How To Record Receipts In Accounting

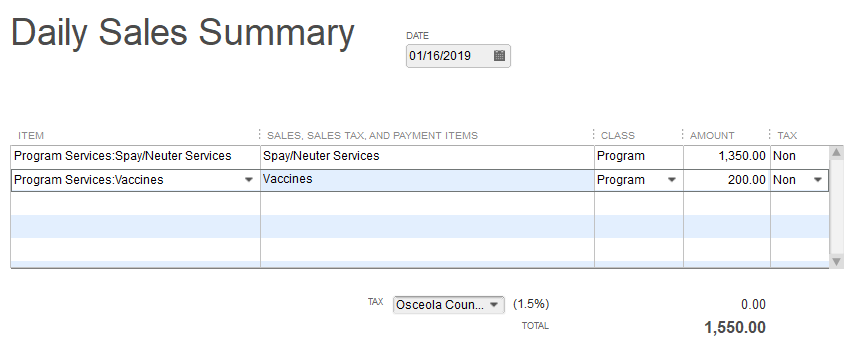

Cash receipts follow the sale and represent payments made by customers.

How to record receipts in accounting. Today we will discuss the cash receipts journal in this brief video. Recording payment in accounting can otherwise be referred to as accounts payable which means the total amount a given company owes to companies or suppliers for products or services. In this video of my xero accounting series i show you how to record invoices as paid and also how to record bank payments and receipts. Cash transactions also include transactions made through cheques.

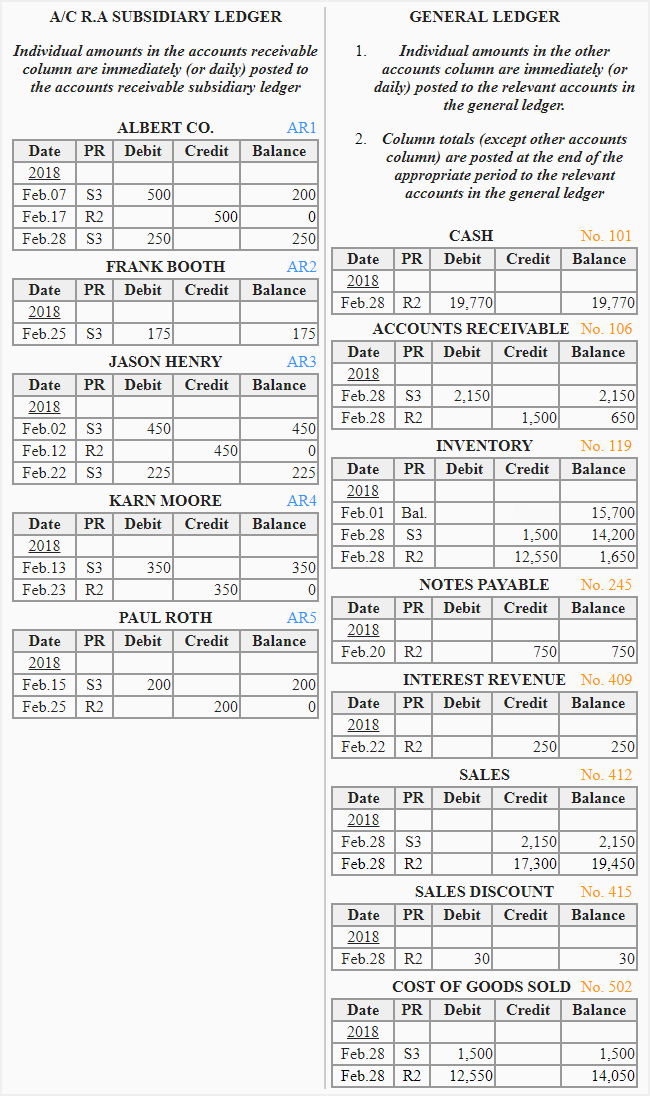

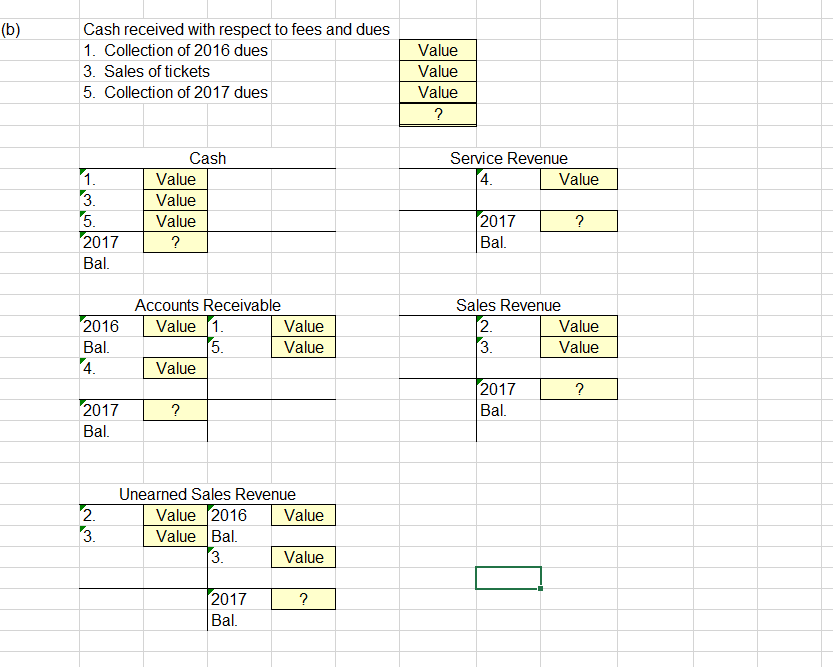

Cash receipts are accounted for by debiting cash bank ledger to recognize the increase in the asset. Create a bookkeeping spreadsheet using microsoft excel http. The purpose of storing purchase invoices in this way is to document expenses and profits and record any changes in your materials. For making entries in a cash receipts journal the receipt.

Your cash receipts procedure should look something like this. Furthermore the accounts payable balance is reflected in the balance sheet specifically on the current liabilities section. Were always exploring how we can simplify the complex issues our small business clients face and help them achieve their goals. In other words this journal is used to record all cash coming into the business.

The business needs sales to bring in money build profits and fund future growth. To keep your books accurate you need to have a cash receipts procedure in place. The information will flow automatically into your wave account. Companies also receive cash payments for purchase returns.

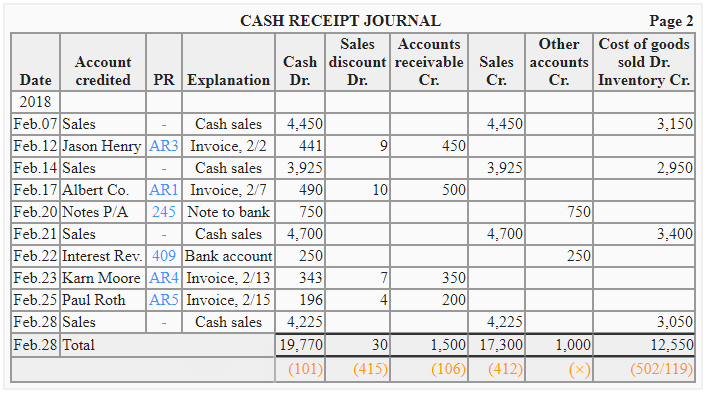

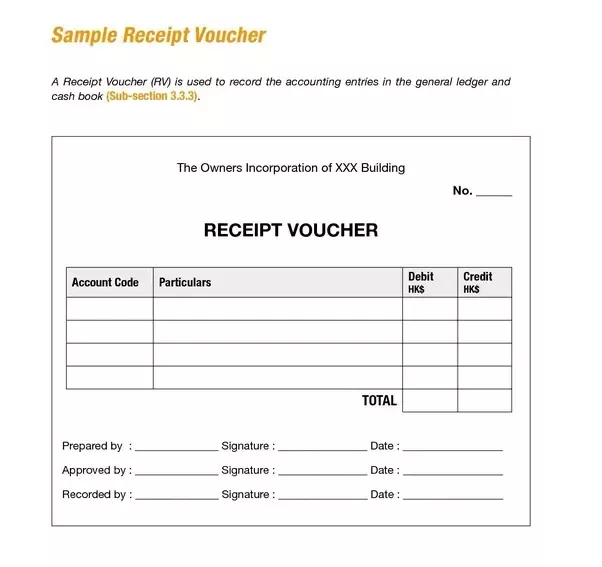

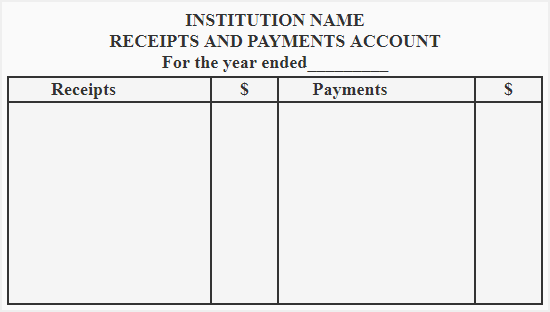

A receipt is an umbrella term for different kinds of source documents or electronic references that record transactions including invoices purchase invoices note payables credit card slips and salary rosters. Cash transactions may be classified into cash receipts and cash payments. The cash receipts journal is a special journal used to record the receipt of cash by a business. The journal is simply a chronological listing of all receipts including both cash and checks and is used to save time avoid cluttering the general ledger with too much detail and to allow for segregation of duties.

Your cash receipts process will help you organize your total cash receipts avoid accounting errors and ensure you record transactions correctly. The first step is the receipt. The cash receipts journal manages all cash inflows of a business organization. The accounting staff record the sales and cash.

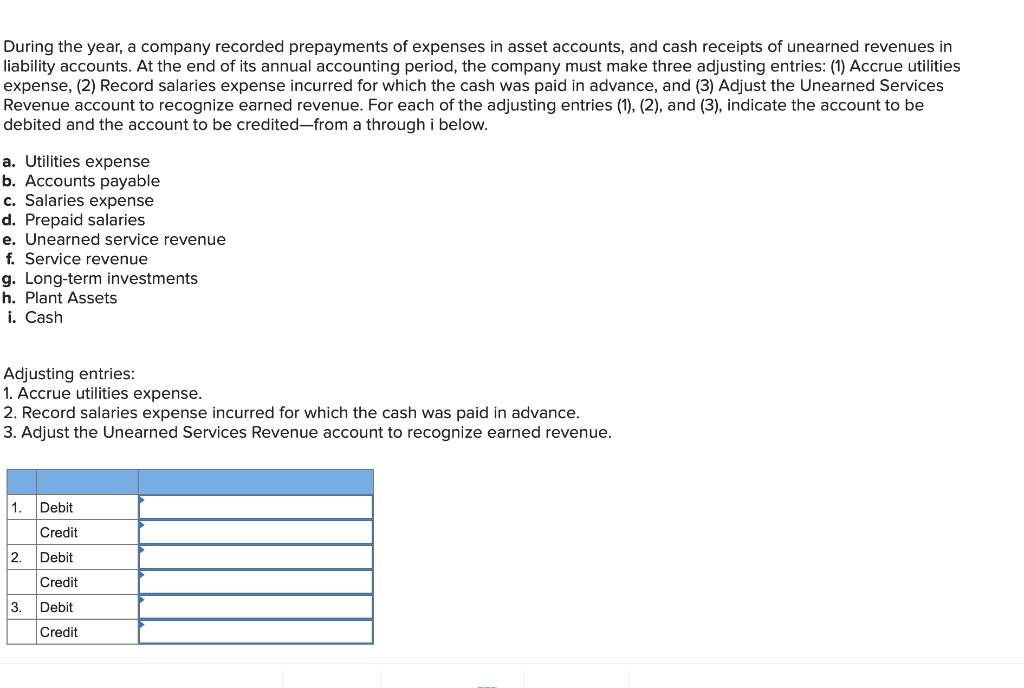

Following are common types of cash receipt transactions along with relevant accounting. Recording transactions into a cash payments journal.