Form For Charitable Donation Receipt

In addition the charity is mandated to provide a written receipt to the donor in accordance with irs publication 4302.

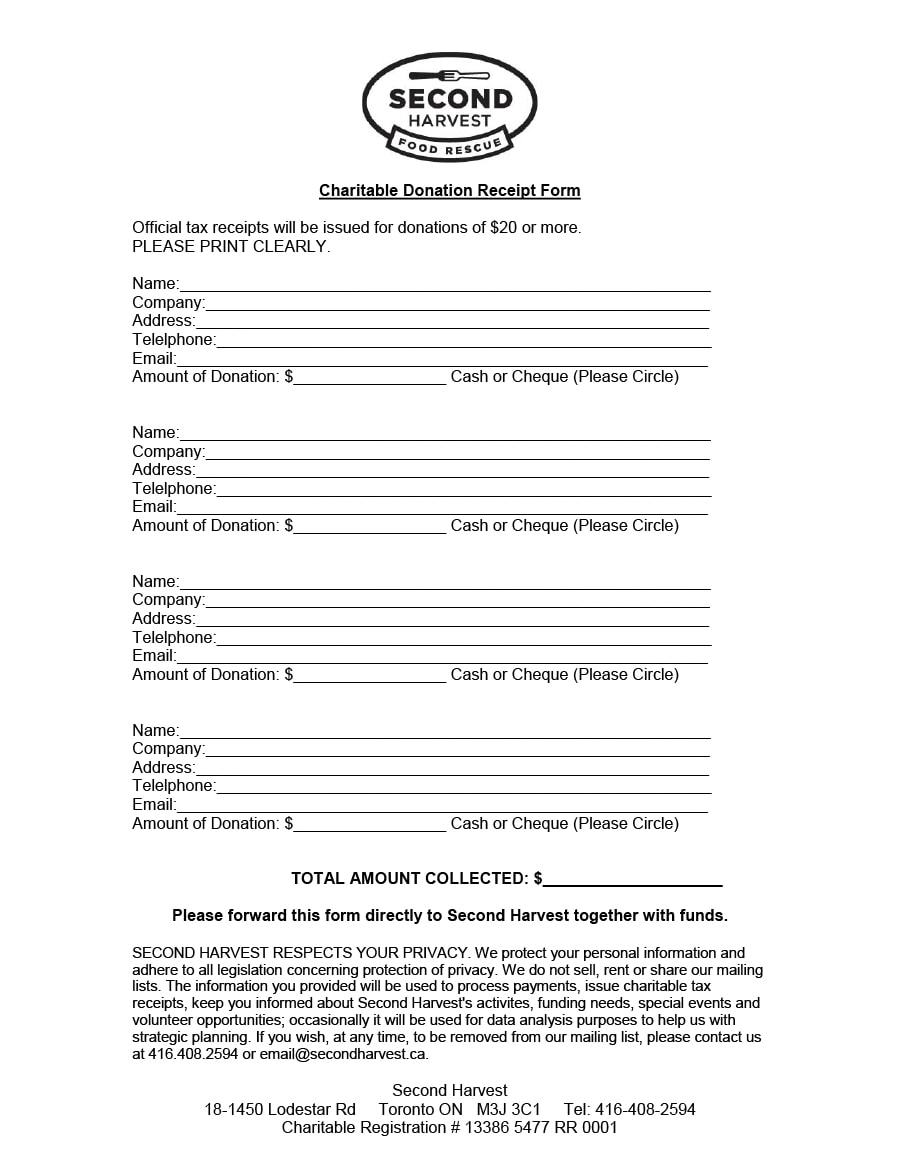

Form for charitable donation receipt. Under this rule a person may make ten 10 trips to donate clothes and claim it as a tax deduction without proof or a receipt. How to create a donation receipt. A quid pro quo contribution is a payment made to a charity by a donor partly as a contribution and partly for goods or services provided to the donor by the charity. For charities irs form 1096 attached with irs form 1098 c.

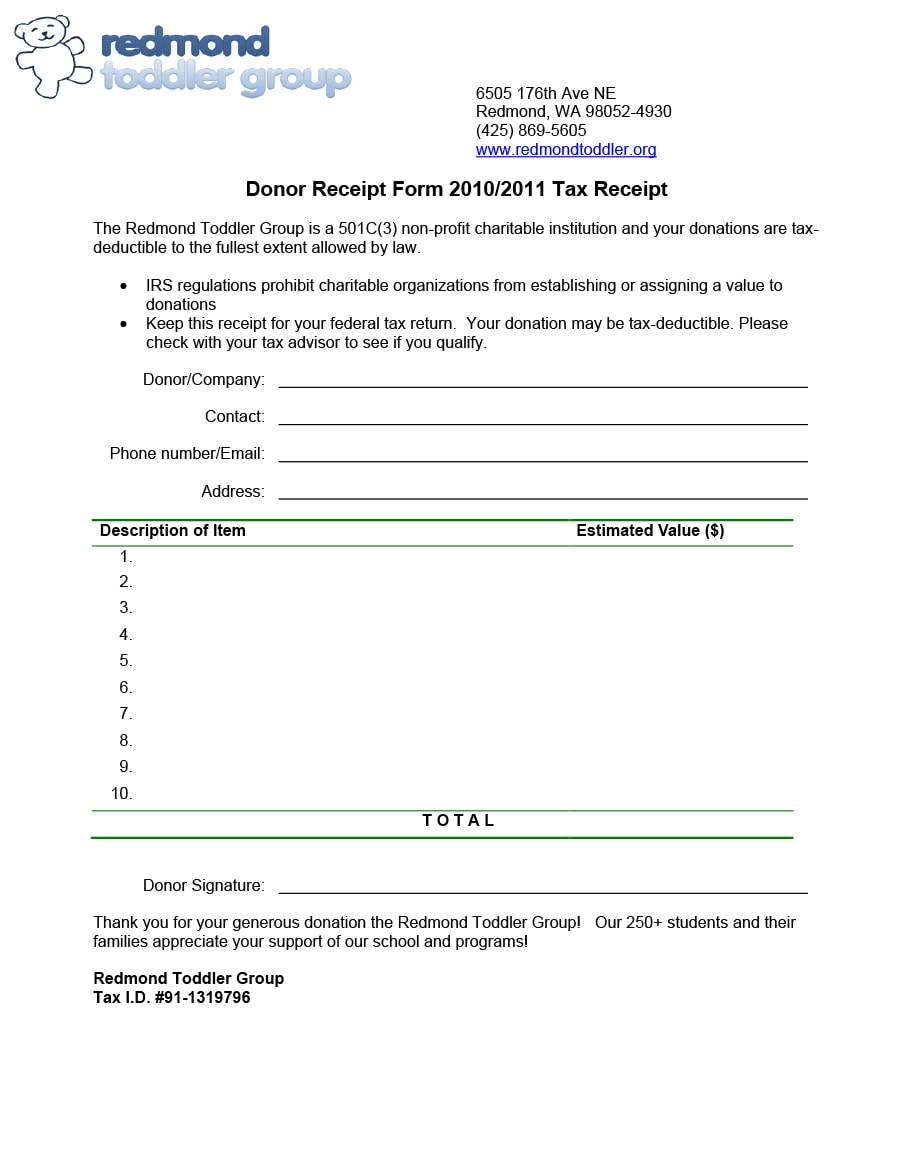

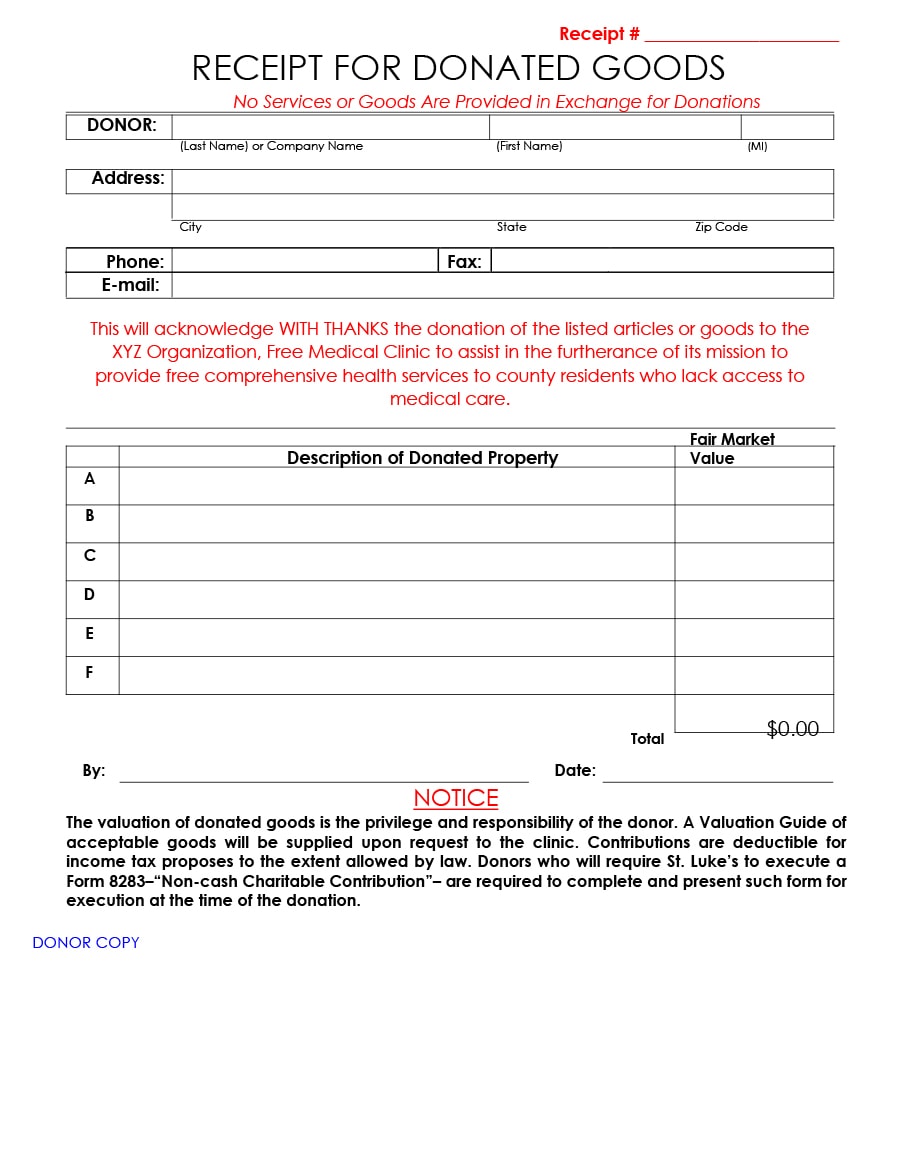

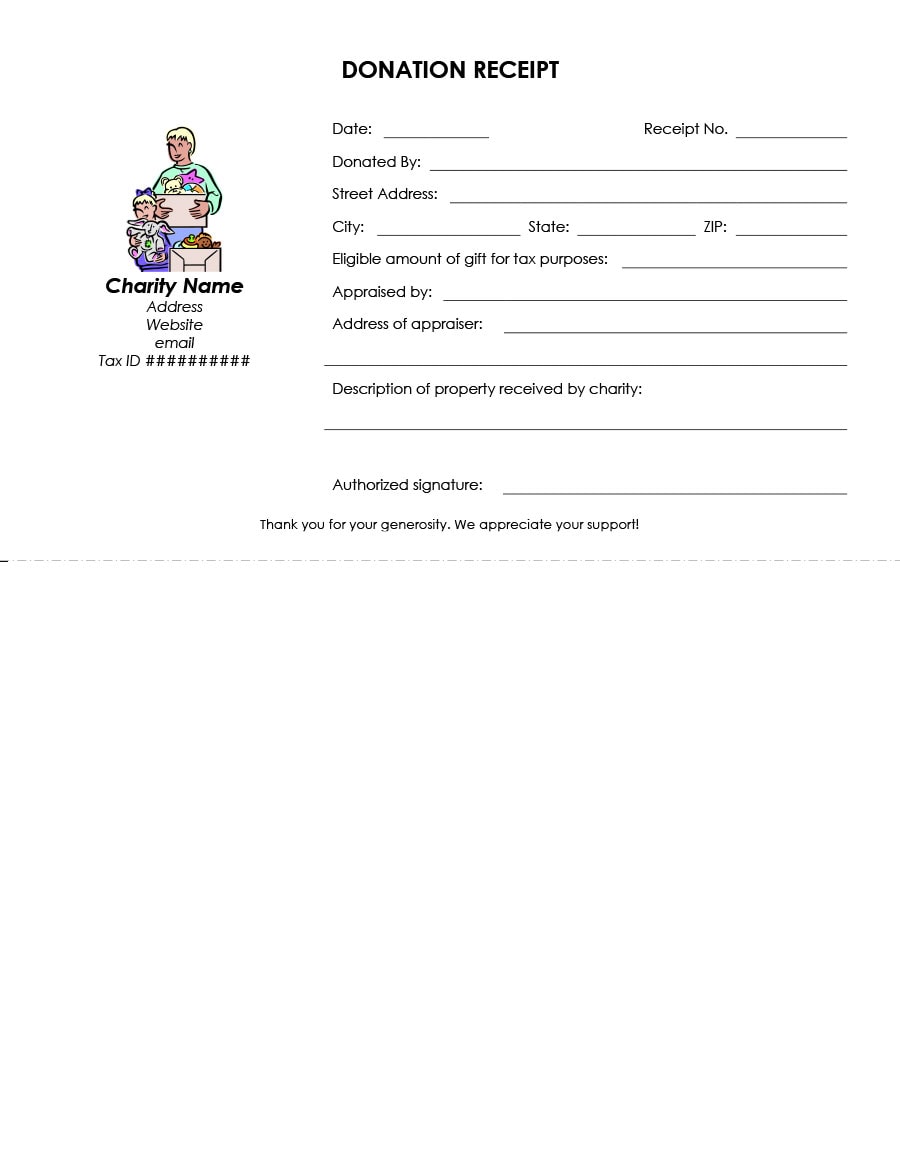

Put your charity organization name and logo. A charitable organization must provide a written disclosure statement to donors of a quid pro quo contribution in excess of 75. Some organizations also only issue receipts for monetary donations and. Best practices for creating a 501c3 tax compliant donation receipt.

Because charitable donations are tax deductible for the donor and reportable by the nonprofit organization a donation receipt must include specific information about the value of the donation and what the. For donors view irs publication 4303 schedule a of irs form 1040. This charitable donation receipt template helps you create donation receipts easily and quickly. Monetary gift unless the donor maintains a record of the contribution in the form of either a bank record such as a cancelled check or a written communication from the charity such as a receipt or letter showing the name of the charity the date of the contribution and the amount of the contribution.

The receipt can take a variety of written forms letters formal receipts postcard computer generated forms etc. Every organization should make sure that they have a donation receipt to give to those that make donations for their records and the recipients records. Any single instance where a donation is made up to 250 does not need a receipt. The donation receipt acts as proof that the individual gave a donation to the charity.

Once the amount for any donation reaches 250 or more a receipt is required. Its important to remember that without a written acknowledgment the donor cannot claim the tax deduction. For example if a donor gives a charity 100 and. The receipt template is a microsoft word document so that you can customize everything to meet your needs.

By using this donation receipt template you can. The charity receiving this donation must automatically provide the donor with a receipt. Any donations worth 250 or more must be recognized with a receipt. In the cases of donations in the form of vehicles there are other things to consider.

Some organizations only give receipts when the donation is of a certain amount or more. The receipt can be a letter a postcard an e mail message or a form created for the purpose. You are not required to issue receipts for all charitable donations given to your organization.