Free Fillable And Printable 1099 Forms

Efile to irsssa for a small fee.

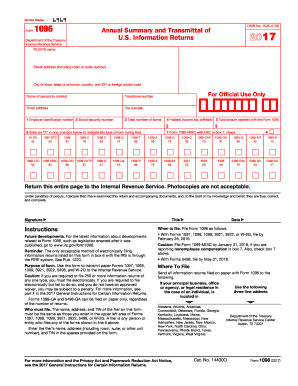

Free fillable and printable 1099 forms. E file with irs for 149 per form. Review a list of current tax year free file fillable forms and their limitations. Report income from self employment earnings in 2019 with a 1099 misc form. Here are a few tips on filling the 1099 misc 2018.

The social security administration shares the information with the internal revenue service. The form is easy to fill. What are the components of a 1099 misc. See the instructions for forms 1040 and 1040 sr or the instructions for form 1040 nr.

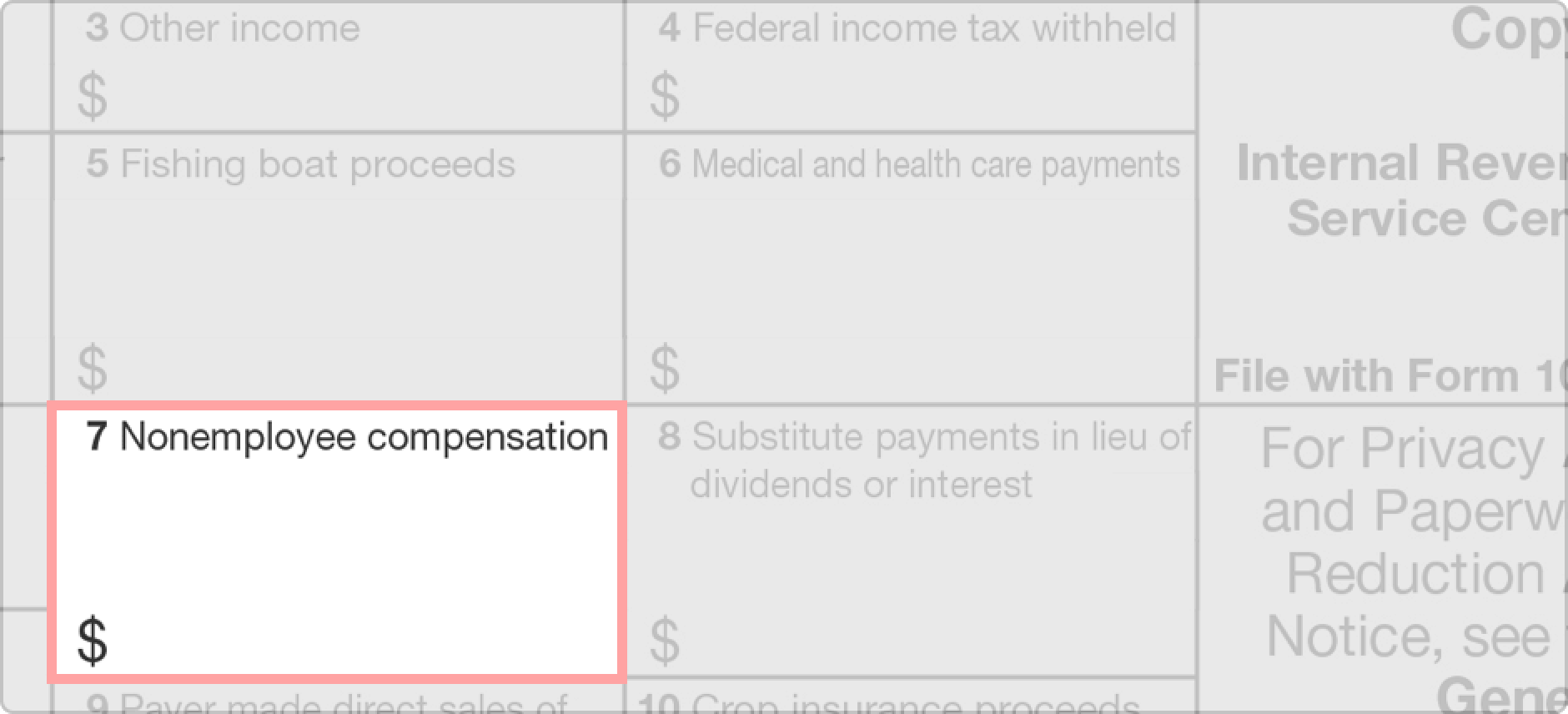

Persons with a hearing or speech disability with access to ttytdd equipment can call 304 579 4827 not toll free. Form 1099 nec as nonemployee compensation. This will not cause your return to reject. Tips on filling the 1099 misc template form 1099 misc miscellaneous income is the form that businesses used to report payments to those who is called non employees by the irs.

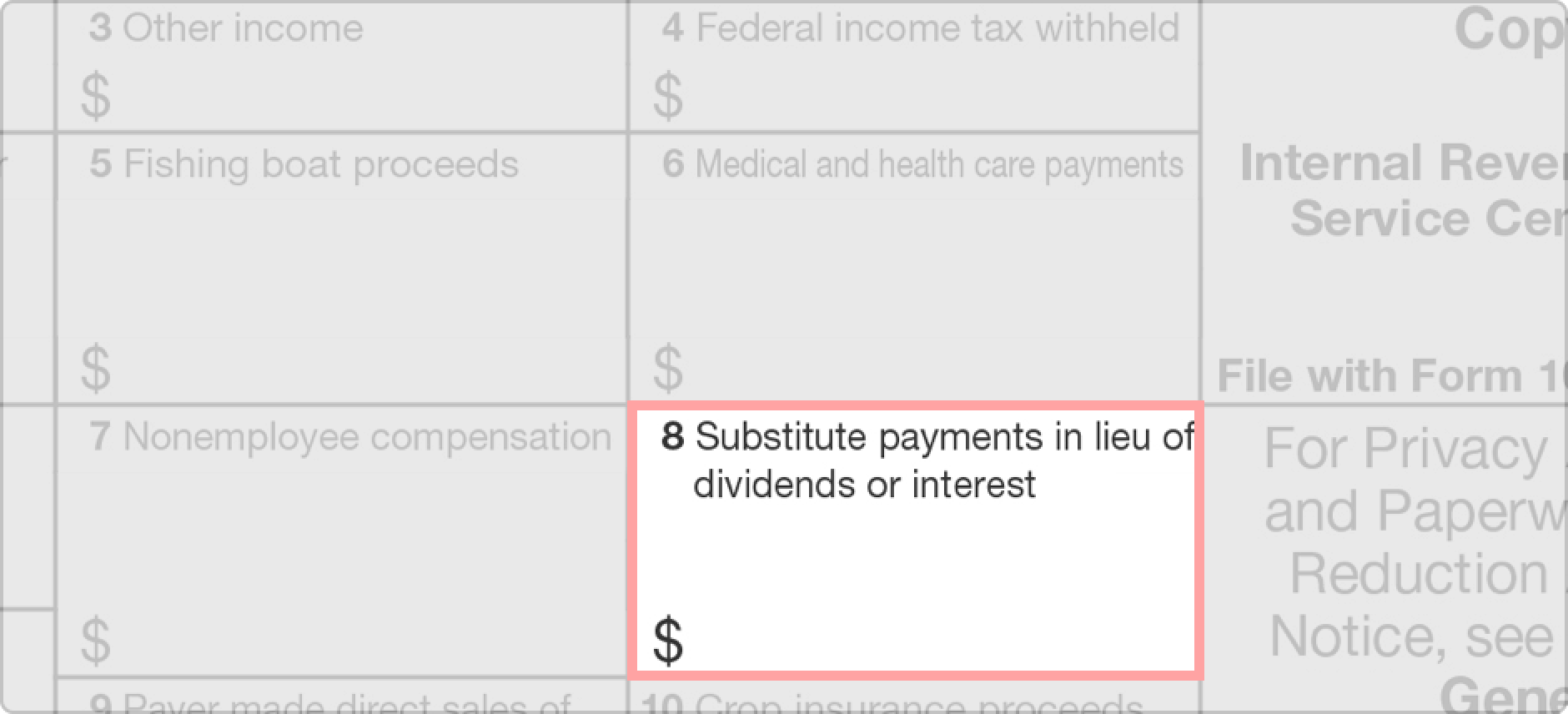

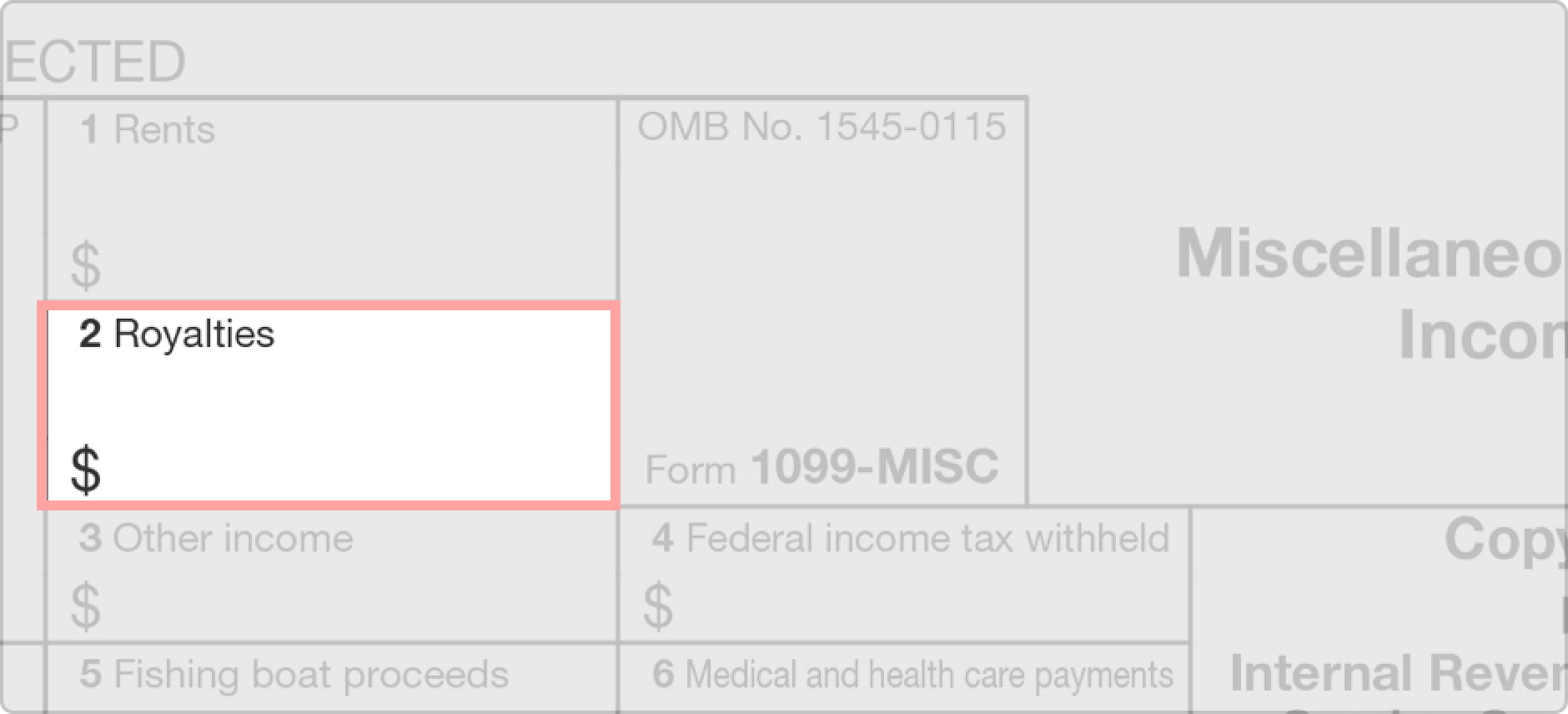

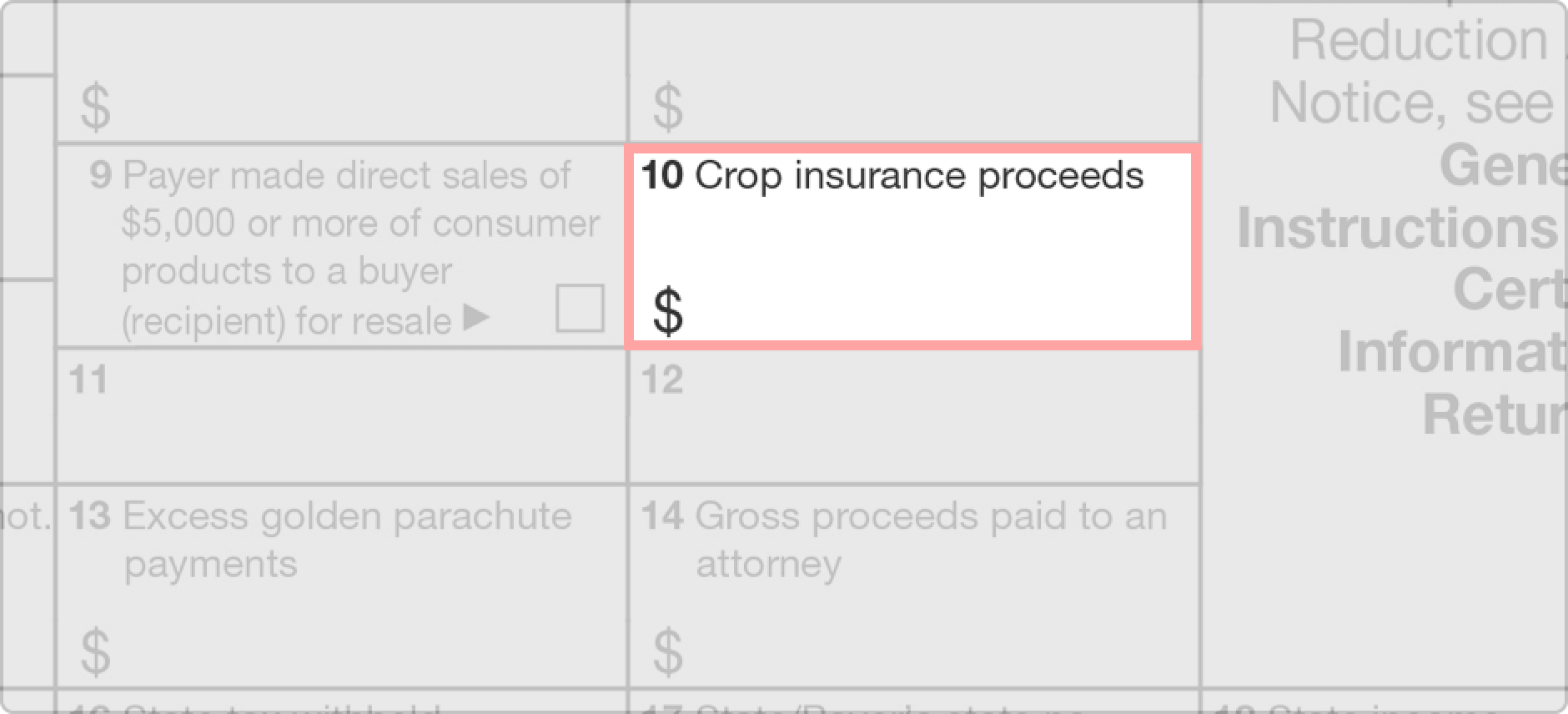

Once youve received your copy of the form youll want to familiarize yourself with the various boxes that must be completed. Instantly send or print your documents. Those who need to send out a 1099 misc can acquire a free fillable form by navigating the website of the irs which is located at wwwirsgov. Employers furnish the form w 2 to the employee and the social security administration.

Generate and download printable forms. Fill generate download or print copies for free. Report payments made in the course of a trade or business to a person whos not an employee. Any amount included in box 12 that is currently taxable is also included in this box.

Distributions from pensions annuities retirement or profit sharing plans iras insurance contracts etc. Create complete and share securely. Free fillable printable 1099 misc form free download irs form 1099 misc 1099 fire irs form 1099 misc and many more programs. When line 35 equals zero the form will not print or transmit with your return.

Overview of fields in a 1099 misc. Create free fillable printable form 1099 misc for 2019. Payers use form 1099 misc miscellaneous income to. This income is also subject to a substantial additional tax to be reported on form 1040 1040 sr or 1040 nr.