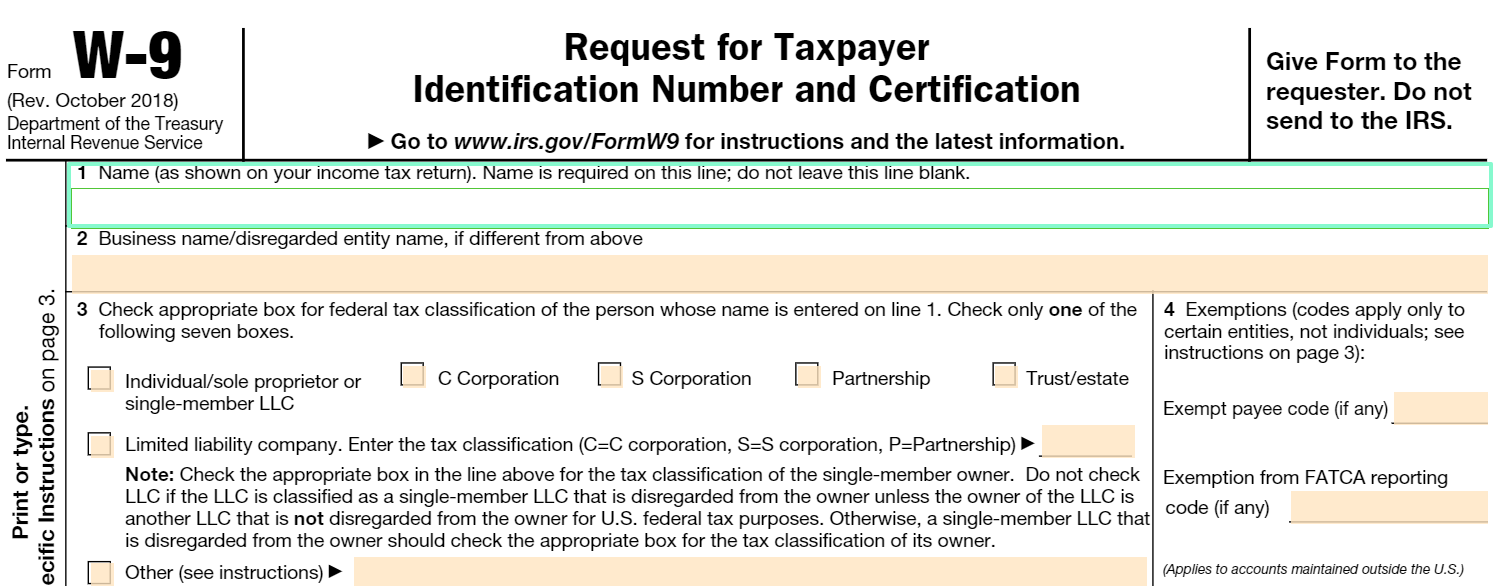

Independent Contractor Printable W 9 Form 2019

An independent contractor is a person corporation or business to present the work when only the result is under control not all the actions and the process.

Independent contractor printable w 9 form 2019. Generally only a nonresident alien individual may use the terms of a tax treaty to reduce. Participating foreign financial institution to report all united states 515 withholding of tax on nonresident aliens and foreign entities. Also refer to publication 1779 independent contractor or employee. Although both of these forms are called information returns they serve different functions.

Nonresident alien who becomes a resident alien. W 9 for 2018 2017 2016. Smallpdf has hosted the w 9 2019 form from within our pdf editor so you can fill this form out online using our free service. Instead use the appropriate form w 8 or form 8233 see pub.

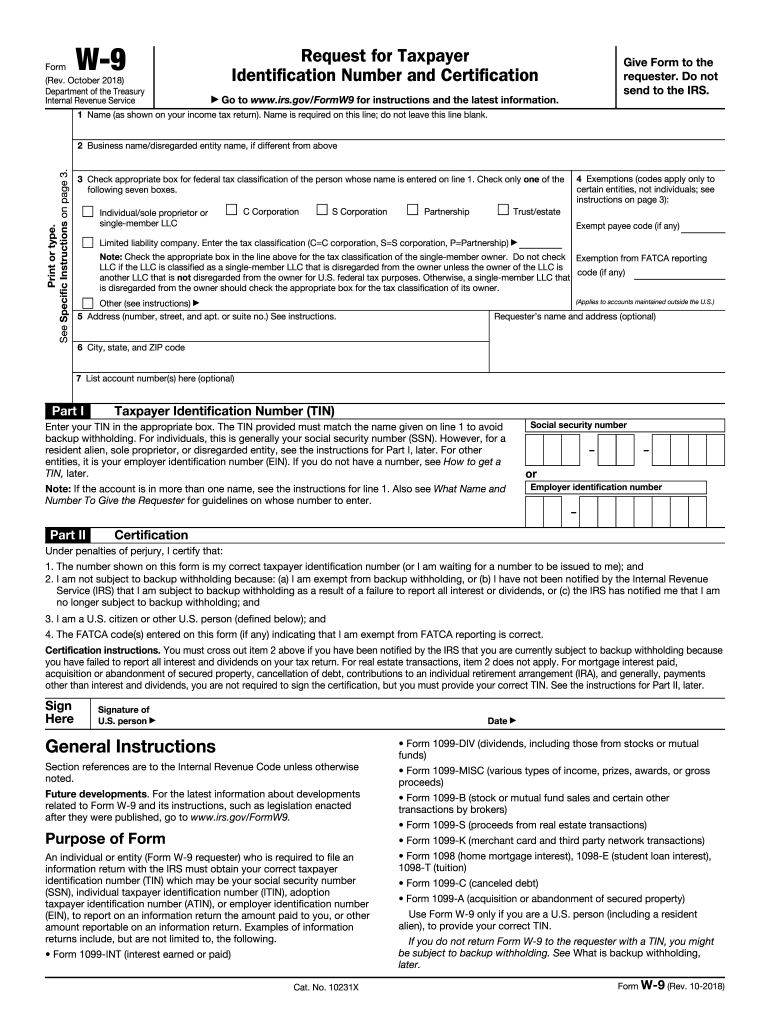

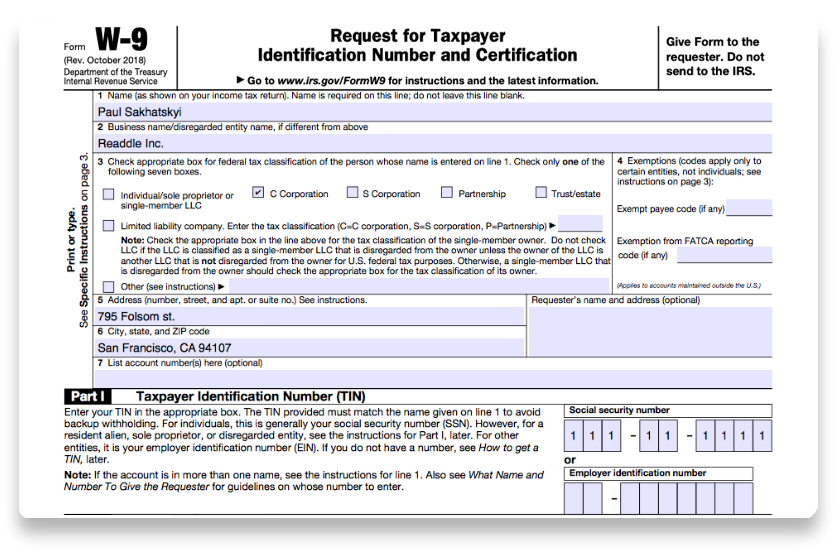

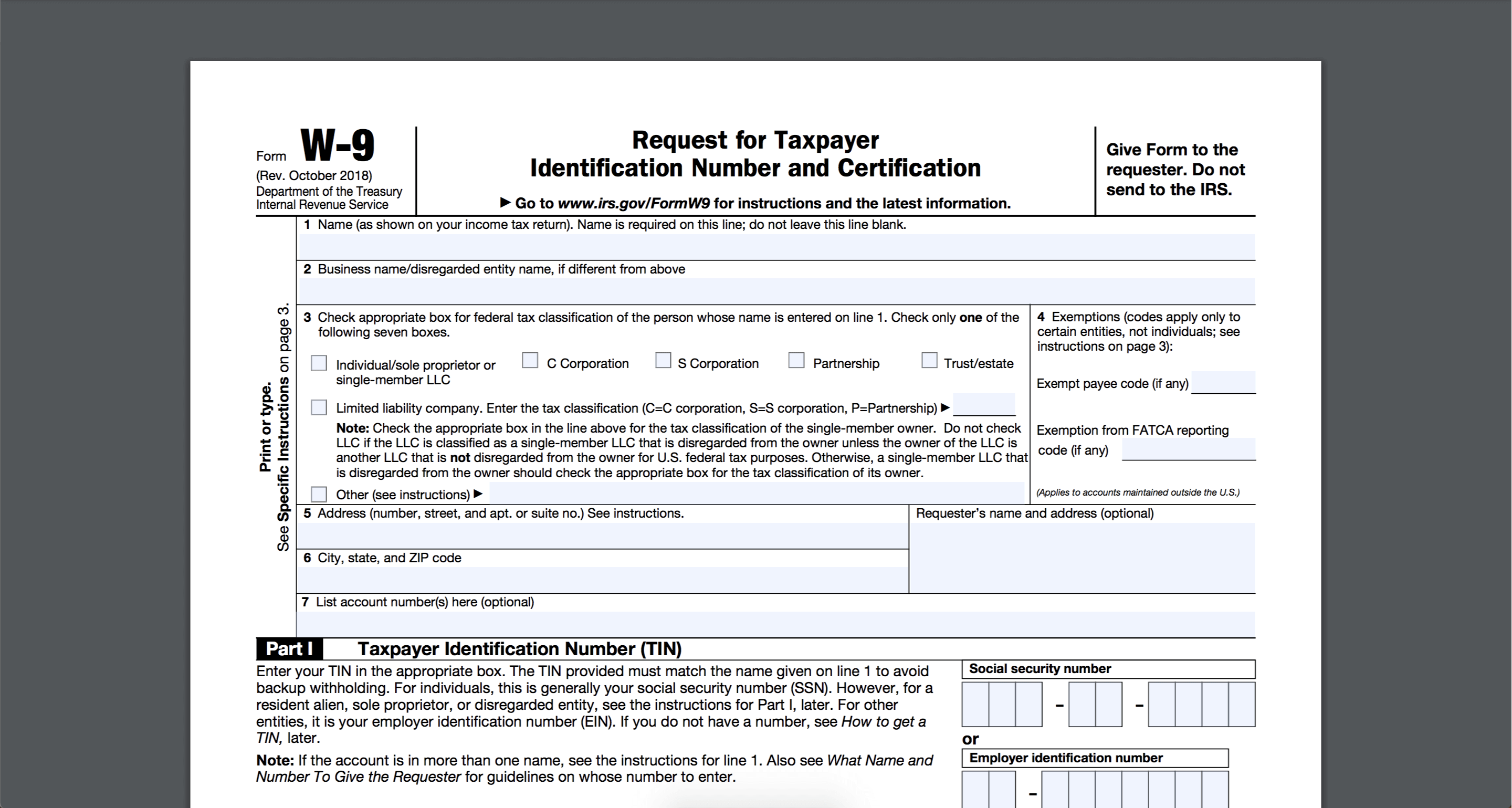

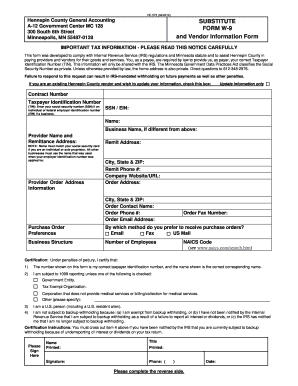

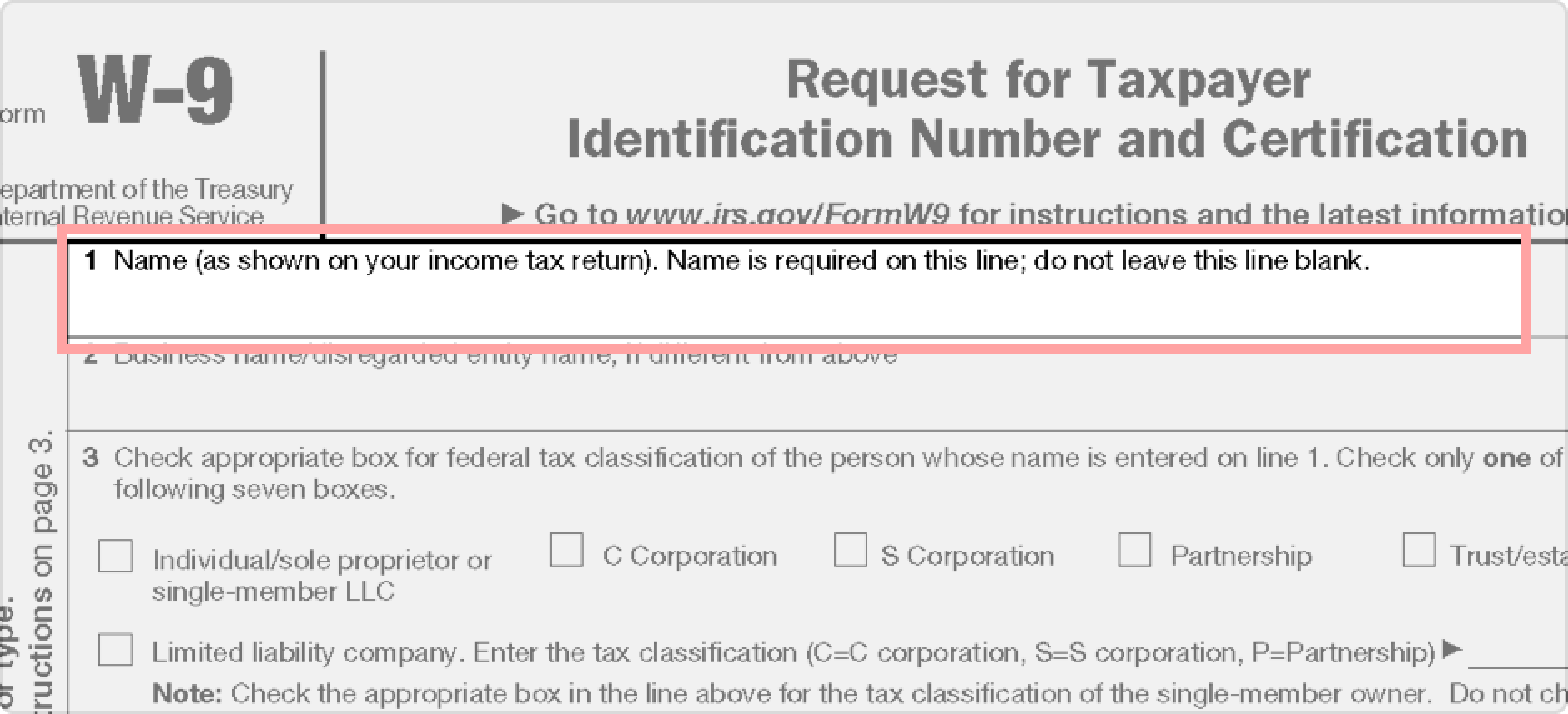

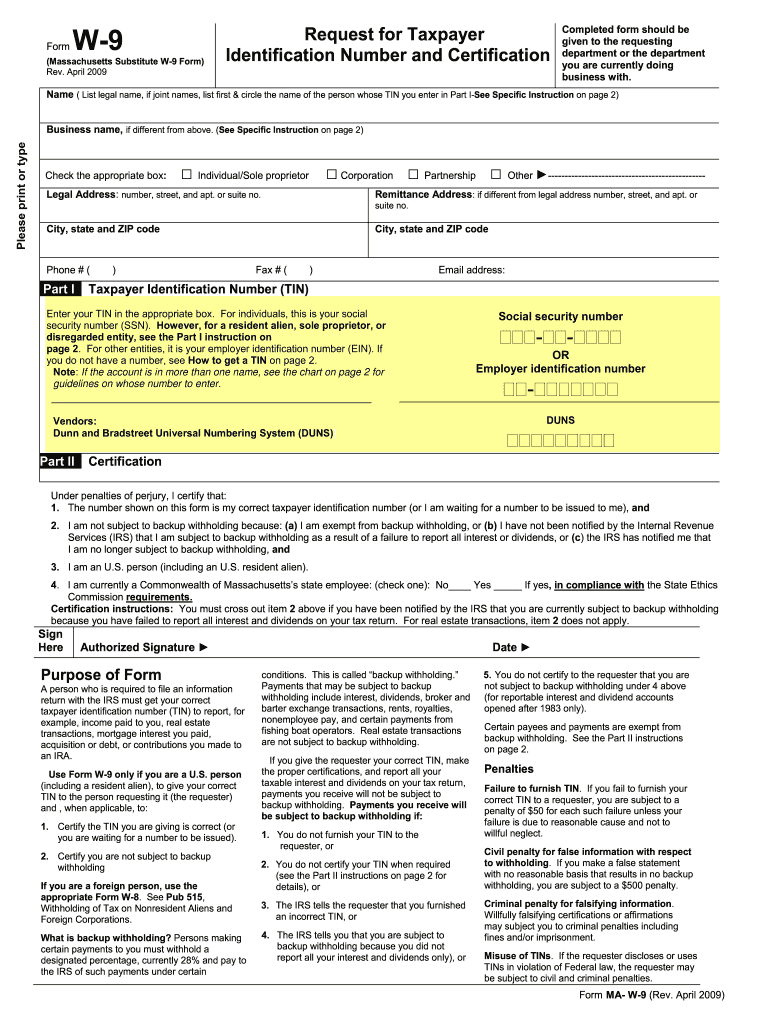

Fill out w 9 for 2019 a w 9 form is used for tax filing purposes. Download a free w 9 form and get our free e guide that includes everything you need to know to legally and effectively work with independent contractors. Employers use form w 2 wage and tax statement to. This form can be used to request the correct name and taxpayer identification number or tin of the workera tin may be either a social security number ssn.

Report the employees income and social security taxes withheld and other information. Information about form w 9 request for taxpayer identification number tin and certification including recent updates related forms and instructions on how to file. Form w 9 is used to provide a correct tin to payers or brokers required to file information returns with irs. Irs form w 9 should be given to the independent contractor and have completed before signing any agreement.

This form is used to get information from a person who you may be hiring or an independent contractor you are planning on using. Requesting form w 9 to be. Step 1 independent contractor completes irs form w 9. Report wages tips and other compensation paid to an employee.

Afterward you may print or save the completed form to your local drive to send to your client. This will identify themselves and require to give their employer identification number ein or social security number ssn before performing any work. Download the printable request for taxpayer identification number and certification template with detailed instructions.

/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg)

/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg)