How To Keep Up With Receipts For Your Business

This point cannot be overstated.

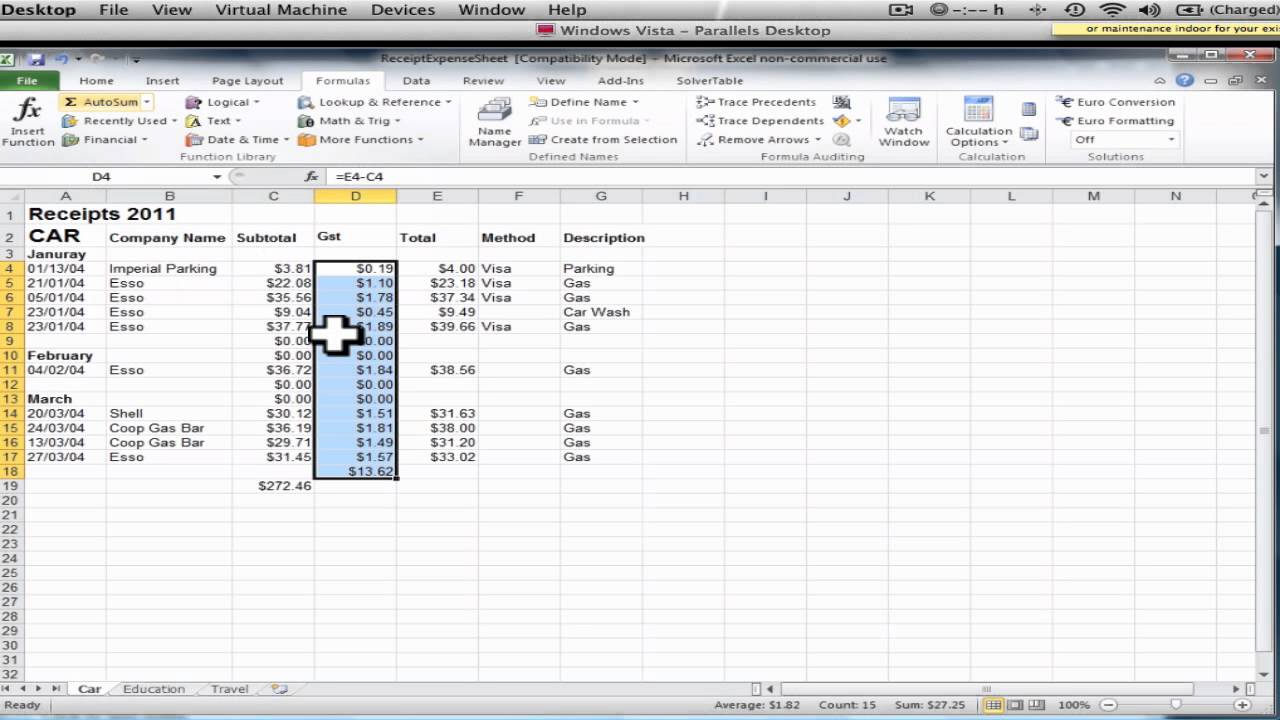

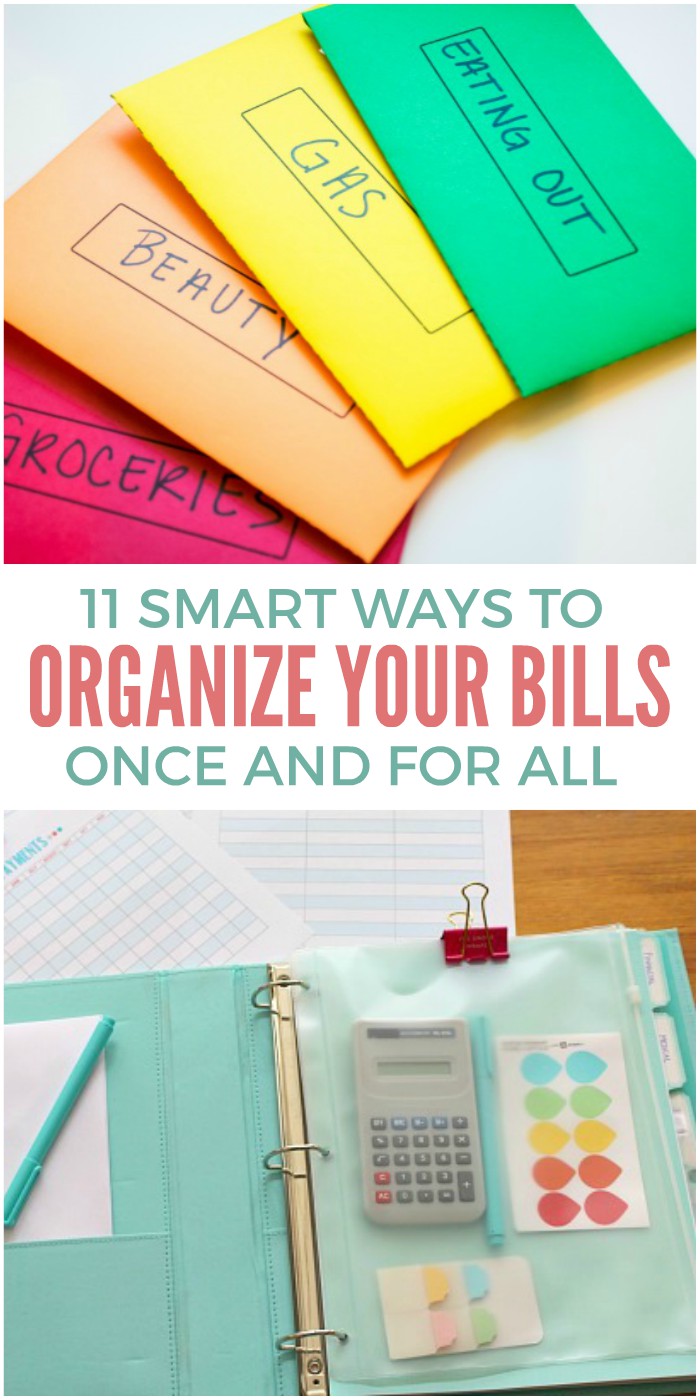

How to keep up with receipts for your business. Neat lets you use your phone to scan in receipts or mail in paper copies using their magic envelopes they use their scanning technology to grab information from your receipts and catalog them in their software. The best way to keep your receipts and expenses is to check in regularly. Including guidelines on how long to keep various types of receipts before tossing a declutter365 mission on home storage solutions 101 see more. The irs is not a big fan of estimating your expenses.

In conclusion the key to organizing receipts for your small business is to make sure theres an easily manageable workflow for the software tools youre using or your filing cabinet. Most supporting documents need to be kept for at least three years. If you are going to claim a deduction youre going to need. Receipts by wave is a great receipt tracking app for small business owners and freelancers who need to keep up with receipts invoices and bills.

That means youll avoid sitting down to do your taxes during tax season and realizing you need to track down months old documentation. The date of the transaction. When first starting a business you might want to keep receipts gathered in order to deduct business expenses on your income tax and more. It keeps you organized keeps you on budget and can be a big money saver when you file deductions at tax time.

If you set a strong foundation from the start and adopt strong organization habits youll find that keeping your receipts organized is a breeze. Employment tax records must be kept for at least four years. The irs allows taxpayers to scan receipts and store them electronically. Rather than stuffing all of your business receipts into a desk drawer a better system is required for when its time to do bookkeeping.

Buy color coded folders to store your receipts and documentation so you can easily find the documentation you need later. Keeping track of receipts for your small business is very important. There are so many different ways to keep your receipts and paperwork organized for your small business but neat is the 1 top tool that i love recommending to my clients. How to organize your receipts the easy way with google drive the dough roller.

Yes the irs can come knocking for documentation and audit you up to six years back in some cases. The app does require you to also use waves free accounting software which provides additional functionality for expense tracking and report creation. However hoping that the ink on your home depot receipt hasnt faded away is a whole other issue. Developing a systematic process of filing receipts can save you a lot of time and money if youre audited.

The eight small business record keeping rules. Always keep receipts bank statements invoices payroll records and any other documentary evidence that supports an item of income deduction or credit shown on your tax return.