Gilti Calculation Template

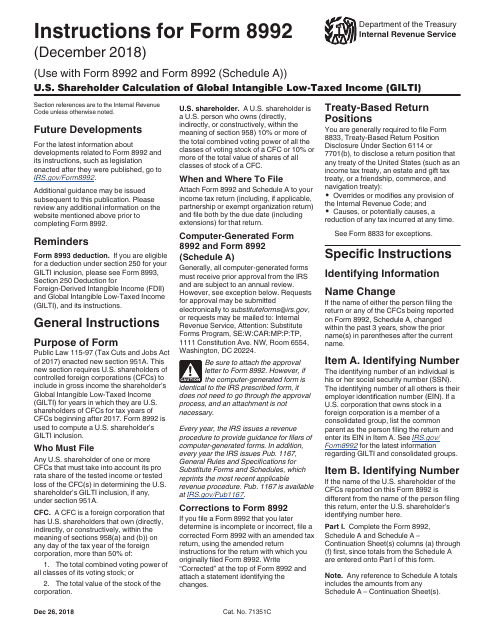

Global intangible low taxed income or gilti provisions can be found in new irc section 951a.

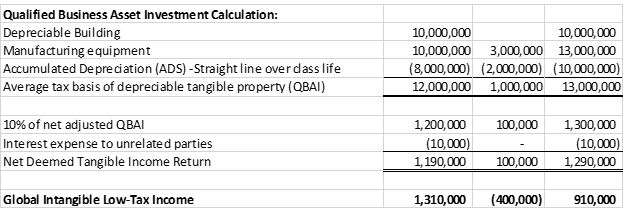

Gilti calculation template. In effect it is a tax on earnings that exceed a 10 percent return on a companys invested foreign assets. Gilti is subject to a worldwide minimum tax of between 105 and 13125 percent on an annual basis. The next difference between the consolidated and entity by entity calculation of gilti is on the calculation of the inclusion percentage. If there is no foreign tax associated with the gilti.

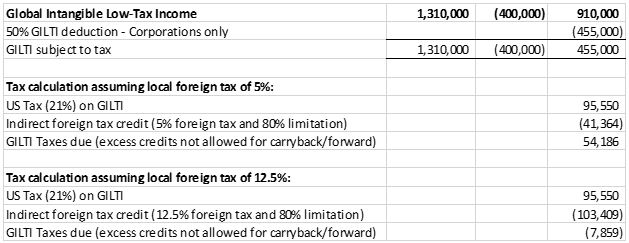

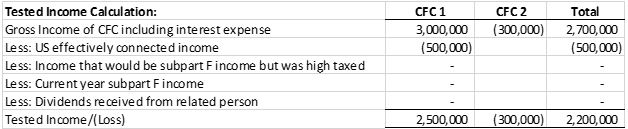

The ftc is calculated by calculating an inclusion percentage gilti divided by total tested income which in this example would be 4136 percent 9100002200000. Each person who is a us shareholder of any controlled foreign corporation cfc must include their share of gilti in gross income for the tax year. Gilti is a provision which aims to discourage this by imposing tax on foreign sourced intangible income. This begs the question of how the current body of regulations will apply to the sec.

Code section 250 governs the calculation of fdii. The inclusion percentage is determined by taking the 951a inclusion over tested income to determine the ftcs deemed paid on gilti. On the other hand fdii is the carrot as it rewards us. Section 250 generally permits a corporate us shareholder a deduction equal to 50 of its gilti inclusion resulting in an effective us federal income tax rate of 105.

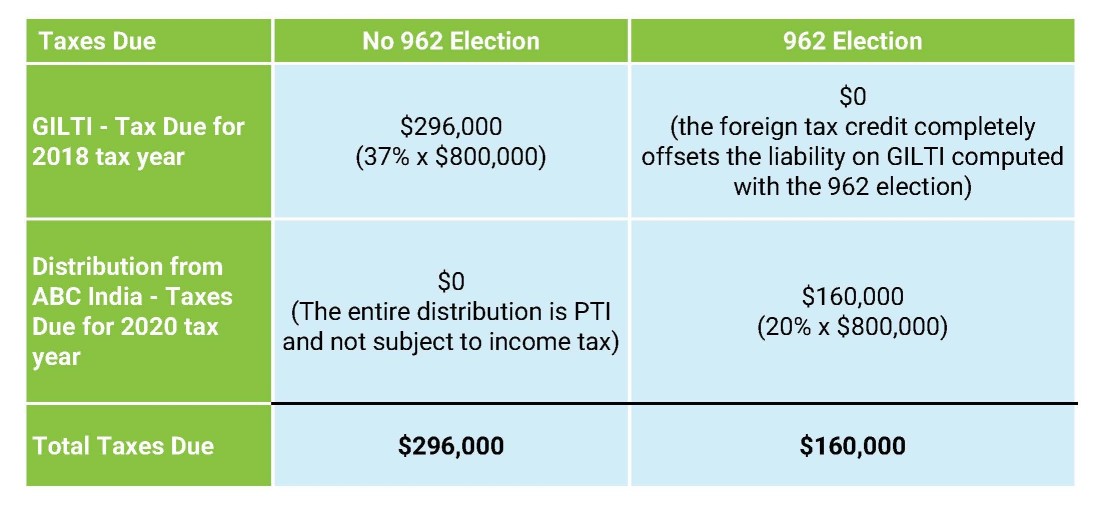

Gilti the deduction is limited to taxable income in the year of inclusion corporate us shareholders are permitted a credit for 80 of the foreign taxes paid with respect to gilti separate ftc basket for gilti foreign taxes section 78 gross up determined without regard to the 80 limitation. Provided that there is positive net gilti after complex expense allocation rules corporations can potentially eliminate us residual tax on gilti if foreign etr on gilti is at least 13125. Companies for keeping their intangibles and operations in the united states. Structure and purpose of gilti.

Corporate taxpayer with profitable foreign subsidiaries will be required to do a gilti calculation annually demanding a foreign tax credit limitation calculation and interest expense allocation. Gilti is a newly defined category of foreign income added to corporate taxable income each year. A deemed deduction of 50 is applied to gilti. A complimentary calculator from our international tax that will help you begin to make a determination if you can avoid or need to comply with global intangible low taxed income gilti requirements freed maxick.

Gilti is referred to as the stick as it has a punitive effect on companies who have moved their intangibles and some of their operations offshore.