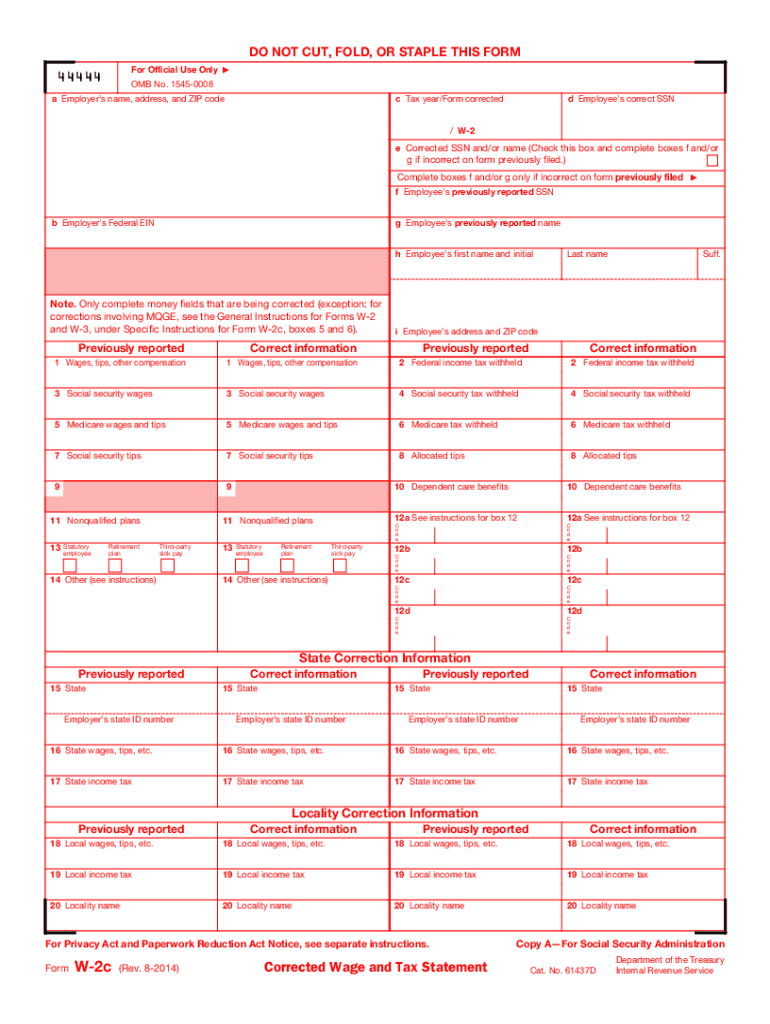

Free Printable 2018 W2

See the penalties section in the current.

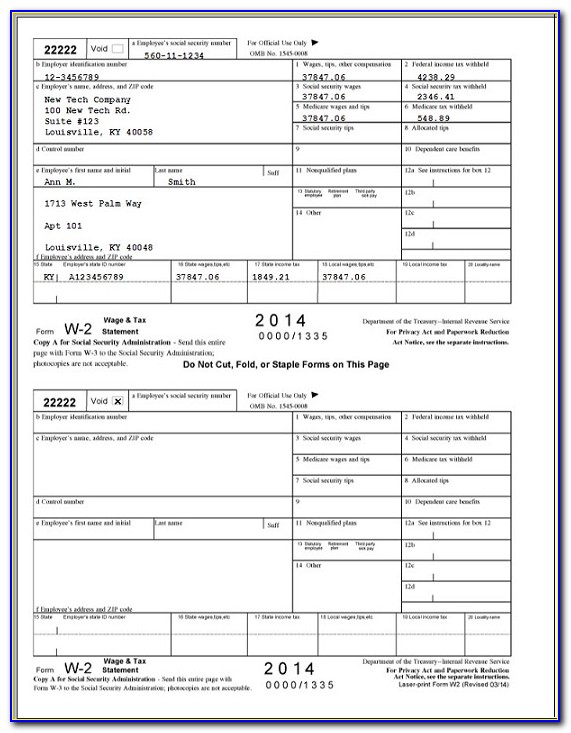

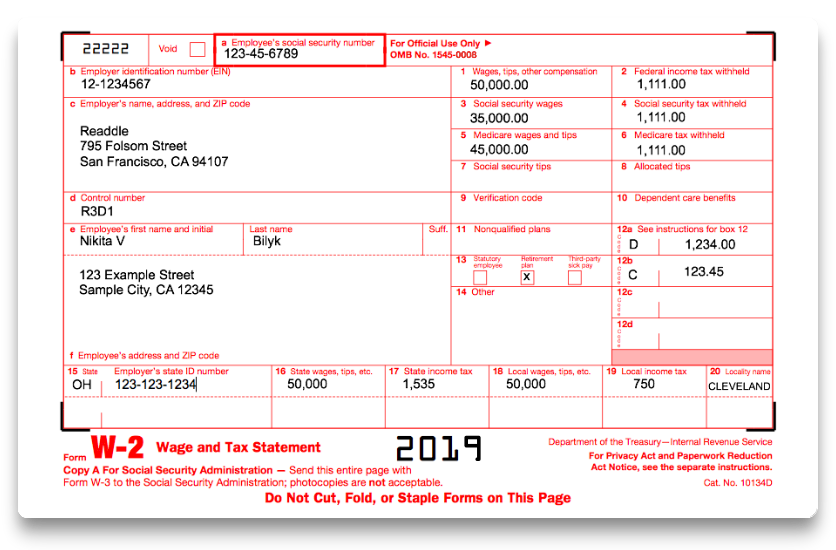

Free printable 2018 w2. W2 form2018 is essential for filing returns of the respective year. Hello my name is mohammad shah freak im a cpa my office is in jackson heights queens new york this video is intended for those who are new to the american tax system and do not have a basic understanding of form w 2 if you have been filing your taxes for few years this video may not be of any help to you every year i come across some taxpayers mostly. It is used as part of the information required to prepare a personal income tax return for employed individualsif anything assuming you are a new employee he. Hence it is required to maintain accuracy while filling the details.

Bureau of internal revenue 6115 estate smith bay suite 225 st. Print and file copy a downloaded from this website with the ssa. Fill generate download or print copies for free. If you are looking for budgetary printable w2 form 2018 use the above template and get your w2 form 2018 ready in minutes in just 699.

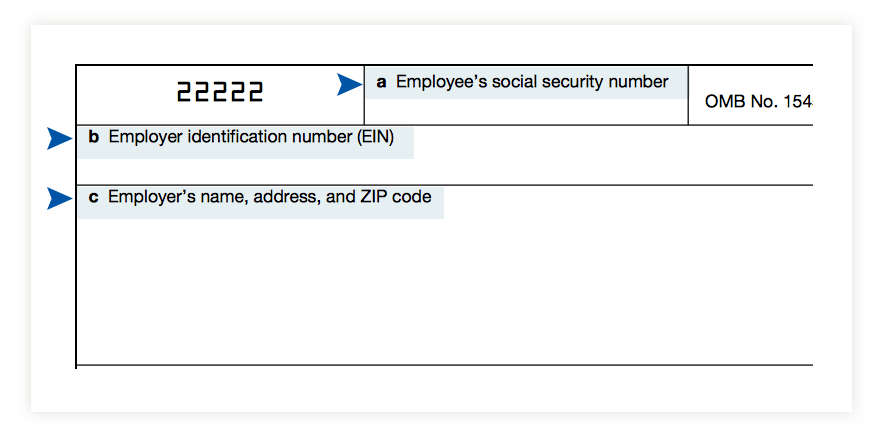

A w 2 form also known as a wage and tax statement is a form that an employer completes and provides to the employee so that they may complete their tax return. Information about form w 2 wage and tax statement including recent updates related forms and instructions on how to file. You may file forms w 2 and w 3 electronically on the ssas employer w 2 filing instructions and information web page which is also accessible. Copy a of this form is.

Wage and tax statement. Form w 2 must contain certain information including wages earned and state federal and other taxes withheld from an employees earnings. You may also print out copies for filing with state or local governments distribution to your employees and for your records. Instructions and help about form w 2 2018.

E file with ssa for 149 per form. Create free fillable printable form w 2 for 2019. 2018 and more than 796080 in social security tax was withheld you can claim a refund of the excess by filing form 1040 with the vi. It is the reflection of the earned wages and tips by your employees.

Department of the treasuryinternal revenue service. Copy bto be filed with employees federal tax return. A w 2 form is issued to all employees at the end of a calendar year which summarizes all of an employees earnings and related income tax deductions made throughout the year. Forms w 2 and w 3 for filing with ssa.