Firpta Exemption Certificate

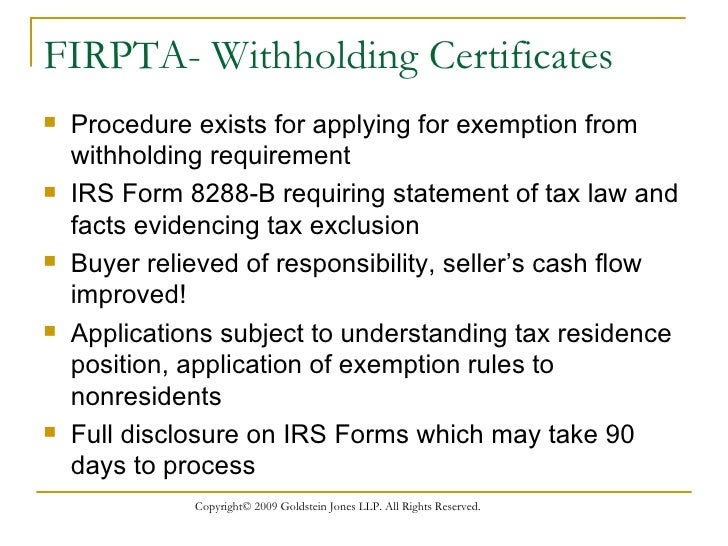

A withholding certificate may be issued due to.

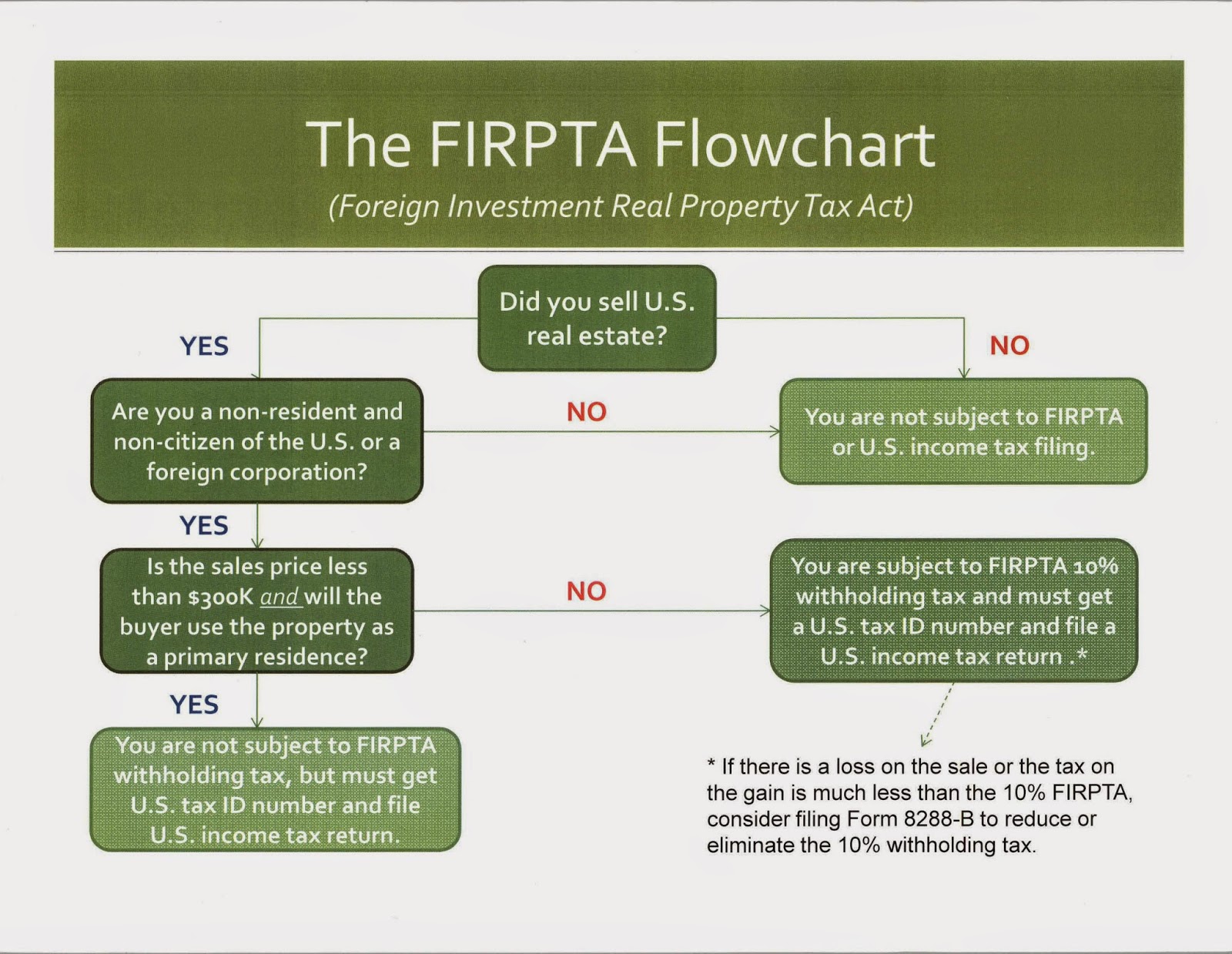

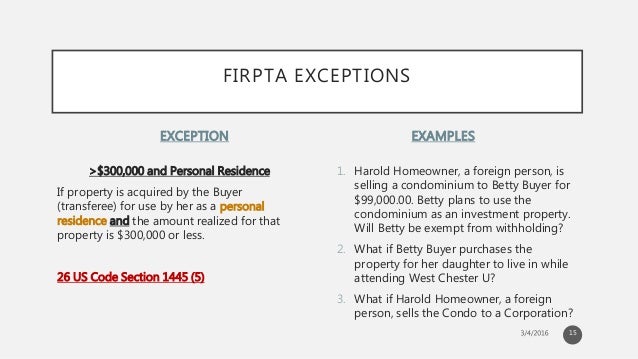

Firpta exemption certificate. One of the most asked questions that we get from people regarding firpta is what are the firpta exceptions and if they can be exempt from firpta. This means that in order to apply for the firpta withholding certificate 90 days in advance of the closing or settlement date of the sale the foreign seller must have an executed contract for the sale of the property 90 days in advance. A withholding is an amount held back to pay potential taxes. A determination by the irs that reduced withholding is appropriate because either.

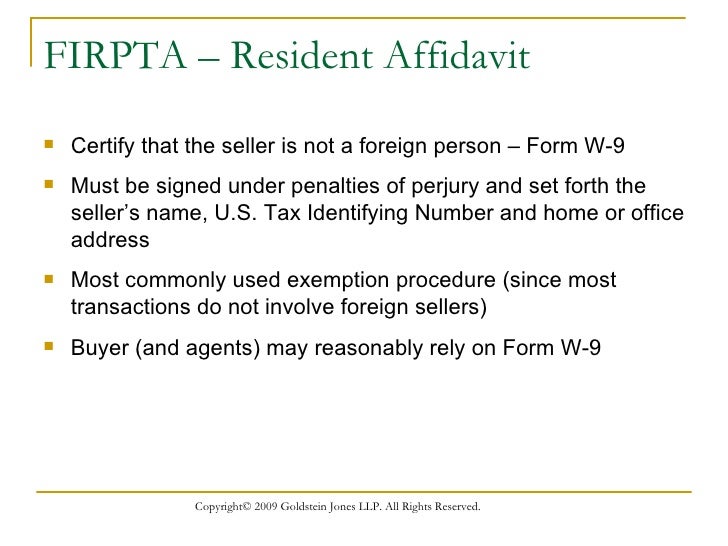

The sale of us. The certification must be dated not more than 30 days before the date of transfer. Dilendorf khurdayan has substantial experience in helping foreign clients reduce and sometimes. This includes but is not limited to a sale or exchange liquidation redemption gift.

The transferor gives you a certification stating under penalties of perjury that the transferor is not a foreign person and containing the transferors name us. Taxpayer identification number and home address or office address in the case of an entity. Firpta withholding applies to any disposition of real estate interest by a foreign person and obligates the buyer to withhold percentage of the purchase price at closing and remit it to the irs. The amount that must be withheld would be more than the transferors maximum tax liability or.

Firpta authorized the united states to tax foreign persons on dispositions of us. Firpta withholding exemption certificate sellers plan ahead and beware. Firpta requires a buyer of real estate to withhold 15 10 for dispositions before feb 17.