Irs W 4 Form 2019 Printable

Choosing not to have income tax withheld.

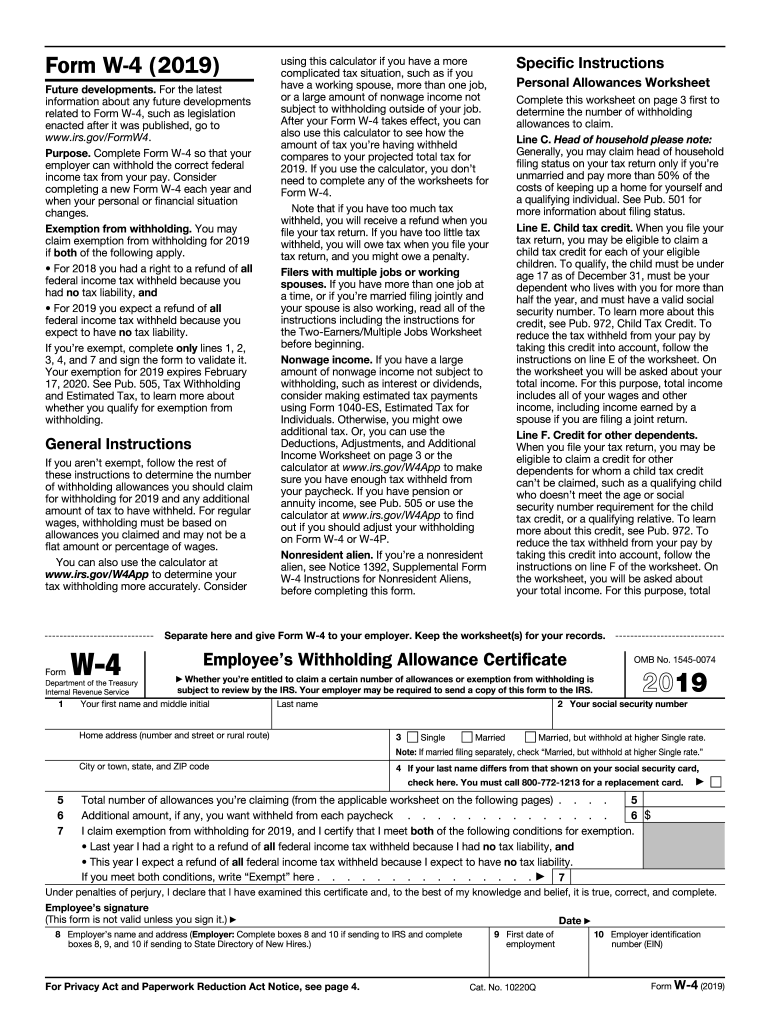

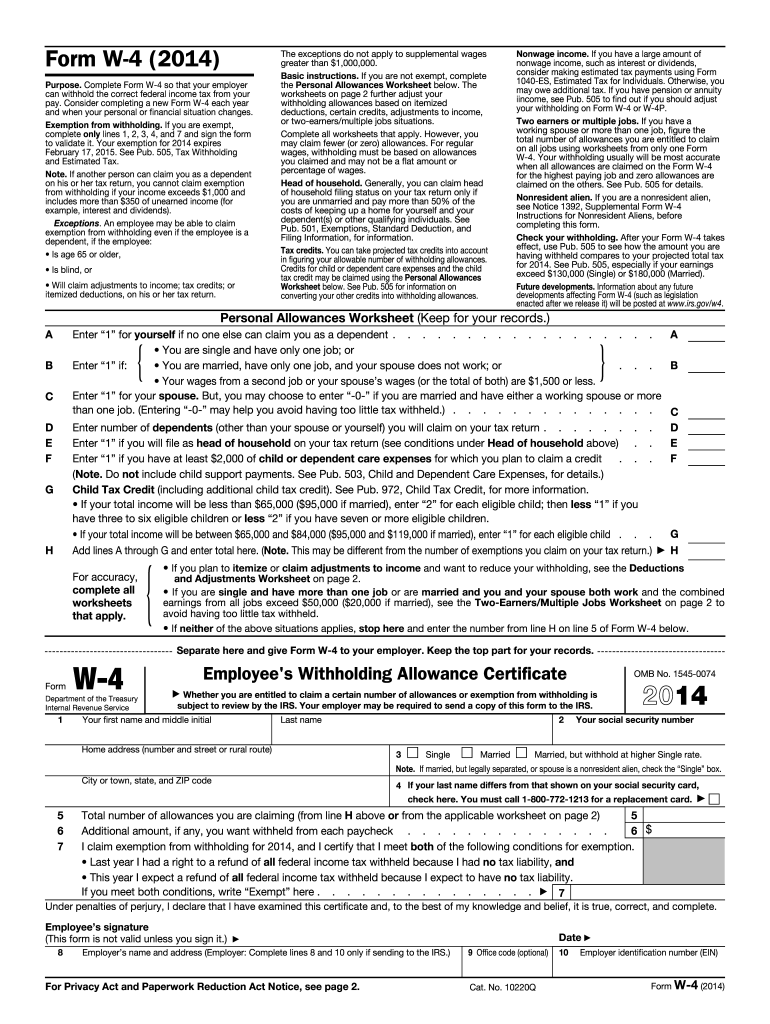

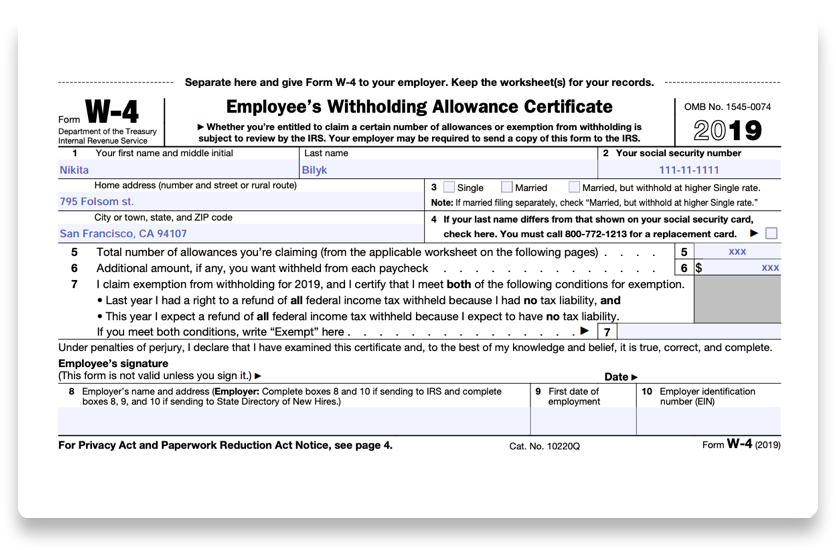

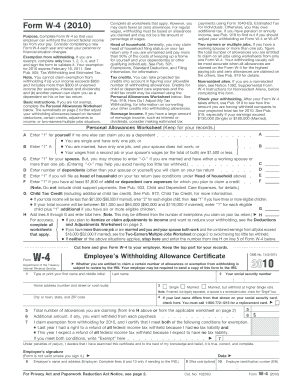

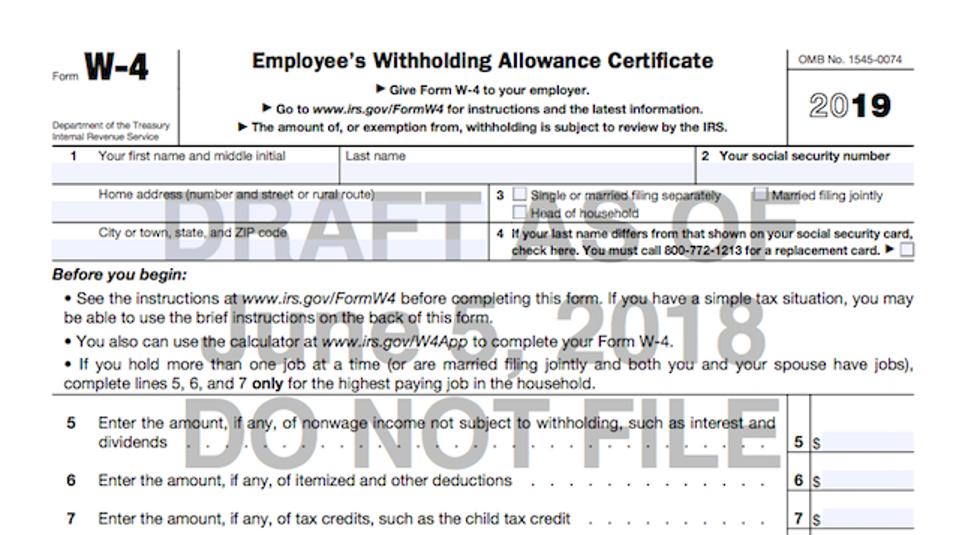

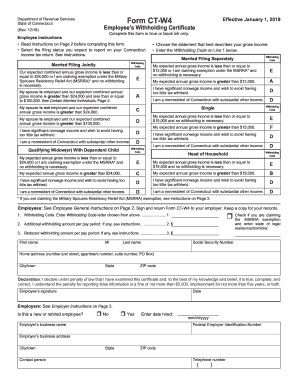

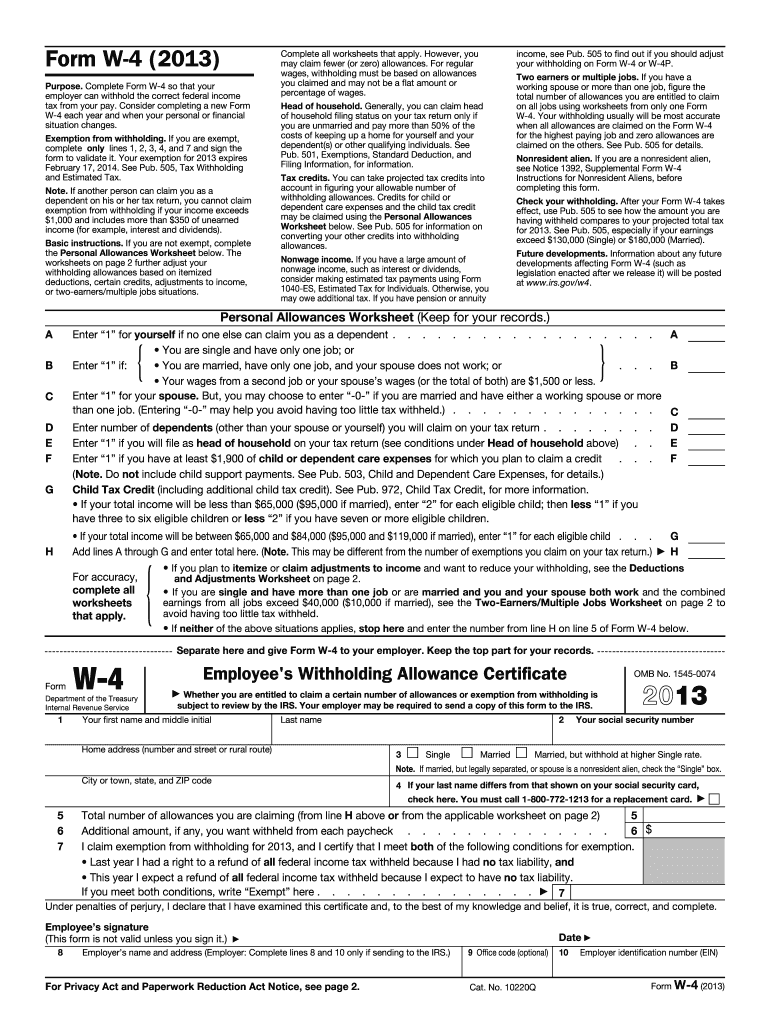

Irs w 4 form 2019 printable. Employees withholding allowance certificate whether youre entitled to claim a certain number of allowances or exemption from withholding is subject to review by the irs. Information about form w 4v voluntary withholding request including recent updates related forms and instructions on how to file. Form w 2 pdf related. Easily fill out your blank edit and download it.

2 because your tax situation may change from year to year you may want to refigure your withholding each year. Give form w 4 to your employer. Your withholding is subject to review by the irs. 2019 02042019 form w 4p.

You can print or submit the form to irs online in minutes. Create and complete a w 4 form 2019 using our pdf templates. Information about form w 4 employees withholding certificate including recent updates related forms and instructions on how to file. Withholding certificate for pension or annuity payments 2018 02052019 form w 4s.

General instructions for forms w 2 and w 3 pdf. For the current 2019 tax year the irs continues to strongly urge taxpayers to review their tax withholding situation as soon as possible to avoid having too little or too much withheld from their paychecks. Request for federal income tax withholding from sick pay 2019. You can easily sign edit and save them.

Form w 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay. Form w 4p 2019 page. The irs is working closely with the payroll and the tax community as it makes additional changes to the form w 4 for use in 2020. Use this form to ask payers to withhold federal income tax from certain government payments.

We offer detailed instructions for the correct federal income tax withholdings. Enter personal information a. Create and fill out pdf blanks online. Form w 4 2020 employees withholding certificate department of the treasury internal revenue service complete form w 4 so that your employer can withhold the correct federal income tax from your pay.

Your employer may be required to send a copy of this form to the irs. You or in the event of death your beneficiary or estate can choose not to. You can change the amount to be withheld by using lines 2 and 3 of form w 4p. Print or instantly send your documents.

Get printable w 4 form to file in 2019. Wage and tax statement. Follow given instructions to calculate withholdings correctly.