Irs Resale Certificate

Purchasers may either document their tax exempt purchases by completing form crt 61 certificate of resale or by making their own certificate.

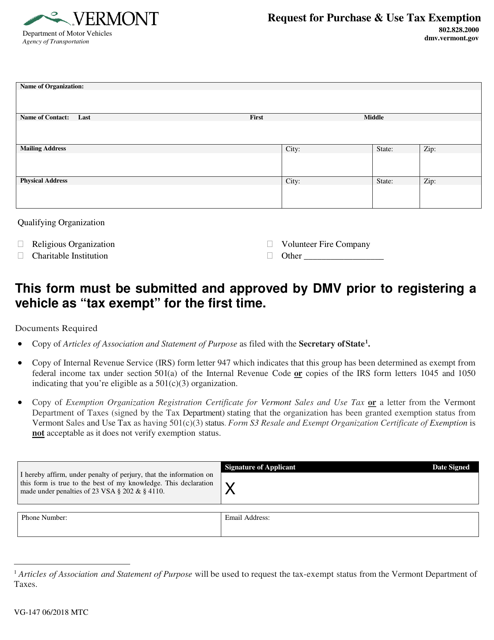

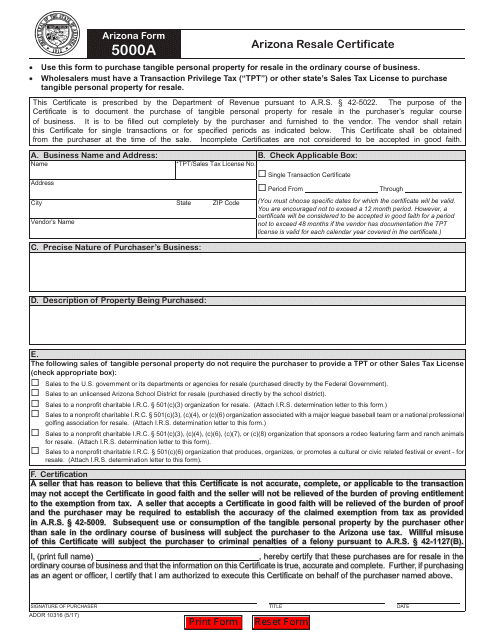

Irs resale certificate. A sales tax exemption certificate is needed in order to make tax free purchases of items and services that are taxable. To document tax exempt purchases of such items retailers must keep in their books and records a certificate of resale. A copy of the certificate must be provided to the retailer. A business which is registered for sales and use tax can use a resale certificate only when the merchandise being purchased is to be resold by the business.

Apply for power of attorney. This certificate is only for use by a purchaser who. Popular for tax pros. I understand that it is a criminal offense to give a resale certificate to the seller for taxable items that i know at the time of purchase are purchased for use rather than for the purpose of resale lease or rental and depending on the amount of tax evaded the offense.

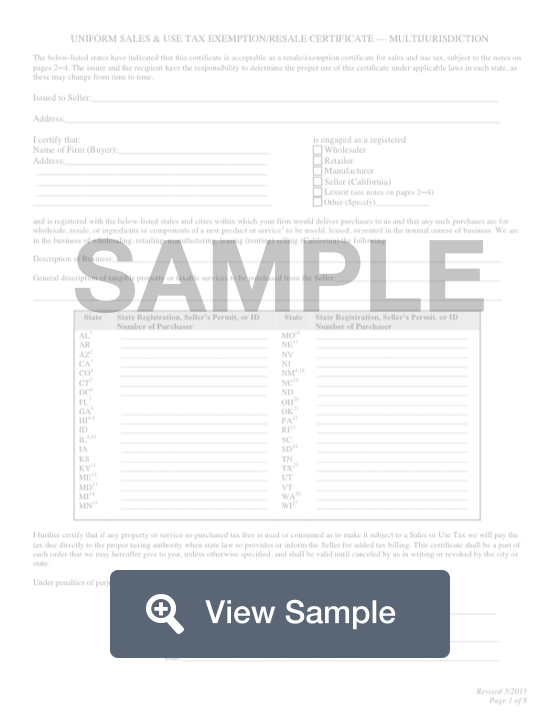

When purchasing items for resale registered sellers may avoid the sales tax by giving their supplier adequate documentation in the form of a resale certificate. How to use and accept resale certificates by jennifer dunn jan 30 2018 as a retailer you have the chance to buy items that you intend to resell without paying sales tax at the time of purchase. A resale certificate is an official document that easily instills confusion in many online resellers. This includes most tangible personal property and some services.

Tsb m 071s electronic resale and exemption documents for sales and compensating use taxes. Depending on the state you live in it can also be called a resellers permit resellers license resellers certificate resale license sales tax id or sales tax permit. Form st 120 resale certificate is a sales tax exemption certificate. To print your resale certificate use the button below to log in then select the print annual resale certificate button from the choose activity menu.

Employers quarterly federal tax return. A business cannot use a resale certificate to purchase merchandise that they will use and consume in the conduct of business. Resale certificates are available through the sales and use tax or communications services tax file and pay webpages. When an exemption certificate is needed.

Employers engaged in a trade or business who pay compensation.