Irs Tax Return Transcript

Be sure you put your students id number 93 on the transcript.

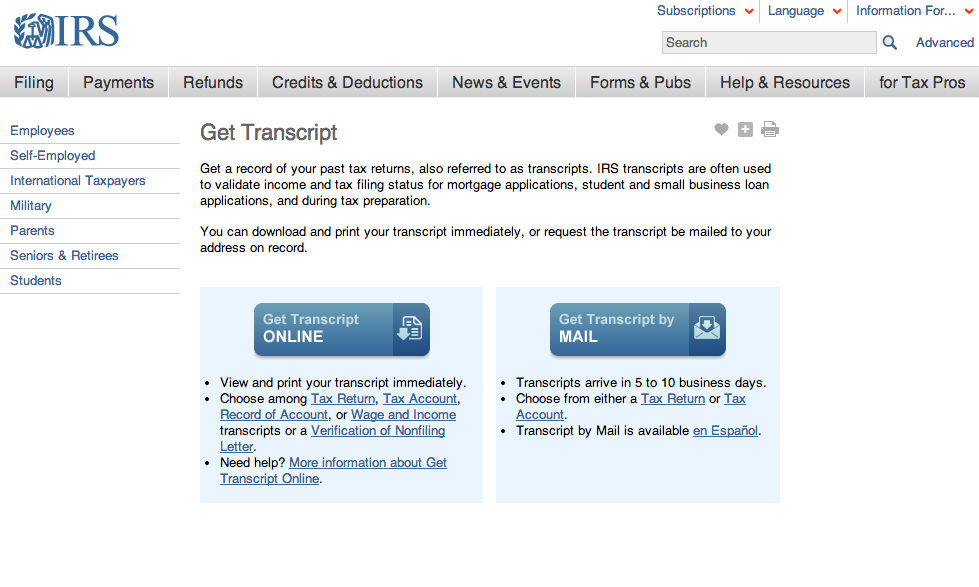

Irs tax return transcript. There are five types. Irs form 4506 t is required for fiscal year filers who cannot use irs form. Mailing in a form. The period in which you will receive the transcript varies from within ten to thirty business days from the time the irs receives your request for the tax return or tax account transcript.

Copy of return 50 form 4506. An irs tax return transcript can be obtained by filing irs form 4506t ez or irs form 4506 t. Irs reminds you that the 20 deduction for pass through businesses can affect your bottom line. If you need your prior year adjusted gross income agi to e file choose the tax return transcript type when making your requestif you only need to find out how much you owe or verify payments you made within the last 18 months you can view your tax account.

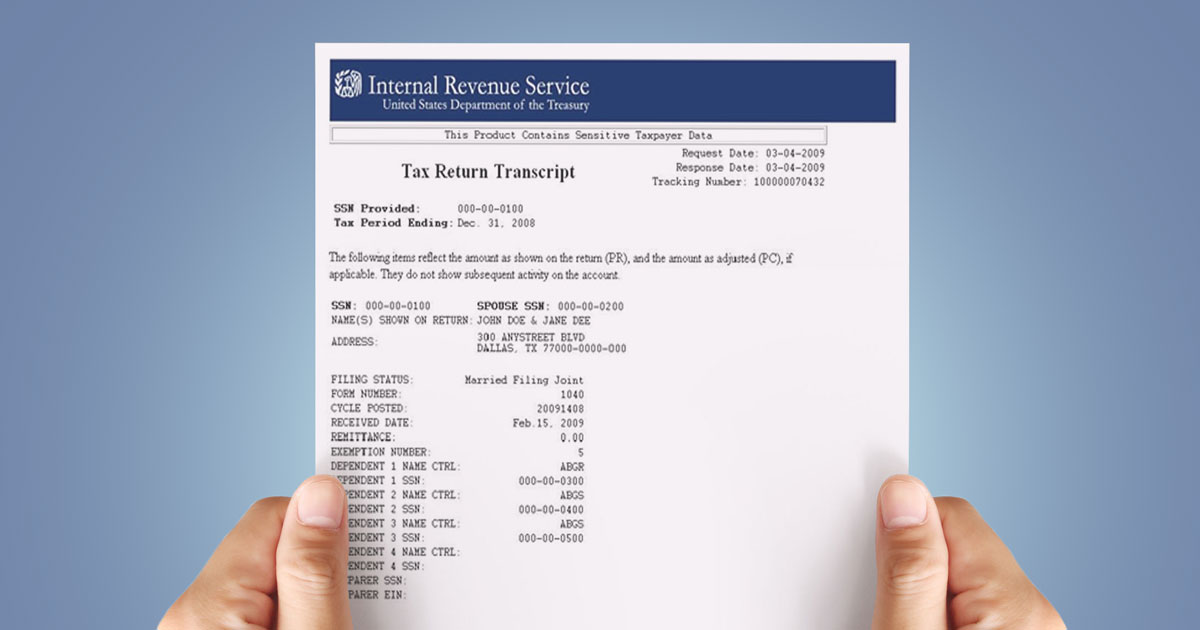

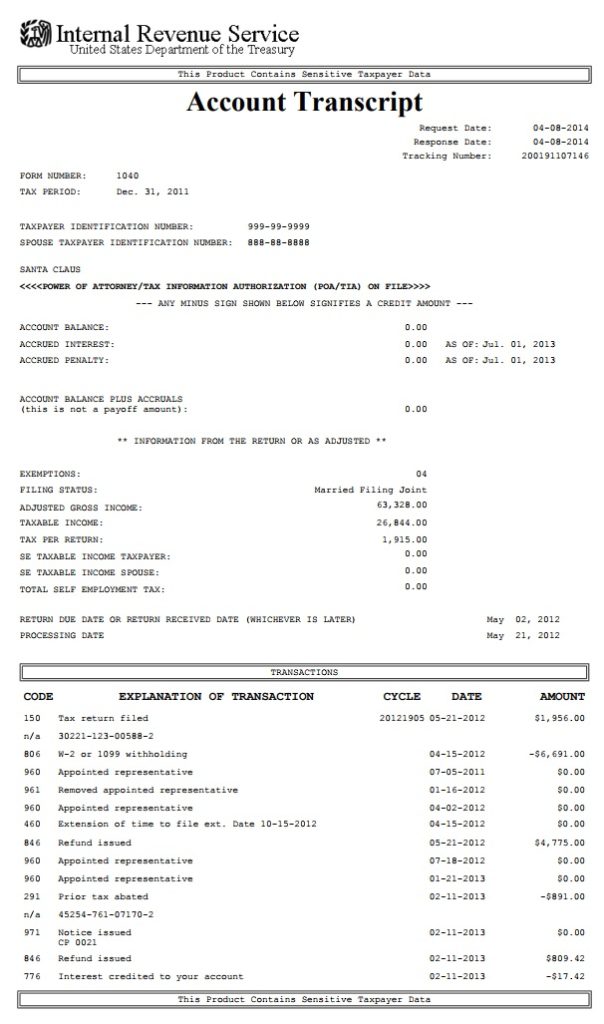

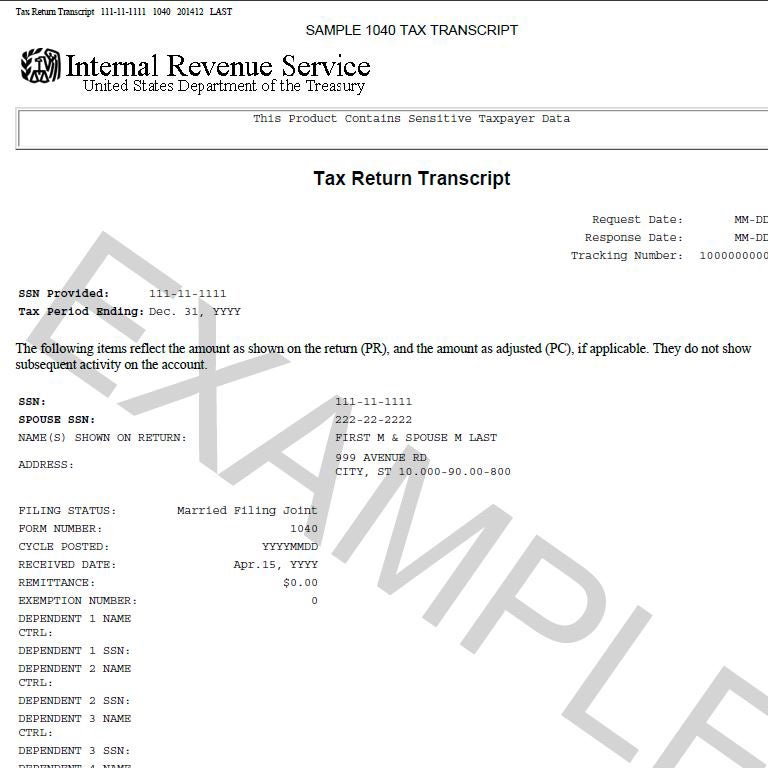

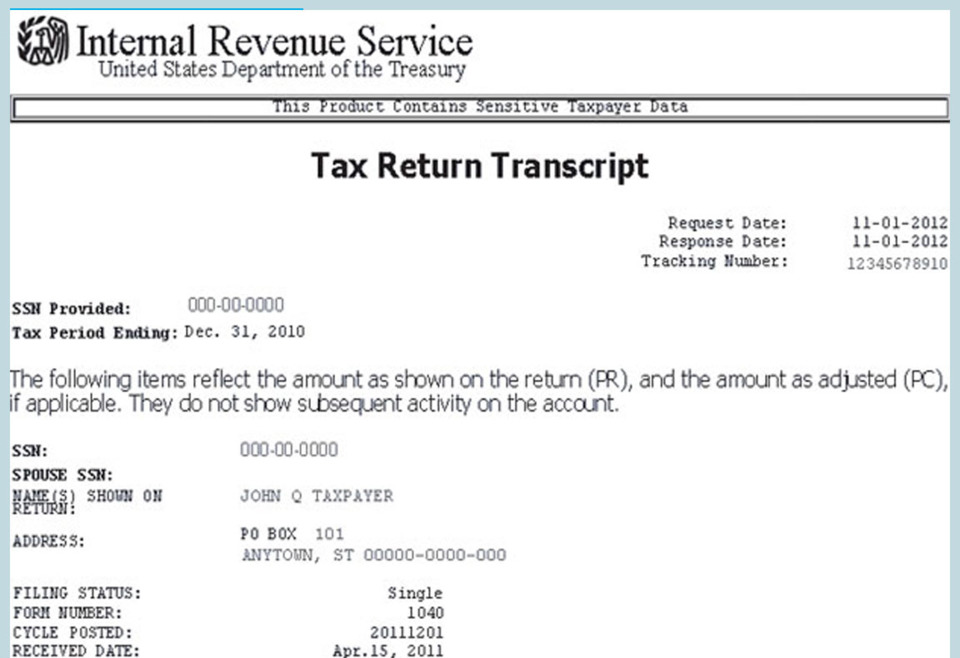

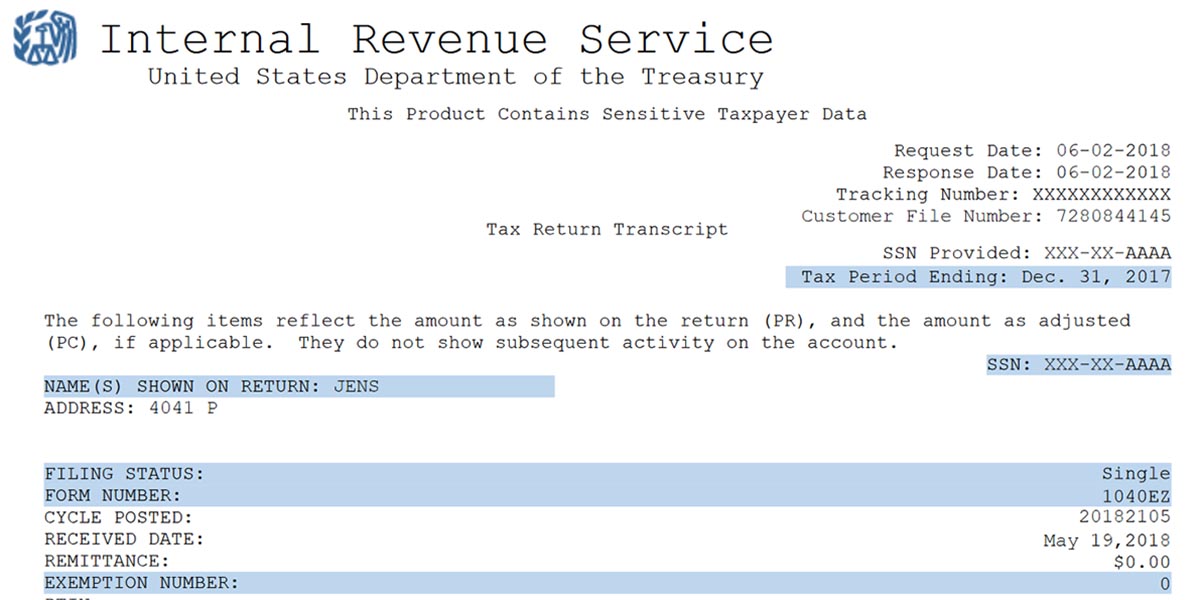

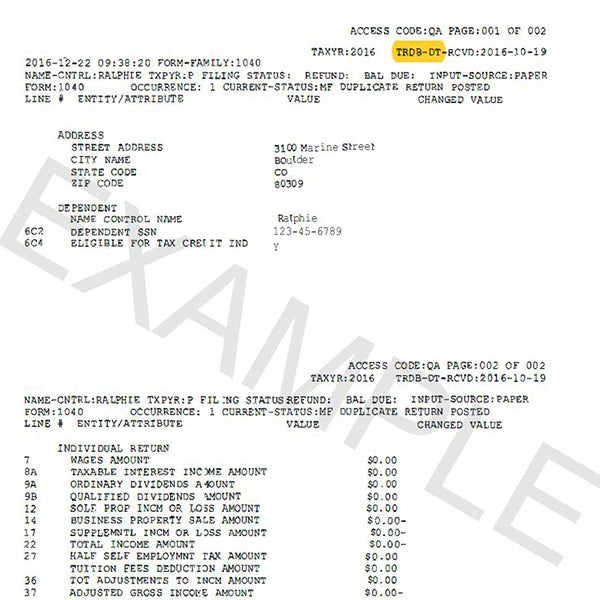

Use of this system constitutes consent to monitoring interception recording reading copying or capturing by authorized personnel of all activities. Tax account transcript shows basic data such as return type marital status adjusted gross income taxable income and all payment types. Those who need a copy of their tax return should check with their software provider or tax preparer. Tax return transcript shows most line items including your adjusted gross income agi from your original tax return form 1040 1040a or 1040ez as filed along with any forms and schedulesit doesnt show changes made after you filed your original return.

The irs has five types of transcripts. Both transcripts are generally available for the current and past three years and are provided free of charge. Irs summertime tax tip 2017 11 july 26 2017 taxpayers should keep copies of their tax returns for at least three years. This transcript is available for the current tax year and up to 10 prior years using get transcript online or form 4506 t.

How to get an irs transcript or request a copy of a tax return in 2019 2020 an irs transcript is a summary or overview of your tax return information. For those that need tax transcripts however irs can help. Government system is for authorized use only. The method you used to file your tax return e file or paper.

The irs tax return transcripts requested cannot be successfully sent directly to a third party by the irs. Prior year tax returns are available from irs for a fee. Employers quarterly federal tax return. It also shows changes made after you filed your original return.

An irs form 4506 t can also be used to request an irs tax account transcript record of account or verification of nonfiling letter in addition to an irs tax return transcript.