How To Organize Business Receipts

A better system is required for when its time to do bookkeeping rather than stuffing all of your business receipts into a desk drawer.

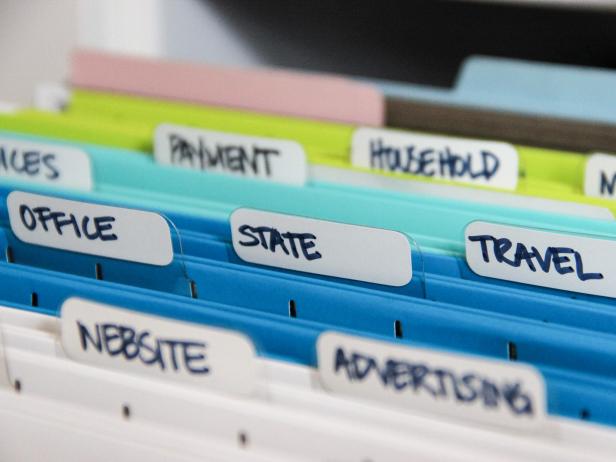

How to organize business receipts. Scan receipts and keep them at least six years. On to the fun part the organizing. Instead follow these tips to keep your receipts organized so theyre ready at tax time. Manual organizer this pertains to the manual filing of business receipts into folders in filing cabinets.

Some businesses wait to organize receipts at the end of the month. Set up a filing system for your business receipts. Yes the irs can come knocking for documentation and audit you up to six years back in some cases. There are many benefits that come along with organizing receipts in the cloud.

Im not perfect or obsessive about organizing but i can confidently say that if you were to stop by my house unexpectedly it would look pretty close to the photos you see here on the blog maybe without the fresh flowers all the time or the bed made on days when we leave for work extra early. How to organize receipts steps on a note pad make a list of categories and subcategories for your receipts. When you go paperless theres little risk of receipts getting lost fading or getting damaged. Use a divided accordion file or other storage system to separate receipts into categories such as payroll vehicle expenses materials purchases or shipping.

Of course discovering a disorganized mass of receipts can create a mess of trouble. How to organize business receipts and paperwork receipts. 6 simple ways to finally organize receipts real talk. When i do my bookkeeping for the month i print off all my bank credit card.

The irs allows taxpayers to scan receipts and store them electronically. Start at the top of your unsorted pile of receipts and handle each only once. The best way to organize receipts for your business is to find the solution that works for you. Set up new files and folders for the new year.

This may be effective but some receipts fade with time making it impossible to make out any detail. Organize from the get go. Stay organized throughout the year. However hoping that the ink on your home depot receipt hasnt faded away is a whole other issue.

Copies of invoices are not commonly thought of as important tax documents to save. Purchase inexpensive file folders for each main category. Im a pretty organized person. As you sort through the receipts look at the date.

The process of sorting out business and personal expenses can be confusing but especially so if you dont have the right system in place. Indicate which year the receipts are from eg 2019 business receipts. An entity has two options in order to organize a company or an individuals business receipts similar to the receipt formats shown on the printable receipt templates. When first starting a business you might want to keep receipts gathered to deduct business expenses on your income tax and more.