How To Use Receipts For Taxes

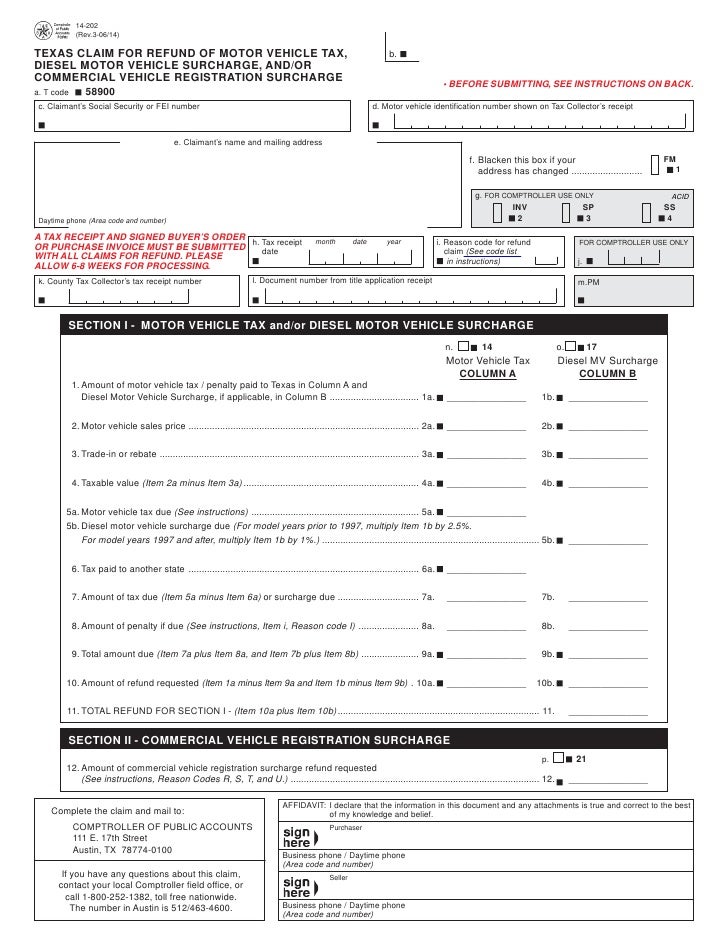

Employment tax records must be kept for at least four years.

How to use receipts for taxes. Veryfi takes privacy a step beyond other receipt tracking apps with its hipaa and gdpr data privacy compliance. For tax years prior to 2018 the irs allows you to deduct unreimbursed work expenses including the cost of tools equipment supplies required uniforms that are unsuitable for. A new client is an individual who did not use hr block office services to prepare his or her 2016 tax return. Turbotax is the 1 rated easiest to use and the tax software with the best advice and options.

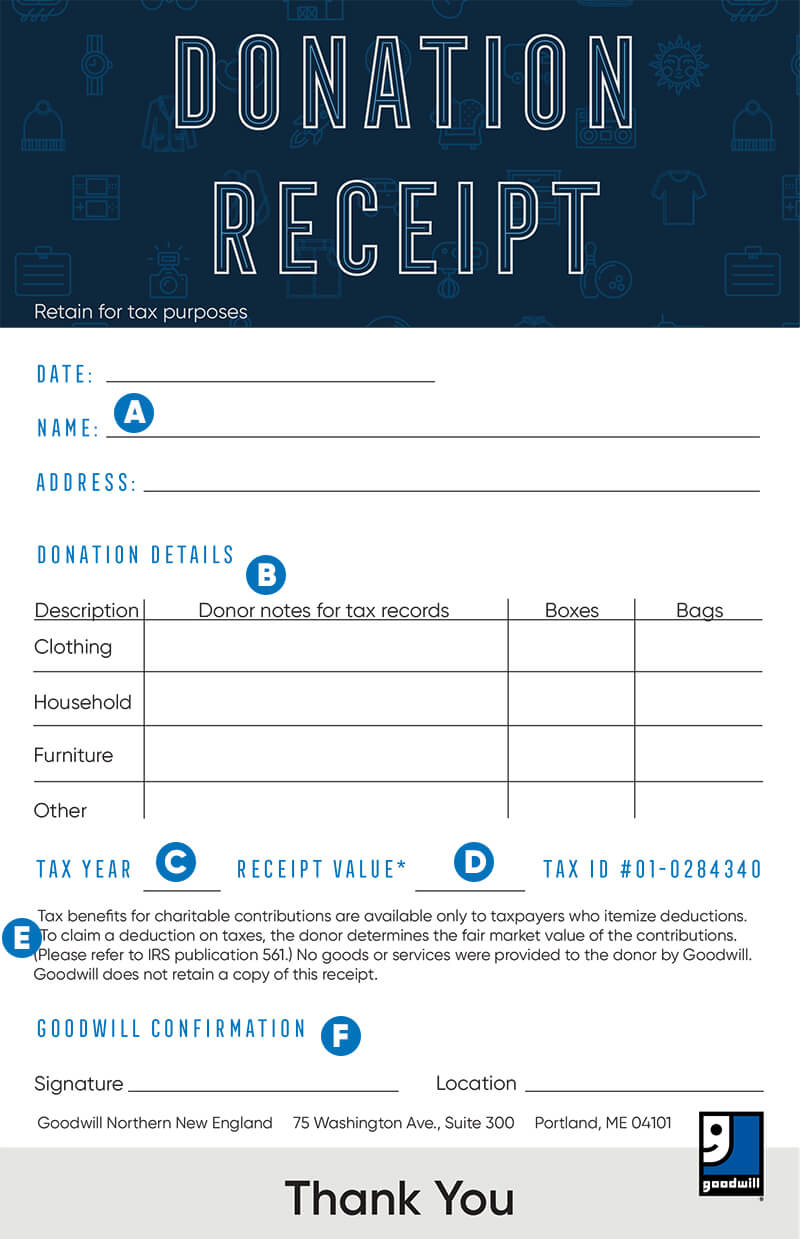

Ideally you should keep receipts for any tax deductible expenses that come up during the year and try to get copies of any receipts you never received or have misplaced. Most supporting documents need to be kept for at least three years. Tax and credit data accessed upon your consent. Valid receipt for 2016 tax preparation fees from a tax preparer other than hr block must be presented prior to completion of initial tax office interview.

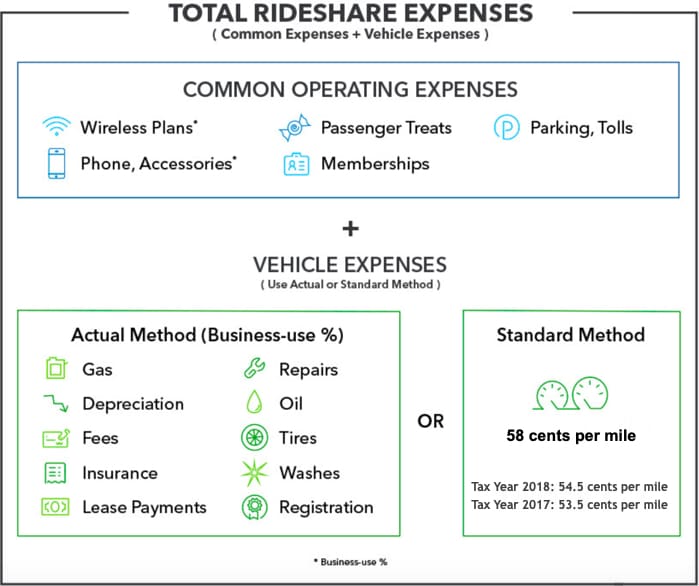

Keep your receipts organized so theyre easier to access for tax time. Tax receipts to keep. 1 actual expenses this is where you take the actual expenses gasinsurance repairsmaintenance interest and depreciation. Always keep receipts bank statements invoices payroll records and any other documentary evidence that supports an item of income deduction or credit shown on your tax return.

Eliminate manual entry of your receipts by using veryfi to scan receipts whether your device is online or offline. Take advantage of these 16 commonly missed tax deductions. Which receipts should i keep for taxes. The app processes receipts in under 10 minutes.

Get tips from turbo based on your tax and credit data to help get you to where you want to be. There are two options the irs gives people when it comes to car and mileage deductions. Business owners and sole proprietors arent the only ones who should be keeping receipts for taxes. Offer valid for tax preparation fees for new clients only.

The eight small business record keeping rules. If you itemize deductions and you know you have to pay for work related expenses you should start saving those receipts.