Insurance Company Asking For Receipts

Never mind the fraud you still want the payout.

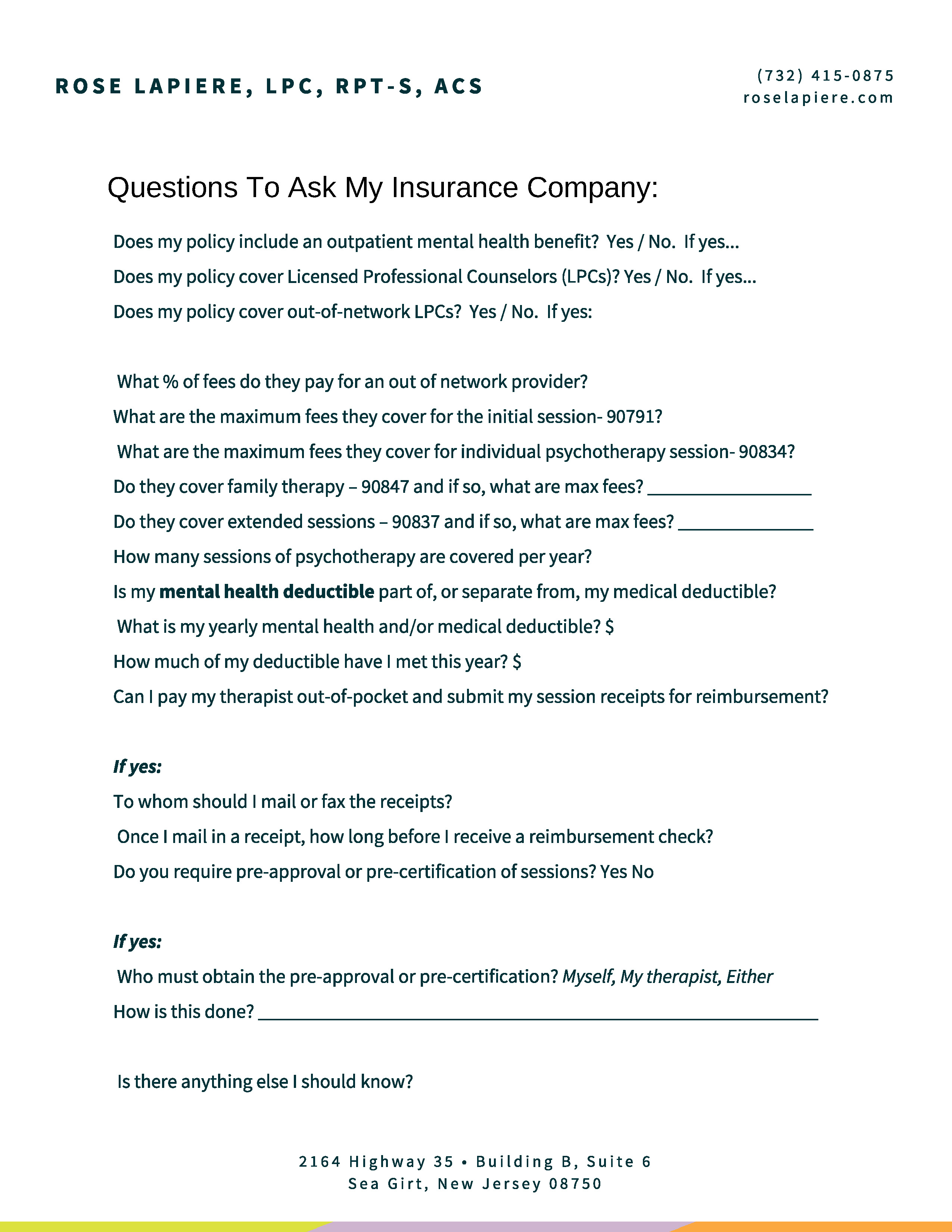

Insurance company asking for receipts. When dealing with theft or loss of property you may actually have receipts. Your company will ask for copies of receipts as proof of purchase then pay the difference between the cash value you initially received and the full cost of the replacement with an item of similar size and quality. It depends but when we ask for the receipts for the roof repair it is. H im asking this question for a work colleague.

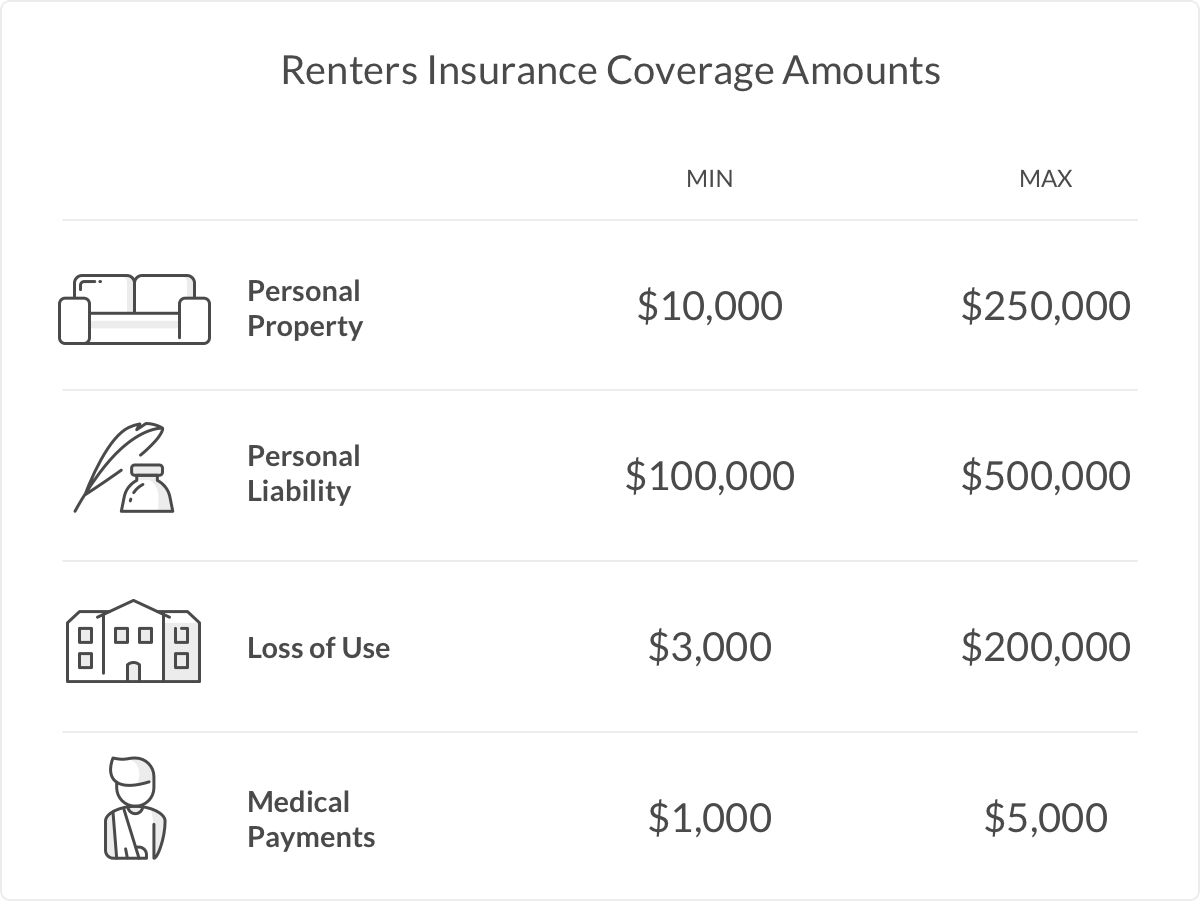

Burgalled insurance company are asking for receipts of the items that were taken. Insurance companies are the biggest crooks in the world. If you need to file an insurance claim your insurer may request a list of items that have been lost or damaged. You might be asked to provide some type of proof that you own these items such as receipts or bills.

But who keeps receipts. This varies and can include receipts credit card statements or even sometimes the box or instruction manual. They will take your money when you ask for insurance and when you make a claim they will treat you like a criminal and refuse to believe. His house was broken into sunday night and they stole his car using keys form within the house.

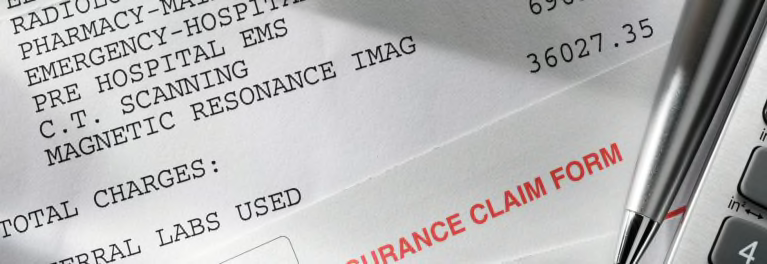

Without fail your adjuster will ask for receipts to determine the actual existence of lost property and the value. However in a total loss situation such as a fire often the receipts are destroyed along with the property. To get fully reimbursed for damaged items most insurance companies will require you to purchase replacements. In the past several years insurance companies have seen a 10 increase in fraudulent property claims.

Except in the case of rare or unusual items insurance companies are unlikely to ask for a box of receipts. This is because your insurer has to determine the total amount they need to insure. Even if they did and even if you had them all they would show is that somewhat bought the item listed on the receipt. Insurance company is overzealous in demanding documents to validate a claim it appears the individual cant be held responsible for providing a.

27th apr 09 at 947 pm 1. From a customers view point fraudulent claims may not seem like a high priority issue but it is devastating to insurance companies and eventually to honest paying. The concept is this the higher the gross revenue of a company the higher the risk of income loss at stake the more business exposure you have the more sources of income you will get and the. The insurance company should know your companys gross revenue.

/close-up-of-a-medical-insurance-form-638892586-5aaf2155c0647100367739f4.jpg)

:max_bytes(150000):strip_icc()/health-insurance-application-form-wait-to-fill-information-on-desk-background-871679614-9e6b2f624a7d444db3860616ba313c40.jpg)