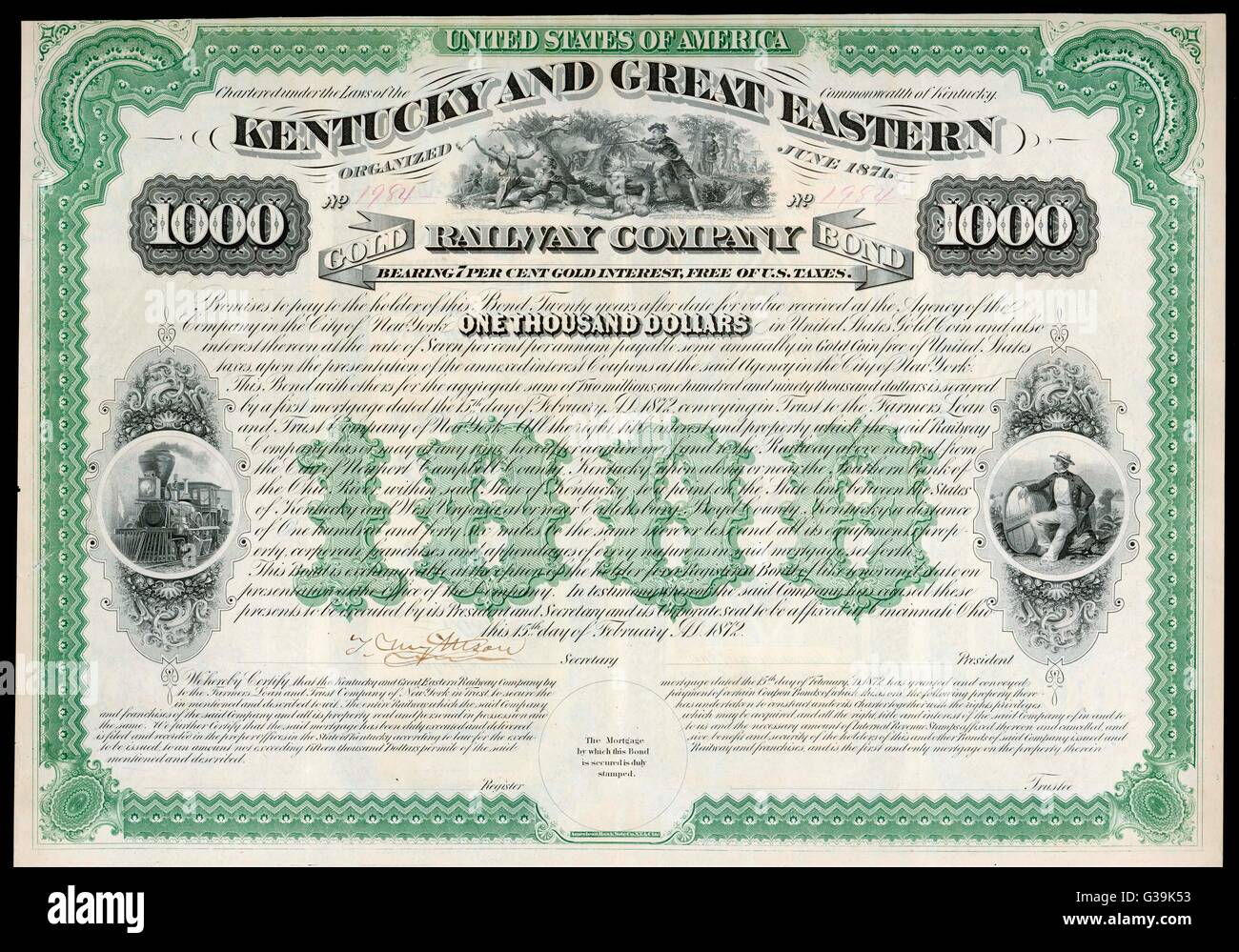

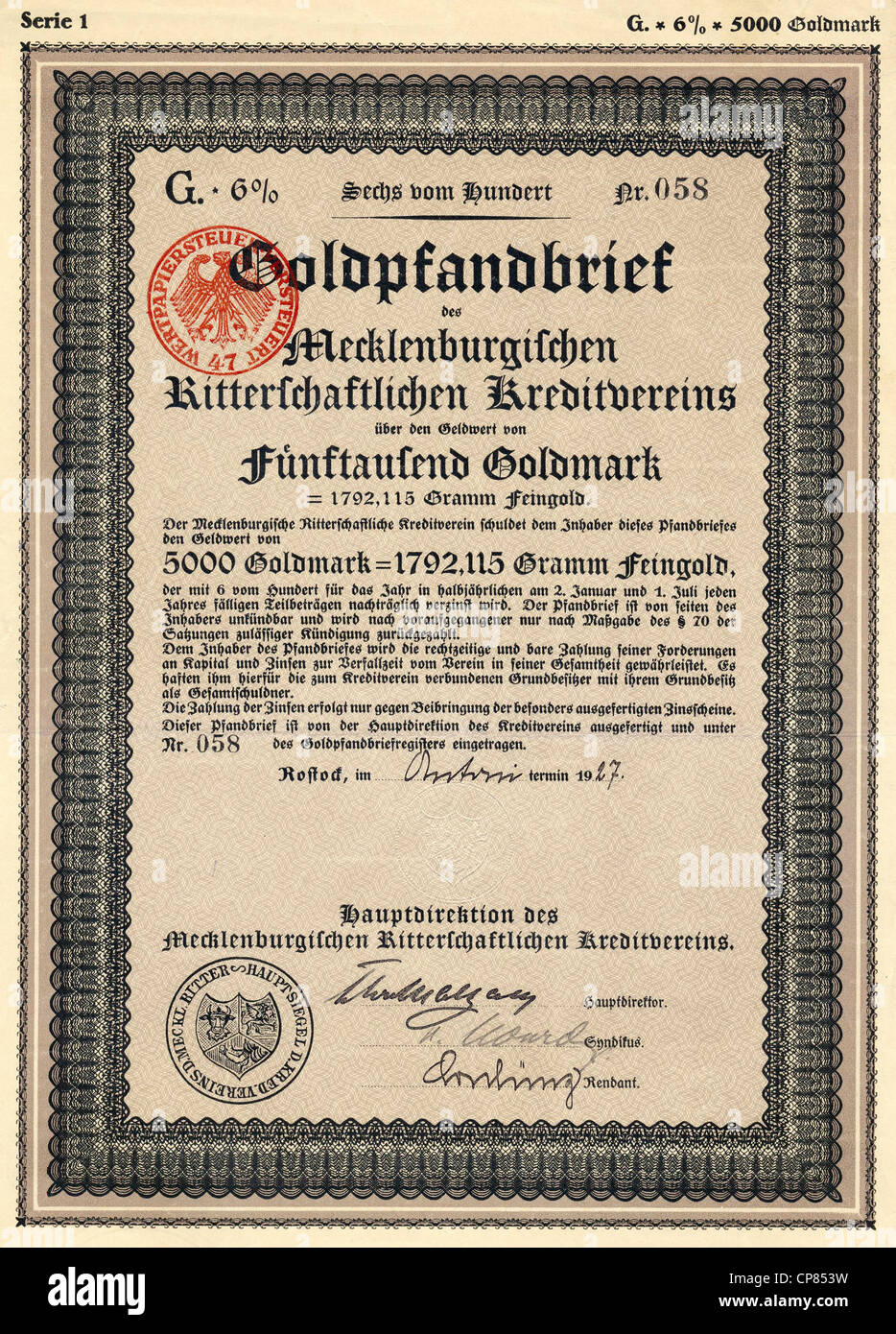

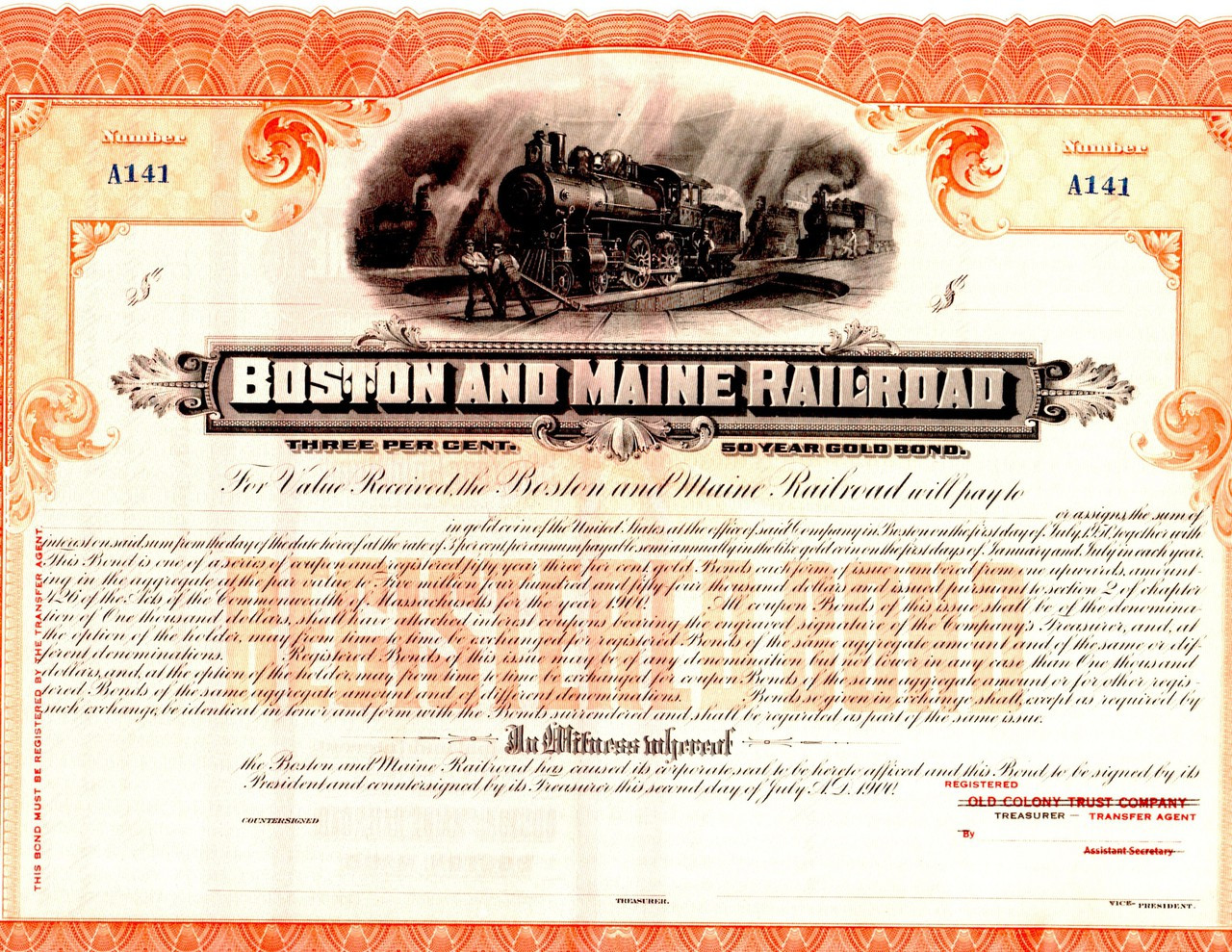

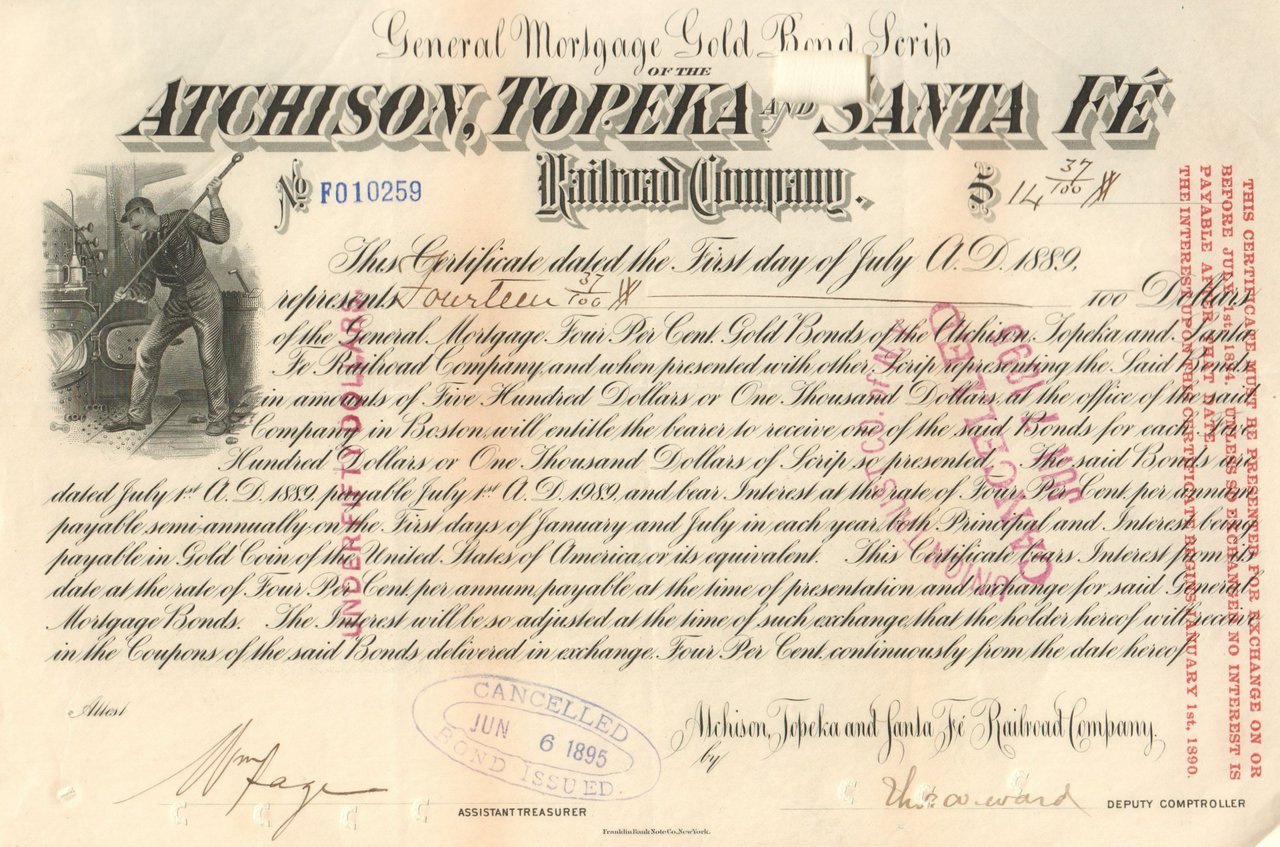

Gold Bond Certificate

Under the scheme the issues are made open for subscription in tranches by rbi in consultation with goi.

Gold bond certificate. Sir madam rbi mumbai has given final certificates of holding bonds after settlement on 17112016 for successfully accepted applications in ekuber portal for sovereign gold bond tranche 6. Instead of buying physical gold investors can invest in gold in a paper form through sovereign gold bond scheme. The subscription for sgb will be open as per following calendar. Sovereign gold bond scheme was launched by govt in november 2015 under gold monetisation scheme.

The under lying asset for these bonds is gold. Two a much improved search well at least we think so but you be the judge. However any certificates still in private hands remain legal tender and you can redeem them for face value. Sovereign gold bond sgb investing in gold is much more easy and convenient now.

Investors have a strong attachment to certificates. Somehow there is a feeling that an intricate and expensively produced piece of paper is necessarily an indication of underlying value. How to redeem old us. You do not require physical lockers to store it.

Sovereign gold bond offers 275 half yearly compounded interest which you receive in your bank account. A gold certificate in general is a certificate of ownership that gold owners hold instead of storing the actual gold. Rbi notifies the terms and conditions for the scheme from time to time. Of india so its also the safest way to hold gold.

April 14 2015 dear all welcome to the refurbished site of the reserve bank of india. The two most important features of the site are. Bonds are issued by govt. Instructions for downloading rbi sovereign gold bonds.

Treasury began pulling all gold certificates from circulation in the 1930s and the vast majority have been destroyed. One in addition to the default site the refurbished site also has all the information bifurcated functionwise. Sovereign gold bonds a smarter way to buy gold. It has both a historic meaning as a us.

These bonds will track the price of gold plus an extra interest earning on top of that. With the government of indias sovereign gold bonds scheme you can earn an assured interest rate eliminating risk and cost of storage. The owner of the gold certificate gets to save money on gold trading delivery storage and insurance costs. Sovereign gold bond scheme is an indirect way of investing in gold.

Banks may issue gold certificates for gold that is allocated non fungible or unallocated fungible or. You are holding bond in demat form so you will be getting your interest in the bank which is linked with your demat account.