House Flipping Partnership Agreement Template

Taking on a partner with different but complementary skills can help ease the workload avoid knowledge gaps and lead to a smoother project overall.

House flipping partnership agreement template. It seems like this set. Our first joint venture real estate deal was the very first property dave and i bought together in 2001. The way you work your first house flip deal will most likely be very different from how you work your second house flip deal and so on. I had excellent credit 16000 in savings and zero debt.

Here are some tips and benefits on entering a house flip partnership agreement. Disclaimer i am not an attorney tax or financial advisor and this is not and should not be construed as legal tax or financial advise. The parties hereby create a real estate joint venture agreement pursuant to the laws of the state of. Contracts agreements lease option agreement promissorynote mh5 wholesalerealestateassignmentcontract1 independent contractor agreement sow mobile home sales contract fannie mae addendum general partnership agreement2 letter of intent to buy apartments commercial earnest money contract sample pet lease addendum finders fee agreement disclosure document occupancyandmoveoutagreement.

Consult a professional for advice whew feels better now that thats out there. Said joint venture in any real estate purchased by the parties shall be defined solely by this agreement regardless of the manner in which title to property may be taken. Partnerships and flipping houses. One thing that youll notice right away in this business is that every deal is different.

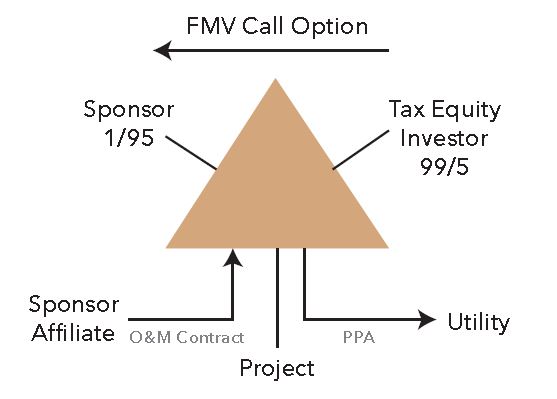

A proper business plan will tell you how much money you should have on hand and it will help you determine how money will flow in and out of the project. How to structure a joint venture real estate deal by. We were dating at the time and pooled our resources to do the first two deals. When are you purchasing and rehabilitating ie flipping residential properties with a business partner you typically are doing business either within a limited liability company llc or a for profit corporation which has made an s election with the irs.