Ein Number Certificate

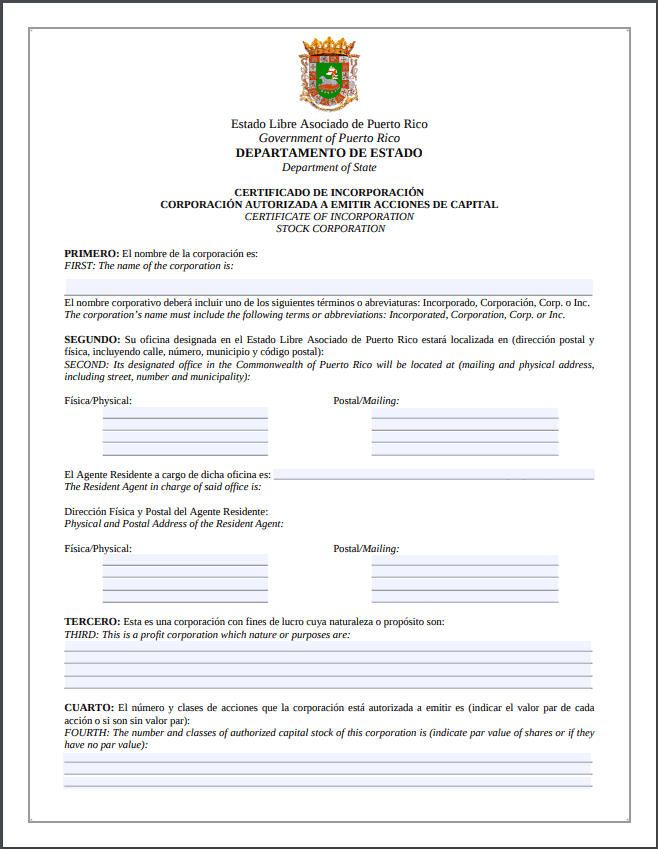

Generally businesses need an ein.

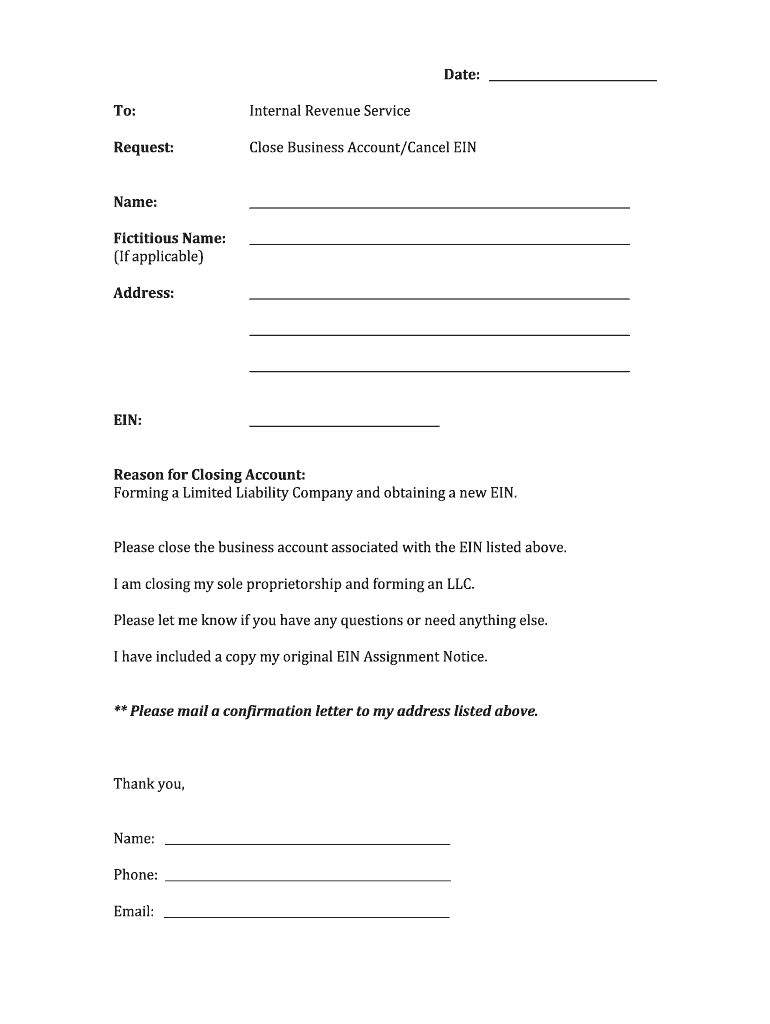

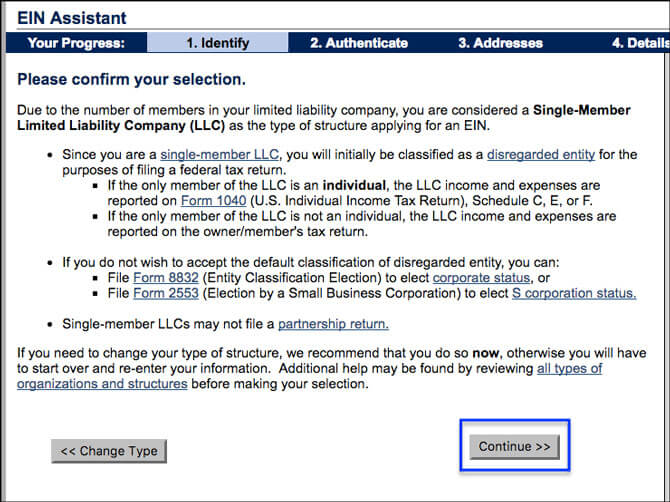

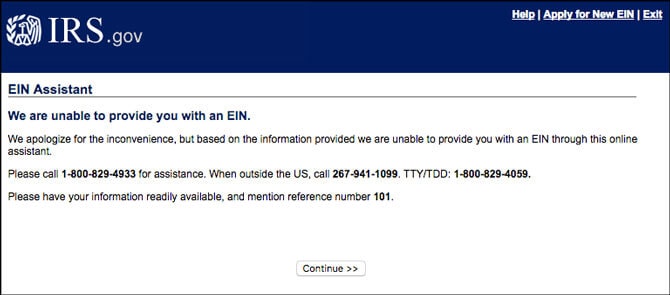

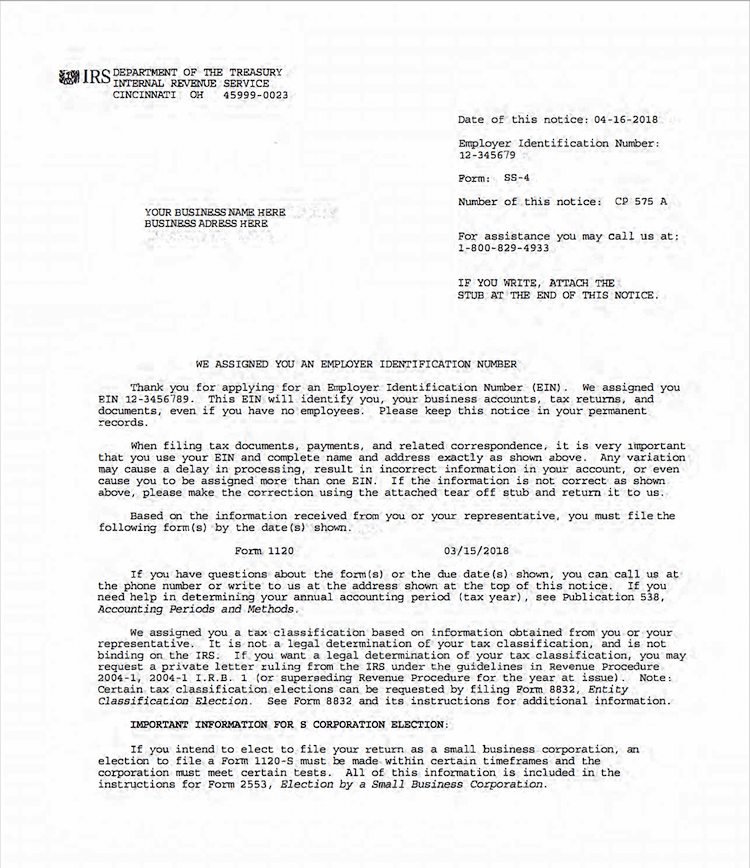

Ein number certificate. Ask the irs to search for your ein by calling the business specialty tax line at 800 829 4933. You may apply for an ein in various ways and now you may apply online. Unfortunately this document can be lost. The responsible party is the person who ultimately owns or controls the entity or who exercises ultimate effective control over the entity.

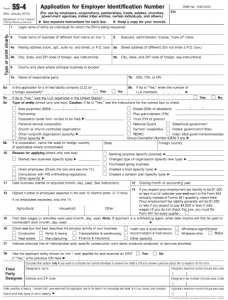

Request a 147c letter when you speak with an agent on the phone. All ein applications mail fax electronic must disclose the name and taxpayer identification number ssn itin or ein of the true principal officer general. Local time monday through friday. An ein also known as an employer identification number federal tax id number or tax identification number allows your business to establish business credit open business checking accounts identifies your business for tax purposes and allows you to hire employees.

This is a free service offered by the internal revenue service and you can get your ein immediately. Lost tax id numbers if you lose the original copy of an ein issued by the irs call them at 800 829 4933. To do so call the irs business specialty tax line toll free at 1 800 829 4933 between the hours of 7am and 7pm in your local time zone. Beware of websites on the internet that charge for this free service.

The hours of operation are 700 am. If you apply online you will receive a copy of your certificate in pdf form minutes after completing the application. When you receive your ein this certificate is mailed to your location. You will have to ask the irs by calling the business specialty tax line at the hours of operation are 700 am.

You are limited to one ein per responsible party per day. When you receive your ein number this certificate is mailed to your location. If you have lost your ein verification letter from the department of treasury you can request a new one. The person applying online must have a valid taxpayer identification number ssn itin ein.

An ein also known as an employer identification number federal tax id number or tax identification number allows your business to establish business credit open business checking accounts and to hire employees. An employer identification number ein is also known as a federal tax identification number and is used to identify a business entity. Applying for an employer identification number ein is a free service offered by the internal revenue service. Answer 1 of 6.