How To Make Receipts For Taxes

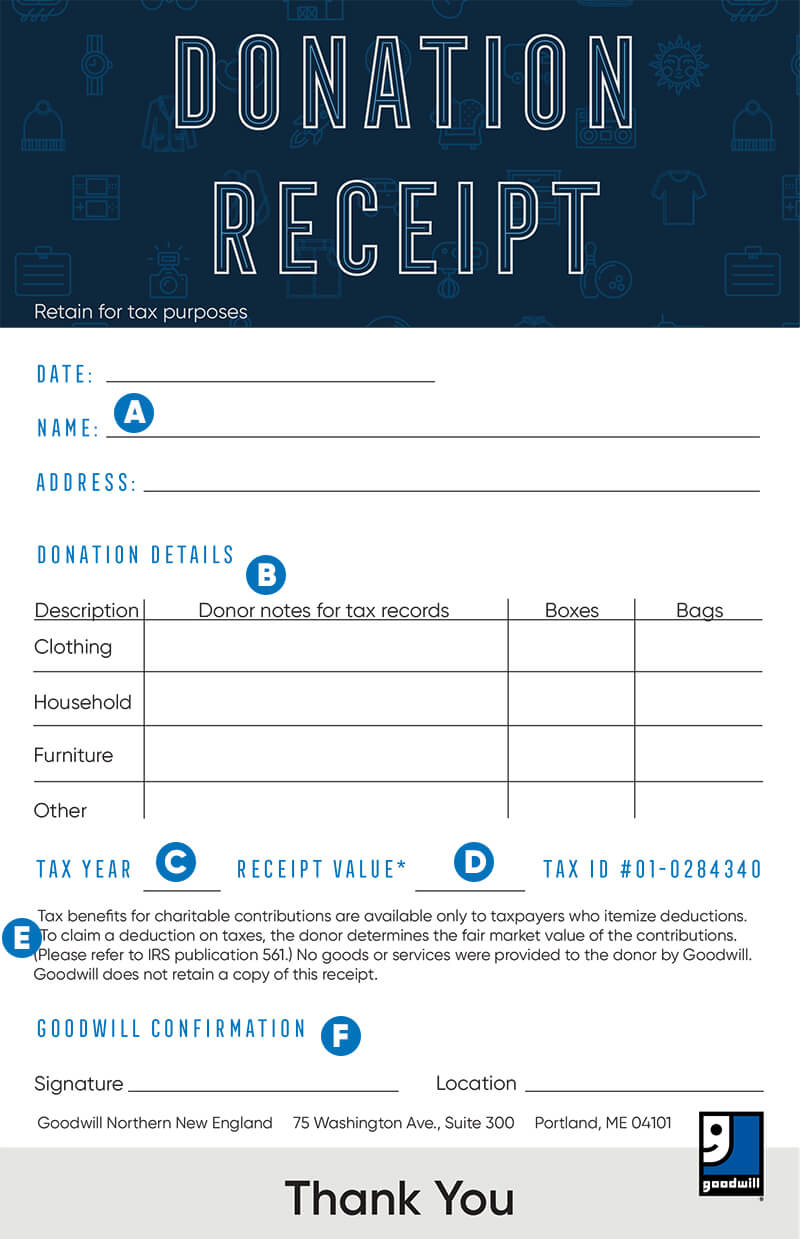

This includes both receipts for every individual donation and consolidated receipts of the entire year of donations.

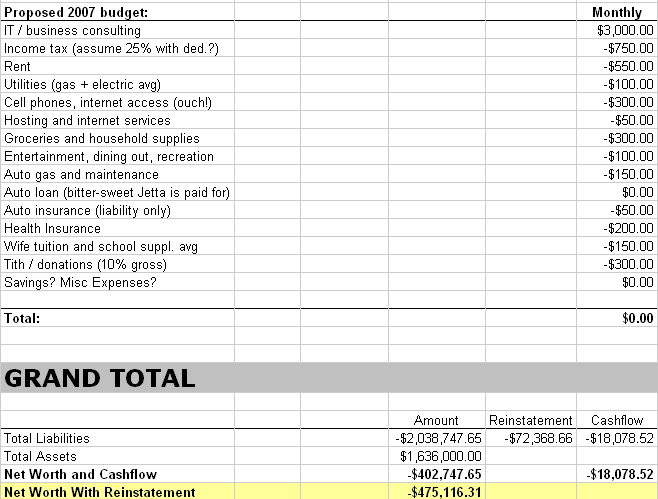

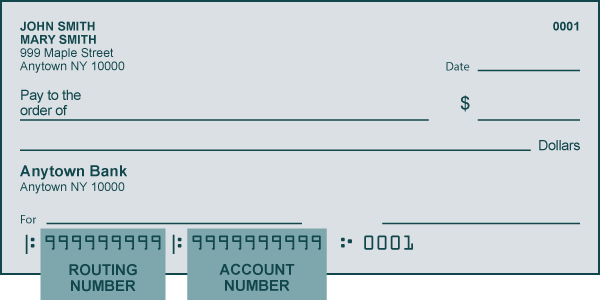

How to make receipts for taxes. Which receipts should i keep for taxes. Always keep receipts bank statements invoices payroll records and any other documentary evidence that supports an item of income deduction or credit shown on your tax return. After your first three invoices and receipts there is a flat monthly fee of 299 usd that allows you to generate unlimited invoices and unlimited receipts. The eight small business record keeping rules.

Make a notation at the top for the total amount you received and return a copy to the parent. How to get the biggest tax refund this year take advantage of these often missed tax deductions and credits to get more money back in your pocket. Follow these tips to organizing receipts and expenses to make taxes easy. It can minimize the effort and time vested on other resources and thus making the system cost effective.

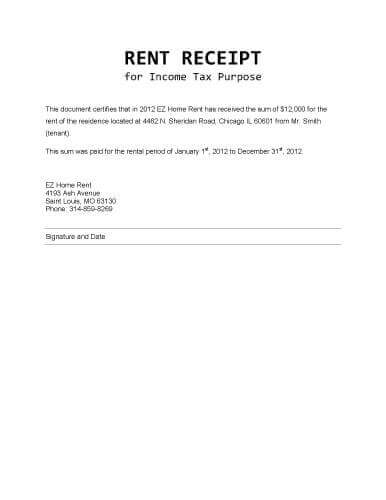

Excel comes with such features that make is possible to customize a worksheet and transform it in a working receipt template. Review which receipts to keep for taxes it will make tax preparation less painful and ensure you take all of your eligible deductions. Tracking your expenses could help you save money at tax time. For self employed individuals it is often helpful to save receipts from every purchase you make that is related to your business and to keep track of all of your utility bills rent and mortgage information for consideration at tax time.

What receipts should you keep for taxes. If receipts give you a headache consider seeking the help of a tax professional. If youd like your receipt to include taxes on top of your prices use the settings pane on the right to enable taxes. 43 receipt templates in word.

Tax receipt template 6 free word excel. Technically parents are supposed to provide you with form w 10s at the end of the tax year. Organizations using donorbox our powerful and effective donation software can very easily generate 501c3 compliant tax receipts. But its essential that you keep receipts and documentation to back up each expense and justify your deductions if necessary.

Employment tax records must be kept for at least four years. Parents are not required to file these forms with their tax returns however so many parents will neglect to do this. How do i charge taxes using the receipt maker.

/cdn.vox-cdn.com/uploads/chorus_image/image/63595807/1040_tax_form_2018_e1544136924598.0.jpg)