agent you specialize in tax issues period such as preparation of taxes for individuals and business entities or advising clients. Enrolled agents are required to renew their license every 3 years.

An enrolled agent is a person who has earned the privilege of representing taxpayers before the internal revenue service by either passing a three part comprehensive irs test covering individual and business tax returns or through experience as a former irs employee. Eas advise represent and prepare tax returns for individuals partnerships corporations estates. Enrolled agent ea status is the highest credential the irs awards extending your preparation and filing privileges to include unlimited representation of the taxpayers you serve. Visit prometrics special enrollment examination see web page to schedule your test appointments review the see candidate information bulletin sample test questions and other test preparation resources.

This ensures that eas are up to date on any changes and additions to the tax code. Ea vs cpa career path difference. Ptin holders tax return preparers who have an active preparer tax identification number but no professional credentials and do not participate in the annual filing season program are authorized to prepare tax returns. Department of the treasury to represent taxpayers before all administrative levelsexamination collection and appealsof the internal revenue service.

An ea is authorized by the us. One passing a three part comprehensive irs test covering individual and business tax returns. An enrolled agent ea is a person who has earned the privilege of representing taxpayers before the irs by either. Ultimately this designation is specifically focused on us taxation of all entity types.

Steps to becoming an enrolled agent. Enrolled agent ea certification the enrolled agent certification is a credential created by the irs to demonstrate ones knowledge of the us tax code and the ability to apply its concepts. Job opportunities for you may be found at tax preparation franchises or working for a cpa. An enrolled agent ea is a federally authorized tax practitioner who has technical expertise in the field of taxation and who is empowered by the us.

But becoming an eaand maintaining that status through cpehas its requirements. Beginning january 1 2016 this is the only authority they have.