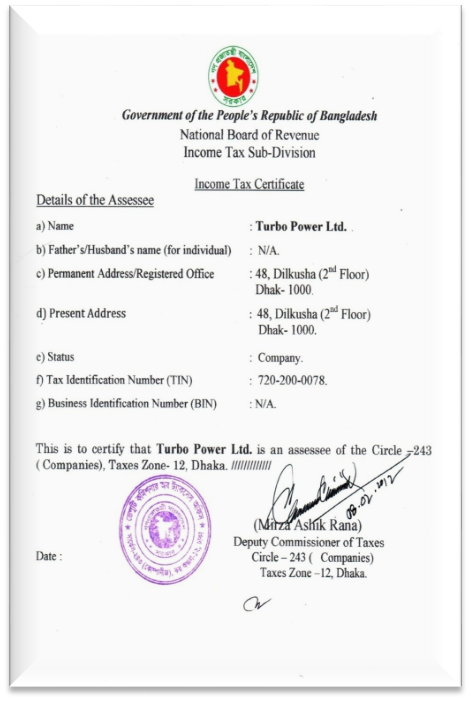

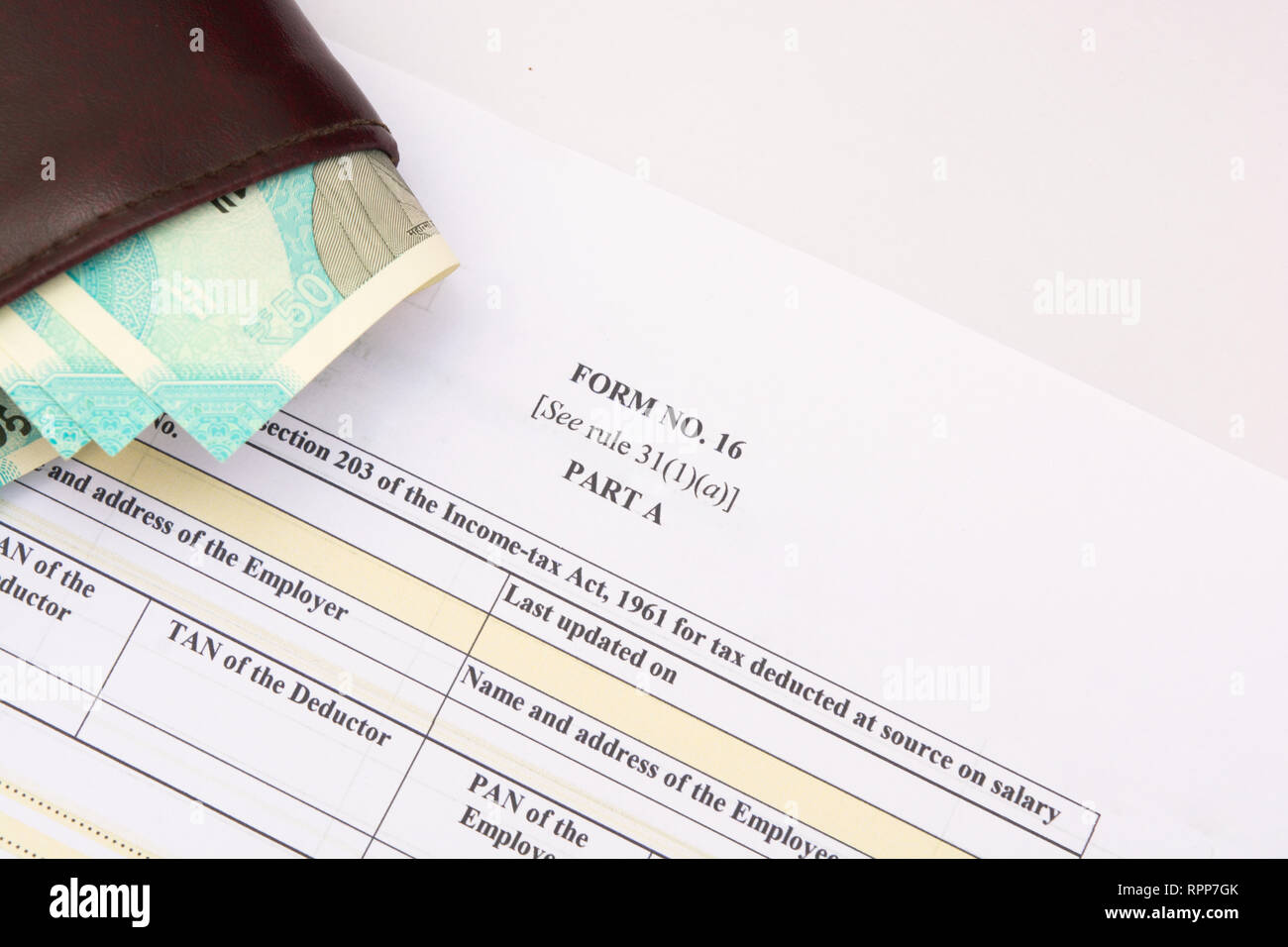

Income Tax Certificate

It was established by the father of the nation bangabandhu sheikh mujibur rahman under presidents order no.

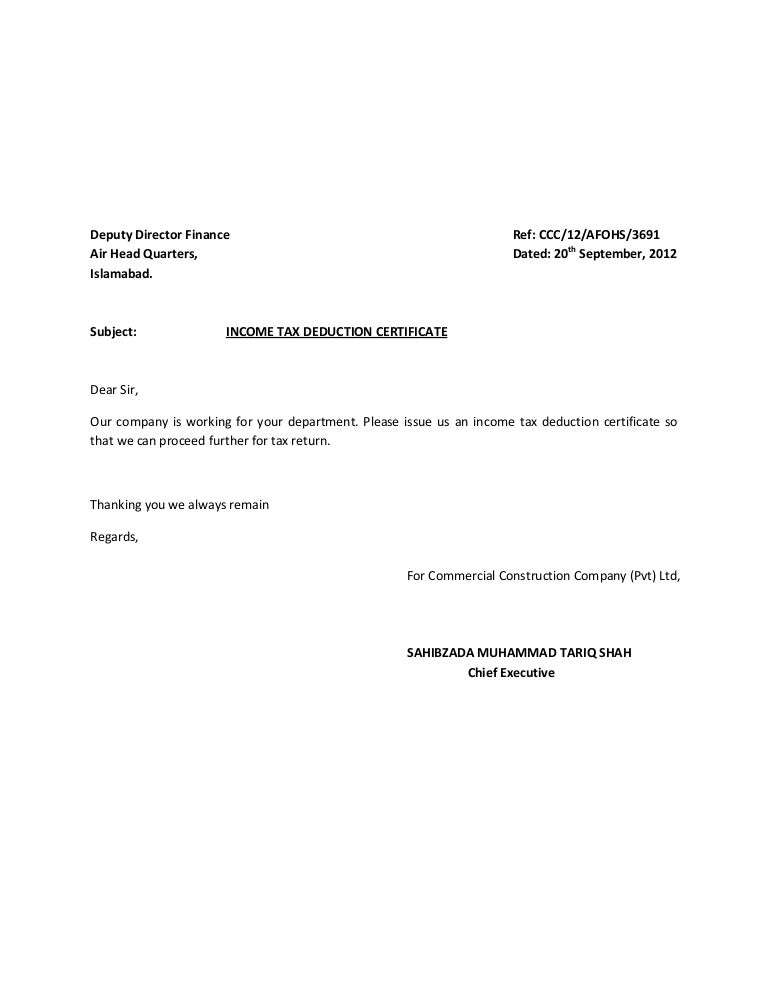

Income tax certificate. If you do not agree with an assessment issued by the income tax office you can appeal against the assessment using form 690a 228kb or form 690c 456kb. A tax clearance certificate is required when tendering for government business contracts and when seeking citizenship residency and the extension of work permits. You must complete an application for tax clearance form and submit it to one of the inland revenue offices listed in the next section. The national board of revenue nbr is the apex authority for tax administration in bangladesh.

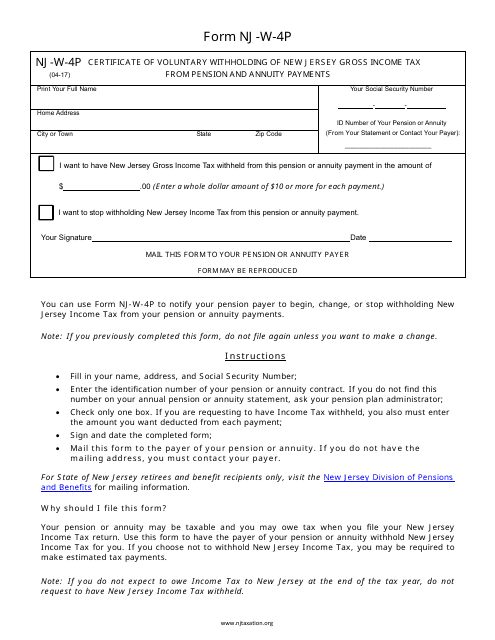

As well as perform all volunteer roles such as tax preparer quality reviewer andor instructor. The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. How your income tax is calculated. How do i apply.

The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. The rpn shows your total tax credits your tax and usc rate bands. Income tax is the normal tax which is paid on your taxable income. Our students average 90.

This year there are two levels for puerto rico training and certification. In order to determine the method of assessment on an individual liable to guernsey income tax it is necessary first to consider that individuals residence for the purposes of income tax. Your employer will use this to calculate your tax and usc. Individual tax filing season officially kicks off january 27 2020.

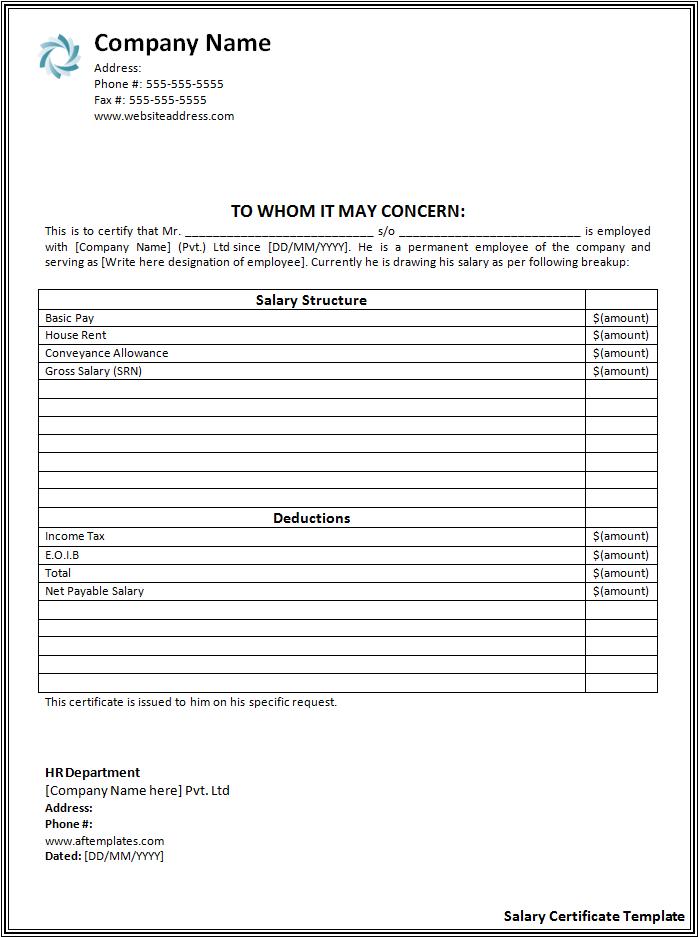

While certificate programs in income tax are rare options in accounting are plentiful. Day breaking news individual taxpayers business taxpayers tax professionals frequently visited links get help wheres my refund tax credits unclaimed property vendor. A volunteer who completes this certification level can prepare all tax returns that fall within the scope of the vitatce program. Step 2 meet the experience requirement for your selected certificate program.

Examples of amounts an individual may receive and from which the taxable income is determined include remuneration income from employment such as salaries wages bonuses overtime pay taxable fringe benefits allowances and certain lump sum benefits. Successfully complete the income tax school courses required in any of the three chartered tax certificate programs. A minimum cumulative grade point average of 80 or higher is required for the chartered tax certificate program.