Firpta Withholding Certificate

Application for reduced rate of withholding.

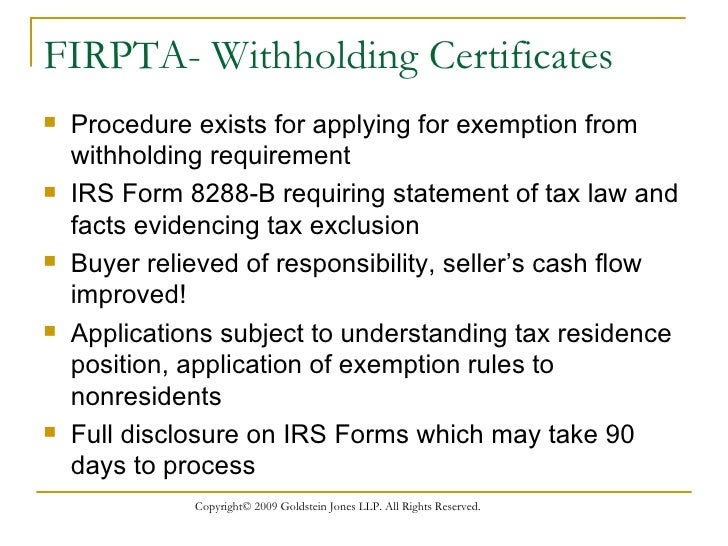

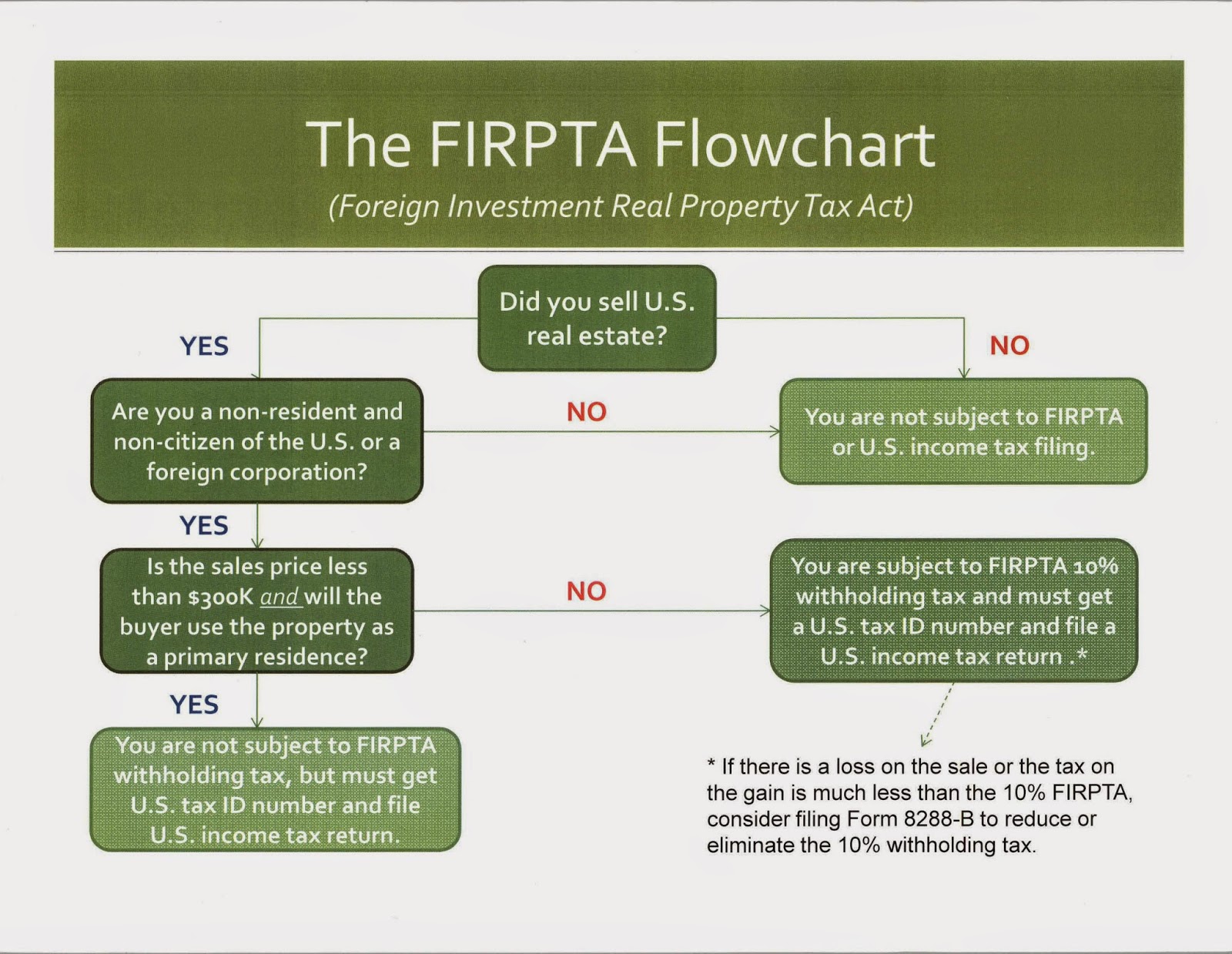

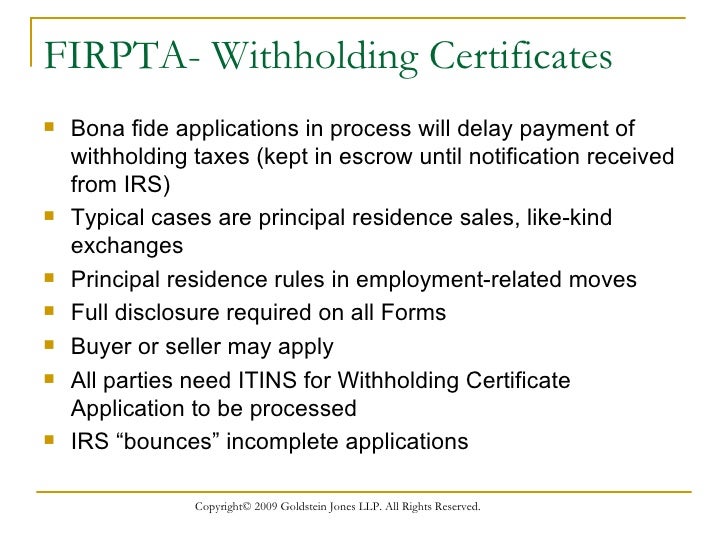

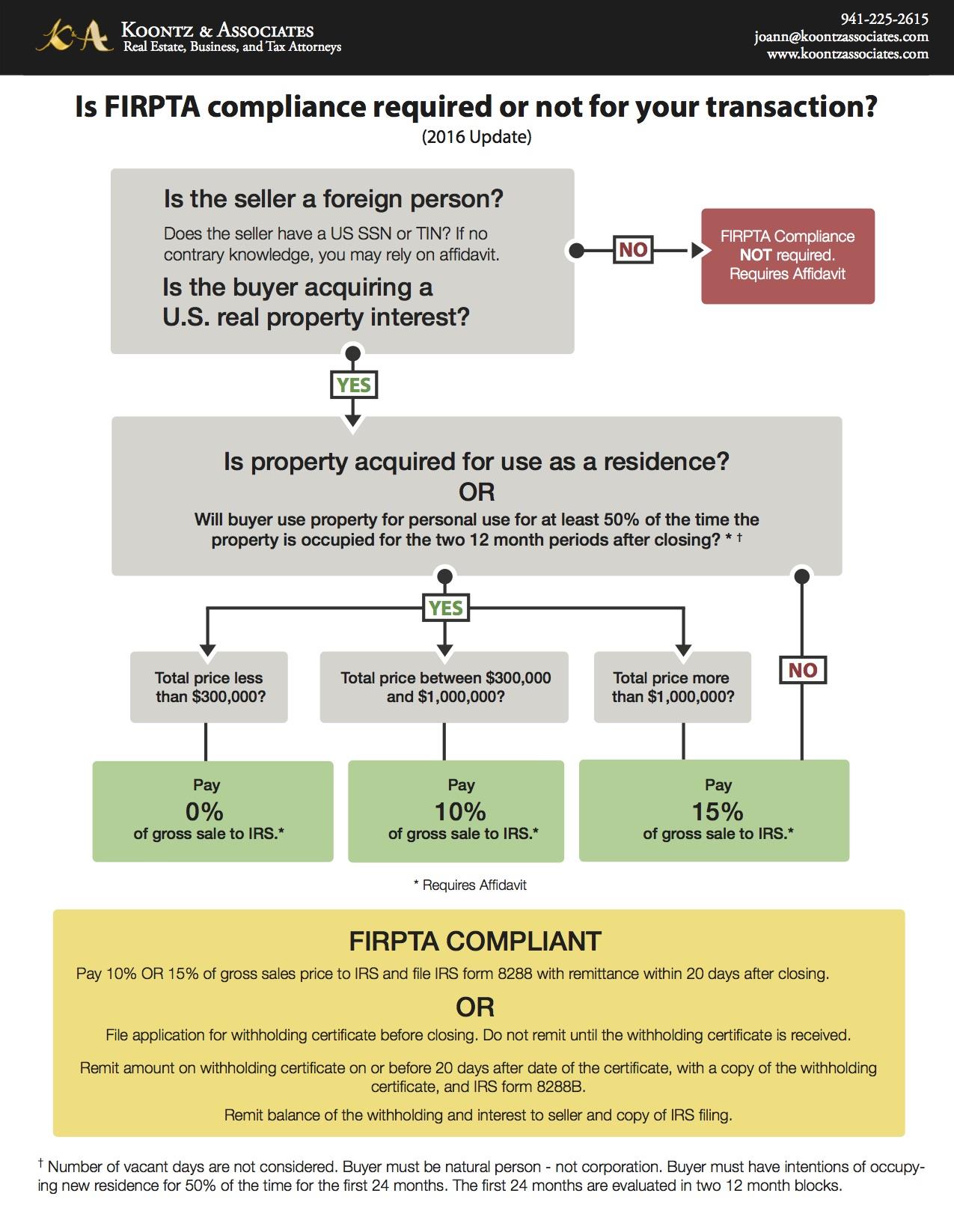

Firpta withholding certificate. Do not use form 8288 b for applications under categories 4 5 and 6. Either the seller or buyer may apply for a withholding certificate issued by the irs. As a result the seller can get the withholding back within a few months compared to having to apply for a refund through filing a us tax return in the following year. A withholding certificate is an application for a reduced withholding based on the gain of a sale instead of the selling price.

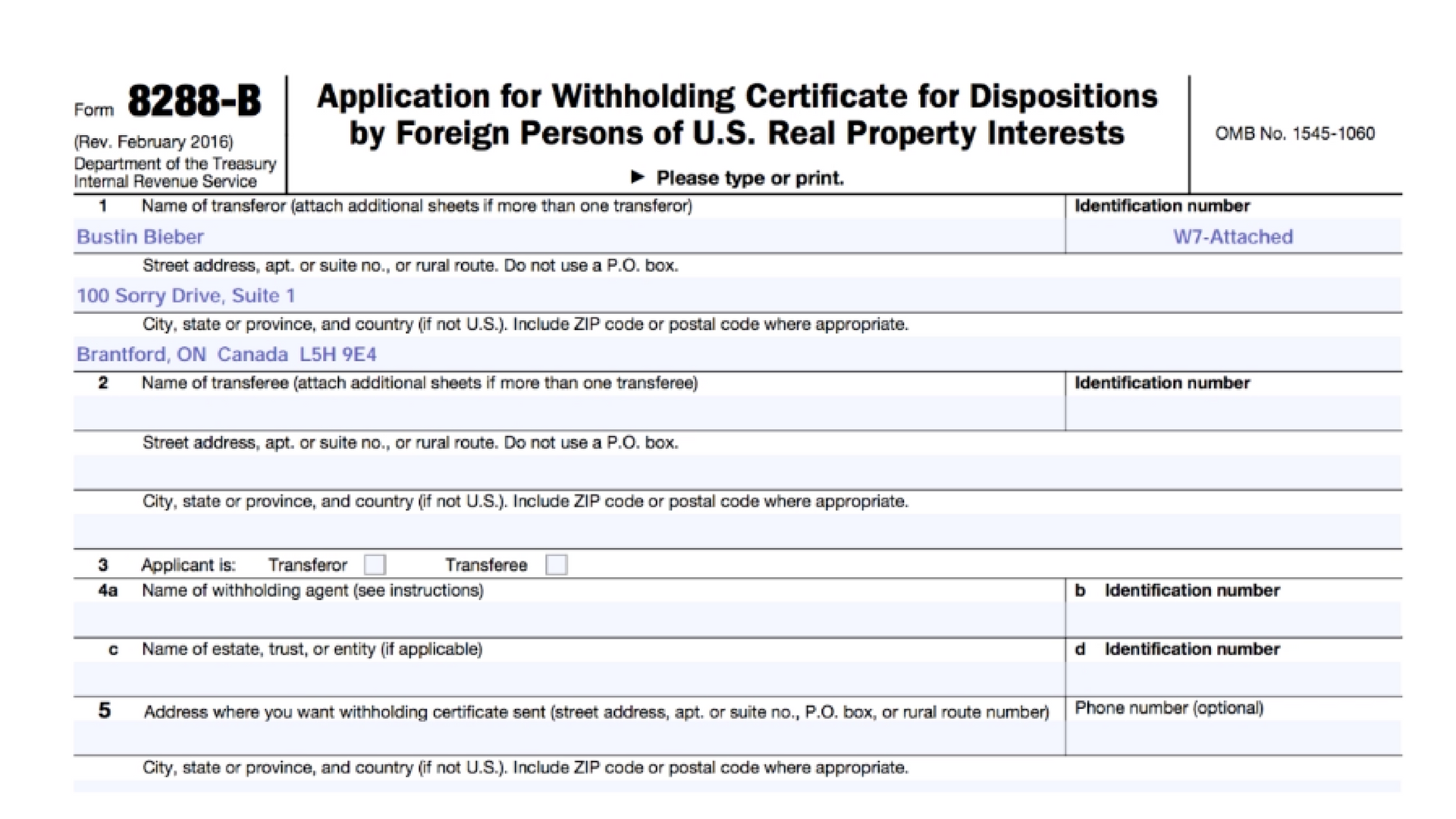

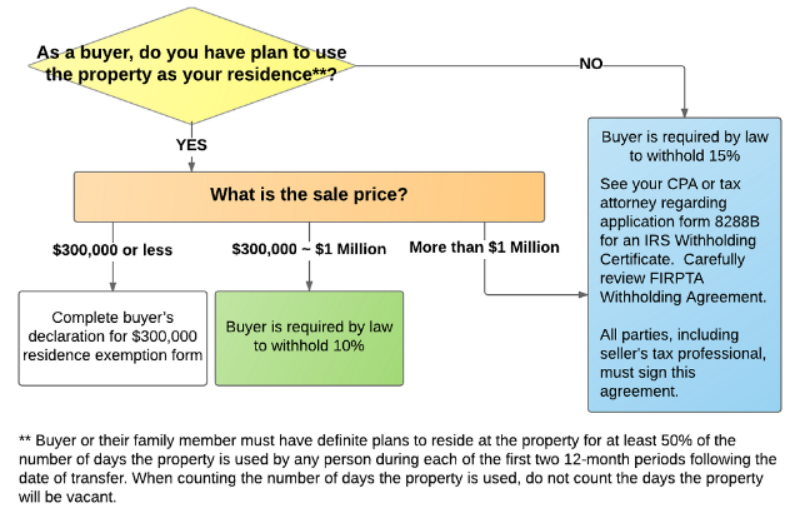

A withholding agent is personally liable for the full amount of firpta withholding tax required to be withheld plus penalties and interest. A reduced rate of withholding may be allowed upon the submission and acceptance of form 8288 b application for withholding certificate for dispositions by foreign persons of us. To avoid unnecessary withholding the irs can determine sellers maximum tax liability in advance. Real property interest by a foreign person the transferor is subject to the foreign investment in real property tax act of 1980 firpta income tax withholding.

With the certificate in hand the withholding agent is then authorized to release the funds back to the seller directly. A withholding agent is any person having the control receipt custody disposal or payment of income that is subject to withholding. While there is no way to get around firpta the foreign seller can plan ahead and apply for a firpta withholding certificate that allows a reduction of the withholding amount withholding certificate allowing more of the sale proceeds to be available to the seller at the time of closing. Withholding of tax on dispositions of united states real property interests.

They are the one who are required to hold the taxes. Applications on any other basis. Applications for firpta withholding certificates. The disposition of a us.

Refer to format for applications for more information. Please refer to publication 515 withholding of tax on nonresident aliens and foreign entities for detailed instructions on how to apply for a withholding certificate under each of the 6 categories above. Obtaining a withholding certificate may reduce or eliminate the amount of withholding required. Real property interests to apply for a withholding certificate under categories 1 2 and 3.

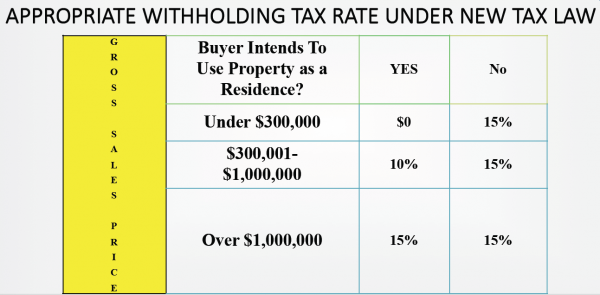

According to irs the buyer is supposed to hold 15 of the payment on the sale price and that should be given to the irs. According to irsgov the withholding amount on the sale of us property can be adjusted if the irs issues a withholding certificate. Refer also to exceptions from firpta. This is the person who is a transferee.