Irs Form W 4 Printable

See form w4v voluntary withholding request for information on voluntary withholding from these payments.

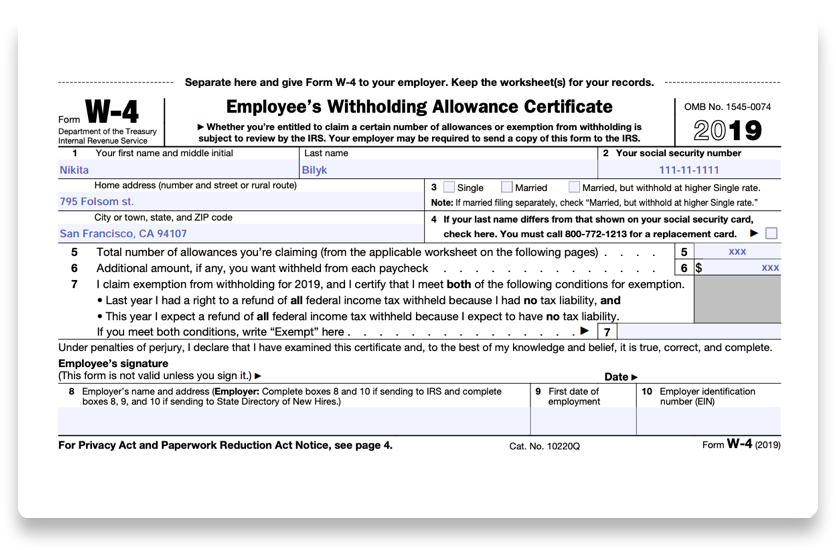

Irs form w 4 printable. Social security and railroad retirement payments may be includible in income. Information about form w 4 employees withholding certificate including recent updates related forms and instructions on how to file. Whichever irs form you need the agency offers them for free without any login or charge at all from its website. Withholding on form w4 or form w4p.

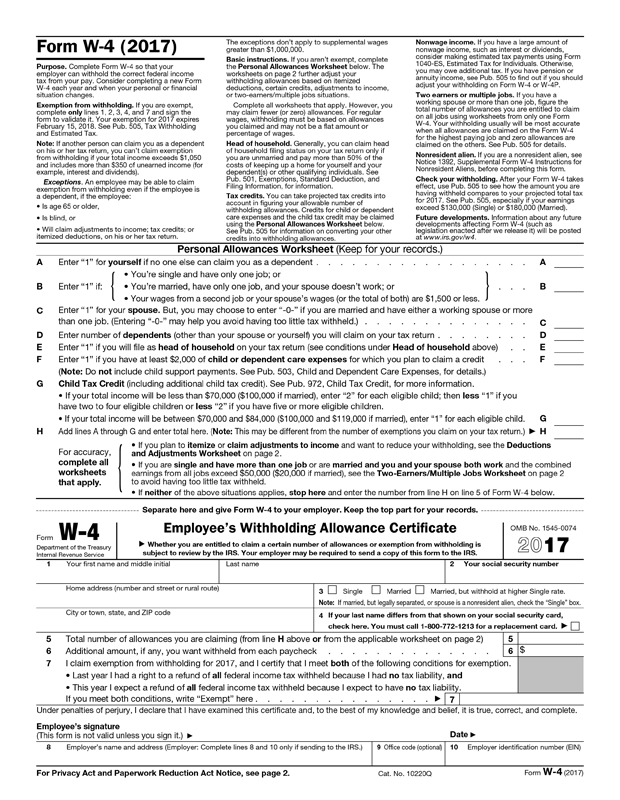

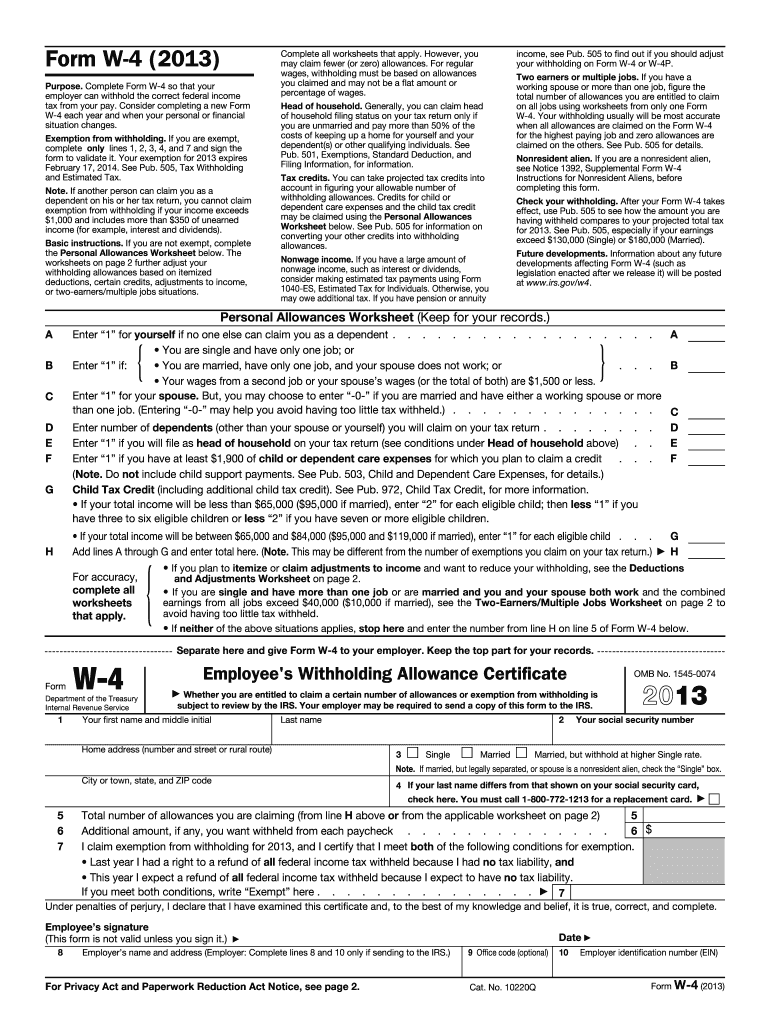

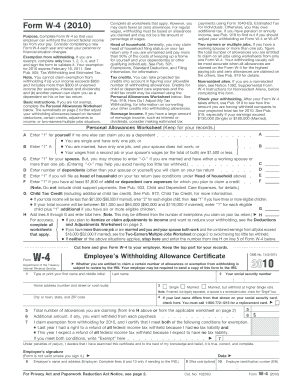

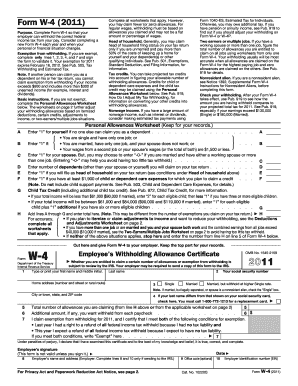

Withholding from pensions and annuities. Keep the worksheets for your records. This is because the irs requires you to pay your taxes on your income throughout the year gradually. Form w 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay.

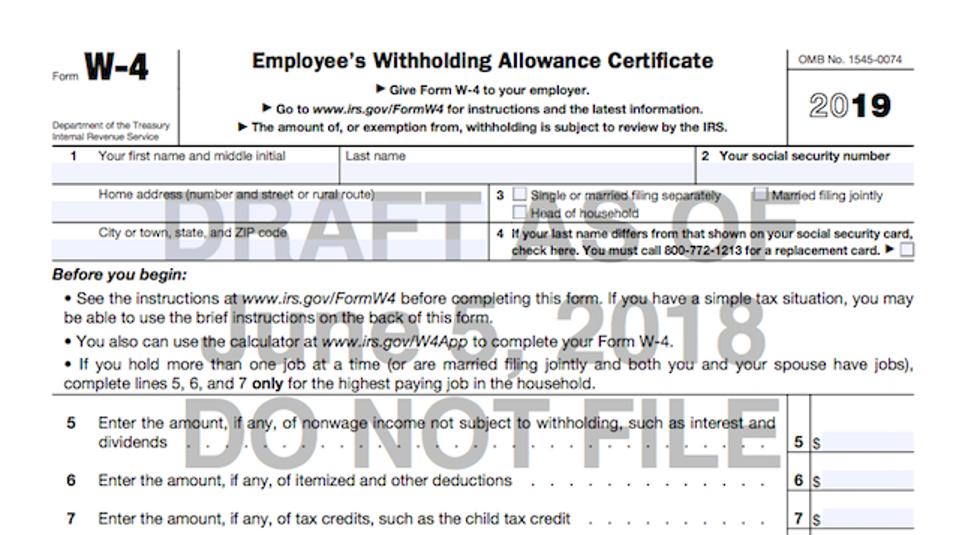

The focus of the form is entirely about how much your employer will withhold from your paychecks to pay your annual income tax. Department of the treasury internal revenue service. General instructions for forms w 2 and w 3 pdf. Request for federal income tax withholding from sick pay 2018 01032019 form w 4s.

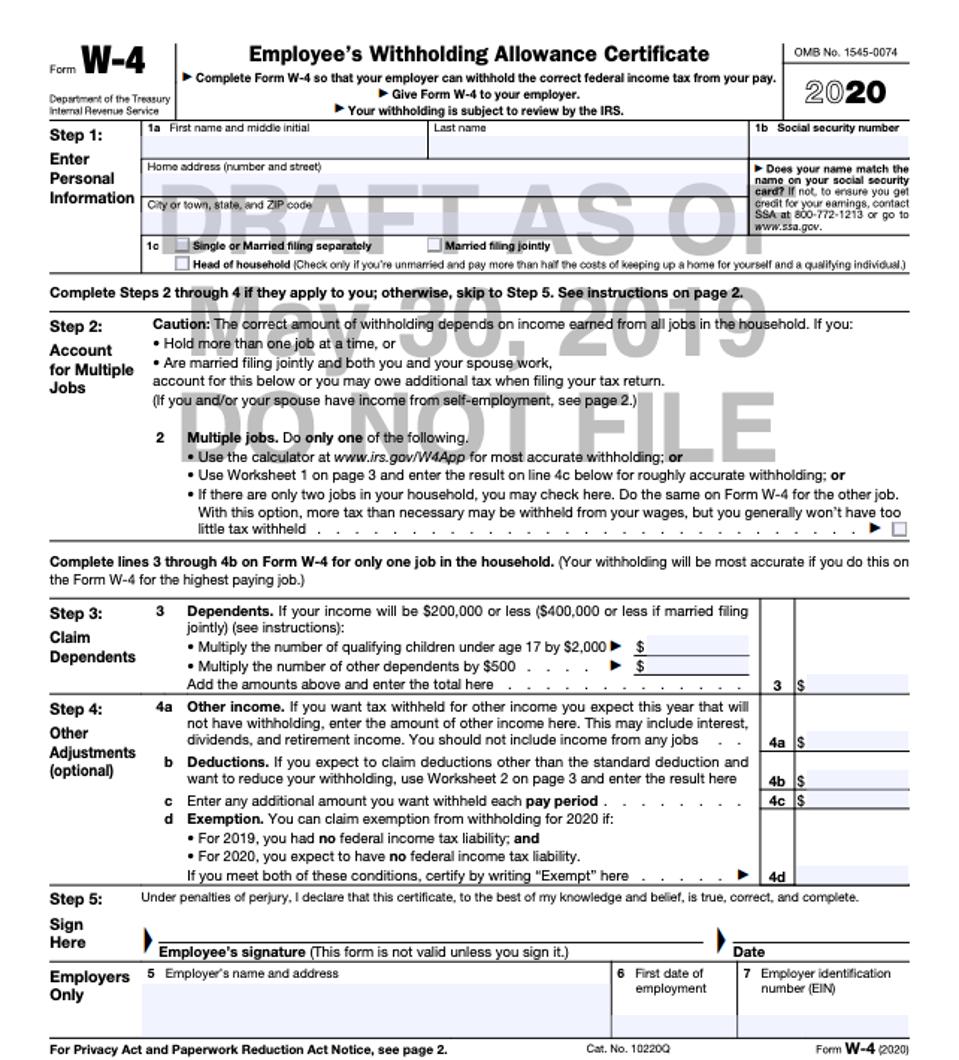

Wage and tax statement. Form w 4 2020 employees withholding certificate department of the treasury internal revenue service complete form w 4 so that your employer can withhold the correct federal income tax from your pay. Generally federal income tax withholding applies to the taxable. Use this form to ask payers to withhold federal income tax from certain government payments.

Irs w 4 form 2020 printable. Request for federal income tax withholding from sick pay 2019 01022019 form w 4v. Withholding certificate for pension or annuity payments 2018 02052019 form w 4s. Separate here and give form w 4 to your employer.

The complete form w 4 is a four page form but the only part that matters is the bottom of the first page which you will have to separate and give it to your employer. Form w 2 pdf related. Employers must file a form w 2 for each employee from whom income social security or medicare tax was withheld. Your withholding is subject to review by the irs.

September 20 2018 following feedback from the payroll and tax communities the treasury department and the irs will incorporate important changes into a new version of the form w 4 employees withholding allowance certificate for 2020. Employees withholding allowance certificate whether youre entitled to claim a certain number of allowances or exemption from withholding is subject to review by the irs. Give form w 4 to your employer.