Independent Contractor Printable 1099 Form 2019

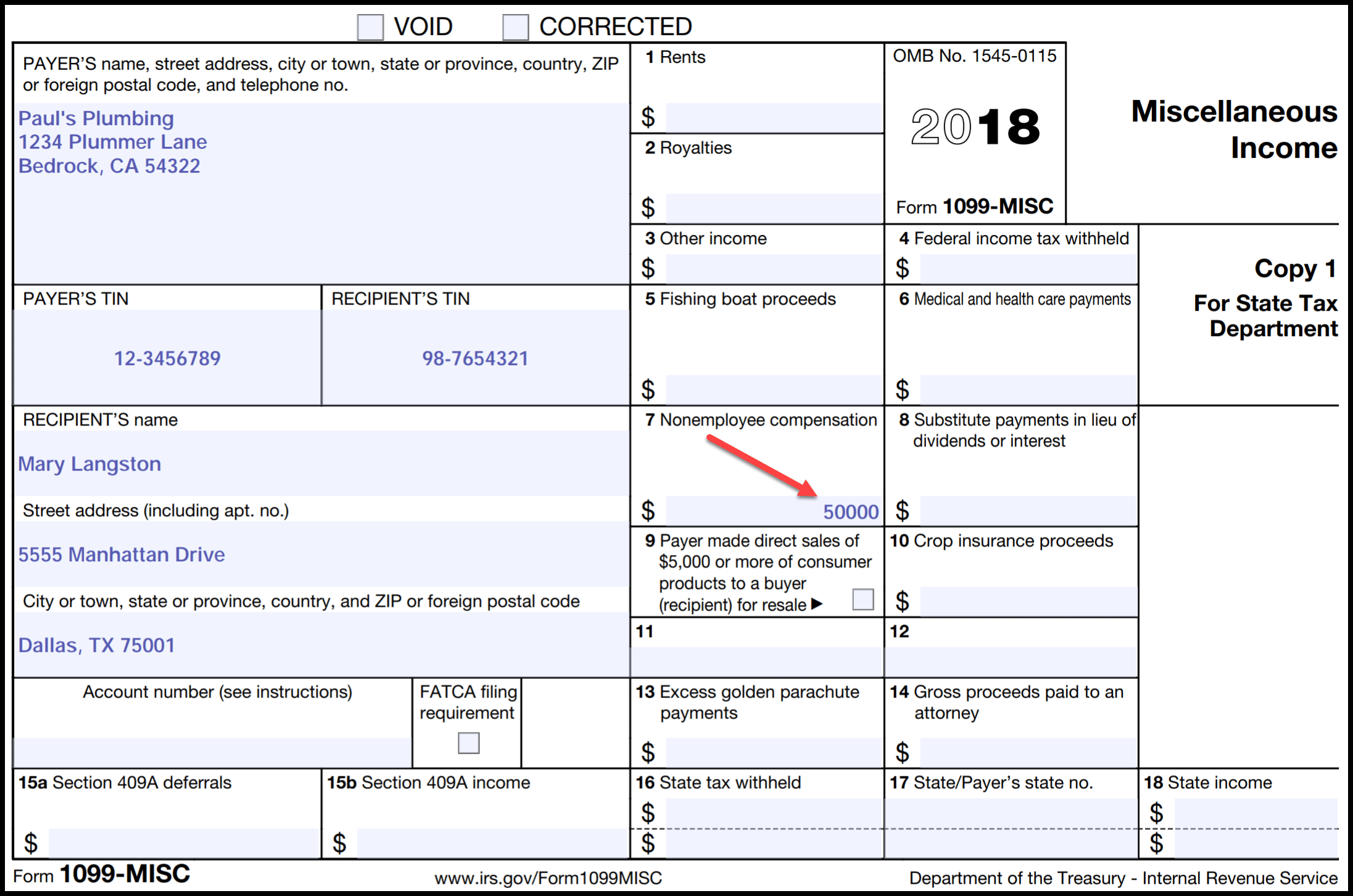

Payers use form 1099 misc miscellaneous income to.

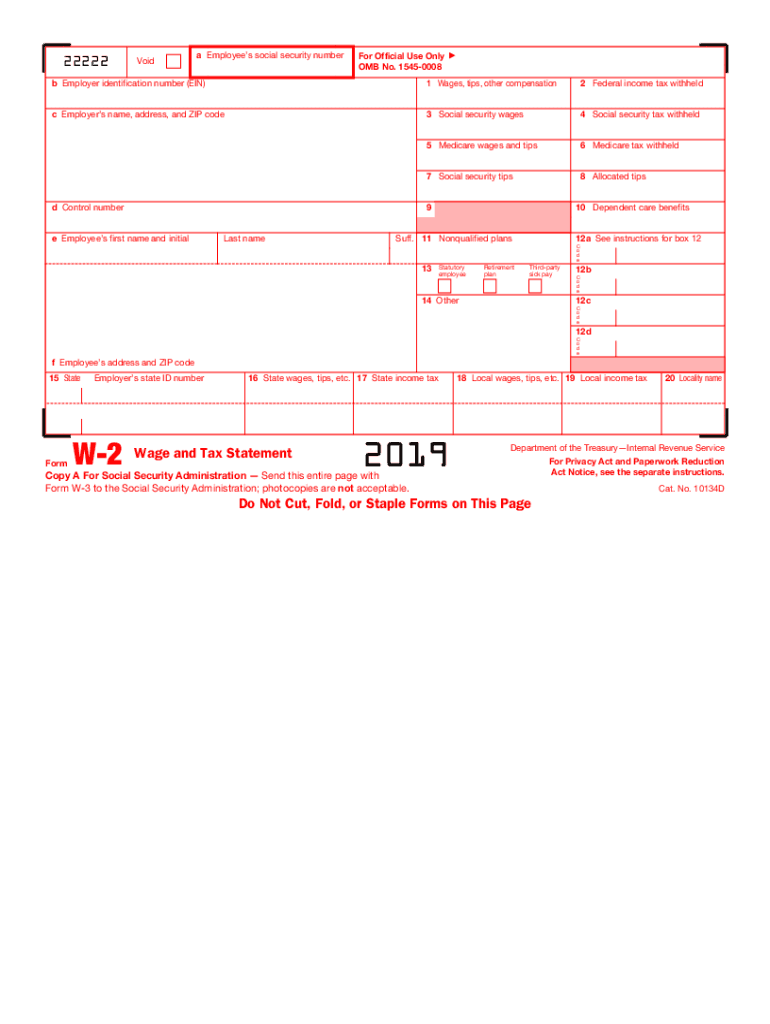

Independent contractor printable 1099 form 2019. Enhance your productivity with powerful service. 1099 form 2015 independent contractor. Report payments made in the course of a trade or business to a person whos not an employee. Employers furnish the form w 2 to the employee and the social security administration.

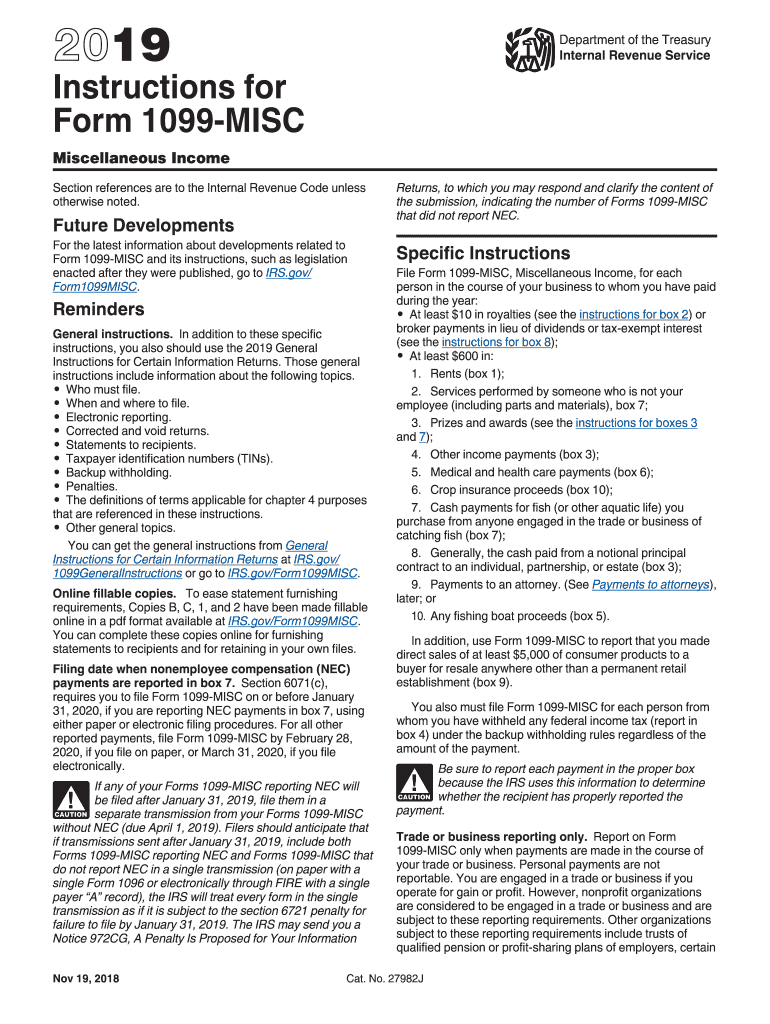

If you would like the irs to determine whether services are performed as an employee or independent contractor you may submit form ss 8 determination of worker status for purposes of federal employment taxes and income tax withholding. Thus the 1099 misc form 2019 is an important irs tax document where you are required to register and report your non employment paymentsoutside income. Any amount included in box 12 that is currently taxable is also included in this box. To put it simply form 1099 is for reporting your outside payments for business owners or non employment income for independent vendors.

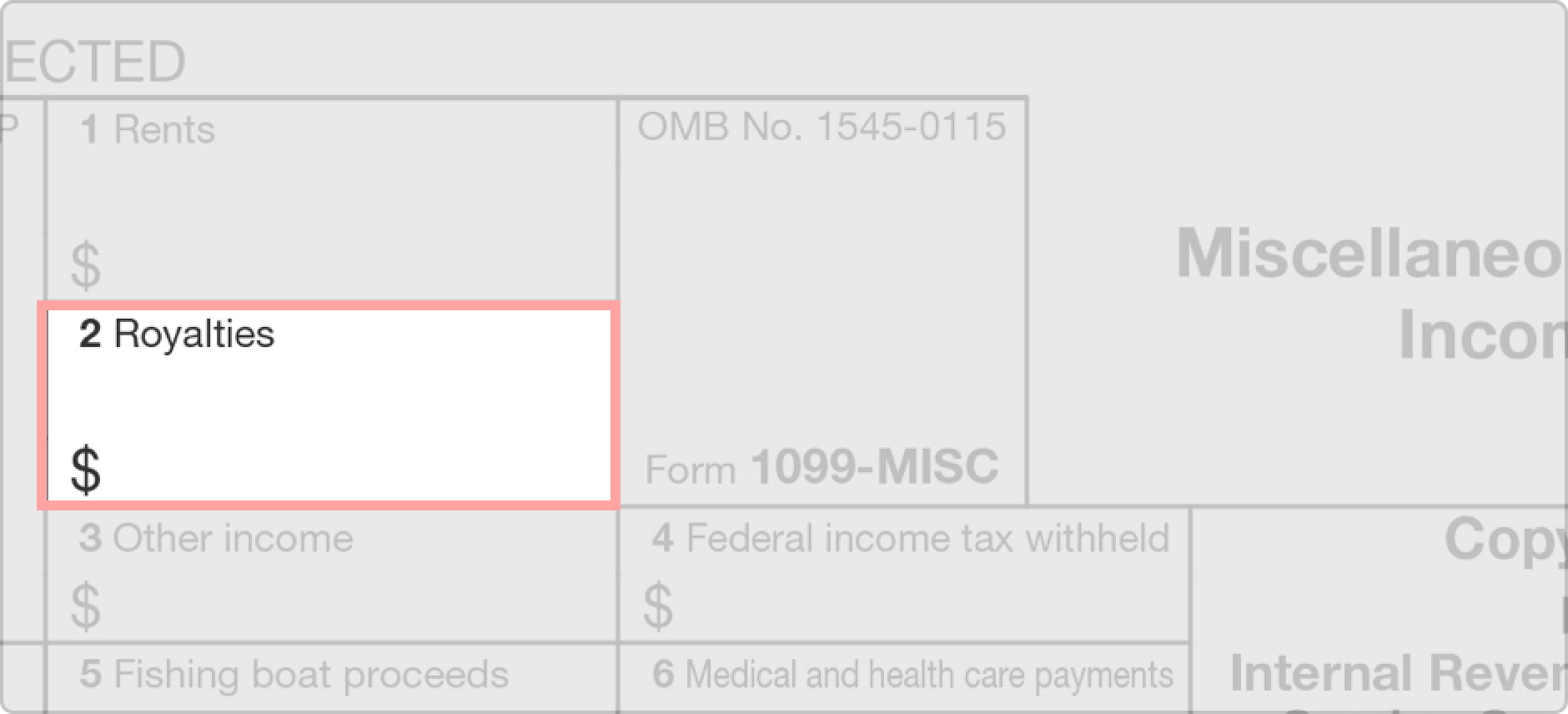

Printable online 1099 misc form. 1099 misc is the version of form 1099 payer use to submit the internal revenue service whenever the payer paid an independent contractor 600 or morerecipient payment in the form of fees compensation real estate rent prizes awards or any other kind of taxable income. 1099 form independent contractor. This income is also subject to a substantial additional tax to be reported on form 1040 1040 sr or 1040 nr.

Also refer to publication 1779 independent contractor or employee. Make them reusable by generating templates add and fill out fillable fields. Free printable estimate forms contractors. 1099 form independent contractor 2017.

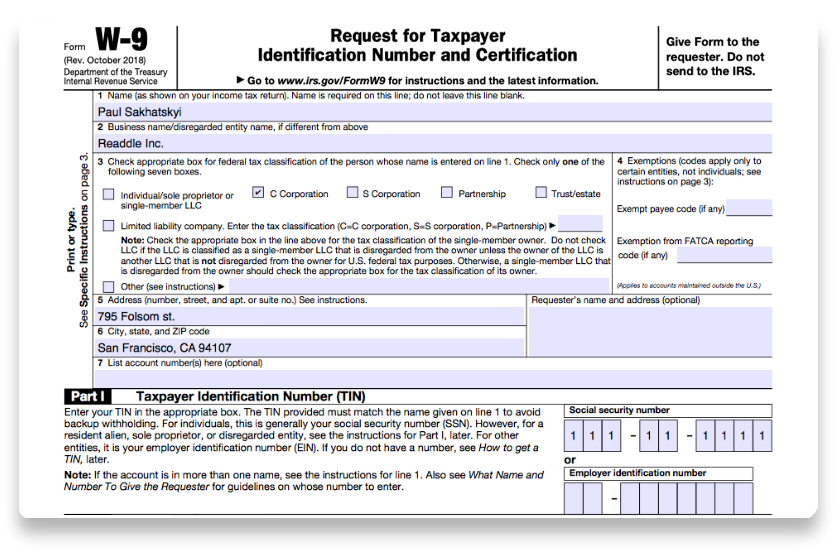

If youre a business owner you must send the 1099 form to all the independent contractors that. Shares share on facebook. Approve documents using a legal electronic signature and share them by using email fax or print them out. Find form w 9 form 1099 and instructions on filing electronically for independent contractors.

Download forms on your computer or mobile device. The 1099 form 2019 is used by business owners and freelancers to document and report their outside employment paymentsearnings. See the instructions for forms 1040 and 1040 sr or the instructions for form 1040 nr. However reporting these types of earnings to the irs is a must.

Workers compensation waiver form for independent contractors texas. Also refer to publication 1779 independent contractor or employee. If you would like the irs to determine whether services are performed as an employee or independent contractor you may submit form ss 8 determination of worker status for purposes of federal employment taxes and income tax withholding. Form w 9 if youve made the determination that the person youre paying is an independent contractor the first step is to have the contractor complete form w 9 pdf request for taxpayer identification number and certification.

Form 1099 nec as nonemployee compensation. Complete forms electronically working with pdf or word format.