Idaho Resale Certificate

There are currently three ways to request a resale certificate from the idaho state tax commission.

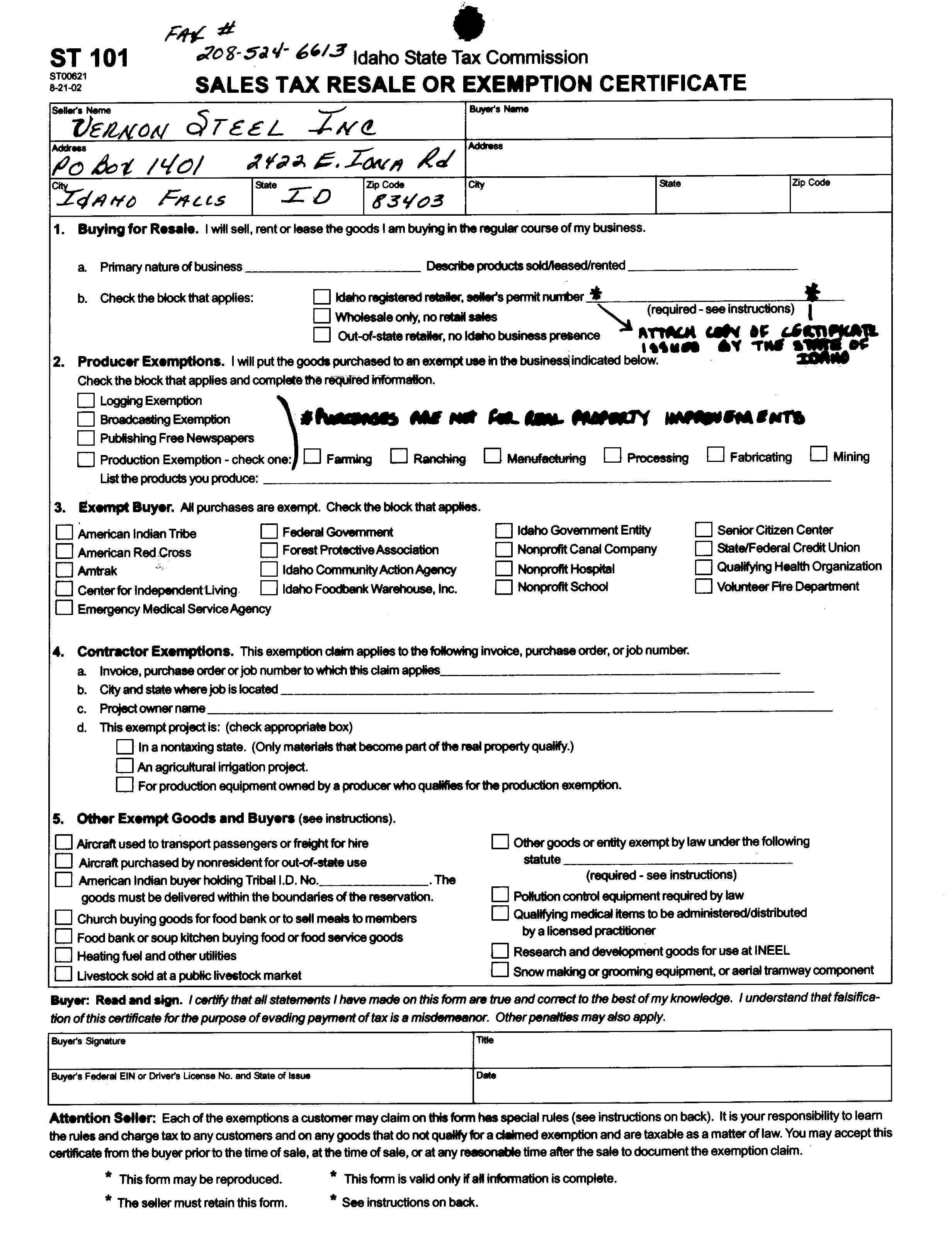

Idaho resale certificate. E911 fee permit number 5. Does an idaho resale certificate expire. The resale certificate is kept on file by the seller and is not filed with the state. If you buy goods for resale from a seller doing business in idaho you must give the seller a completed form st 101 sales tax resale or exemption certificatethe seller should keep this form on file and not charge tax on your future qualifying purchases.

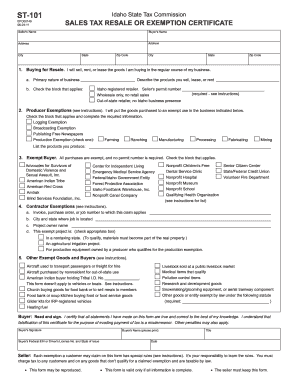

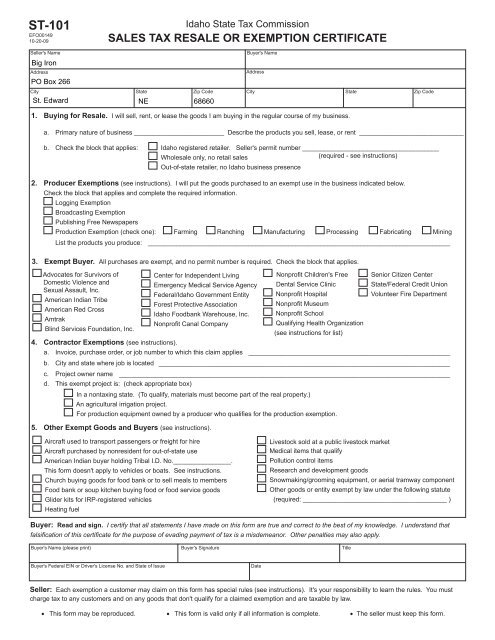

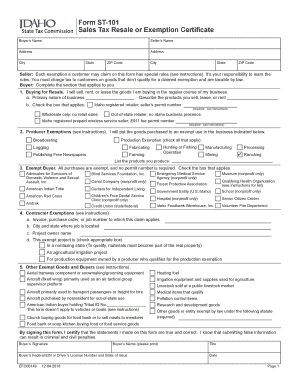

Purchases by retailers buying goods for resale resaleexemption certificates st 101. This page explains how to make tax free purchases in idaho and lists one idaho sales tax exemption forms available for download. Each exemption a customer may claim on this form has special rules see instructions. Sales tax resale and exemption certificate document title.

Idaho resale certificate info for resellers. Form st 101 sales tax resale or exemption certificate buyers name sellers name address address city state zip code city state zip code seller. Other exempt goods and buyers see instructions. This post will go over the requirements for using a resale certificate as well as accepting one.

Its your responsibility to learn the. In some cases sellers must keep a copy of the documents the buyer provides. No idaho business presence idaho registered prepaid wireless service seller. Read the form st 101 instructions.

St 101 idaho state tax commission sales tax resale or exemption certificate efo00149 10 20 09 sellers name buyers name address address city state zip code city state zip code 1. Idaho state tax commission sales tax resale or exemption certificate st 101 efo00149 06 10 14 required see instructions buyer. If you are a retailer making purchases for resale or need to make a purchase that is exempt from the idaho sales tax you need the appropriate idaho sales tax exemption certificate before you can begin making tax free purchases.